AMM, positioned in the "last mile," focuses on providing a small, smooth, and transparent exchange experience.

Written by: @sanqing_rx

Introduction

Real World Assets (RWA) are becoming a key narrative for Web3's mainstream adoption. However, bringing trillion-dollar real assets on-chain is just the first step; the real challenge lies in building efficient and robust secondary market liquidity for them. As the cornerstone of DeFi, Automated Market Makers (AMM) are naturally expected to play a significant role, but can they be directly applied to the world of RWA?

Summary (Three-Sentence Overview)

Conclusion: Current mainstream AMMs (concentrated liquidity, stablecoin curves, etc.) are not suitable to serve as the "main market" for RWA. The biggest obstacle is not the curve model, but rather the economic model of LPs (liquidity providers) which cannot sustain in the low turnover, strong compliance, and slow pricing environment of RWA.

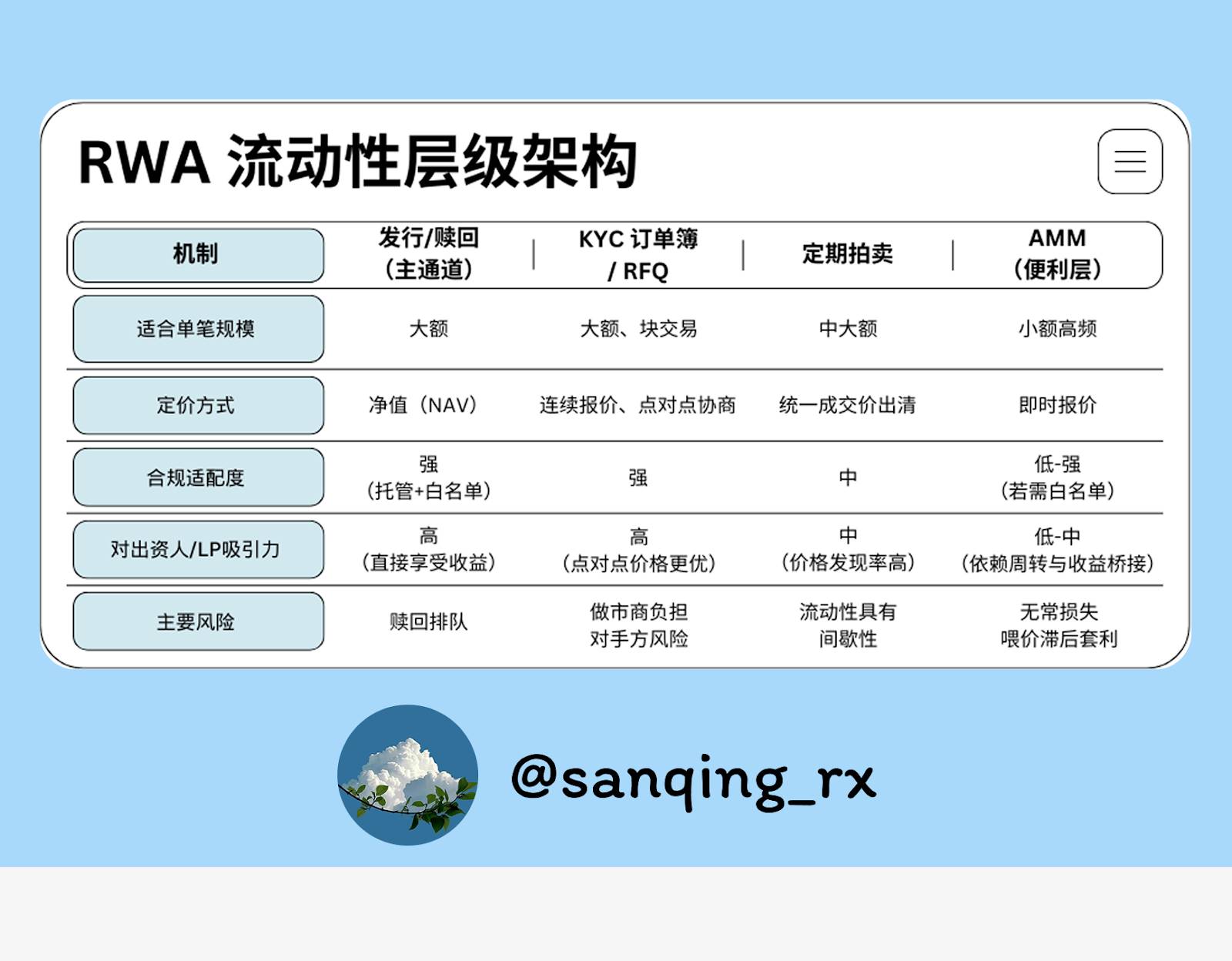

Positioning: Issuance/redemption, KYC order books/RFQ, and periodic auctions should be set as the "main thoroughfare" for RWA liquidity; AMMs should retreat to the "convenience layer," only accommodating small, daily, and convenient secondary trading needs.

Method: By combining "narrow-band market making + Oracle slip-band/Hook + yield bridging," the native yields of RWA (such as coupon payments and rents) can be effectively transmitted to LPs, supported by comprehensive risk control and information disclosure.

1. AMM Should Not Be the "Main Market" for RWA

RWA seeks predictable, measurable, and settleable financial frameworks. While the continuous quoting mechanism of AMMs is highly innovative, it faces three inherent challenges in most RWA scenarios: naturally low transaction volumes, slow information updates, and extended compliance paths. This makes it difficult for LPs to rely solely on trading fees for returns, while also exposing them to the risks of impermanent loss.

Therefore, our core viewpoint is that AMMs should not take on the role of the "main market" for RWA but should serve as the "last mile" of liquidity. Their role is to allow users to conveniently exchange small assets anytime and anywhere, enhancing user experience, while the core functions of large transactions and price discovery must be entrusted to other more suitable mechanisms.

2. Why AMMs Thrive in the Native Crypto World?

To understand the limitations of AMMs in RWA scenarios, we must first grasp the foundational elements of their success in the native crypto world:

Continuous trading: A 24/7 global market, combined with permissionless cross-market arbitrageurs, ensures that any price discrepancies are immediately corrected, creating sustained trading activity.

High composability: Almost anyone or any protocol can participate as an LP or engage in arbitrage without barriers, forming strong network effects and self-reinforcing traffic.

Volatility equals business: High volatility generates significant trading demand and arbitrage opportunities, allowing LPs to "outperform" impermanent loss through generated trading fees.

When we attempt to replicate these three points in the RWA domain, we find that the entire foundation has changed: transaction frequency significantly decreases, pricing updates are extremely slow, and compliance thresholds are greatly increased.

【On-the-spot Explanation|Pricing Heartbeat】

"Pricing heartbeat" refers to the "frequency of credible price updates," which is key to understanding the differences between RWA and crypto-native assets.

Crypto-native assets: Heartbeat is usually at the second level (exchange quotes, oracle price feeds).

Most RWA: Heartbeat is often at the daily or even weekly level (fund net value updates, property valuations, auction transaction prices).

Assets with slower heartbeats are less suitable for long-term deep continuous quoting pools.

3. The Economic Model of LPs in RWA Scenarios is Unbalanced

The "annualized return feeling" of LPs depends mainly on three factors: trading fee rates, the turnover intensity of funds within effective price ranges, and the annual repetition of trading rhythms.

For RWA, this calculation is difficult because:

Generally low turnover rates: "Funds sitting in the pool" are rarely activated by high-frequency trading, leading to scarce fee income.

High opportunity costs: External markets offer considerable coupon payments or risk-free rates. LPs holding RWA assets directly (if possible) often find it more profitable than providing liquidity.

Risk-return imbalance: In the context of low fee income, LPs also bear the risk of impermanent loss (compared to losses from holding assets unilaterally) and the risk of being "preyed upon" by arbitrageurs due to delayed price feeds.

Overall, the economic model of LPs is naturally at a disadvantage in RWA AMMs.

4. Two Structural Frictions: Pricing and Compliance

In addition to the economic model, two structural issues hinder the application of AMMs.

Misalignment of pricing rhythms: The net value/valuation/auction of RWA is a "slow heartbeat," while AMMs provide instant tradable quotes. This time difference creates a significant arbitrage window for those with the latest information, allowing them to easily "exploit" the price discrepancies of uninformed LPs on AMMs.

Compliance cuts into composability: KYC, whitelisting, transfer restrictions, and other compliance requirements extend the paths for capital inflow and outflow, breaking the Lego block model of DeFi where "everyone can participate." This directly leads to liquidity fragmentation and insufficient depth.

The "pipeline project" of cash flow: Cash flows from RWA, such as coupon payments or rents, are either reflected through net value appreciation or need to be directly distributed. If the AMM/LP mechanism does not design a clear path for capturing and distributing these yields, LPs may not receive their rightful cash flows or may be diluted during arbitrage processes.

5. Applicable Boundaries and Practical Cases

Not all RWAs are incompatible with AMMs; we need to categorize them for discussion.

More Friendly: Short-duration assets with daily updated net values and high price transparency (such as money market fund shares, short-term government bond tokens, interest-bearing certificates). These assets have clear central prices and are suitable for narrow-band AMMs to provide convenient exchange services.

Less Friendly: Assets relying on offline valuations or low-frequency auctions (such as commercial real estate, private equity). These assets have slow heartbeats and severe information asymmetry, making them more suitable for order books/RFQ and periodic auction mechanisms.

Case Study: Arbitrage Window of Plume Chain Nest

Background: The nALPHA and nBASIS tokens of the Nest project have AMM pools on Curve and the native Rooster DEX. Initially, their redemption process was quick (about 10 minutes), but the token price update frequency was about once a day, sometimes slower.

Phenomenon: Due to the "daily update" of net value and "second quotes" from AMM, when the new net value is announced, the AMM price fails to keep up, creating an arbitrage window of "buying low on DEX → immediately applying for redemption from the project → settling at the updated higher net value."

Impact: Arbitrageurs profited, while AMM LPs bore all the impermanent losses, especially those LPs providing liquidity at more deviated price ranges, suffering greater losses.

Review and Repair Suggestions:

Review: The root of the problem lies in the mismatch of pricing heartbeats, while the protocol lacks necessary risk control safeguards and order diversion mechanisms.

Repair Suggestions:

Order diversion: AMMs should only handle small transactions (as explained below), while large orders should be forcibly directed to RFQ or issuance/redemption channels.

Active price following: Implement "Oracle slip-band + Hook" mechanisms to provide liquidity only within a narrow range around the latest net value, automatically migrating price bands or temporarily increasing rates during net value updates.

Risk control safeguards: Set oracle freshness thresholds, price deviation circuit breakers, and switch to auction or redemption-only modes on days of significant valuation adjustments.

Information disclosure: Establish a public dashboard displaying premium/discount distributions, oracle status, redemption queues, etc., allowing LPs to make informed decisions.

6. A Four-Pronged "Liquidity Framework"

A mature RWA market should have a multi-layered liquidity structure.

7. Refined Operations: Three Key Strategies for Effective RWA AMM

To ensure that AMMs play their role well in the "convenience layer," three things need to be done:

1. Narrow-Band Market Making (Concentrated Liquidity)

Provide liquidity only within a very narrow range around the asset's net value. This greatly enhances capital efficiency and reduces the time window for liquidity to be "stuck at old prices" and exploited.

2. Price Following and Self-Protection (Oracle Slip-Band / Hooks)

This is a dynamic upgrade of narrow-band market making. By orchestrating oracles and smart contracts, it achieves automatic price following and can activate protective mechanisms during market fluctuations.

【On-the-spot Explanation|Oracle Slip-Band and Hook】

Slip-Band: A small "quote corridor" closely following the oracle price feed (such as net value). Liquidity is concentrated here.

Hook: "Programmable actions" embedded in the AMM contract. When the oracle price updates, the Hook is automatically triggered to migrate the "slip-band" to the vicinity of the new price, and can even temporarily increase rates to hedge risks.

Core Objective: Avoid being stuck at old prices for extended periods while retaining the convenience of small transactions.

3. Yield Bridging

A clear mechanism must be established to accurately distribute cash flows generated by RWA assets, such as coupon payments and rents, to LPs in the AMM pool. The key is to clearly define the complete path of "yield into the pool → how to allocate shares → when to claim" at the code level, allowing LPs' sources of income to expand from solely trading fees to "trading fees + native asset yields."

8. Conclusion: From "Continuous Quoting" to "Predictable Liquidity"

RWA may not need the 24/7 price noise of blockchain; what it truly requires is predictable, measurable, and settleable liquidity thoroughfares.

Let us entrust professional matters to professional mechanisms:

Issuance/redemption, KYC order books/RFQ, periodic auctions — building these main routes allows for price discovery and execution of large transactions to occur.

AMM — positioned in the "last mile," focusing on providing a small, smooth, and transparent exchange experience.

When capital efficiency aligns with compliance realities, and when we can no longer expect AMMs to bear the fantasy of being the "main market," the on-chain secondary liquidity ecosystem for RWA will become healthier and more sustainable as a result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。