The prediction market hides rich data, behavioral patterns, and time arbitrage opportunities.

Written by: Pix

Translated by: Saoirse, Foresight News

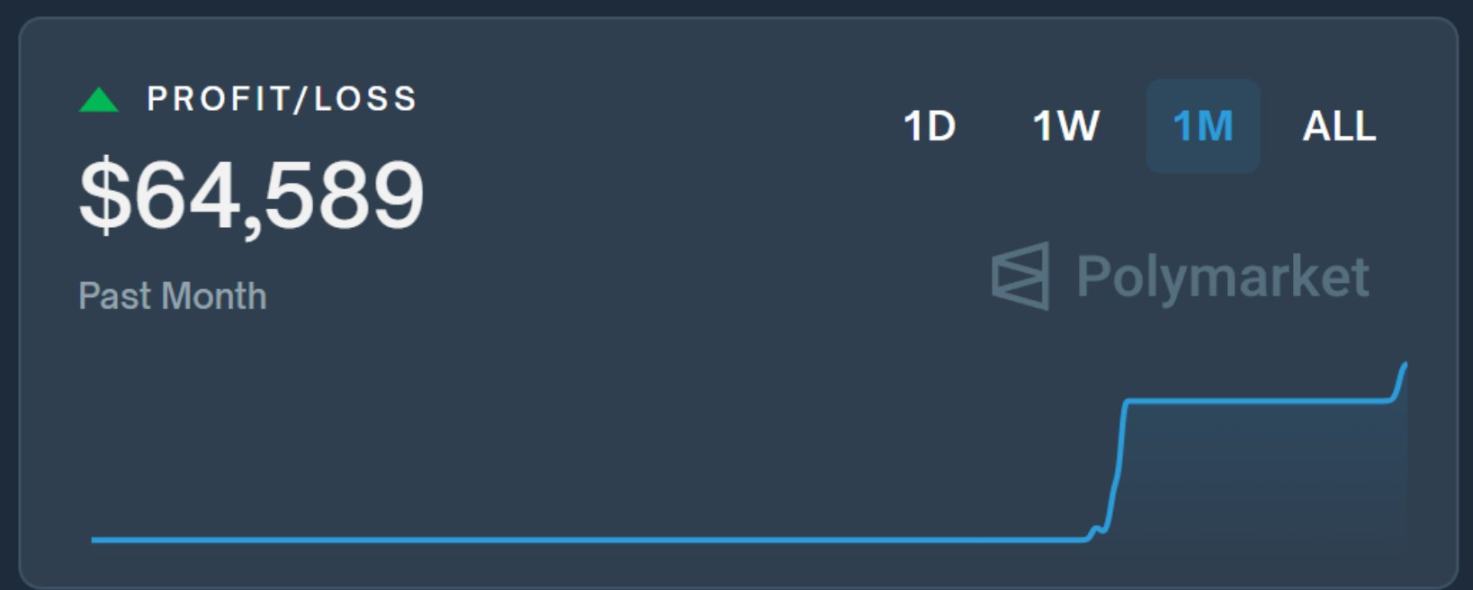

Translator's Note: People’s understanding of prediction markets often stays at the level of "event betting," while the author of this article reveals its deeper logic with a monthly practical profit of $64,000—this is not a casino, but a profit system hiding structural opportunities such as pricing biases and market lags. The 11 strategies range from cross-market arbitrage to reflexive operations, hoping to open new perspectives for readers, whether they are traders or market observers, allowing them to glimpse the pathways.

Most people think prediction markets are for betting, but that is just the surface function.

In the eyes of experts, they can reveal much more:

Unreasonable pricing odds

Lagging market reactions

Herd behavior

Influencable reflexive cycles

If you understand the operational logic of these systems, you won't be limited to betting on outcomes but can profit directly from market structures.

Here are 11 methods I have implemented in detail:

Arbitrage Strategies

1. Cross-Market Arbitrage

The odds for the same event can differ across platforms. For example, the odds for "Trump winning" on Polymarket might be 55%, while on Kalshi it could be 48%.

In this case, buying low and selling high can yield risk-free expected returns.

This can be done manually or automated through an API. Using the Kelly Criterion to control trade size is even more effective. (For related details, see the FN translated article “KOL: How I Made $100,000 Through Prediction Market Arbitrage”)

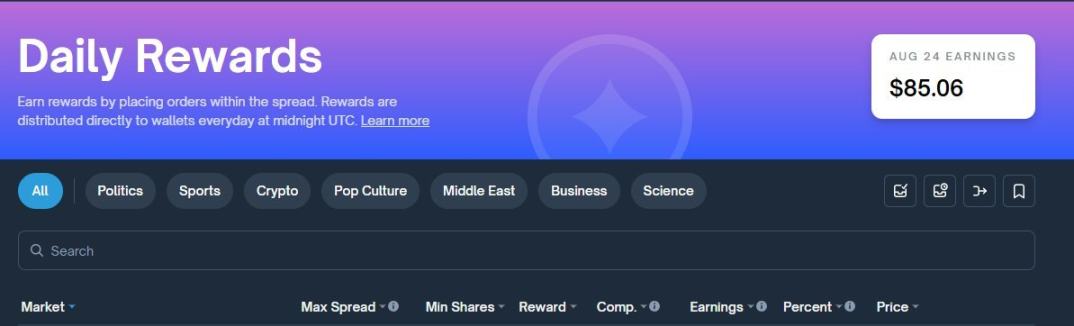

2. Providing Liquidity to Market Pools

If there is an automated market maker (AMM) behind the market, you can become a liquidity provider (LP).

This is similar to a straddle option strategy, allowing you to maintain delta neutrality while earning fees from trading activity.

In highly volatile and high-attention markets, this method can yield particularly significant returns.

3. Bayesian Updating vs. Market Lag

(Bayesian Updating refers to continuously adjusting the judgment of the probability of an event occurring based on new information, gradually approaching a more accurate conclusion.)

Market reactions are often slow, especially in decentralized markets.

For instance, if a candidate drops out of an election, most bettors won't immediately adjust their positions.

However, if you have a model that can update odds in real-time based on new information, you can position yourself ahead of their actions.

This time lag is your profit space.

Meta-Reflexivity and Exploiting Incentive Gaps

(Meta-Reflexivity describes the deep interactive relationship where market participants' behaviors are influenced not only by market conditions but also shape the market itself, even altering the predicted outcomes of events.)

4. Trading Oracles

Some markets rely on a single news source for outcome determination.

If the rules of a bet state "Will event X occur before date Y (according to CNN reports)," then you are not betting on the event itself, but rather on whether CNN will report on it.

Understanding the biases and reporting tendencies of these "oracles" (information sources) is a significant advantage.

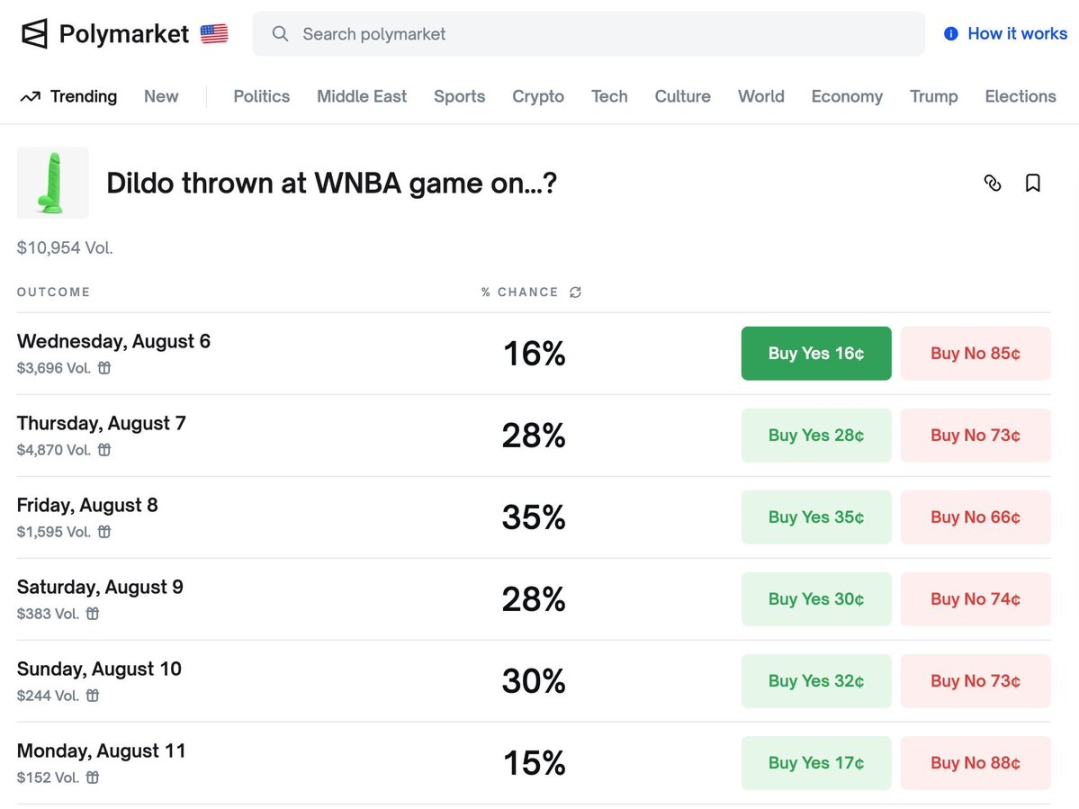

5. Reflexive Arbitrage

Some markets can actually promote the outcomes they predict.

For example, if there is a bet on "Will project X launch before Q3?" and you buy "yes," you have the incentive to push for that outcome.

Tweeting to create momentum, contacting the project team, engaging the community…

Prediction markets can be actively guided.

Remember the incident with rubber products appearing on the WNBA court? There’s always a way to find profit if you think creatively; those who understand will know…

Using Prediction Markets as Information Sources

6. Using Odds to Guide Perpetual Contract Trading

Platforms like Polymarket often reflect probabilities faster than the media.

If the odds of an Ethereum ETF approval suddenly spike to 90%, you can even establish a long position in Ethereum before the news is announced.

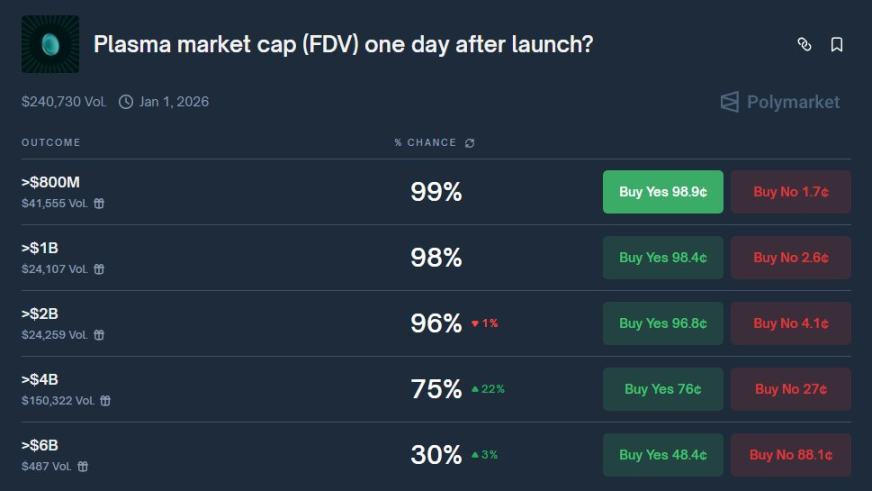

7. Early Positioning in Token Trading

Some markets can predict the popularity of a project.

When Polymarket adds a new bet related to a token, it often indicates that the token is about to experience high trading volume.

You don’t have to bet on the outcome; just follow this trend or be prepared to provide liquidity when it launches.

Structural Operations

8. Treating Prediction Markets as Synthetic Options

Binary outcome bets are actually similar to capped options.

For example, if there are 3 days until expiration and the current price of the "YES" option is 0.09, if the actual probability of occurrence is 20%, it represents a volatility pricing error.

Analyze it as an option, modeling and calculating delta (sensitivity of price to probability), theta (time decay), and gamma (rate of change of sensitivity).

9. Building Custom Parlay Bets

A Parlay Bet refers to a betting style where the bettor combines two or more independent bets into a single wager. The entire "parlay" only wins if all combined bets hit; if any single bet fails, the entire parlay loses.

By stacking multiple markets, you can create synthetic combination strategies.

For example, if the odds of Trump winning the Republican primary are 70% and the odds of winning the general election are 40%, if the former comes true as you expected, the latter's odds will surely skyrocket, allowing you to profit by buying into the latter.

10. Tax Planning

In some regions, losses in prediction markets can be reported as gambling losses.

If you have gains from holding cryptocurrencies, creating some losses through structured operations may reduce your tax bill.

However, be sure to consult professionals.

Token Exposure Operations

11. Trading Infrastructure Tokens

Some platforms have native tokens (such as Zeitgeist, Truemarkets, etc.).

When trading volume on these platforms surges, the prices of these prediction market tokens often lag in rising (not investment advice).

To be honest, I’m not very good at evaluating these tokens, but "when the big trend comes, all boats will rise."

I currently have no positions, but I may provide some liquidity in the future.

Conclusion

Prediction markets are often misunderstood as simple gambling tools,

but in fact, they hide rich data, behavioral patterns, and time arbitrage opportunities.

If you treat it as a set of operational logic rather than a casino, you will find asymmetric profit opportunities everywhere.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。