Author: bruce

In 2025, Wall Street once again witnessed a remarkable collision between the crypto wave and traditional capital markets. This time, the protagonist is a company named MEI Pharma (NASDAQ: MEIP). In just a few weeks, it completed a stunning transformation from a dusty, cash-strapped oncology company to the world's first and only publicly traded company with Litecoin (LTC) as its core treasury asset.

This is not just a self-rescue of a company; it could be a landmark event that opens up a new path for crypto assets recognized by mainstream capital markets.

Section 1: The Past and Present of the "Zombie Pharma"

To understand the significance of this transformation, we must first look at the "past" of MEI Pharma. According to its financial documents submitted to the U.S. Securities and Exchange Commission (SEC), MEI Pharma was on the brink of death in early 2025.

Cash Depletion: As of March 31, 2025, the company had only $20.5 million in cash and cash equivalents left.

Stalled R&D: All clinical drug projects, including its core CDK9 inhibitor voruciclib, had officially been halted.

Public Sale Announcement: The company's board announced in July 2024 that it was evaluating "strategic alternatives," which in capital market jargon typically means seeking a sale, merger, or direct liquidation.

At this point, MEI Pharma had become a typical "zombie biotech company"—almost devoid of anything except a valuable "shell" resource of a NASDAQ-listed company. However, it was precisely this clean, debt-free public platform that provided a perfect stage for a complete makeover.

Section 2: The "Alchemy" of Over a Hundred Million Dollars: Analyzing the Transaction Structure

The new vitality came from a carefully designed $100 million private investment in public equity (PIPE). MEI Pharma sold a total of 29.2 million shares of common stock and pre-funded warrants to specific investors at a price of $3.42 per share. The core mission of this substantial funding was singular: to purchase Litecoin (LTC) and use it as the company's primary treasury reserve asset.

But the story did not end there. More crucially, MEI Pharma also established an "At-the-Market" (ATM) issuance mechanism of up to $100 million.

This "PIPE + ATM" dual structure is the essence of this transformation, creating a powerful financial flywheel:

PIPE Provides Initial Capital: The $100 million private placement ensures the company has sufficient initial capital to immediately build a large position in LTC.

ATM Provides Continuous "Ammunition": The ATM mechanism allows the company to continuously and flexibly issue shares at market price. If the market gives MEIP a high valuation (i.e., high mNAV, which will be detailed later), the company can use high-priced shares to acquire relatively low-priced LTC, thereby continuously increasing the per-share LTC holdings without harming shareholder interests.

This strategy is a complete replication of the "money printer" model successfully validated by MicroStrategy (MSTR) with Bitcoin, now fully applied to Litecoin.

Section 3: The "Operators" of the Dream Team: Founders and Top VCs

Such a bold transformation naturally involves a "dream team."

Core Soul: Charlie Lee

The key figure in this transaction is undoubtedly Charlie Lee, the founder of Litecoin. He is not only one of the lead investors but will also personally join the board of MEI Pharma. His resume is legendary:

Academic Background: Holds a Bachelor's and Master's degree in Computer Science from the Massachusetts Institute of Technology (MIT).

Silicon Valley Experience: Worked as a software engineer at Google, contributing to projects like Chrome OS. It was during his time at Google that he created Litecoin in 2011.

Crypto Native: Later joined Coinbase as the Director of Engineering, leaving in 2017 to fully dedicate himself to the Litecoin Foundation.

Charlie Lee's personal involvement injects unparalleled trust and legitimacy into MEIP's new strategy.

Top Investment Institutions

The investors in this round are a star-studded lineup of crypto-native capital, including: GSR, ParaFi, Hivemind, CoinFund, Primitive, and MOZAYYX.

GSR: This top crypto market maker and investment firm is not only the lead investor but will also serve as the treasury asset manager for MEIP, responsible for trading and managing LTC.

MOZAYYX: Notably, this VC is also a key investor in another company that successfully transformed into a public company with an Ethereum treasury, "$BMNR." This indicates that crypto VCs are systematically laying out a path for such "public company + crypto treasury" models.

Section 4: The Driving Force: Professional Financial Architects

Such complex transformational transactions have given rise to a number of professional financial service firms.

Underwriters and Advisors: The exclusive placement agent and key advisor for this transaction is Titan Partners Group, an investment bank under American Capital Partners. Their professionalism in such transactions serves as a crucial bridge connecting traditional public companies with the crypto world.

Section 5: The Valuation Game: The Secrets of mNAV and "Listing Premium"

How to value such companies? The core metric commonly used in the market is mNAV (Market Value / Digital Asset Holdings). This ratio reflects how much premium investors are willing to pay for "compliant, liquid public crypto asset exposure."

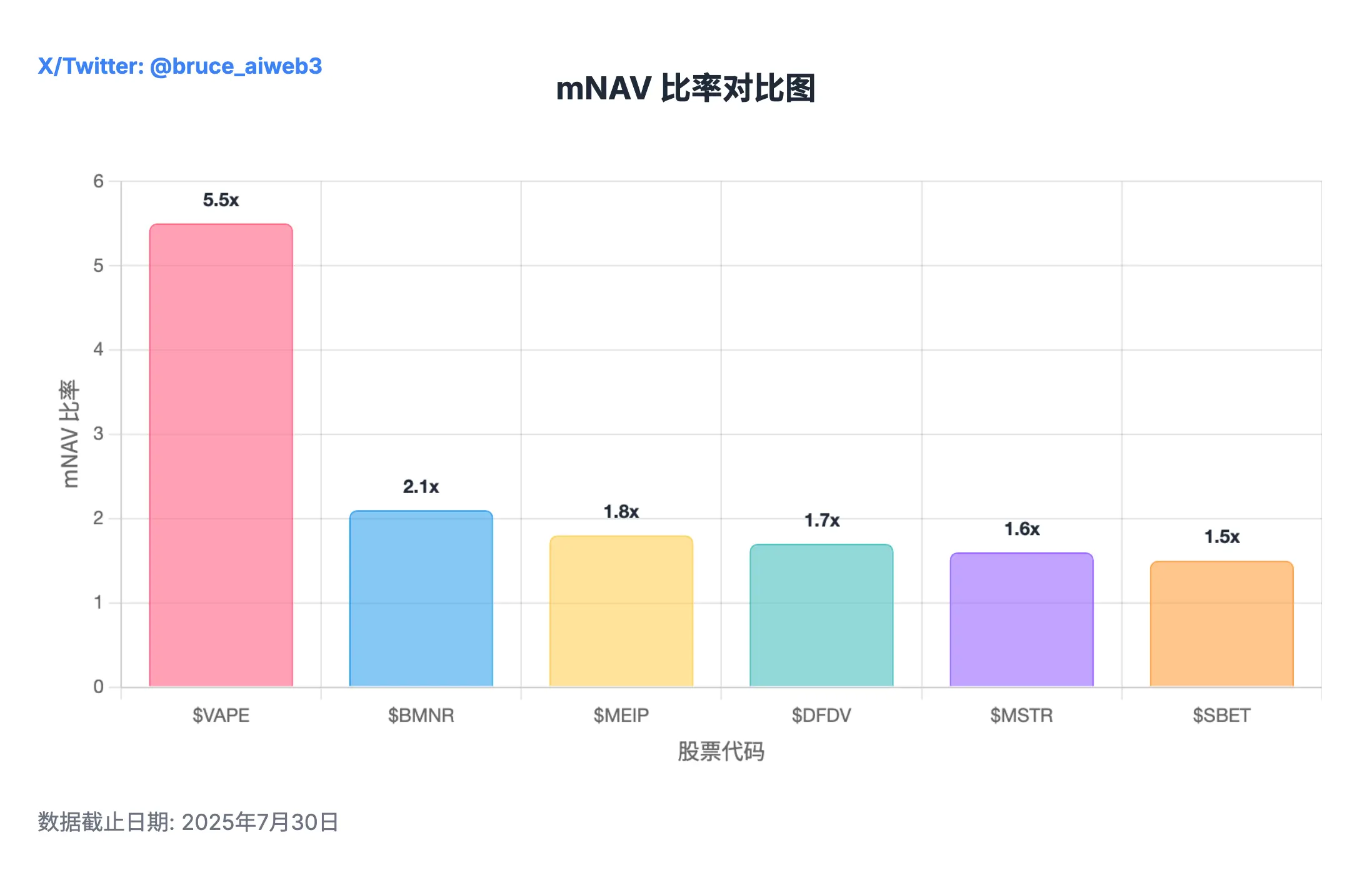

According to current market data, the mNAV performance of different digital asset treasury companies varies significantly:

MicroStrategy (MSTR): As a pioneer of Bitcoin treasuries, its mNAV fluctuates between 0.5x and 3x, currently around 1.6x.

Bitmine Immersion (BMNR): As a representative of Ethereum treasuries, its mNAV is approximately 2.1x.

SharpLink (SBET): Another Ethereum treasury company, with an mNAV of about 1.5x.

CEA Industries (VAPE): As an emerging BNB treasury, its mNAV is as high as 5.5x.

DeFi Development Corp (DFDV): A major SOL treasury company, with an mNAV of about 1.5x.

From the data above, it is clear that an mNAV ratio above 1.0x indicates a market premium. As the "only child" of Litecoin, MEIP is expected to achieve a considerable market premium (1.8x mNAV), directly reflecting the market's high expectations for the first and only publicly traded LTC company.

Section 6: Opportunities and Risks: Is it "Gold and Silver Standard" or "House of Cards"?

This gamble presents both opportunities and risks.

Bull Case 🚀

Monopolistic Position: As the world's first and only pure LTC public company, it offers traditional stock market investors a unique compliant entry point.

Value-Adding Flywheel: Its unique financial structure has the potential to continuously increase the per-share LTC content, creating a positive cycle.

Founder Endorsement: Charlie Lee's personal involvement provides the highest level of trust endorsement and strategic guidance.

Bear Case ⚠️

Asset Price Volatility: The company's core value is highly tied to the price of LTC, and significant fluctuations in LTC prices will directly impact the company's stock price.

Asset Custody Risks: As a holder of digital assets, the company faces risks of theft, loss, or other security vulnerabilities of its crypto assets.

Equity Dilution Risks: The success of the ATM issuance model relies on maintaining a stock price premium. Once the premium disappears, continuous issuance may dilute the value for existing shareholders.

Final Conclusion

MEIP's transformation is another milestone in the integration of crypto assets into the mainstream financial system. It provides the capital market with a bold, well-structured investment target, allowing people to invest in Litecoin, long regarded as "digital silver," through a compliant stock market, in comparison to "digital gold" Bitcoin.

This "gold and silver standard" experiment unfolding on Wall Street is worth our continued attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。