Consensus: September is not the turning point of a bull market, but a test that must be faced.

Written by: BitpushNews

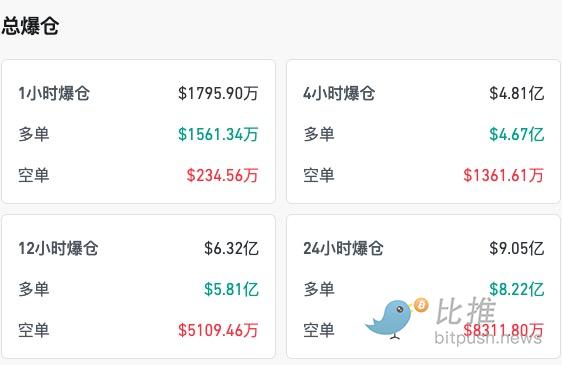

This Monday, the cryptocurrency market experienced intensified fluctuations. Bitcoin briefly fell below the $110,000 mark, hitting a low of $109,324, the lowest point since early July, while Ethereum briefly dropped below $4,400, with a 24-hour decline of nearly 8%. This round of decline triggered a large-scale liquidation across the market: according to CoinGlass data, as of the time of writing, the 24-hour liquidation amount exceeded $900 million, with Ethereum longs losing approximately $322 million and Bitcoin longs losing $207 million.

The market's chain reaction was swift, with mainstream altcoins under pressure: Solana plummeted over 8% in a single day, XRP fell 6%, while smaller market cap tokens like PENDLE, LDO, and PENGU recorded double-digit declines, with daily drops as high as 13%.

Historical Pattern: The "September Curse"

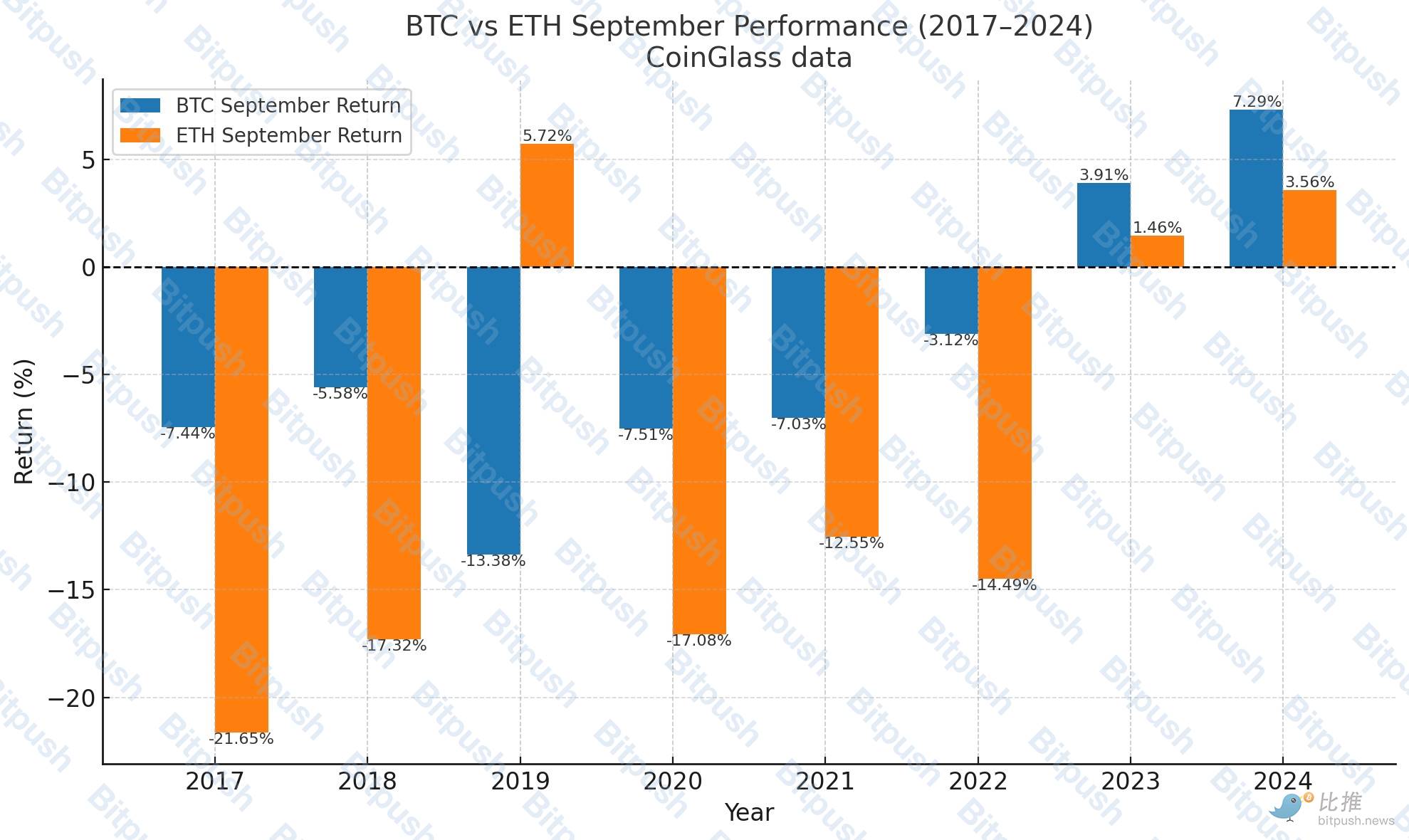

Investor caution is not without reason. CoinGlass statistics show that September is one of the worst-performing months for Bitcoin and Ethereum.

The chart above compares the actual gains and losses of BTC and ETH in September from 2017 to 2024, revealing that:

BTC has shown negative performance in most years in September, with only 2023 (+3.91%) and 2024 (+7.29%) recording gains.

ETH's September declines are usually larger, with significant underperformance compared to BTC in 2017 (–21.65%), 2020 (–17.08%), and 2022 (–14.49%).

Only in 2019 (ETH +5.72% vs BTC –13.38%), 2023, and 2024 did ETH show stronger performance.

This "September curse" has appeared in previous bull market cycles. In 2013, 2017, and 2021, Bitcoin experienced severe corrections in September after strong rebounds in the summer.

Analyst Views: Short-Term Trend Reversal

Renowned analyst Benjamin Cowen pointed out that the strength seen in July and August often reverses in September, with Bitcoin likely to test the bull market support zone around $110,000. He also warned that Ethereum might briefly reach new highs but could then drop by 20-30%, with altcoins potentially falling by 30-50%.

Another active market analyst, Doctor Profit, added a more pessimistic assessment from macro and psychological perspectives. He believes that the Fed's potential rate cut in September may not be a positive signal but rather a trigger for uncertainty. Unlike the "soft landing rate cuts" expected in 2024, this could represent a true "turning point," leading to synchronized corrections in both the stock and crypto markets.

On the price front, he emphasized that there is still a CME gap in the BTC chart around $93k–$95k, where a large amount of liquidity is concentrated, while retail investors' entry points are generally in the $110k–$120k range or even higher. To flush out these "weak hands," prices must drop into their "maximum pain zone."

In his strategy, he mentioned that he has gradually reduced his positions in BTC and ETH spot, shifting to short positions.

Recent capital flow data shows that the enthusiasm for ETFs is cooling. According to SoSoValue, last week saw a net outflow of $1.17 billion from spot Bitcoin ETFs, marking the second-largest weekly net outflow in history; spot Ethereum ETFs saw a net outflow of $237.7 million, the third-largest on record. This indicates that institutional funds are temporarily shifting to a wait-and-see approach, weakening support in the spot market.

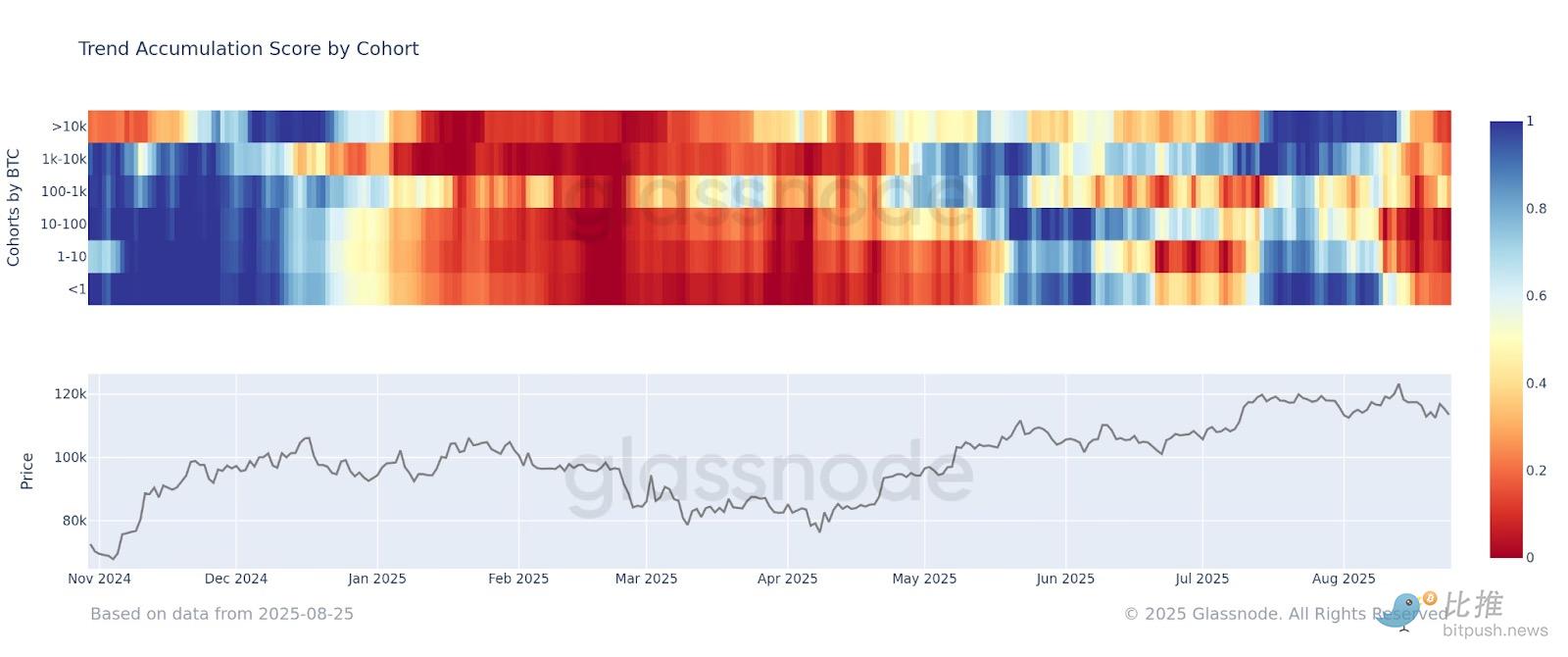

On-chain data also reveals structural signals. Glassnode pointed out that all Bitcoin holders have "collectively entered the distribution phase," highlighting that the market is experiencing widespread selling pressure. After reaching a new high of $4,946, Ethereum has retraced, with the MVRV indicator rising to 2.15, indicating that investors are holding an average of over 2 times unrealized gains. Historically, this level has been similar to December 2020 and March 2024, both occurring before significant volatility and profit-taking.

Macro Factors: Fed and Interest Rate Risks

The uncertainty in the macro environment further exacerbates market tension. Last Friday, Fed Chairman Powell hinted at a possible rate cut in September, which initially stimulated market optimism, but both Cowen and Doctor Profit cautioned that a rate cut does not necessarily mean good news; it could instead lead to rising long-term U.S. Treasury yields, thereby suppressing risk assets. This situation is quite similar to September 2023, when a rate cut marked the low point in the bond market, followed by a surge in yields. Additionally, Benjamin Cowen noted that recent Producer Price Index (PPI) data shows inflation "hotter than expected," undoubtedly adding extra pressure to the market. With inflationary pressures not fully alleviated, a shift in Fed policy could trigger new market turmoil.

Outlook and Conclusion

Looking at historical patterns, analyst views, and the macro environment, it is evident that September poses multiple pressures on the cryptocurrency market:

Seasonal decline — Historically, September has averaged significant losses;

Macro uncertainty — Fed policy could become a watershed moment for the market;

Imbalanced capital structure — Institutional funds are flowing out, while retail investors chase highs;

Increased on-chain selling pressure — All holding groups are entering distribution, with whale trades disturbing the market.

Although Cowen and Doctor Profit differ in their assessments of the magnitude of the adjustment, the consensus is that September is not a turning point for a bull market but a test that must be faced.

However, from a longer-term perspective, this cleansing may also be a necessary step for the continuation of the bull market. The market needs to clear overheated positions in the "maximum pain zone" to make room for the next round of upward movement. If the cleansing is sufficient, BTC may still challenge new highs in subsequent cycles, and the long-term upward logic for ETH will not change as a result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。