Compiled by: Jerry, ChainCatcher

Last Week's Performance of Crypto Spot ETFs

U.S. Bitcoin Spot ETF Net Outflow of $1.178 Billion

Last week, the U.S. Bitcoin spot ETF experienced a net outflow for five consecutive days, totaling $1.178 billion, with a total net asset value of $150.23 billion.

Seven ETFs were in a net outflow state last week, with the outflows mainly coming from IBIT, FBTC, and ARKB, which saw outflows of $615 million, $235 million, and $182 million, respectively.

Data Source: Farside Investors

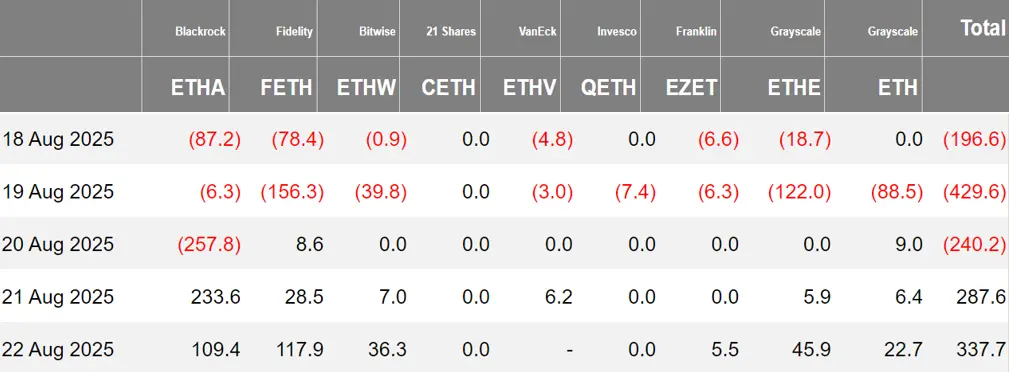

U.S. Ethereum Spot ETF Net Outflow of $241 Million

Last week, the U.S. Ethereum spot ETF had a net outflow for three consecutive days, totaling $241 million, with a total net asset value of $26.55 billion.

The outflow mainly came from Grayscale's ETHE, which had a net outflow of $88.9 million. Seven Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 9.89 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 9.89 Bitcoins, with a net asset value of $48.6 million. The issuer, Harvest Bitcoin, saw its holdings decrease to 292.76 Bitcoins, while Huaxia maintained 2,330 Bitcoins.

The Hong Kong Ethereum spot ETF had a net inflow of 1,265.34 Ethereum, with a net asset value of $12.1 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of August 22, the nominal total trading volume of U.S. Bitcoin spot ETF options was $2.17 billion, with a nominal total long-short ratio of 2.97.

As of August 21, the nominal total open interest of U.S. Bitcoin spot ETF options reached $23.19 billion, with a nominal total open interest long-short ratio of 1.90.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 39.90%.

Data Source: SoSoValue

Overview of Last Week's Crypto ETF Developments

Asset management companies Grayscale, Bitwise, Canary, CoinShares, Franklin, 21Shares, and WisdomTree submitted updated statements for their proposed XRP spot ETF this Friday, indicating the financial companies' eagerness to obtain listing approval from the U.S. Securities and Exchange Commission (SEC).

Bloomberg ETF analyst James Seyffart stated that the emergence of these applications is almost certainly due to feedback received from the SEC. This is a good sign, but it was also largely expected.

The updated documents appear to change the structure of some funds, allowing for XRP or cash creation and cash or physical redemption, rather than just cash creation and redemption.

Jito has submitted the S-1 filing for the VanEck JitoSOL ETF

According to official news, Jito announced that it has submitted the S-1 filing for the VanEck JitoSOL ETF. This application is the result of months of collaboration with regulatory bodies such as the SEC and ongoing business development and educational efforts by various ecosystem contributors.

According to Yahoo Finance, Hong Kong investment management company MicroBit's two virtual asset spot exchange-traded funds (ETFs) have officially listed on the Hong Kong Stock Exchange, namely the MicroBit Bitcoin Spot ETF (HKD counter stock code: 3430.HK, USD counter stock code: 9430.HK) and the MicroBit Ethereum Spot ETF (HKD counter stock code: 3425.HK, USD counter stock code: 9425.HK). It is reported that both ETFs have a management fee of 0.5%.

U.S. SEC delays decision on multiple crypto ETF applications

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on the approval of the Truth Social platform's application for Bitcoin and Ethereum ETFs under Trump Media & Technology Group.

According to documents submitted on Monday, the SEC has extended the approval deadline for the Truth Social ETF to October 8, which is part of the agency's routine process for evaluating dozens of cryptocurrency ETF proposals.

Also delayed for approval on the same day were the CoinShares Litecoin ETF, CoinShares XRP ETF, and 21Shares XRP ETF, with decision deadlines extended to late October. The SEC stated in the documents: "The committee believes it is necessary to extend the review period to adequately assess the proposal's content and related issues."

21 SHARES XRP ETF has been registered in Delaware

Views and Analysis on Crypto ETFs

The ETF Store President Nate Geraci stated that the U.S. SEC should not continue to delay the approval of the staking feature for the spot Ethereum ETF.

He believes that even though the IRS has not yet issued specific tax guidelines for staking rewards, this should not be a reason for the SEC to hinder progress, as the two belong to different regulatory agencies. He pointed out that this feature should have been approved when the spot Ethereum ETF was launched.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。