Bitcoin and Ethereum Crash Driven by Whale Moves and Weak Technicals

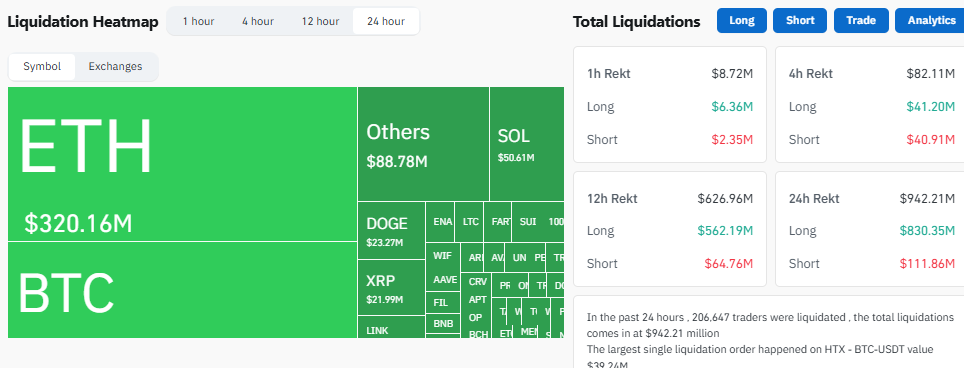

The crypto market has been hit hard as the Bitcoin and Ethereum Crash caused close to $1 billion in liquidations in the last 24 hours.

Both cryptocurrencies faced high selling pressure. It led to a sudden dip in market sentiment and broader concern among traders.

Heavy Pressure on Prices

Binance Market data shows that the Bitcoin and Ethereum Crash resulted in lowering the prices to huge percentages dragged. BTC crashed below $110,000, on the other hand ETH slipped to $4,367.

Together, these drops wiped out $941 million from the crypto market, with most losses coming from long positions.

The biggest single liquidation happened on HTX, where a BTC/USDT trade worth $39.24 million was forced out.

Analysts point out that this chain of liquidations was triggered by:

-

Large whale activity

-

Technical weakness

-

Nervousness over the United States monetary policy.

Whale Moves Spark Panic

The Bitcoin and Ethereum Crash was fueled by:

A whale dumped 24,000 BTC worth $2.7 billion, this reason alone triggered more than $500 million in liquidations.

Also, the same whale, who earlier shifted funds from BTC into ETH, took profits on a $250 million long position in ETH.

According to Arkham,

This whale once held nearly 94K BTC during its 2018 peak, from major exchanges.

Now, related wallets still control over $6 billion worth of this crypto, showing the scale of their influence on market trends.

Technical Weakness Adds to Losses

The Bitcoin and Ethereum Crash also revealed cracks in the technical structure of both coins.

-

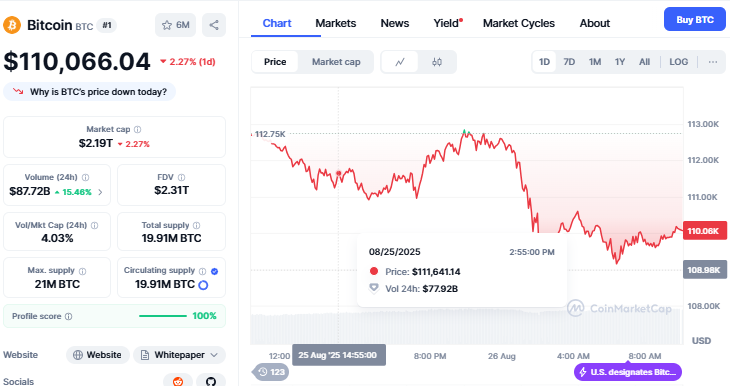

Bitcoin slipped under its 7-day and 30-day moving averages.

-

Turning the $111K zone into a resistance point.

-

Momentum indicators like MACD and RSI also have a bearish outlook.

Source: CoinMarketCap

Currently the coin is trading at $110,066 with a decrease of 2.27 in a day, while trading volume increased by 15% to reach $87.72 Billion.

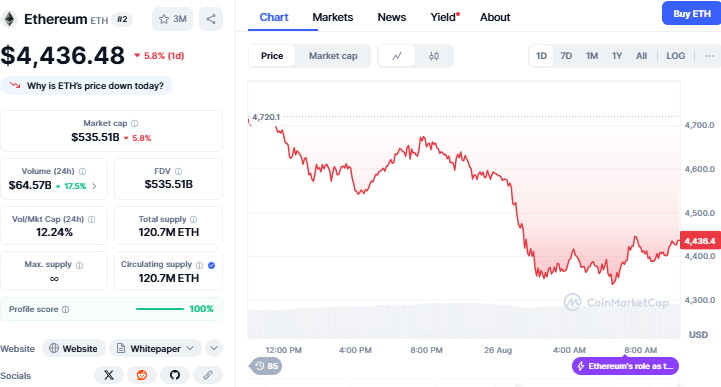

ETH showed similar weakness,

-

Breaking under its $4,350 support and 100-hour moving average.

-

More than $210 million in long positions were liquidated.

-

Traders are now closely watching the $4,000 mark as the next critical support.

-

If it fails, further losses could be triggered.

Source: CoinMarketcap

The currency is now trading at $4,437 with a 24 hour decline of 5.8%. This low comes just after it hitting its all time high of $5,200. While trading volume increased by more than 17%.

Institutional Activity Amid Decline

In spite of the Bitcoin and Ethereum Crash, institutions still continue to accumulate.

Strategy recently acquired 3,081 coins for $356.9 million, increasing its balance to more than 632,000 valued at $46.5 billion.

Metaplanet also bought 103 BTC , noting that long-term faith in digital currencies persists even during the phase of market volatility.

Market Outlook

The Bitcoin and Ethereum Crash has depicted how fast leveraged bets and whale activities can impact the crypto-market confidence negatively.

Traders are now monitoring if BTC can stay above $109,000 and if Ethereum can hold at $4,000.

Upcoming decisions by the U.S. Federal Reserve and macroeconomic indicators will be crucial in determining the next direction, according to analysts.

Conclusion

The Crash shook the crypto space, triggering close to $1 billion in liquidations and compelling traders to review risk levels.

With whales unloading, technicals are bearish, and uncertainty regarding Fed policy, the next several weeks will determine if this was merely a sharp correction or the beginning of more extensive losses.

Also read: Dropee Daily Combo And Question of the Day 26 August 2025免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。