Markets Welcome Powell Rate Cut, Yet Trump Calls It Weak and Delayed

Will a long-awaited relief finally arrive for markets, or will politics overshadow the Fed’s cautious path?

On Friday, Jerome dropped the biggest hint yet — a Powell rate cut could be coming in September. Investors cheered, cryptocurrency jumped, and optimism spread across Wall Street. But the celebration didn’t last long.

Source: Not Jerome Powell X Account

Within minutes, Donald Trump dismissed Powell move as “too late,” demanding deeper and faster reductions. What looked like good news for the economy suddenly turned into a political showdown, raising the question: Is the federal reserve steering the economy, or is the US president pulling the wheel?

Powell’s Jackson Hole Signal Lifts Investor Mood

At the Jackson Hole conference Jerome Powell gave his clearest sign yet that a rate cut could arrive in September. Markets immediately reacted with relief, pushing stocks higher. His words hinted at a softer policy path, but with one clear caveat — decisions will be made on economic data only.

He admitted the labor market is weakening and warned that the inflation threat — particularly from tariffs — remains alive. His message: relief is coming, but slowly.

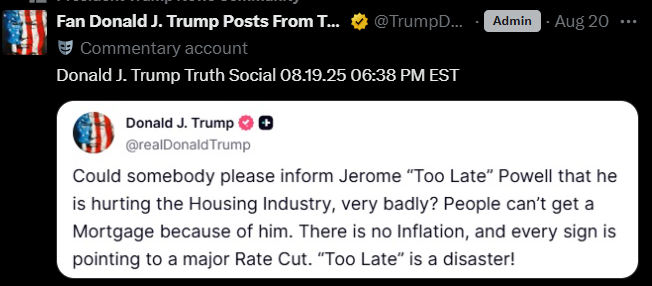

Trump’s Harsh Reply: “Too Late”

The U.S. president however, wasn’t celebrating. In sharp criticism, he blasted the Fed chief for moving too slowly. From the White House, he said, “He should have acted a year ago.”

Source: Truth Social Trump Posts X Account

Administration voices have gone further. Treasury Secretary Scott Bessent suggested the Fed September rate cut should be just the beginning, with reductions of up to 150 basis points possible. For Donald, a 25-point adjustment is merely “scratching the surface.”

Why Does Jerome Remain Careful?

Despite political noise, he stood firm that the Federal Reserve will act cautiously. His two priorities are:

-

Employment risks – Weakness in hiring is his top concern.

-

Price pressure – Tariff-linked inflation still lingers.

That balance explains why the Powell rate cut September isn’t designed as a rapid series. Instead, the Fed prefers gradual moves to protect credibility and avoid runaway prices.

Fed Faces Political Storm

While Jerome was speaking in Wyoming, the United States president turned up the heat again. In the latest Trump powell news, he threatened to remove Lisa Cook, a Fed Governor, citing mortgage fraud allegations. Cook has denied wrongdoing and said she won’t step aside.

This clash highlights both the parties' stance: one side pushing for aggressive action, the other stressing data and independence.

What’s Next for the Fed?

September now becomes critical. Possible outcomes include:

-

Single 25bps reduction → Markets gain, but White House keeps pressing.

-

No move → Donald escalates pressure, creating more political risk.

-

Larger slash → Could spark a new inflation warning if prices flare again.

Investors must watch carefully as policy, politics, and credibility collide.

Conclusion: Fed Patience vs. Trump’s Urgency

The Powell rate cut is almost certain, but it won’t match the Republican leader’s aggressive demands. The central bank insists on steady decision-making, while the former president wants sweeping reductions.

For now, his careful path may reassure traders, but this showdown ensures the debate over America’s interest rate cut news will dominate the weeks ahead.

Bottom Line: A September adjustment is likely, but the fight over how deep to go is just beginning.

Also read: Beetz Daily Combo 24 August 2025: Earn Tokens Easily免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。