Power never belongs to those in the spotlight.

Written by: David, Deep Tide TechFlow

“What important truth do very few people agree with you on?”

This is the question Peter Thiel loves to ask in interviews, and it is also the opening line of his bestselling book "Zero to One."

If you were to ask him this question, his answer might be:

In 2003, when everyone was focused on social networks, he chose to do data analysis for the CIA;

In 2014, when Bitcoin dropped to $400, he invested $20 million;

In 2022, when everyone was shouting “Bitcoin will reach $100,000,” he liquidated all his holdings.

Today, 57-year-old Peter Thiel has a fortune of $26.6 billion.

His company Palantir is valued at $400 billion; he made $2.5 billion from cryptocurrency investments, and his investments are behind the recently popular coin stock BMNR and the listed cryptocurrency exchange Bullish;

Moreover, his protégé J.D. Vance has become the Vice President of the United States.

But in Silicon Valley, he remains an outlier:

A billionaire who openly supports Trump, a tech entrepreneur serving intelligence agencies, an investor who sells when everyone else buys.

This is a story about how contrarian thinking creates wealth and how patience translates into power.

The PayPal Power Struggle

In December 1998, 31-year-old Peter Thiel and 23-year-old Max Levchin founded Confinity in Palo Alto. Almost simultaneously, Elon Musk founded X.com.

Both companies were engaged in a cash-burning war, each wanting to become the dominant player in internet payments. Three months later, the two companies merged to form PayPal, with Musk as CEO.

However, the honeymoon period lasted only six months. In September 2000, while Musk was on vacation in Australia, the company’s board voted to remove Musk from his CEO position, with Thiel taking over.

The official reason for the ousting was technical disagreements; Musk wanted to migrate the system from Unix to Windows. But the deeper reason was the fundamental disagreement between the two on the company’s direction: Musk wanted to build an all-encompassing financial services platform, while Thiel just wanted to focus on payments.

This is one of the most famous power struggles in Silicon Valley history, and Thiel's coup was executed quite cleverly. He chose to act while Musk was absent, preemptively rallying support from PayPal’s then-technical head, Max Levchin, using technical reasons to mask the power struggle.

After the leadership change, PayPal focused on its payment business, quickly achieving profitability, and was sold to eBay for $1.5 billion in 2002.

As the largest individual shareholder, Thiel cashed out $55 million. This money became his first pot of gold in the investment world.

Investing in Former Colleagues

More than twenty years later, when people talk about the power structure in Silicon Valley, they cannot overlook one fact: many of the most influential people once worked in the same office of the same company.

And that office belonged to Peter Thiel.

After eBay's acquisition was completed in October 2002, Thiel, with his $55 million from PayPal, founded the investment fund Founders Fund.

His first batch of investment targets were almost all former colleagues from PayPal, a group that later became known as the "PayPal Mafia":

When Reid Hoffman founded LinkedIn, Thiel was the first external investor, putting in $500,000; when Chad Hurley and Steve Chen were working on the video site YouTube, Thiel participated in the early financing; when Jeremy Stoppelman wanted to create the local review site Yelp, Thiel provided the first seed funding…

The most interesting aspect is his relationship with Musk. After the 2000 "coup," the two seemingly went their separate ways.

But in 2008, when SpaceX was on the brink of bankruptcy and a fourth failed launch could mean the end of the company, Founders Fund led a $20 million investment. This money allowed SpaceX to secure a contract with NASA.

The businesses of his former colleagues also brought great success to Founders Fund. YouTube was acquired by Google for $1.65 billion, LinkedIn reached a peak market value of over $26 billion, and SpaceX is now valued at over $200 billion.

But what Thiel seems to care about is not just money; the "PayPal Mafia" gradually came to control half of Silicon Valley.

Reid Hoffman became Silicon Valley's "super connector," with almost every entrepreneur needing to go through him for connections; David Sacks transitioned from entrepreneur to podcast host, with his All-In podcast influencing the entire tech circle's discourse, and he himself became the crypto czar of the White House. Musk, needless to say, has defined the technological ambitions of this era, from Tesla to SpaceX to X.

Even more remarkably, this network has a loyalty that transcends business.

In 2016, when Thiel was isolated by all of Silicon Valley for supporting Trump, members of the PayPal Mafia remained silent. They may not have agreed with his choice, but no one kicked him while he was down.

By 2024, when Thiel pushed J.D. Vance to run for office, David Sacks not only donated but also publicly endorsed him on his podcast.

Every investment Thiel makes adds a node to his power network, and every successful investment exit strengthens this network.

Betting on Facebook, Selling at IPO

In the summer of 2004, 20-year-old Harvard dropout Mark Zuckerberg also sought out Thiel.

At that time, Facebook had just surpassed 1 million users. The social network space was already crowded, with Friendster having 7 million users and MySpace having 5 million users.

Mainstream investors in Silicon Valley were skeptical about Facebook, but Thiel asked Zuckerberg one question:

“What’s the difference between Facebook and MySpace?”

“On Facebook, you have to use your real name,” Zuckerberg replied.

This seemingly simple difference led Thiel to make a judgment. He later wrote in his own book "Zero to One": real identity means trust, trust means real social relationships, not just virtual follower counts.

In September 2004, Thiel personally invested $500,000 in Facebook, acquiring a 10.2% stake. The terms of this investment were surprisingly simple, with no board seat requirement, no liquidation preference, and even no anti-dilution clause.

The subsequent story proved his judgment correct. In 2005, when Accel Partners invested at a $1.27 billion valuation, other VCs finally realized what they had missed. By 2007, Microsoft invested at a $15 billion valuation, and Facebook had become a phenomenon.

In May 2012, Facebook went public at an opening price of $38. Most early investors chose to hold, but Thiel sold 16.8 million shares on the day of the IPO, cashing out approximately $640 million. In the following months, he continued to reduce his holdings, ultimately turning his initial $500,000 investment in Facebook into over $1 billion in profit, with a return on investment exceeding 2000 times.

Facebook's stock price later did rise to over $300, suggesting that Thiel did not maximize the returns on this investment. But just two years after Thiel cashed out, in 2014, Bitcoin's price dropped to $400.

On one side were the star stocks everyone was chasing, and on the other was the emerging market everyone was panicking about. Thiel once again chose the latter.

Bottom Fishing and Building a Crypto Empire

In 2014, Bitcoin was priced at $400, just emerging from the ruins of Mt. Gox.

The total market capitalization of the entire crypto market was less than $5 billion. At this time, Peter Thiel's Founders Fund quietly bought $15-20 million worth of Bitcoin, with an average price of less than $500. This investment was so small that it didn’t even appear in the fund's quarterly reports.

From 2014 to 2022, Founders Fund did not sell a single Bitcoin, even increasing its holdings twice in 2017 and 2020.

In March 2022, when Bitcoin was still at a high of $42,000, Founders Fund suddenly liquidated all its holdings.

According to later reports from the Financial Times, this liquidation netted $1.8 billion. Two months later, the Terra/Luna collapse triggered the most severe bear market in crypto history. By the end of the year, Bitcoin had dropped to $15,500.

Interestingly, just four months after accurately cashing out at the peak, Thiel gave a passionate speech at the Miami Bitcoin Conference, calling Bitcoin the “future of financial freedom.” He even created an "enemies list," labeling Buffett as the "Socratic grandpa from Omaha" for not supporting Bitcoin.

The audience of believers applauded wildly, but no one knew that this "evangelist" had just completed the largest-scale liquidation of crypto assets in history.

But Peter Thiel is not just a savvy cryptocurrency trader. While buying and selling Bitcoin, he systematically invested in the entire crypto ecosystem:

- Trading Infrastructure: In 2018, Founders Fund led an investment in Tagomi Systems, a company providing cryptocurrency trading services for institutional investors. Tagomi addresses trading slippage by aggregating liquidity from multiple exchanges. In 2020, Coinbase acquired Tagomi for $150 million.

In 2021, Thiel personally invested in Bullish, an institutional-grade cryptocurrency exchange operated by Block.one. What sets Bullish apart is its commitment to compliance from the outset, having obtained licenses in multiple jurisdictions. In July 2025, Bullish officially submitted its IPO application, with a valuation exceeding $9 billion.

- Lending and DeFi: Valar Ventures (another fund of Thiel) invested in BlockFi in 2019, which was once one of the largest cryptocurrency lending platforms; however, BlockFi ultimately went bankrupt in 2022.

In 2023, during a market downturn, Founders Fund invested in Ondo Finance, a previously overlooked RWA sector, which by 2025 had become one of the hottest directions in the crypto space.

- Project Incubator: In October 2023, Founders Fund also invested in Alliance DAO, acquiring a minority stake and providing support for companies invested in by Alliance DAO. The latter is currently one of the largest incubators in the crypto industry and an early supporter of star projects like Pump.fun.

- European Expansion: Through connections in Germany, Thiel invested in Bitpanda, Austria's largest cryptocurrency trading platform. In 2021, it reached a valuation of $4.1 billion, becoming Europe's most valuable crypto unicorn.

In the summer of 2023, Bitcoin hovered below $30,000 for several months. The bankruptcy trial of FTX was ongoing, the SEC was intensifying its crackdown on the crypto industry, and mainstream media was filled with narratives proclaiming "crypto is dead."

At a time when everyone was fleeing, Founders Fund returned.

According to a Reuters report in February 2024, the fund gradually purchased $200 million worth of Bitcoin and Ethereum, each accounting for half, from late summer to early fall 2023.

Time once again proved Thiel's judgment.

In January 2024, the SEC approved a Bitcoin spot ETF. Within months, over $50 billion in institutional funds flooded in. By August 2025, Bitcoin surpassed $117,000, and Ethereum exceeded $4,000. Founders Fund's $200 million investment yielded a paper profit of over 100%.

On July 16 of this year, Bitmine announced that Peter Thiel's Founders Fund had purchased a 9.1% stake in the company.

Looking back at every node of Peter Thiel's entry into crypto—timing the market, investing, and sector positioning—most have been executed with the right timing. In public, he is a Bitcoin evangelist; in practice, he is an executor of contrarian thinking.

As of August 2025, estimates suggest that Thiel has made over $2.5 billion from cryptocurrency: $1.8 billion from the 2022 market peak, $500 million from early investment exits, and $200 million from bottom fishing in 2023.

This does not include his holdings in Bullish, Bitpanda equity, and the latest BMNR investment.

Binding to America's Destiny

In addition to investing in the PayPal Mafia, Thiel actually founded his own company—Palantir—after leaving PayPal in 2003, a company that serves the government and military by developing intelligence systems.

What was the mainstream in Silicon Valley at that time? Social networks, e-commerce, search engines. Thiel chose to do data analysis for the CIA.

Palantir's first startup funding of $2 million came from the CIA's venture capital arm, In-Q-Tel, with Thiel investing $30 million himself. The company is named after the "seeing stone" from "The Lord of the Rings," which can perceive all information.

For the next seven years, there was almost no public reporting. It wasn't until the Afghanistan War in 2010 and the killing of Osama bin Laden in 2011 that the media learned of Palantir's critical role in intelligence analysis.

The company Thiel created has a client list resembling a spy thriller: CIA, FBI, NSA, the Pentagon; but in the freedom-advocating Silicon Valley, this made Palantir a target. Protesters demonstrated outside its offices, calling it an "evil company." Hiring became difficult, and commercialization faced repeated setbacks.

When it went public in 2020, Wall Street was skeptical. It had never been profitable for years and was overly reliant on government contracts. The stock price fell from $10 to as low as $5.92.

After the explosion of ChatGPT in 2023, Palantir launched the AIP platform, combining 20 years of intelligence analysis capabilities with popular large language models to serve more internal process management for enterprises. When Google withdrew from the Pentagon's AI project due to employee protests, Palantir took over.

Subsequently, military orders began to surge: in 2024, the U.S. Army signed a 10-year, $10 billion contract with it; in April 2025, NATO officially procured its developed Maven Smart System.

At the same time, the company's stock price soared from $6 at the beginning of 2023 to $187 by August 2025, with a total market value reaching $440 billion, surpassing the combined market value of the three major traditional U.S. defense contractors.

(Reference Reading: 20x in 5 Years, The Birth of America's Most Expensive National Fortune Stock)

The true value of Palantir is not in its stock price. The company's systems connect every node of American power: the Department of Homeland Security uses it to track immigrants, the SEC uses it to investigate insider trading, and the IRS uses it for tax audits.

After Thiel-backed J.D. Vance became Vice President, Palantir's government contracts noticeably increased. Thiel influences policy-making through Vance, participates in power operations through Palantir, and controls Silicon Valley through the PayPal Mafia. The synergistic effect of this power network is just beginning to emerge.

From an initial investment of $30 million in 2003 to today's $440 billion market value, for Thiel, Palantir brings not just wealth but a passport to the core of Washington's power.

Choosing to work for the CIA 20 years ago seemed like the most incredible choice in Silicon Valley at the time. Looking back today, it may be Thiel's shrewdest move.

Silicon Valley's Kingmaker, Not Too Late in Ten Years

In August 2025, sitting in the second highest seat of power in the United States is a man who four years ago was calling Trump "Hitler."

J.D. Vance, 39, one of the youngest Vice Presidents in American history.

From Yale Law School to Silicon Valley, from bestselling author to Senator, and now Vice President, this incredible trajectory has always been propelled by Peter Thiel.

In 2011, Peter Thiel was invited to speak at Yale Law School, stating that elite institutions overly focus on competition among peers, and students blindly pursue the ascent of the prestige ladder. J.D. Vance, sitting in the audience, was deeply moved and met Thiel.

Years later, he wrote that this speech was "the most important moment at Yale," and it changed Vance's life trajectory.

After graduating from Yale in 2013, he joined the top law firm Sidley Austin as expected. But just two years later, he resigned. His next stop was a biotech startup in Silicon Valley, Circuit Therapeutics, where he served as the Chief Operating Officer.

For a lawyer with no tech background, this leap was significant. Circuit's CEO, Frederic Moll, later admitted to the media that part of the reason for hiring Vance was Peter Thiel's recommendation.

Thiel's venture capital fund had previously invested in Moll's last company, which is typical of Silicon Valley's networking. In 2016, Vance's career took another turn. He joined Peter Thiel's venture capital fund Mithril Capital as a partner.

In July of that same year, his memoir "Hillbilly Elegy" was published, quickly reaching the top of The New York Times bestseller list. Suddenly, this previously unknown venture partner became a nationally recognized author and cultural commentator.

According to a Wall Street Journal report in 2024, former colleagues at Mithril recalled that during Vance's year there, he was rarely seen in the office; he spent most of his time traveling across the country for book signings, speeches, and interviews.

But this seemed to be exactly what Thiel wanted—not to cultivate an investment manager, but to create a public intellectual.

In March 2017, Vance left Mithril but did not leave Peter Thiel's orbit. He first joined the Revolution fund of AOL founder Steve Case, and then in 2019, he founded his own fund, Narya Capital.

The investor list for Narya says it all: leading the investment was Peter Thiel, with co-investors including a16z founder Marc Andreessen and former Google CEO Eric Schmidt.

In 2021, Vance announced his candidacy for the Ohio Senate. During this period, according to public records from the Federal Election Commission, Thiel donated $15 million to the super PAC Protect Ohio Values supporting Vance. This was the largest single donation in history for a Senate campaign.

Not just Peter Thiel. His friend David Sacks donated $1 million, and other Silicon Valley figures followed suit. Ultimately, donations from the tech industry made up the majority of Vance's campaign funds. A Senate seat in Ohio became a target for Silicon Valley capital.

From being elected senator in November 2022 to being nominated as a vice presidential candidate in July 2024, Vance took less than two years. This speed is extremely rare in American political history.

Multiple media outlets reported that during Trump's selection of a running mate, the voices from Silicon Valley were remarkably unified. Not just Peter Thiel, but also Elon Musk, David Sacks, and others were recommending Vance.

These tech billionaires saw not just a vice president, but their representative in Washington.

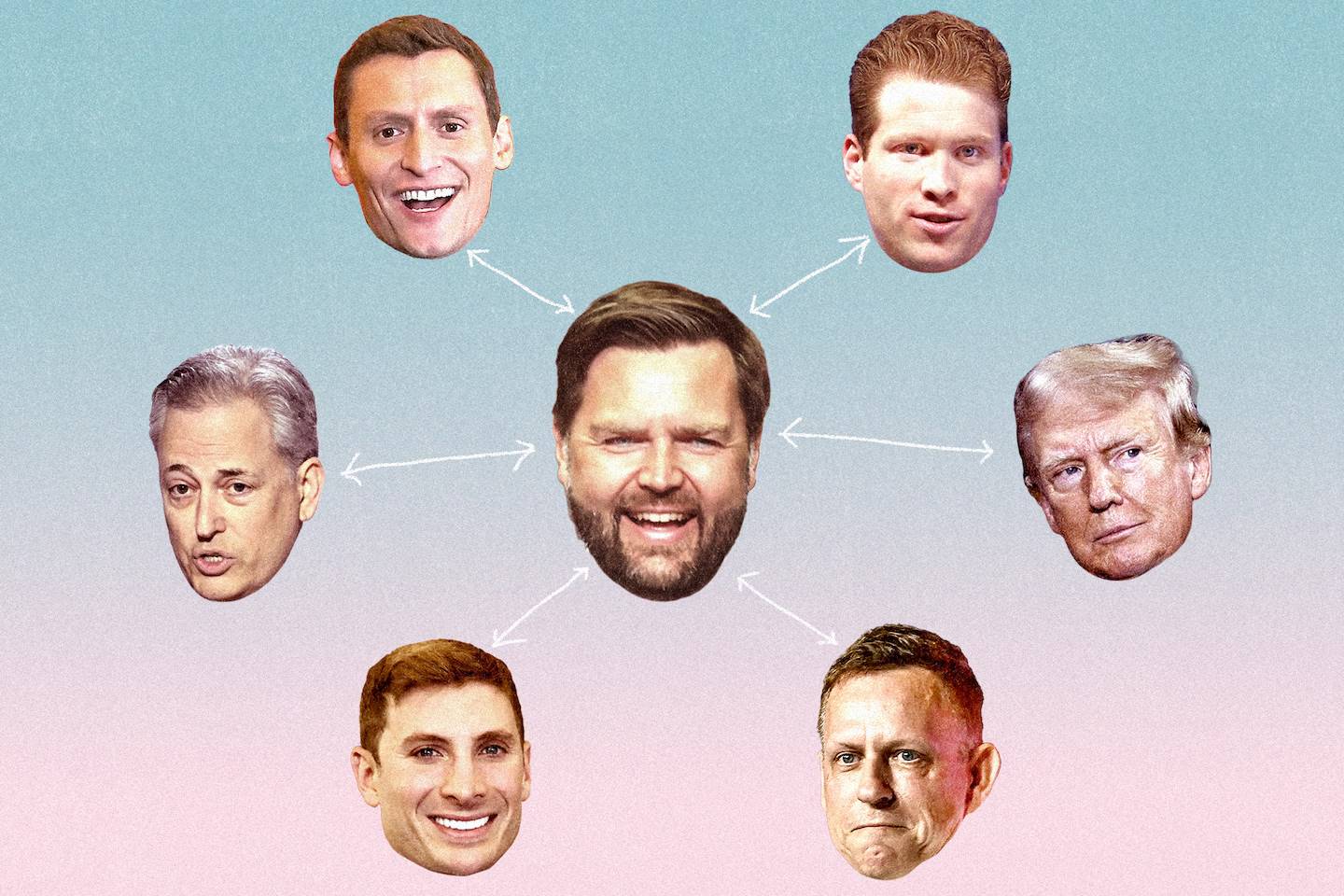

JD Vance's Silicon Valley Network | Source: The Washington Post

Top left, clockwise: Blake Masters, Joe Lonsdale, Peter Thiel, Jacob Helberg, David Sacks

After Vance took office, policies began to shift.

The federal government increased its procurement of AI and data analysis tools, with Peter Thiel's Palantir becoming a major beneficiary; at the same time, the U.S. government's regulatory stance on cryptocurrencies noticeably softened.

These changes may not be directly attributed to Thiel's influence, but the timing is thought-provoking.

The relationship between Thiel and Vance may also represent a new model of political influence. Unlike traditional lobbying or political donations, this resembles a "venture capital-style cultivation": identifying promising talent early, providing funding and resource support, helping them gain power, and then achieving long-term influence through ideological resonance.

At 39, Vance may have decades of political career ahead of him. This means Thiel's influence extends far beyond ordinary election cycles.

"What important truth do you believe that most people do not?"

Perhaps for Peter Thiel, the answer has always been simple: Power never belongs to those in the spotlight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。