Is USDf just another "me-too" stablecoin?

Written by: Alex Liu, Foresight News

DWF co-founder said: "A protocol that allows entry with any asset, generates returns, and exits with any asset to any place is Falcon Finance."

This is a grand vision that doesn't sound like a description of a stablecoin project, and that is precisely what makes USDf unique—there are currently too many stablecoins on the market, sometimes feeling "monotonous," making it hard to spot differences, but the ultimate winner will always be the one that stands out.

Standing out does not mean being "right." Where is Falcon different, and will it be the winner?

Different Background

USDf (Falcon Finance) has a different background.

The founders and team of Falcon Finance come from DWF Labs, with co-founder Andrei Grachev also serving as the managing partner of Falcon.

DWF Labs and DWF Ventures are seasoned market makers and investment institutions in the industry, having participated in the market making of various mainstream altcoins and well-known meme coins, achieving remarkable results in this cycle. It is the first time for a market maker to venture into stablecoins.

The underlying yield strategy of Falcon Finance relies on a large number of hedging trades, similar to Ethena, distributing trading profits to users while masquerading as a yield-generating stablecoin company. (See: Is ENA a model innovation or a valuation scam under the guise of a stablecoin?)

The identity of a market maker gives it a natural advantage in executing trading and yield strategies.

Different Capital

The capital supporting Falcon Finance is also different.

Falcon Finance is supported by DWF Labs. In April of this year, DWF Labs invested $25 million in the Trump family's crypto project World Liberty Financial (WLFI) at an average price of $0.1, stating that it would support the liquidity of its stablecoin USD1. (The market also assumes that DWF Labs will become the market maker for WLFI tokens.)

On July 30, 2025, Falcon Finance announced that WLFI would invest $10 million in it. This is WLFI's first investment in the stablecoin sector, and WLFI has its own dollar stablecoin USD1 (backed by physical assets such as U.S. Treasury bonds and cash). Both parties stated that the funding would be used to accelerate Falcon's cross-chain compatibility and the interoperability between USDf and USD1.

Falcon officially stated that USD1 has been included in Falcon's collateral list, and a cross-chain conversion tool for USDf/USD1 will be launched in the future, forming a complementary relationship between the two.

WLFI tokens have been listed on Binance's pre-contract market, with a fully diluted market cap (FDV) exceeding $20 billion, and related concept tokens (such as DOLO, etc.) have performed well recently. The "WLFI concept" brought to Falcon by different capital is likely to be positive.

Different Model

Falcon's model (sources of yield, minting mechanism, etc.) is also different.

There are other stablecoin projects in the market that derive their yield from hedging trading profits, such as the USDe/sUSDe of the Ethena protocol. Unlike traditional stablecoins that are fully collateralized by fiat, Ethena's USDe is also a synthetic dollar, but its model involves hedging (delta-hedging) using crypto assets like BTC, ETH, SOL in conjunction with perpetual contract positions, while holding a certain amount of mainstream stablecoins to stabilize the mechanism.

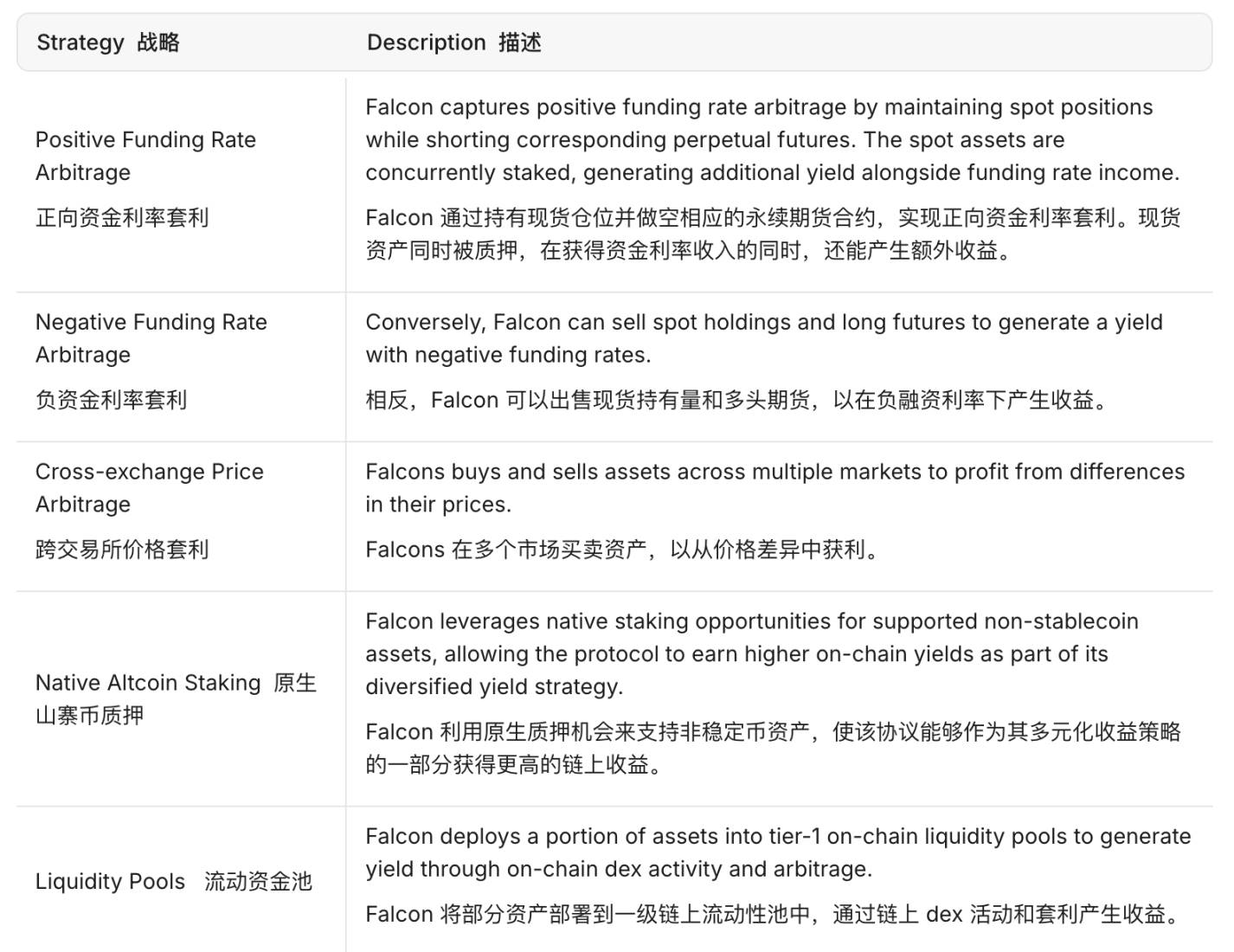

Falcon's sources of yield are as follows, and with the addition of cross-exchange price arbitrage and other "market maker specialties," they become more diverse and complex.

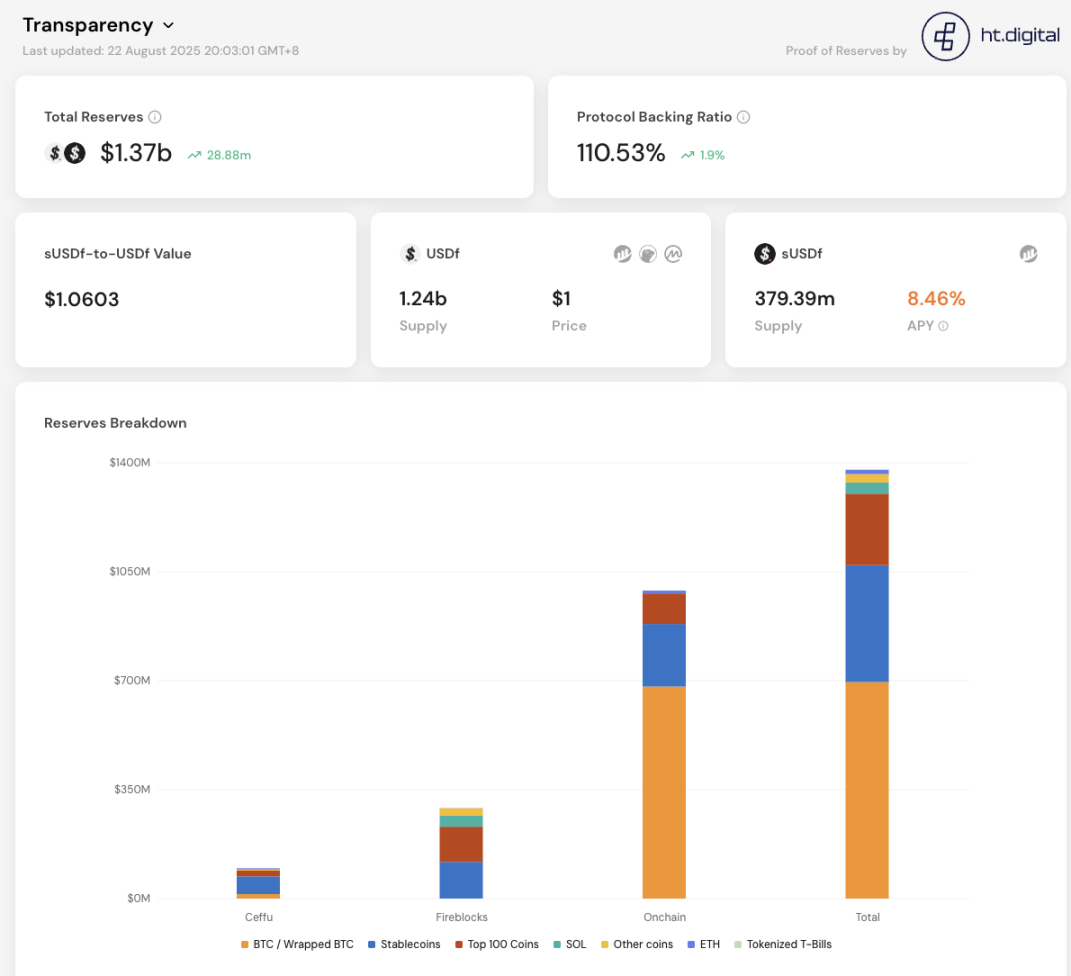

Unlike most stablecoins, USDf is not backed by a single asset but uses a multi-asset over-collateralization strategy combined with hedging: all issued USDf must be supported by collateral worth more than $1, with the current collateralization rate between 110% and 116%.

Falcon's design allows users to mint USDf using various assets: it supports mainstream stablecoins (such as USDT, USDC, DAI), mainstream cryptocurrencies (such as BTC, ETH, SOL), and other selected altcoins. The official statement indicates that more asset types, including tokenized real-world assets (RWA), will be integrated in the future.

Users can obtain USDf in two ways: first, by minting USDf on the Falcon official app (which requires KYC verification and meeting a minimum amount requirement), where they can choose between "traditional mode" or "innovative mode" (a low-level option-based packaging play) for collateral; second, by directly purchasing USDf on decentralized exchanges (such as Uniswap, Curve, etc.) without KYC or minimum amount restrictions. In either case, users can enjoy the platform's point incentive "Falcon Miles," although directly minting collateralized non-stablecoins can earn higher point multipliers.

After obtaining USDf, users can participate in the ecosystem and earn returns through various means.

Holding rewards — Simply holding USDf can earn daily rewards of 6 times the points;

Staking rewards — Users can stake USDf into sUSDf to earn interest, supporting both non-locking (base yield) and fixed-term locking (higher yield) modes;

Liquidity mining — USDf can provide liquidity on mainstream DEXs (Uniswap, Curve, PancakeSwap, etc.) or aggregators (Convex, StakeDAO, etc.), earning trading fees while also earning points (up to 40 times);

Lending and leverage — Falcon has integrated lending markets like Morpho, Euler, Silo, supporting USDf or sUSDf as collateral for lending and circular mining;

Yield Tokenization protocols (such as Pendle) can also use USDf, allowing users to further speculate on points or lock in fixed returns by separating future cash flows (minting "SY/YT" tokens). Recommended reading: Pendle is hard to understand, but not knowing it is your loss

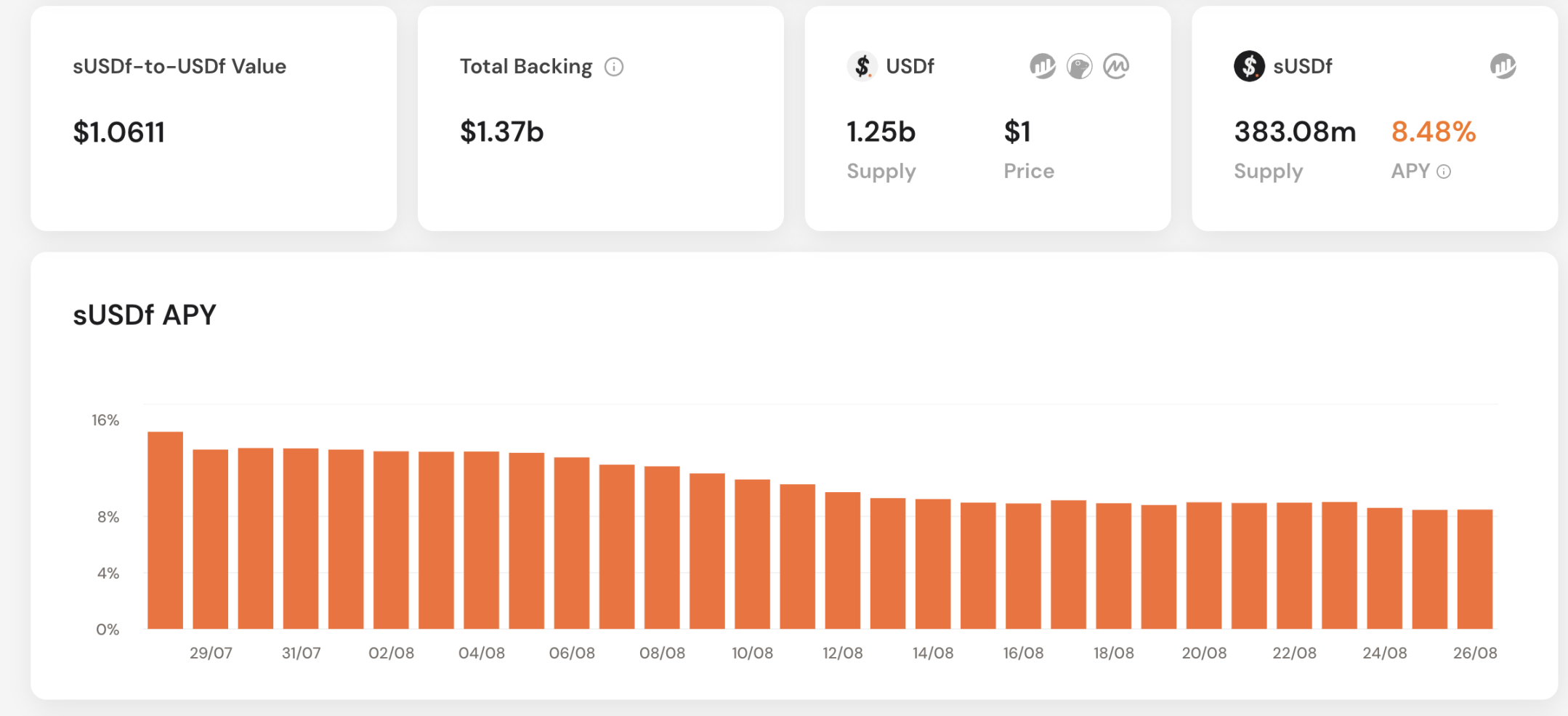

As of today (August 26), the circulating supply of USDf is $1.25 billion, ranking among the top 10 in terms of issuance among all stablecoins as an emerging protocol. The yield-generating version sUSDf has a supply of 383 million tokens, offering an annualized yield of 8.48%.

Different Vision

As mentioned at the beginning, Falcon's vision is also different, not limited to the category of "stablecoins."

Falcon Finance positions itself as a "universal collateral infrastructure," aiming to transform various custodial assets (including crypto tokens, fiat-pegged tokens, and tokenized real assets) into on-chain synthetic liquidity pegged to the dollar.

Falcon is not just looking to issue a new stablecoin but to create a financial connection layer that accommodates various assets and markets—entering with any asset, generating returns, and exiting with any asset to any place.

Co-founder Andrei Grachev has repeatedly emphasized that the design goal of USDf is to enable traditional financial assets such as U.S. Treasury bonds and stocks to go on-chain and generate liquidity and returns.

Falcon achieves this goal by efficiently linking real-world assets with the DeFi ecosystem (trading, lending, market making, etc.) through protocol logic, based on transparent risk control and high levels of compliance. The official team has also designed mechanisms including audits and transparency report panels to enhance trust: for example, the newly launched transparency dashboard publicly shows that USDf is backed by over 110% reserves, verified by third-party audits. Falcon's product team also plans to regularly release more detailed reserve proofs and audit reports to meet institutional users' demands for security and compliance.

Different Roadmap

Due to the aforementioned differences, Falcon's project roadmap is also significantly different from conventional stablecoin projects.

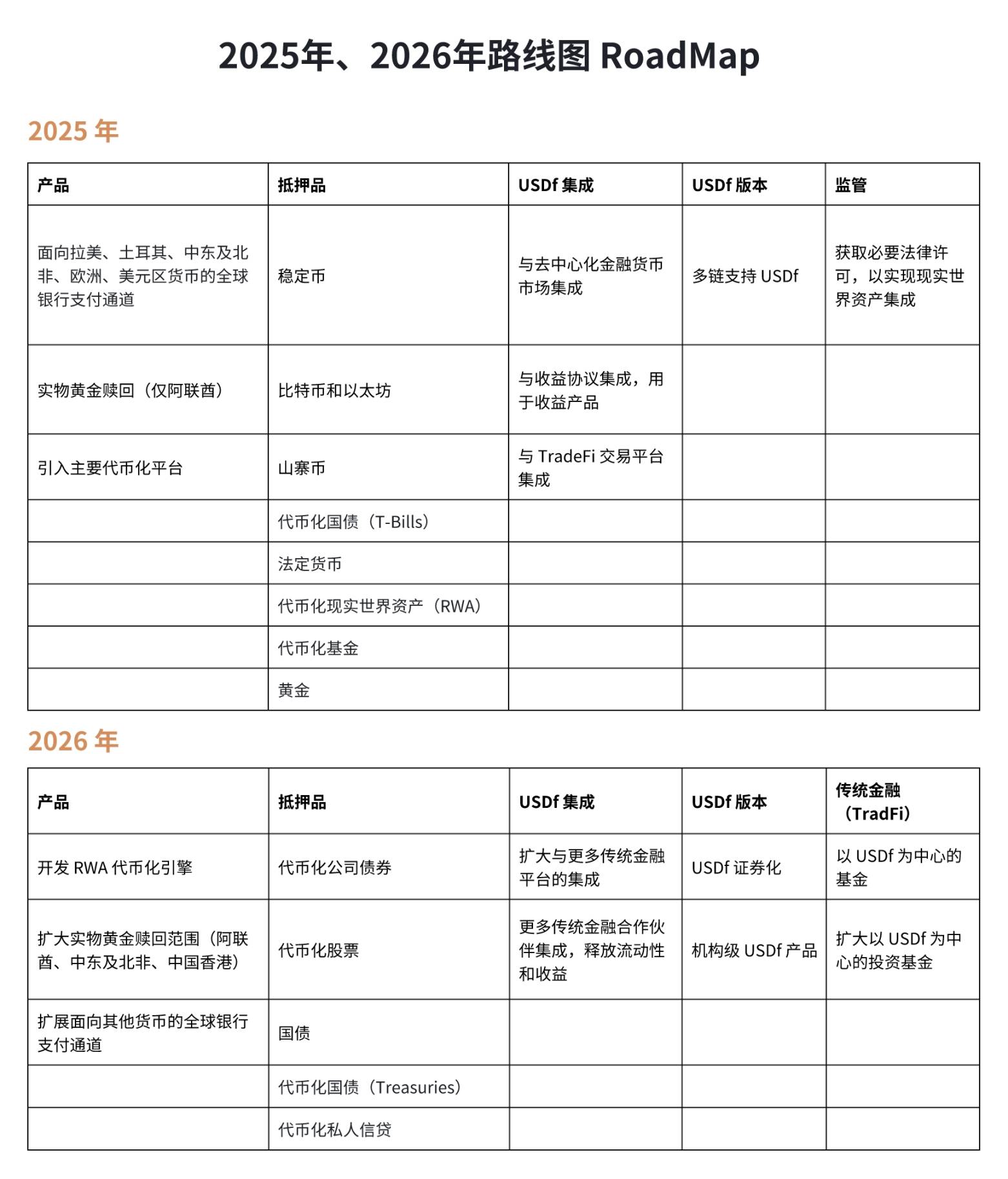

According to the official roadmap, by the end of 2025, Falcon will focus on expanding the "fiat channel" for dollar liquidity and achieving multi-chain deployment: plans include opening regulated fiat deposit channels in major markets such as Latin America, Turkey, and the Eurozone, providing 24/7 real-time settlement, and pushing USDf to Layer 1/Layer 2 of Ethereum L2 and other public chains to enhance cross-chain capital efficiency.

The team is also advancing partnerships with licensed custodians and payment institutions to launch bank-grade USDf products, such as overnight yield management and money market fund channels, and is considering adding on-chain exchange services for physical gold in major global financial centers (such as the Middle East, Hong Kong, etc.). By 2026, Falcon plans to build a "real asset engine," supporting the tokenization of corporate bonds, private credit, and other assets, and launching USDf investment tools and structured securities products to meet larger-scale institutional demands.

How to Participate

At the community level, Falcon has also launched a series of incentive activities to expand ecosystem participation, including Falcon Miles points and the Yap2Fly social leaderboard.

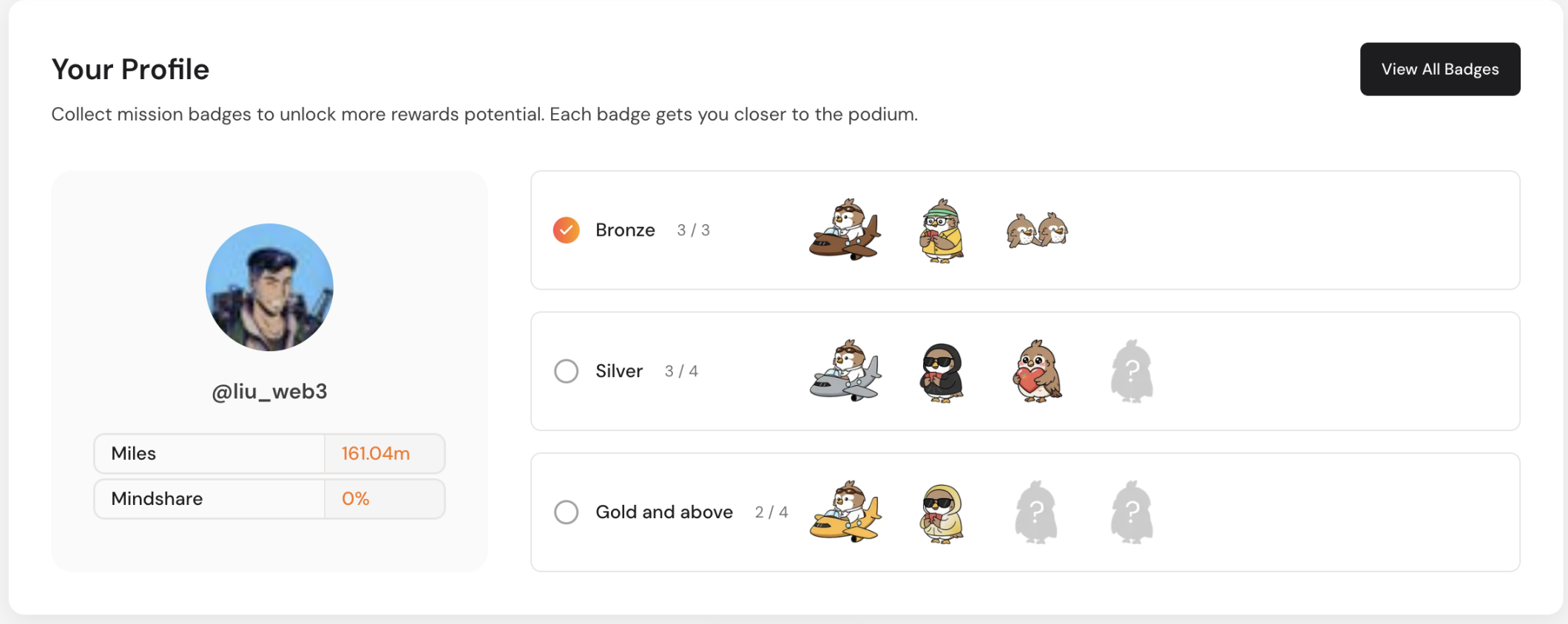

Falcon Miles is the project's points system, which is often directly linked to future project airdrops, as mentioned earlier.

Yap2Fly is an initiative launched by Falcon in collaboration with Kaito, which will comprehensively calculate users' Falcon Miles and the "Mindshare" gained from posting Yap on social media to generate rankings. Each month, approximately $50,000 worth of USDf will be distributed to the top 50 ranked users, and the badge system will not only be used to unlock reward ratios but may also offer additional rewards.

In summary, Falcon Finance currently has over $1 billion in USDf circulation and total locked value, leading in scale among synthetic dollar protocols.

Its uniqueness lies in "using large-scale assets as collateral to create on-chain liquidity while allowing these assets to continue generating returns." The project team emphasizes attracting institutional-level users through rigorous risk control, compliance planning, and diversified asset access, rather than just targeting ordinary DeFi users.

In future developments, Falcon Finance is expected to continue exploring the integration path between DeFi and traditional finance by expanding the variety of assets and multi-chain deployment.

Disclaimer: The author of this article holds sUSDf YT, which meets the disclosure standards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。