I. Review of OKB's Amazing Surge

1. Event Overview: The Wealth Creation Effect Captivating the Market

OKB has become the core star of the recent digital asset market, surging 5.6 times in just 10 days, successfully topping the list of investor discussion topics and attracting widespread attention.

Starting Point of the Surge: On August 13, 2025, the lowest price of OKB was only $46.14.

Stunning Performance: On August 22, 2025, OKB peaked at $258.60, setting a historic high, with an increase of over 5.6 times in just 10 days.

This explosive increase not only validates the market's expectations for its ecological value and future potential but also sparks a new wave of investment trends exploring similar potential coins.

Through this event, we observe the rapid changes and immense opportunities in the digital asset market, providing investors with new strategic thinking directions. This has also raised the market's demand for analytical tools and data support—how to timely discover the next potential "wealth code" seed project?

2. In Response to This Surge, AiCoin Research Institute Tracked the Entire Timeline of OKB

- August 13, 2025, 2:10 PM (UTC+8): Announcement of the Destruction Plan

OKX officially announced the upgrade of the OKB economic model, declaring that OKB would become the only native Gas token within the X Layer ecosystem, while simultaneously launching a one-time destruction action. The platform stated it would destroy 65,256,712.097 OKB that had been historically repurchased and automatically transfer them to a black hole address via smart contracts.

👉 This is a highly strategic move that locks the total destruction amount, fixing the total issuance of OKB at 21 million, clarifying the deflationary economic model and attracting significant investor attention.

- August 13, 2025, 3:00 PM (UTC+8): On-chain Interaction Switch

OKX stopped users from withdrawing OKT to the OKX exchange and completed the conversion of OKT in user accounts to OKB according to the rules. This operation made OKB the only circulating asset within the entire X Layer ecosystem, while enhancing its practical use cases in on-chain smart contracts.

- August 15, 2025, 10:00 AM (UTC+8): Destruction Preparation Completed

The platform automatically completed account checks and prepared to adjust eligible user accounts to OKB holding status, laying the technical and data foundation for the subsequent one-time destruction.

- August 15, 2025, 2:00 PM (UTC+8): Full Chain Historical Destruction Completed

The historical repurchase of 65,256,712.097 OKB was officially destroyed on-chain, executed via smart contracts, and all transferred to the black hole address. The transparency and credible logic of this operation further enhanced the scarcity of OKB in the eyes of investors, reaching the first peak of market sentiment.

- August 18, 2025, 2:00 PM (UTC+8): Total Token Supply Locked

The upgraded OKB smart contract function was activated, removing all issuance and destruction functions after the destruction was completed, confirming the total issuance fixed at 21 million. This action fundamentally freed OKB from potential inflation expectations, solidifying its value positioning as a scarce asset.

👉 AiCoin Research Institute Commentary: Through the timeline sorting and market sentiment analysis, we clearly see that OKB's success is inseparable from a series of precise operational rhythms and innovative token economic models. For participants in the digital asset market, these time points not only reveal the key strategies but also provide experiential references for seeking the next potential coin. If one can grasp similar timelines and event-driven factors, replicating the "OKB miracle" may not be out of reach.

II. Reviewing the Logic Behind OKB's Surge: The Successful Wealth Creation Gene

1. Driving Factors Behind the Surge

a. Platform Effect: Continuous Expansion of the OKX Exchange Ecosystem Empowering OKB

Ecosystem Expansion Support: OKX has long been laying out a multi-chain ecosystem, using OKB as the core support in key areas such as trading, payment, and wallets. Especially in the payment sector, OKX launched the X Layer payment chain, significantly enhancing OKB's functionality. In application scenarios, OKB is not only an investment target but also an indispensable native Gas token in the ecosystem circulation.

User and Brand Effect: As one of the world's top exchanges, OKX's platform traffic and continuous operational optimization provide strong support for OKB. User trust in the platform gives OKB a higher market recognition, thereby enhancing its asset investment value.

b. Supply and Demand Mechanism: Destruction Model Combined with Scarcity of Total Issuance

Economic Model Optimization: On August 2025, OKB initiated a one-time destruction of 65,256,712.097 tokens, achieving on-chain automatic destruction through smart contracts. After the destruction, the total issuance was fixed at 21 million, completely locked with no possibility of further issuance. This economic design based on a deflationary model attracted concentrated capital inflow to OKB.

Scarcity Driving Price Surge: The absolute scarcity of 21 million tokens, combined with the destruction mechanism, further amplified market demand for OKB. With a fixed and gradually decreasing circulation, investor enthusiasm rapidly grew, driving the price to double in a short time.

c. Market Trend: Bullish Sentiment in the Crypto Space Providing Momentum

Bullish Sentiment Eruption: After the announcement of the destruction plan, the market's bullish sentiment towards OKB quickly fermented. Driven by the wealth effect, investors began to focus on scarce assets, further promoting concentrated capital inflow. Multiple mainstream crypto discussion spaces have regarded OKB as the "new wealth creation code," with discussion heat directly guiding continuous capital inflow in the secondary market.

Expansion of Investment Logic Application: This surge, combined with the overall positive sentiment in the sector, formed a positive feedback loop driving capital inflow, amplifying the momentum of OKB's price increase. Some investors even compared OKB with different public chain assets, believing that OKB's financial attributes and platform advantages far exceed most competing projects.

2. In-depth Exploration of Driving Logic

a. Optimization of Token Economic Model: Dual Empowerment of Destruction and Application

As the core asset of the OKX platform, OKB's positioning is very clear, extending from the exchange ecosystem to on-chain payments and multi-chain circulation. Especially the implementation of the destruction mechanism is a key breakthrough for the token economic model:

Real Significance of Destruction: Destruction not only reduces circulation but also stabilizes market expectations for future deflation, thereby enhancing investor confidence. Combined with the total supply locking mechanism, OKB has achieved a qualitative change from semi-deflationary to fully deflationary, further elevating its investment value.

Strengthened Growth Consensus: The on-chain transparent operation of the destruction plan has enhanced market trust and consensus. Against the backdrop of ecological circulation and scarcity, the market gives OKB a higher valuation expectation.

b. Strategic Layout in the Payment Sector

OKB plays an important role not only as the Gas token of the exchange in ecological circulation but also in the X Layer payment chain. Payment scenarios are gradually coming to the forefront:

Cross-Scenario Migration from Trading to Payment: OKX's strategic core is gradually shifting towards wallets and payment sectors, promoting OKB's transformation from a "trading-driven token" to a "function-driven token." Its wallet function has become one of the user entry points, further enhancing user experience by introducing decentralized payment features.

Binding Payment Ecosystem Enhancing Recognition: In the payment chain, OKB is designed as the only supported native Gas token, which not only locks in the liquidity demand through payment scenarios but also further amplifies the space for value creation.

c. Competitive Advantage in the Crypto Space: Backed by Strong Platform and Team Trust

OKB's rapid emergence is closely related to the long-term ecological layout of the OKX team:

Team's Execution and Product Design Capability: The OKX team has been expanding in the fields of exchanges, public chains, and wallets for many years. Its excellent execution efficiency and stable operations are core reasons for crypto investors choosing OKB. Compared to other mainstream public chain teams that may be more mysterious or resource-divided, the OKX team has a clearer development path and strong output capability.

Exchange's Financial Support: Resource and Traffic Aggregation: As one of the important CEX exchanges, OKX is not only a capital entry point but also a "traffic pool" for project incubation and asset promotion. This resource-based advantage directly provides strong backing for OKB's long-term growth.

3. Insights and Reflections from OKB's Wealth Creation for the Future

Learning from OKB's Surge: The "Wealth Code" of Tokens

Core in Application Scenarios: The transition from trading to payment endows OKB with long-term value, while the destruction and deflationary model further introduces scarcity-driven factors. This indicates that successful tokens not only require ecological endorsement but also need "hard logic" in application design.

Scarcity as an Accelerator: The surge of OKB indicates that deflationary economic models are evidently more attractive to long-term capital, becoming core targets pursued by the market.

4. Reviewing Data Aspects, What Changes Occurred During OKB's Acceleration

a. Key Areas of Chip Distribution

From the chip distribution data, since February 2023, OKB has long oscillated between $37 and $60, with chips mainly concentrated between $50 and $54, forming a clear price support area. During this period, the average cost of chips was around $50, indicating strong recognition and confidence in holding positions among investors.

When the news of the destruction and economic model upgrade was announced, the market price of OKB was around $46, at the lower edge of the chip distribution area. Based on the strong support zone, positive news quickly shifted market sentiment, prompting investors to actively follow up, resulting in an explosive price increase that surged to several times higher.

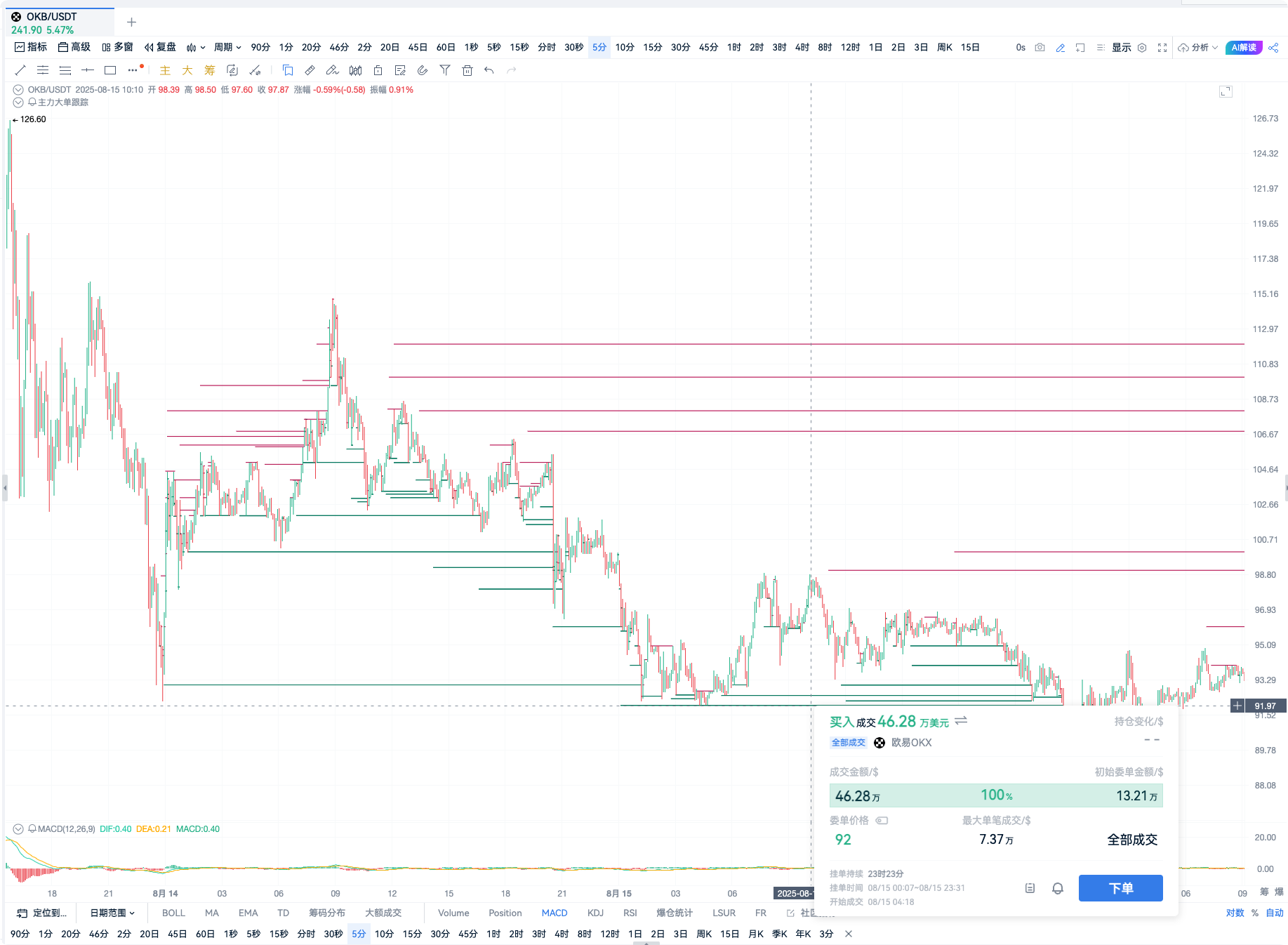

b. Frequent Large Orders from Major Players

After the announcement of positive news, during the rapid rise in OKB's price, large buy orders frequently appeared during significant pullbacks, especially in high-frequency bottom-fishing behaviors, clearly showing strong intervention and active accumulation by major funds. The frequency and amount of these large buy orders further confirm that OKB has been favored by major funds in this market trend.

By observing the trend, each pullback is quickly followed by capital support, indicating the market's continued optimism towards OKB and showing that major funds are using strong buying to drive prices steadily upward. This characteristic of capital flow is a direct reflection of OKB becoming a strong trend asset and serves as the best annotation for the deepening bullish logic in the market.

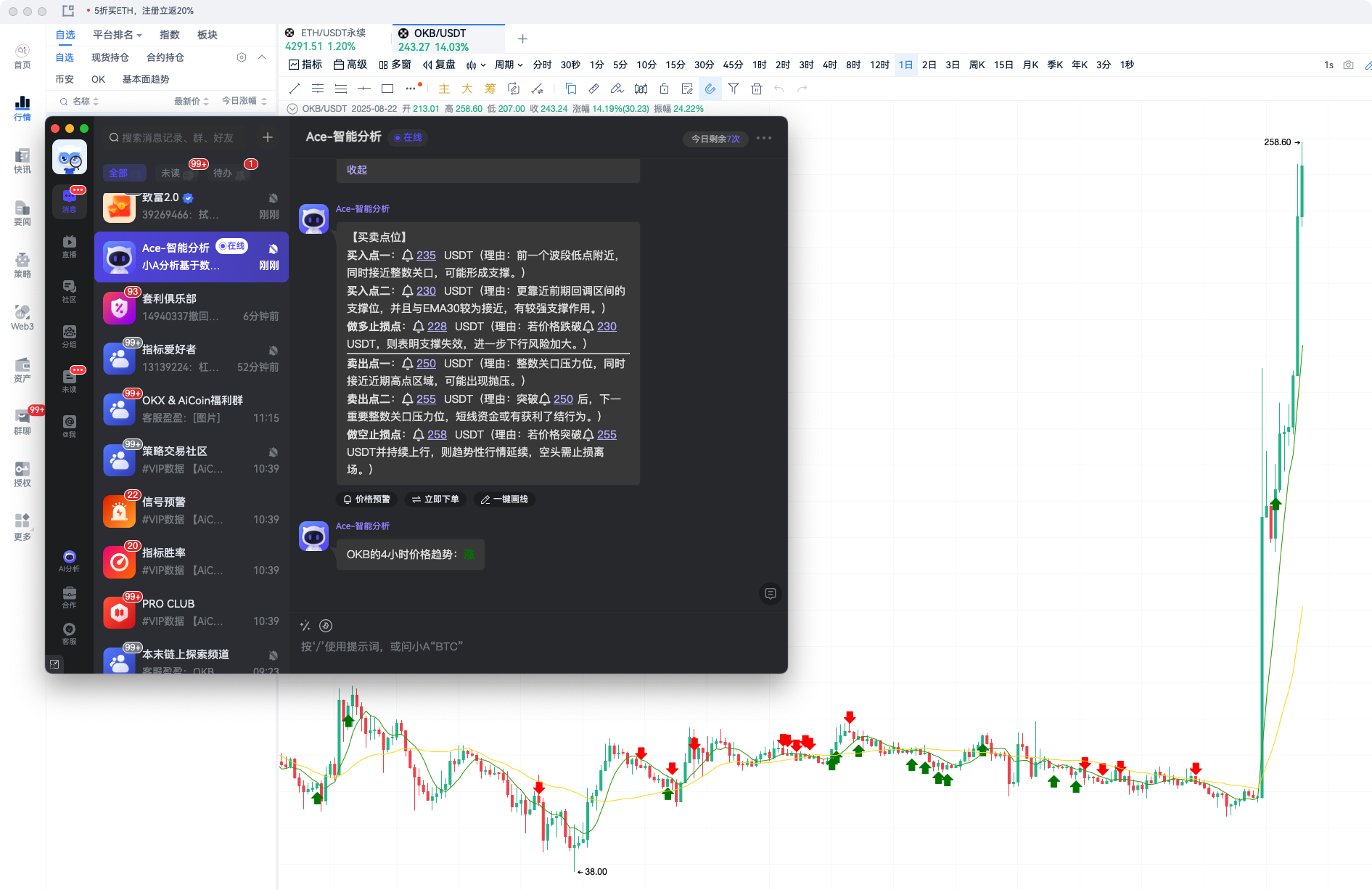

c. AI Coin Market Interpretation

Through Ace's intelligent analysis of OKB's 4-hour trend, multiple technical indicators currently show that OKB remains in a strong upward trend.

The AI system has provided multiple support and resistance signals at key price levels and specifically pointed out:

The current price area still maintains short-term strength, and the upward momentum after breaking through important resistance levels has not yet been exhausted.

The key support levels below are at $230 and $228, which provide a solid defensive foundation.

The short-term target above has successfully tested $255, and the technical indicators show that the trend remains positive, with potential for further challenges to higher points.

👉 Overall, the AI interpretation further reinforces the market's confidence in OKB's current trend, with short-term capital still actively operating at high levels. This complements the previous logic of major fund accumulation, indicating that the trend of rising prices has not yet ended, and investors can flexibly respond to opportunities during pullbacks.

III. Finding the Next "OKB": Key Screening Logic

## 1. Platform Tokens Still Have Opportunities

a. Do other existing platform tokens that have not yet surged (such as BGB, GT, HTX, etc.) possess similar explosive potential?

The performance of platform tokens is closely related to the ecological development behind them, so potential targets can be screened from the following dimensions:

Ecological Activity: Examine whether the platform continues to launch innovative businesses, such as contract trading upgrades, Web3 scenario expansions, etc., especially in the DeFi and NFT-related fields. The expansion of the ecosystem can drive the actual usage demand for platform tokens, thereby pushing up their prices.

Deflation Model Adjustment Potential: The deflation mechanism of platform tokens (such as secondary market repurchase and destruction) is a major highlight. If a platform token is planning to upgrade its economic model, increase the destruction ratio, or improve the release method, it may have opportunities similar to OKB's explosive growth.

Comparative Advantages with OKB: OKB's strong rise benefits from OKX's leading position in compliance, scenario expansion, and user growth. Do other platform tokens have characteristics that exceed OKB in a particular advantageous area? For example, is BGB attracting more institutional users? Are there new changes in GT's ecological interactivity? These factors are all key.

Value-Added Services/Income Attractiveness: Do some platform tokens offer higher returns to users through holding rights, such as staking dividends, fee rebates, or exclusive event qualifications? These incentive mechanisms can directly enhance price support, or similar transformations like Gas fees.

b. Well-known other public chains that have not yet surged (such as ADA, SUI, NEO, etc.)

In the current market, some public chains may already have a certain level of recognition, but their ecological development, technological breakthroughs, or market acceptance may not have fully released their value. For these public chains that have not experienced significant growth, analysis and exploration can be conducted from the following directions:

- Ecological Development Potential:

Just-Started Innovative Ecosystems: For example, SUI is gradually expanding its developer community and DApp ecosystem. If ecological applications gain user favor, it may become a representative of the next generation of public chains.

Application of Scalability Technologies: Focus on whether they are attempting to adopt Layer 2 (such as OP, Arbitrum) or zero-knowledge proof (ZK) technology architectures, which can enhance network scalability, security, and privacy, offering great potential in future Web3 applications.

- Developer and Community Support:

Developer Participation: Whether developers are continuously launching high-quality DApps on-chain, and whether development tools are user-friendly; also observe if there is technical support or resource tilt from leading institutions.

Community-Driven Value Increase: If a project has a strong community foundation (such as the loyal user base of Cardano/ADA), it can more quickly couple price increase momentum when technological breakthroughs or ecological layouts are improved.

- Practical Use Cases:

Are there practical applications that solve real pain points? For example, does SUI optimize user on-chain interaction experiences, attracting more mainstream developers?

- Macroeconomic Environment and Project Rhythm:

As zero-knowledge proofs (ZK) become a hot topic, can technologies like ZK Rollup and ZK-STARK bring greater imaginative space to traditional public chains?

During market recovery cycles, innovative ecosystems or technological highlights of public chains often easily attract market capital, so it is essential to pay attention to whether these public chains are in a latent stage before the cycle starts.

c. Analyzing from Chip Distribution, Capital Flow, and Major Orders

Large Holder Position Analysis: By tracking on-chain capital flows, analyze whether major funds are quietly laying out specific assets. For example, identify tokens favored by leading funds through changes in holding ratios.

Chip Concentration: Observe whether chips are concentrated in a few addresses. If there is a significant concentration of chips that gradually lock up, it may be a precursor to price explosion. Conversely, if chip distribution is too dispersed, it indicates a higher risk of short-term volatility.

Exchange Capital Inflow/Outflow: When on-chain data shows a significant increase in token inflow to exchanges (potential sell-off) or a gradual increase in outflow from exchanges (locking up and long-term investment), it can serve as a forward-looking signal for assessing market sentiment.

Major Order Trends: Pay attention to the dynamics of major funds in trading. For example, analyzing whether there are continuous large buy orders in the candlestick chart can help assess the intensity of latent fund involvement.

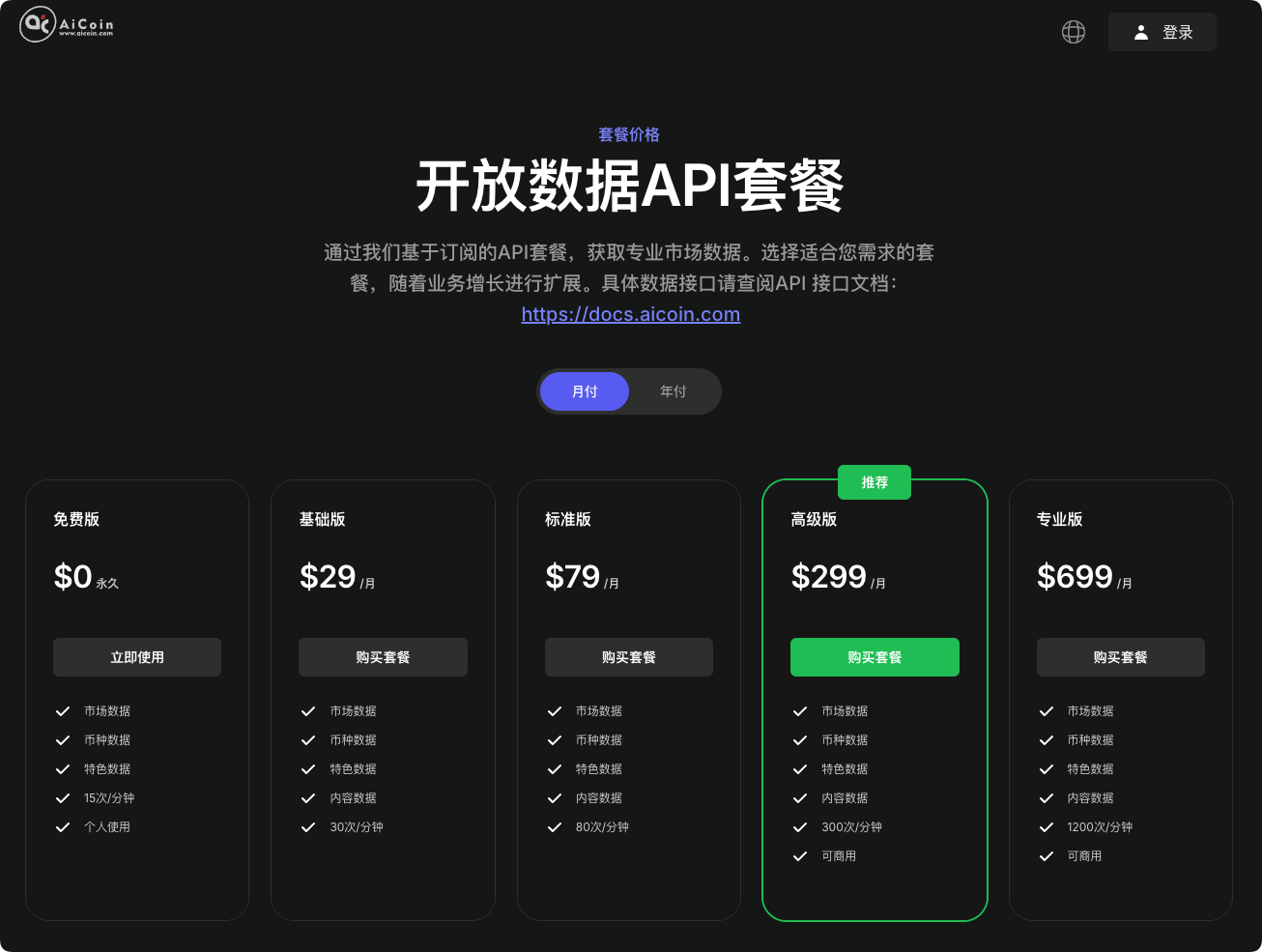

## 2. Where Can You Find All the Above Data?

AiCoin offers an open data API package, providing comprehensive data support, including:

Common Basic Data:

Contract Big Data: Real-time provision of important information such as long-short ratios and liquidation data to guide investment strategy optimization.

Anomaly Signal Data: Capturing high-risk opportunities in market fluctuations.

Trading Signals: Assisting users in formulating bottom-fishing or exit strategies.

Major Order Tracking: Analyzing major fund movements to help investors identify institutional behaviors.

Industry News: Continuously pushing important market information to users.

AI Analysis Interpretation: Using AI technology to explore the potential impacts of news events.

New Listing Information from Exchanges: Comprehensive tracking of new coin project information to quickly grasp market hotspots.

Funding Rates: Helping to assess the cost situation for long or short positions in contracts.

Liquidation Map: Providing risk areas for low buying opportunities.

Historical Liquidation Orders: Analyzing historical capital flows under extreme market sentiment.

Transaction Details: Tracking major trading behaviors in the market.

Free Usage Address: https://www.aicoin.com/zh-Hans/opendata

# IV. Conclusion: Wealth Creation is Never Absent

OKB has realized a wealth myth of over 5 times in 10 days, but the next miracle in the market has never stopped. For investors, opportunities are only reserved for those who are always prepared!

Join our community to discuss and become stronger together!

Register for OKX to receive a permanent 20% rebate: https://www.okx.com/zh-hans/join/aicoin20

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。