Market Reacts to SharpLink Ethereum Buy Back as ETH Nears $5K

SharpLink Ethereum Buy Back Plan of $1.5B, What It Means for Investors

SharpLink Gaming (ticker SBET) said Friday its board approved a share repurchase program of up to $1.5 billion, positioning the ETH focused treasury company to purchase back shares when its stock trades at or below the net asset value of its crypto holdings. The move has already pushed its SBET shares higher and sparked discussions across financial and crypto communities.

Source : Website

The company’s latest move of $1.5 billion stock buyback plan, has caught the attention of investors and crypto watchers.

What is a Buyback and Why Does It Matter?

SharpLink Ethereum Buy Back plan is directly tying shareholder value to its cryptocurrency treasury, stating that it would only purchase when its stock falls below the net worth of its ETH holdings. The gaming firm is successfully linking its equity performance to Ether's growth, which is unique but strategic—not many companies have the guts to do so.

Depending on market conditions, the organization stated that buying might be made through private transactions, open-market purchases, or other legally allowed means. A statement claims that there are no obligations associated with the program and that it can be discontinued or terminated at any moment.

Co-CEO’s Vision and Strategic Positioning

SharpLink Ethereum Buy Back plan, as explained by Co-CEO Joseph Chalom, isn’t designed for immediate execution but rather as a reserve strategy. By keeping the option open to buy shares when its price dips below the value of its ETH holdings, the company is sending a clear message: they believe Ether is central to their future, and they are prepared to reward long-term shareholders who share that vision. Recently SharpLink expanded its Ether holdings to over $3 Billion in assets showing its confidence in the layer-1 token that too when it is in dip.

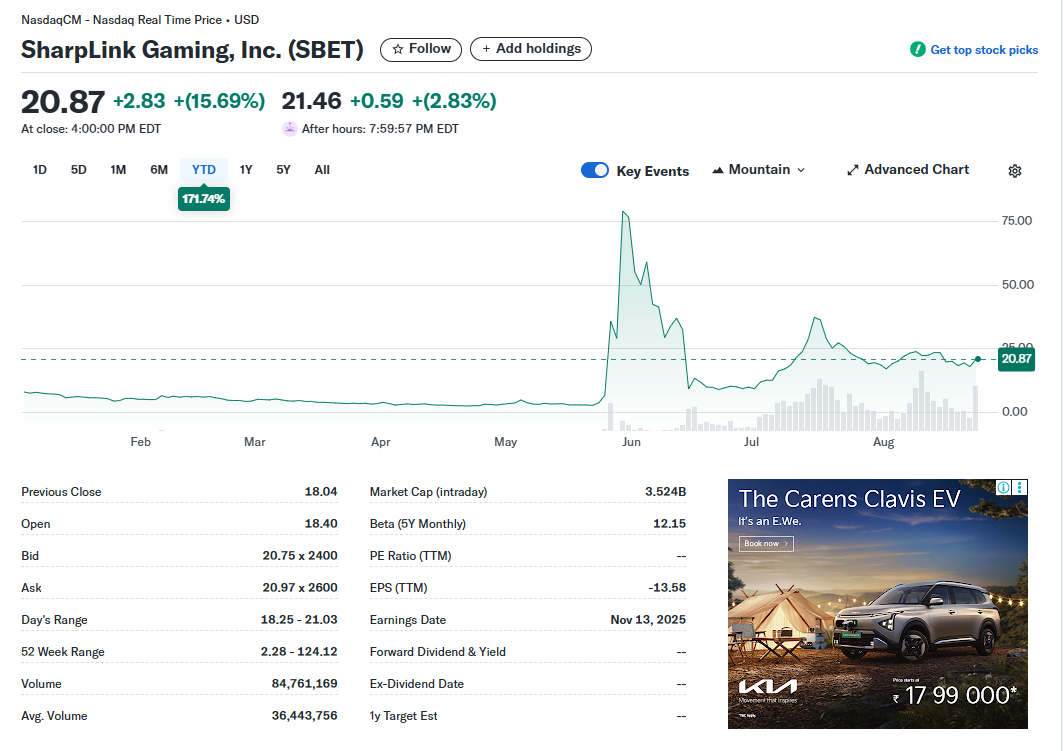

SBET stock surged over 15% to $21 following the announcement of SharpLink Ethereum Buy Back program

Company stock surged above 15% to $21 as the news of SharpLink Ethereum Buy Back program of up to $1.5 billion and despite recent corrections, the stock remains up 171% since the start of 2025.

Source : Yahoo Finance

The share price closed at 20.87 with a market capital of 3.5B. In the second quarter of 2025, Sharplink's revenue dropped significantly from $1,000,000 to $700,000. Today, it controls over 740,000 ETH valued at roughly $3.1 billion, making it one of the biggest corporate holders of Ether.

Ethereum Price Prediction as SharpLink Ethereum Buy Back Announced

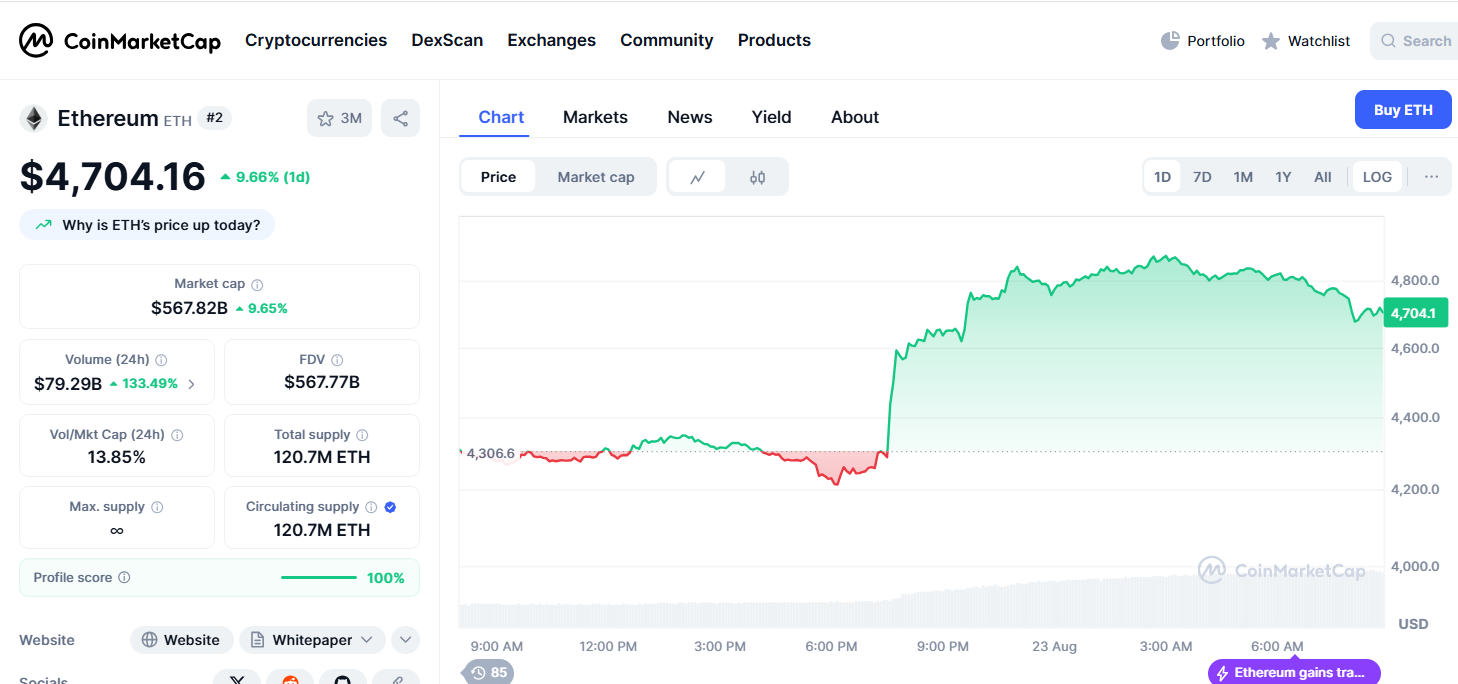

The coin is trading at approximately $4,704, reflecting an interesting 9.66%% gain in the past 24 hours and above 5% rise over the past week. As per the Coinmarketcap data the community sentiments are bullish with above 80% reflecting optimist sentiments among traders. Trading volume surged massively with 133% as the news of SBET stock price got momentum.

Source : Coinmarketcap

As analysts are predicting to reach above $5k breaking all its previous records. If the coin could hold the $4,800 value or break above $4,800 could act as a trigger for technical buyers. Today’s price jump could signal a healthy rally, and watching SharpLink Ethereum Buy Back action offers insight into how institutions might leverage crypto as a strategic asset not just a speculative play.

For SharpLink shareholders rising ETH values strengthen the backing of their shares. But the company’s buyback plan hinges on timing investors should monitor both ETH levels and SBET price dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。