Author: BitpushNews

In the past few weeks, a noteworthy trend has emerged in the cryptocurrency market: Ethereum (ETH) has significantly outperformed Bitcoin (BTC).

According to the latest research report released by JPMorgan, Wall Street analysts attribute this phenomenon to four core factors—ETF structural optimization, increased holdings by corporate treasuries, a more lenient regulatory attitude, and the potential future opening of staking functions. These factors not only explain Ethereum's recent strength but also suggest that it may have greater upside potential in the future.

1. Market Background: Dual Drivers of Policy and Capital Flow

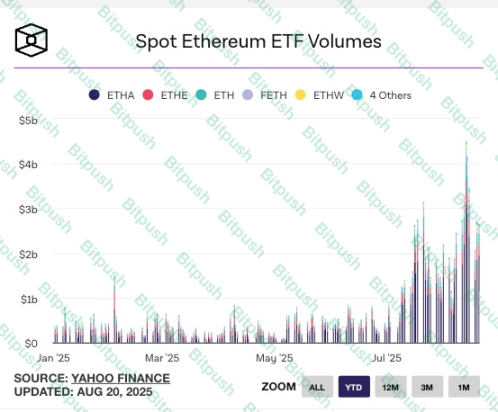

In July, the U.S. Congress passed the GENIUS Act stablecoin bill, bringing unprecedented institutional benefits to the cryptocurrency market. Subsequently, Ethereum spot ETFs attracted a record $5.4 billion in inflows in July alone, nearly matching the inflows of Bitcoin ETFs.

However, entering August, Bitcoin ETFs experienced a slight outflow of funds, while Ethereum ETFs continued to see a trend of net inflows. This divergence in capital flow became the direct catalyst for Ethereum's outperformance compared to Bitcoin.

At the same time, the market is awaiting the upcoming vote in September on the "Cryptocurrency Market Structure Bill." Investors generally expect this to be another significant turning point similar to stablecoin legislation. Under the dual influence of policy and market expectations, Ethereum's position in the capital market has rapidly risen.

2. Analysis of Four Key Factors: Why is Ethereum Outperforming Bitcoin?

JPMorgan analyst Nikolaos Panigirtzoglou and his team clearly pointed out in the report that Ethereum's strength comes from the following four core driving factors:

1. Potential Opening of Staking Functions

Currently, a major feature of the Ethereum ecosystem is the PoS (Proof of Stake) staking mechanism. Users need at least 32 ETH to run their own validation nodes, which is relatively high for most institutional investors and retail investors.

If the SEC ultimately approves spot Ethereum ETFs to allow staking, fund managers could create additional returns for holders without requiring investors to run their own nodes. This means that spot ETH ETFs would not only serve as a price tracking tool but would upgrade to "yield-generating passive investment products."

This is fundamentally different from Bitcoin's spot ETFs: Bitcoin itself does not have a native yield mechanism, while Ethereum ETFs may potentially come with "interest," which clearly enhances their market appeal.

2. Increased Holdings and Applications by Corporate Treasuries

JPMorgan noted that approximately 10 listed companies have included Ethereum in their balance sheets, accounting for about 2.3% of the circulating total.

More notably, some companies are not just "buying and holding," but are further participating in the ecosystem:

- Running validation nodes: directly earning staking rewards.

- Adopting liquid staking or DeFi strategies: putting ETH into derivative protocols to earn additional returns.

This means that Ethereum is gradually evolving from a "speculative asset" to a "sustainable asset allocation tool for enterprises." This trend has not yet been fully realized with Bitcoin.

The involvement of corporate treasuries represents a longer-term, more stable influx of capital, which also enhances the market's valuation anchoring for Ethereum.

3. Regulatory Attitude Towards Liquid Staking Tokens Has Eased

Previously, the SEC had ongoing disputes regarding the compliance of liquid staking tokens (LSTs) like Lido and Rocket Pool, and the market was concerned that these tokens would be classified as securities, affecting large-scale institutional participation.

However, the latest situation is that the SEC has provided clarifying opinions at the staff level indicating that "they may not be considered securities." Although formal legislation has not yet been enacted, this statement has significantly alleviated institutional concerns.

In this context, institutional funds that were previously cautious about compliance may enter Ethereum staking and related derivative markets more quickly and on a larger scale.

4. Optimization of ETF Redemption Mechanism: Approval for Physical Redemption

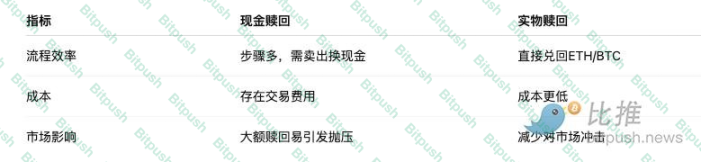

The SEC recently approved the physical redemption mechanism for spot Bitcoin and Ethereum ETFs. This means that institutional investors no longer need to go through the cumbersome process of "selling the ETF for cash" when redeeming ETF shares, but can directly withdraw an equivalent amount of Bitcoin or Ethereum.

This mechanism brings three major benefits:

- Increased efficiency: saves time and costs.

- Enhanced liquidity: direct linkage between ETFs and the spot market.

- Reduced selling pressure: avoids triggering market sell-offs during large-scale redemptions.

For both Bitcoin and Ethereum, this system is beneficial, but since Ethereum's proportion of corporate and institutional holdings is relatively low, it indicates greater future growth potential and more significant marginal effects.

3. Future Outlook: Has Ethereum's Potential Surpassed Bitcoin?

JPMorgan pointed out in the report that while Bitcoin remains the "store of value" leader in the cryptocurrency market, Ethereum has broader growth potential:

- ETF adoption: The current fund size of ETH ETFs is still lower than BTC, but with the opening of staking functions, it is expected to attract more long-term capital.

- Corporate adoption: Bitcoin has already been widely held by many companies and institutions, while Ethereum is still in its early stages, indicating significant future incremental space.

- DeFi and application ecosystem: Ethereum is not only a digital asset but also supports decentralized finance (DeFi), NFTs, stablecoins, AI+ on-chain computing, and other applications, thus possessing richer use cases.

In other words, Bitcoin is more like "digital gold," while Ethereum is evolving into "the infrastructure of the digital economy."

4. Conclusion

JPMorgan's analysis reveals a key logic: Ethereum's strength is not driven by short-term speculation but is built on the cumulative effects of policy benefits, structural optimization, institutional adoption, and potential returns.

With the further improvement of the ETF mechanism, continued accumulation by corporate treasuries, and the SEC's potential future policy confirmations, Ethereum is expected to gradually narrow or even surpass Bitcoin's advantages in the future market landscape.

For investors, this trend is not only a signal of capital flow but may also signify a turning point for the entire cryptocurrency market from "single value storage" to "multi-dimensional application ecosystem."

In the new chapter of cryptocurrency history, Bitcoin may still be "digital gold," but Ethereum is rapidly growing into "the heart of the digital economy."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。