When everything is a bank, nothing is a bank.

Written by: oel John, Sumanth Neppalli, Decentralised.co

Translated by: AididiaoJP, Foresight News

Cryptocurrency has now become a true financial technology.

This article explores how legislative changes will untie traditional banking. If blockchain is the currency track and everything is a market, users will ultimately leave idle deposits in their preferred applications. In turn, this will accumulate balances in applications with significant distribution capabilities.

In the future, everything can be a bank, but how will this be achieved?

The GENIUS Act allows applications to hold dollars on behalf of users in the form of stablecoins. It opens the incentive switch for platforms, encouraging users to deposit funds and spend directly through the application. But banks are not just vaults for storing dollars; they are complex databases layered with logic and compliance. In today’s discussion, we explore how the technology stack supporting this transformation has evolved.

Most of the fintech platforms we use are essentially wrappers around the same underlying banks. Therefore, we are no longer chasing the next shiny payment product but are starting to build direct relationships with the banks themselves.

You cannot build a startup on top of another startup. You need to establish direct relationships with the entities that actually do the work, so that if something goes wrong, you are not stuck playing a game of telephone with layers of intermediaries. As a founder, choosing a stable but slightly traditional vendor can save you hundreds of hours and just as many back-and-forth emails.

In banking, most profits come from where the funds are located. Traditional banks hold billions in user deposits and may have internal compliance teams. Compared to a startup where a founder worries about their license, banks may be a safer choice.

But at the same time, sitting in the middle layer of high-frequency asset turnover can also generate huge profits. Robinhood does not "hold" stock certificates, and most trading terminals in cryptocurrency do not custody users' assets. Yet they generate billions in fees each year.

This represents two contrasting forces in the financial world, a tug-of-war between wanting custody and becoming the layer where transactions occur. Your traditional bank may feel conflicted about allowing you to trade meme coins with assets they custody because they profit from deposits. Meanwhile, exchanges profit by convincing you that wealth is generated by betting on the next meme token.

Behind this friction is the evolving concept of portfolios. In contrast, a savvy 27-year-old today might consider her holdings of Ethereum, rights to Sabrina Carpenter's music, and streaming royalties from "My Oxford Year" as secure additions to her portfolio, alongside gold and stock certificates. While rights and streaming royalties do not currently exist in a tangible form, the ongoing development of smart contracts and regulations is likely to make this possible in the next decade.

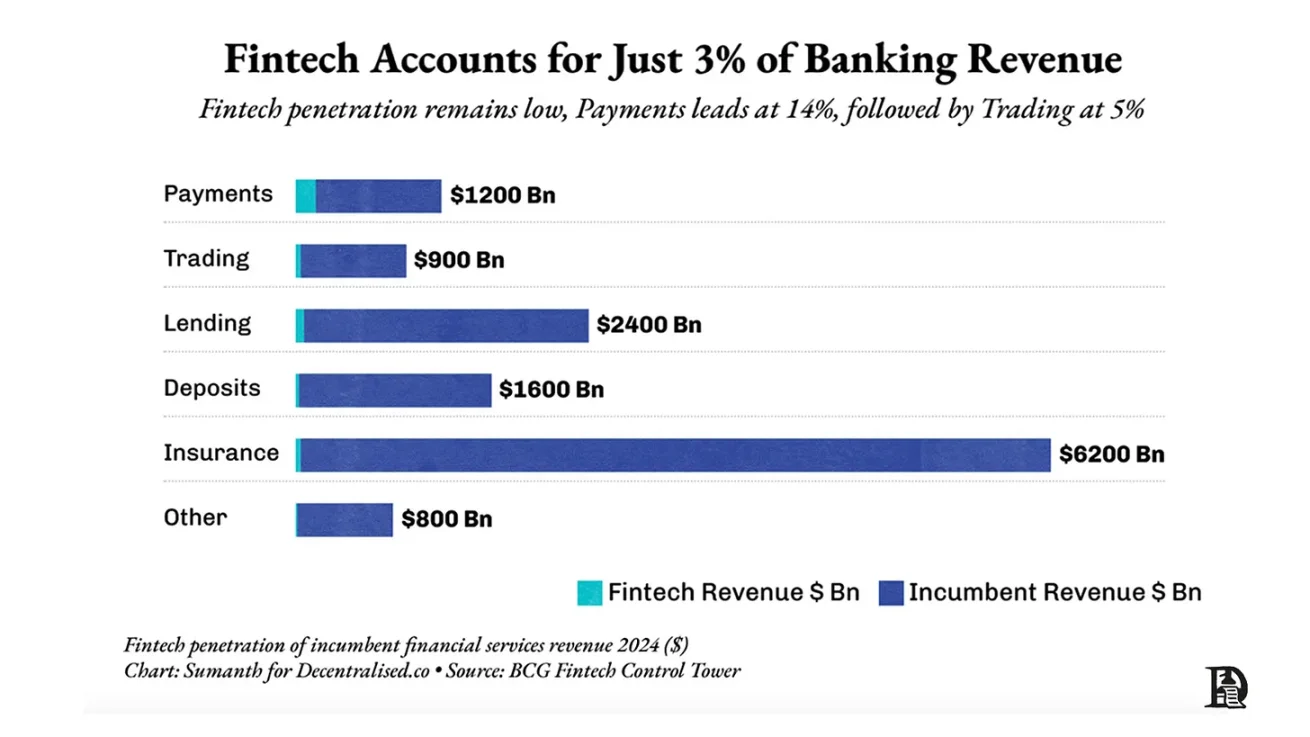

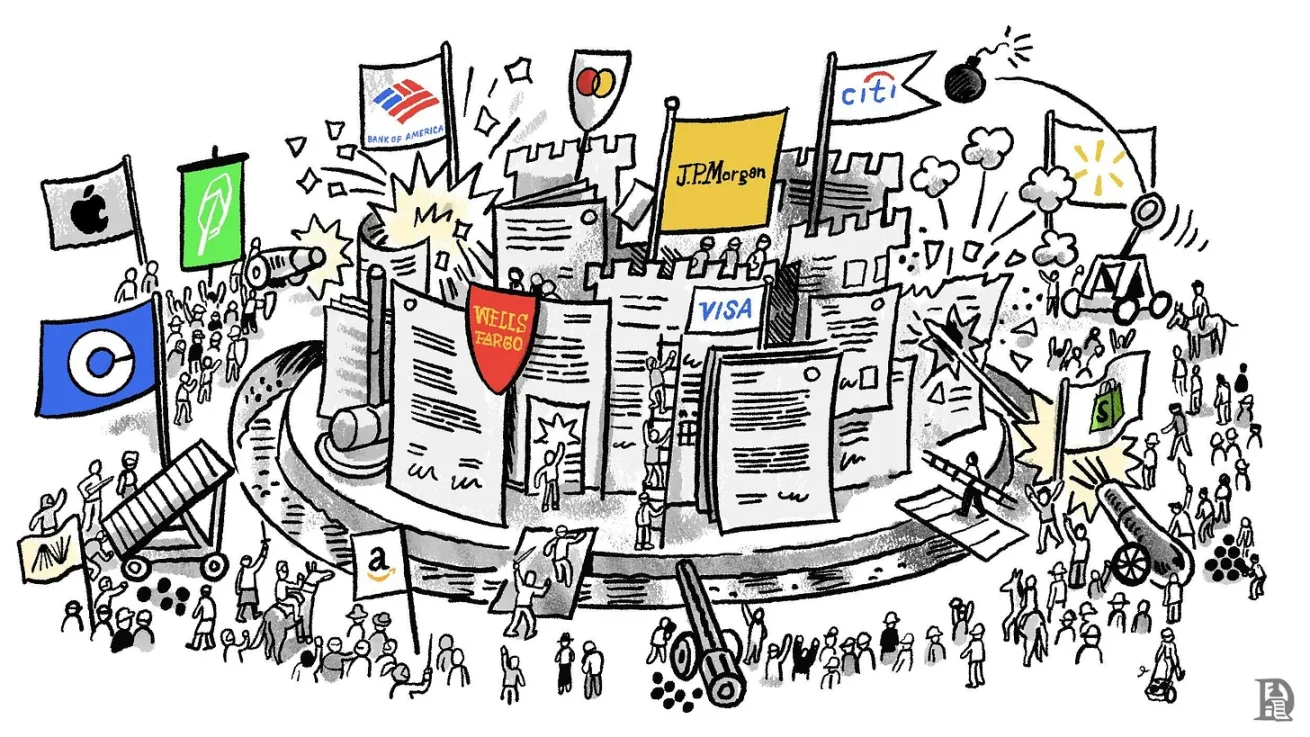

If the definition of a portfolio is changing, then where we store wealth will also change. Few places illustrate this transformation as clearly as today’s banks. Banks account for 97% of all banking revenue, leaving about 3% for fintech platforms. This is a classic Matthew effect; banks generate most of the revenue because most capital is stored with them today. But can businesses be built by peeling away some of the monopoly and owning specific functions?

We tend to think so. This is also part of the reason why half of our portfolio consists of fintech startups.

Today's article aims to argue for the untethering of banks.

New banks are not in shiny offices downtown; they are in your social information streams, in your applications. Cryptocurrency has reached a mature stage, no longer just associated with early adopters. It has begun to flirt with the boundaries of fintech, making what we build the total addressable market (TAM) for the world. What does this mean for investors, operators, and founders?

We attempt to find answers in today’s discussion.

The GENIUS Act in Liquidity

Warren Buffett is known as the Oracle of Omaha for good reason; his portfolio performance is nothing short of magical. But behind that magic is some often-overlooked financial engineering. Berkshire Hathaway possesses what can be considered permanent capital. In 1967, he acquired an insurance business with stable idle capital. In insurance terms, he could leverage the insurance float, which is the amount of premiums paid but not yet claimed, viewing it as an interest-free loan.

Contrast this with most fintech lending platforms. LendingClub is a startup focused on peer-to-peer lending. In this model, liquidity comes from other users on the platform. If I lend money to Saurabh and Sumanth on LendingClub and they both default, I might be less willing to lend to Siddharth on the same platform. The reason is that by then, my trust in the platform's ability to vet, verify, and bring in quality borrowers has diminished.

If you had an accident every time you took a ride, would you still use Uber?

Think of this, but in terms of lending. LendingClub ultimately had to acquire Radius Bank for $185 million to gain a stable source of deposits that could be used for lending.

Similarly, SoFi spent nearly $1 billion over seven years to scale as a non-bank lender. Without a banking license, you are not allowed to take deposits and lend them to potential borrowers. Therefore, it had to provide loan funding through partner banks, which consumed most of the interest generated. It can be understood as me borrowing money from Saurabh at a 5% interest rate and then lending it to Sumanth at a 6% interest rate. This 1% spread is my profit from issuing that loan. But if I had a stable source of deposits (like a bank), I could earn more.

That is what SoFi ultimately did. In 2022, it acquired Golden Pacific Bank in Sacramento for $22.3 million. This move was to obtain a license that allows it to take deposits. This change pushed its net interest margin to around 6%, well above the typical 3-4% for U.S. banks.

Smaller bank wrappers cannot generate a large enough profit margin to operate. So what about giants like Google? Google launched Plex as a mechanism to embed a wallet directly into your Gmail app. It was built in collaboration with a banking consortium to handle deposits. The business involved Citigroup and Stanford Federal Credit Union, but it never launched. After two years of regulatory back-and-forth, Google canceled the project in 2021. In other words, you can have the world’s largest inbox, but it’s hard to convince regulators why people should be allowed to transfer funds where they send and receive emails; that’s just life.

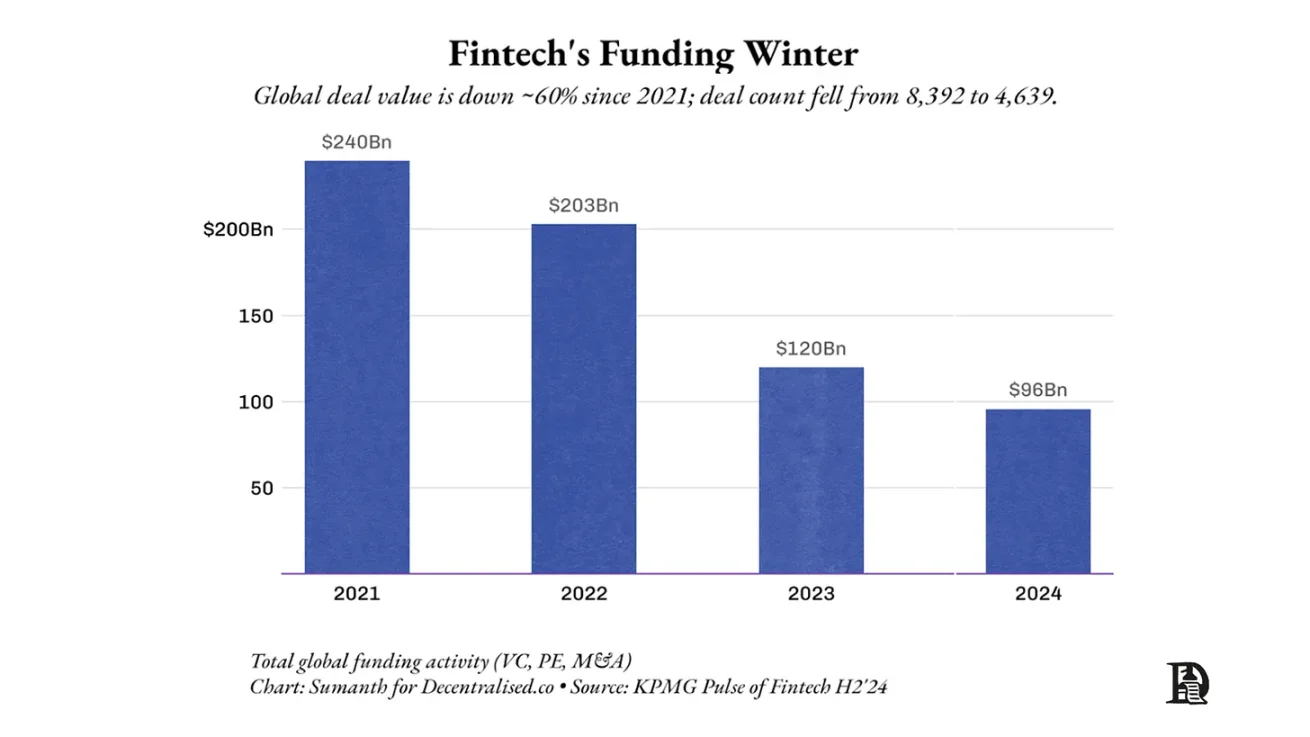

Venture capital understands this struggle. Since 2021, total funding flowing to fintech startups has halved. Historically, most of the moats for fintech startups have been regulatory. This is why banks capture the largest share of the banking revenue pie. But when banks misprice risk, they are gambling with depositors' money, as we saw with Silicon Valley Bank.

The GENIUS Act erodes this moat. It allows non-bank institutions to hold user deposits in the form of stablecoins, issue digital dollars, and settle payments 24/7. Lending remains isolated, but custody, compliance, and liquidity have slowly transitioned to the realm of code. We may be entering a new era where a new generation of Stripes will build on these financial primitives.

But does this increase risk? Are we allowing startups to gamble with user deposits, or just allowing suited individuals to do so? Not entirely. Digital dollars or stablecoins are typically much more transparent than their traditional counterparts. In the traditional world, risk assessment is a private matter. On-chain, it is publicly verifiable. When ETF or DAT holdings can be verified on-chain, we see versions of this situation where you can even verify how much Bitcoin countries like El Salvador or Bhutan hold.

The transformation we are witnessing is that products may look like Web2, but the assets are on a Web3 track.

If blockchain tracks enable faster fund transfers, and digital primitives like stablecoins allow users to hold deposits under appropriate regulatory frameworks, we will see the emergence of a new generation of banks with entirely different unit economics.

But to understand this transformation, it helps to first understand the components that make up a bank.

Building Blocks of Banks

What exactly is a bank? At its core, it does four things:

First, it holds information about who owns how much asset, a database.

Second, it enables people to transfer funds between each other through transfers and payments.

Third, it ensures compliance with users to ensure that the assets held by the bank are legitimate.

Fourth, it leverages the information in the database to upsell loans, insurance, and trading products.

The way cryptocurrency eats away at these parts is somewhat inverted. For example, stablecoins are not yet mature banks today, but they have enormous appeal in terms of transaction volume. Historically, Visa and Mastercard charged tolls on everyday transactions. Every time a card was swiped, a few basis points went into their moat because merchants had no alternative.

By 2011, the average debit card fee in the U.S. was about 44 basis points, high enough for Congress to pass the Durbin Amendment, which cut those rates in half. Europe set its cap even lower in 2015, with debit cards at 0.20% and credit cards at 0.30%, after Brussels determined that the two giants were "coordinating rather than competing." However, U.S. credit cards without a cap still settle at rates of 2.1%–2.4% today, only slightly lower than a decade ago.

Stablecoins have overturned this economic model. On Solana or Base, the settlement fee for a USDC transfer is less than $0.20, a fixed fee regardless of the amount. Shopify merchants accepting USDC through self-custody wallets can retain the 2% credit card network fees that were once charged. Stripe has already seen the trend. It now offers a checkout rate of 1.5% for USDC, down from its 2.9% + $0.30 fee rate.

The new flow of funds in the U.S.

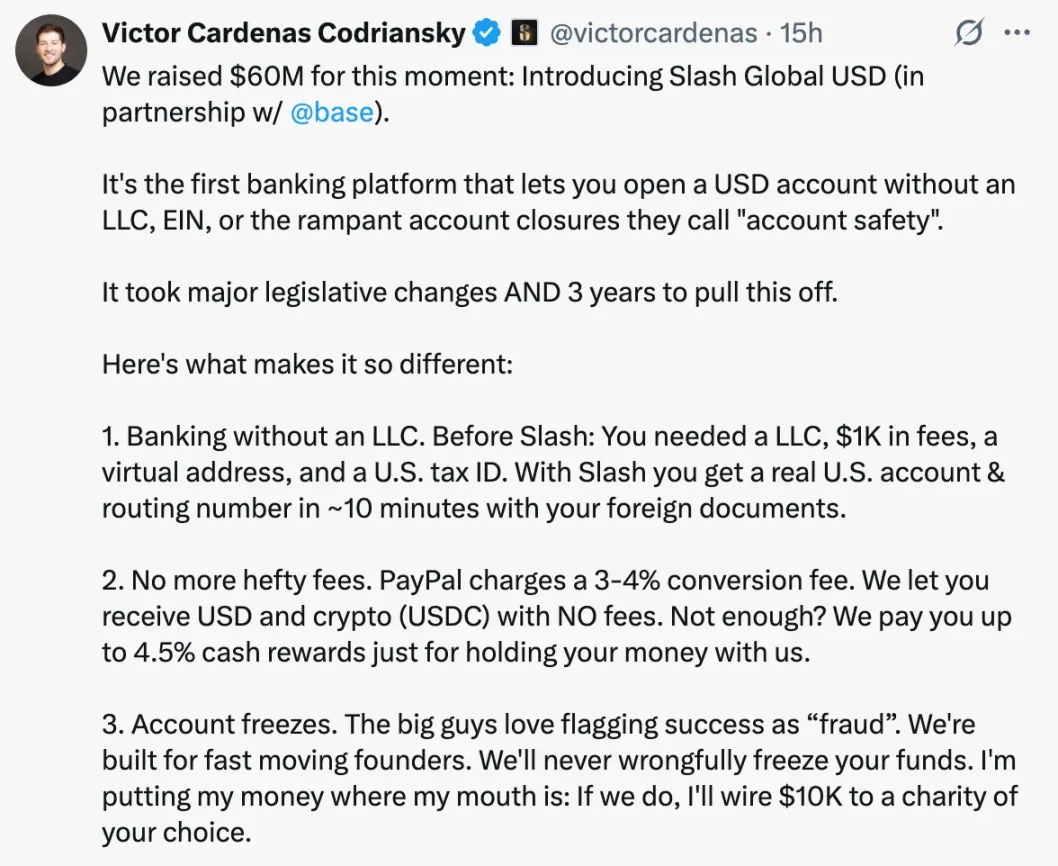

These tracks invite new participants at a much lower cost. YC-backed Slash allows any exporter to start accepting payments from U.S. customers in five minutes, without the need for a Delaware C Corporation, acquiring a merchant bank contract, paperwork, or lawyer retainers—just a wallet. The message to traditional processors is clear: upgrade to stablecoins or lose card swipe revenue.

For users, the economic rationale is very straightforward.

Accepting stablecoins in emerging markets means avoiding the hassles and staggering fees associated with foreign exchange.

It is also the fastest way to send funds cross-border, especially for merchants with downstream import payment needs.

You save about 2% in fees that would need to be paid to Visa and Mastercard. There are off-ramping costs, but in most emerging markets, stablecoins trade at a premium to the dollar. USDT is currently trading at 88.43 rupees in India, while the dollar price offered by Transferwise is 87.51 rupees.

The reason stablecoins are accepted in emerging markets is that the economic rationale is quite direct. They are cheaper, faster, and safer. In regions like Bolivia, where inflation rates reach 25%, stablecoins provide a viable alternative to government-issued currency. Essentially, stablecoins give the world a taste of what blockchain as a financial track could look like. The natural evolution will be to explore what other financial primitives these tracks can enable.

Merchants converting cash to stablecoins will soon discover that the issue is not receiving funds but operating a business on-chain. Funds still need to be stored in a vault, yesterday's transactions must be reconciled, vendors expect payments, payroll needs to be streamed, and auditors require proof.

Banks encapsulate all these elements in core banking systems, which are behemoths from the mainframe era, written in Cobol, maintaining ledgers, enforcing cut-off times, and pushing batch files.

Core Banking Software (CBS) performs two fundamental tasks:

Maintains a tamper-proof true ledger: who owns what, mapping accounts to customers.

Securely exposes that ledger to the outside world: supporting payments, loans, cards, reporting, and risk management.

Banks outsource this work to CBS software providers. These providers are tech companies skilled in software, while banks excel in finance. This architecture dates back to the 1970s when branches transitioned from paper ledgers to connected data centers, then became rigid under a mountain of regulations.

The FFIEC is an agency that publishes operational guidelines for all U.S. banks. It outlines the rules that core banking software should follow: placing the primary data center and backup data center in different geographic regions, maintaining redundant telecom lines and power, continuously recording transaction logs, and monitoring any security incidents.

Replacing a core banking system is a top-tier defensive event because data, every customer balance and transaction, is trapped in the vendor's database. Migration means weekend switches, dual ledger operations, regulatory fire drills, and a high likelihood of failure the next morning. This built-in stickiness turns core banking into an almost permanent lease. The top three vendors—Fidelity Information Services (FIS), Fiserv, and Jack Henry—trace back to the 1970s and still lock banks into contracts of about seventeen years. They collectively serve over 70% of banks and nearly half of credit unions.

Pricing is usage-based: a retail checking account costs between $3 and $8 per month, decreasing with volume but increasing with additional features like mobile banking. Enabling fraud tools, FedNow payment tracks, and analytics dashboards can drive costs even higher.

Fiserv alone generated $20 billion in revenue from banks in 2024, about ten times the Ethereum chain fees during the same period.

Putting the assets themselves on a public chain means the data layer is no longer proprietary. USDC balances, tokenized government bonds, and loan NFTs all reside on the same open ledger, readable by any system. If a consumer application finds its current "core layer" too slow or expensive, it does not need to migrate the state of bytes; it simply points a new orchestration engine to the same wallet address and continues operating.

That said, the conversion costs do not drop to zero; they simply mutate. Payroll providers, ERP systems, analytics dashboards, and audit pipelines all need to integrate with the new core. Changing vendors means reconnecting these hooks, which is no different from switching cloud providers. The core is not just a ledger; it also runs business logic: mapping user accounts, cut-off times, approval workflows, and exception handling. Even if balances are portable, re-coding this logic in a new tech stack still requires effort.

The difference is that these frictions are now software issues rather than data hostage issues. There is still the glue work of coding workflows, but those are sprint cycle problems rather than years of hostage negotiations. Developers can even adopt a multi-core strategy, using one engine for retail wallets and another for treasury operations, as both point to the same authoritative blockchain state. If a vendor has issues, they failover by redeploying containers rather than arranging data migrations.

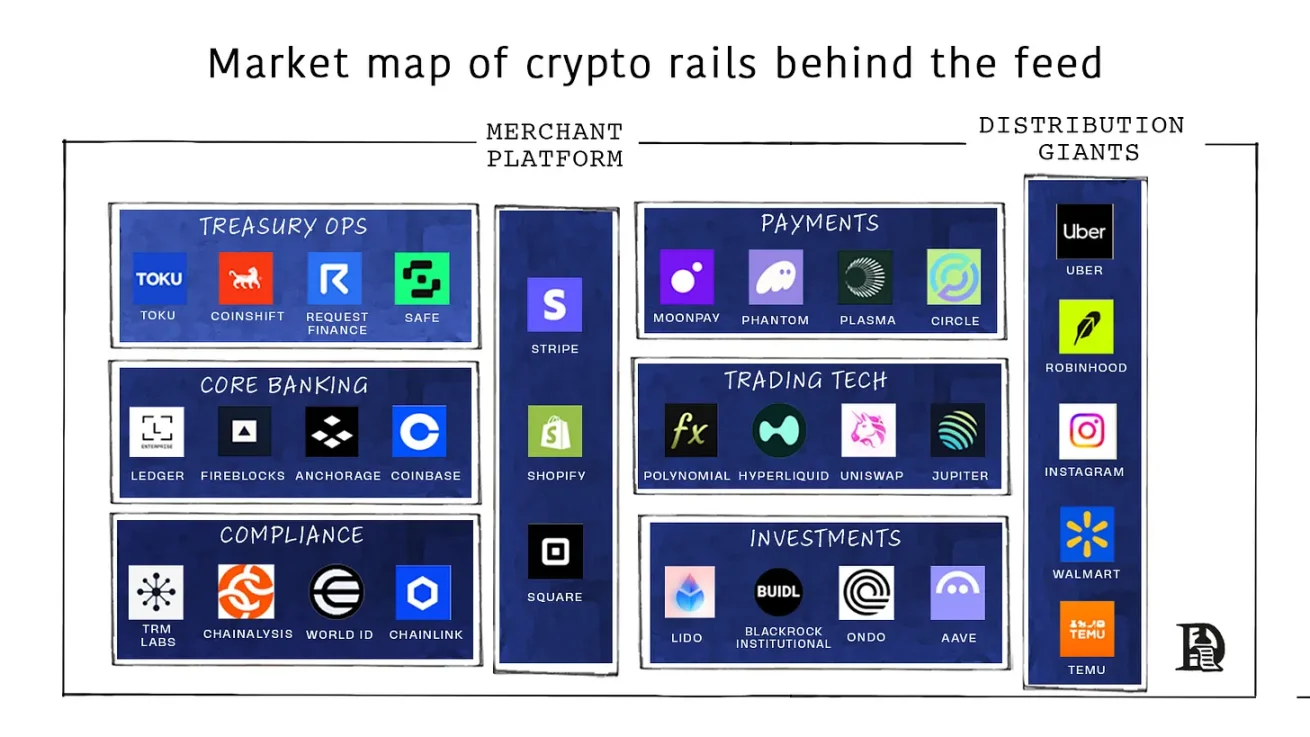

Viewing the future of banks through these lenses may look very different. These components exist in isolation today, waiting for developers to package them together for retail users.

Fireblocks protects over $10 trillion in token flows for banks like BNY Mellon. Its strategy engine can mint, route, stake, and verify stablecoins across more than 80 chains.

Safe protects about $100 billion in smart account treasuries; its SDK provides any application with simple logins, multi-signature strategies, gas abstraction, streaming payroll, and automatic rebalancing.

Anchorage Digital, the first chartered crypto bank, leases a regulated balance sheet that understands Solidity. Franklin Templeton directly mints its Benji government bond fund into Anchorage custody, settling shares on T+0 instead of T+2.

Coinbase Cloud offers wallet issuance, MPC custody, and sanctioned-checked transfers as a single API.

These participants possess elements that traditional vendors lack: an understanding of on-chain assets, compliance anti-money laundering laws built into the protocol, and event-driven APIs rather than batch files. Comparing this to a market expected to grow from about $17 billion today to around $65 billion by 2032, the equation is simple: line items that once belonged to Fidelity and its partners are now up for grabs, and companies delivering products in Rust and Solidity rather than Cobol will seize it.

But before they are truly ready for retail, they need to battle the great evil that all financial products must contend with: compliance. What might compliance look like in an increasingly on-chain world?

Code is Compliance

Banks operate four types of compliance: Know Your Customer (KYC and due diligence), screening counterparties (sanctions and PEP checks), monitoring funds (transaction monitoring with alerts and investigations), and reporting to regulators (SARs/CTRs, audits). This is vast, expensive, and ongoing. In 2023, global spending exceeded $274 billion, and the burden is almost always increasing.

The scale of paperwork exposes risk patterns. FinCEN reported about 4.7 million suspicious activity reports and 20.5 million currency transaction reports last year, all of which are retrospective forms about risk. This work is batch-heavy: collecting PDFs and logs, compiling narratives, submitting reports, and waiting.

For on-chain transactions, compliance is no longer a pile of manual artifacts but begins to operate like a real-time system. The FATF's "travel rule" requires sender/beneficiary information to be transmitted with transfers; cryptocurrency providers must obtain, hold, and transmit this data (traditionally above the $1,000 threshold for "occasional transactions" in USD/EUR). The EU has gone further, applying this rule to all cryptocurrency transactions. On-chain, this payload can be transmitted as encrypted data blocks with the transfer, available for regulators but not visible to the public. Chainlink and TRM publish sanction lists and fraud oracles; transfers query the lists in the process, and if an address is flagged, it is reversed.

Once zero-knowledge wallets like Polygon ID or World ID can carry an encrypted badge to prove, say, "I am over 18 and not on any sanctions list," privacy is also protected. Merchants see the green light, regulators receive an auditable trail, and users never have to disclose passport scans or street addresses.

If funds stagnate in back-office paperwork, a fast-moving, liquid market is of no use. Vanta is an example of a reg-tech startup that has shifted SOC2 compliance from consultants and screenshots to APIs. Startups selling software to Fortune 500 companies need SOC2 certification. This should prove that you adhere to reasonable security practices, avoiding storing customer data in unprotected public links.

Startups need to hire auditors who bring a massive spreadsheet demanding screenshots of everything from AWS setups to Jira tickets, disappear for six months, and then return with a signed PDF that expires immediately. Vanta simplifies this ordeal into an API. You do not need to hire consultants; you simply integrate Vanta with AWS, GitHub, and your HR tech stack; it monitors logs, automatically takes the same screenshots, and provides them to auditors. This move has propelled Vanta to $200 million in annual recurring revenue (ARR) and a $4 billion valuation.

Linear's founder laments the state of compliance.

Finance will follow the same trajectory: less binder management, more strategy engines evaluating events in real-time, leaving behind encrypted receipts. Balances and liquidity are transparent, timestamped, and cryptographically signed, making audits observational.

Oracles like Chainlink serve as the true trust bridge between off-chain rulebooks and on-chain execution. Its proof-of-reserve data streams make reserve adequacy clear and readable for contracts, allowing issuers and venues to connect to automatically responsive circuit breakers. There is no need to wait for annual checks; the ledger is continuously monitored.

Proof of reserves gradually reaches the level of liquid collateral; if a stablecoin's collateralization ratio falls below 100%, the minting function automatically locks and notifies regulators.

There is still real work to be done. Authentication, cross-jurisdiction rules, edge case investigations, and machine-readable policies all need to be strengthened. The coming years will feel less like dealing with paperwork and more like managing API version control: regulators will issue machine-readable rules, oracle networks and compliance providers will offer reference adapters, and auditors will shift from sampling to oversight. As regulators understand what real-time audits can bring, they will collaborate with vendors to implement a new class of tools.

A New Era of Trust

Everything is bundled and then gradually unbundled. The story of humanity is one of continually trying to improve efficiency by integrating things, only to realize decades later that they are better off remaining independent. The legislative nature surrounding stablecoins and the current state of underlying networks (Arbitrum, Solana, Optimism) means we will see repeated attempts to rebuild banking. Yesterday, Stripe announced its attempt to launch an L1.

Two forces are working in synergy in modern society.

Rising costs due to inflation.

Increasing meme desires due to our highly interconnected world.

In an era where consumer desires are increasing while wages stagnate, more people will take control of their finances. The GameStop surge, the rise of meme coins, and even the frenzy around Labubu or the Stanley Cup are all effects of this shift. This means that applications with sufficient distribution capabilities and embedded trust will evolve into banks. What we will see is a version of the Hyperliquid builder code system expanding into the entire financial world. Whoever owns the distribution channels will ultimately become the bank.

If your most trusted influencer recommends a portfolio on Instagram, why would you still trust JPMorgan? If you can trade directly on Twitter, why bother trading on Robinhood? As for me? Personally? My preferred way to lose money would be to keep it on Goodreads to buy rare books. My point is that with the introduction of the GENIUS Act, legislation allowing products to hold user deposits has changed. In a world where the mobile components that constitute banking turn into API calls, more products will mimic banks.

Platforms that own the information flow will be the first to undergo this transformation, which is not a new phenomenon. Social networks heavily relied on the activities of e-commerce platforms to monetize in their early days because that was where money changed hands. Users seeing ads on Facebook might purchase products on Amazon, generating referral revenue for Facebook. In 2008, Amazon launched an app called Beacon, specifically designed to view platform activities to create wish lists. Throughout the history of the web, there has always been a beautiful waltz between attention and commerce. Embedding banking infrastructure into their platforms will be another mechanism closer to where the money resides.

Won't established companies jump on this trend of providing access to digital assets? Existing fintech companies won't sit idly by, right? FIS is negotiating with almost every bank, aware of what is happening. Ben Thompson's point in his recent article is simple and brutal: when the paradigm flips, yesterday's winners are at a disadvantage because they want to continue doing what they did when they were winning. They optimize for the old game, defend old KPIs, and make the right decisions for the wrong world. This is the curse of the winner, and it equally applies to putting funds on-chain.

When everything is a bank, nothing is a bank. If users do not trust a single platform to hold most of their wealth, the location of funds will become diversified. This has already happened for crypto-native users who store most of their wealth on exchanges rather than banks. This means the unit economics of bank revenue will change. Smaller applications may not need as much revenue to operate as large banks because most of their business may occur without human involvement. But this means that traditional banks as we know them will slowly fade away.

Perhaps, like life, technology is merely a continuum of creation and destruction, a continuum of bundling and unbundling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。