Active Chainlink Addresses Hit 8-Month High

Chainlink network activity reached an eight-month high with active addresses up, reserves up and institutional certifications pointing to an increasingly bright future of adoption.

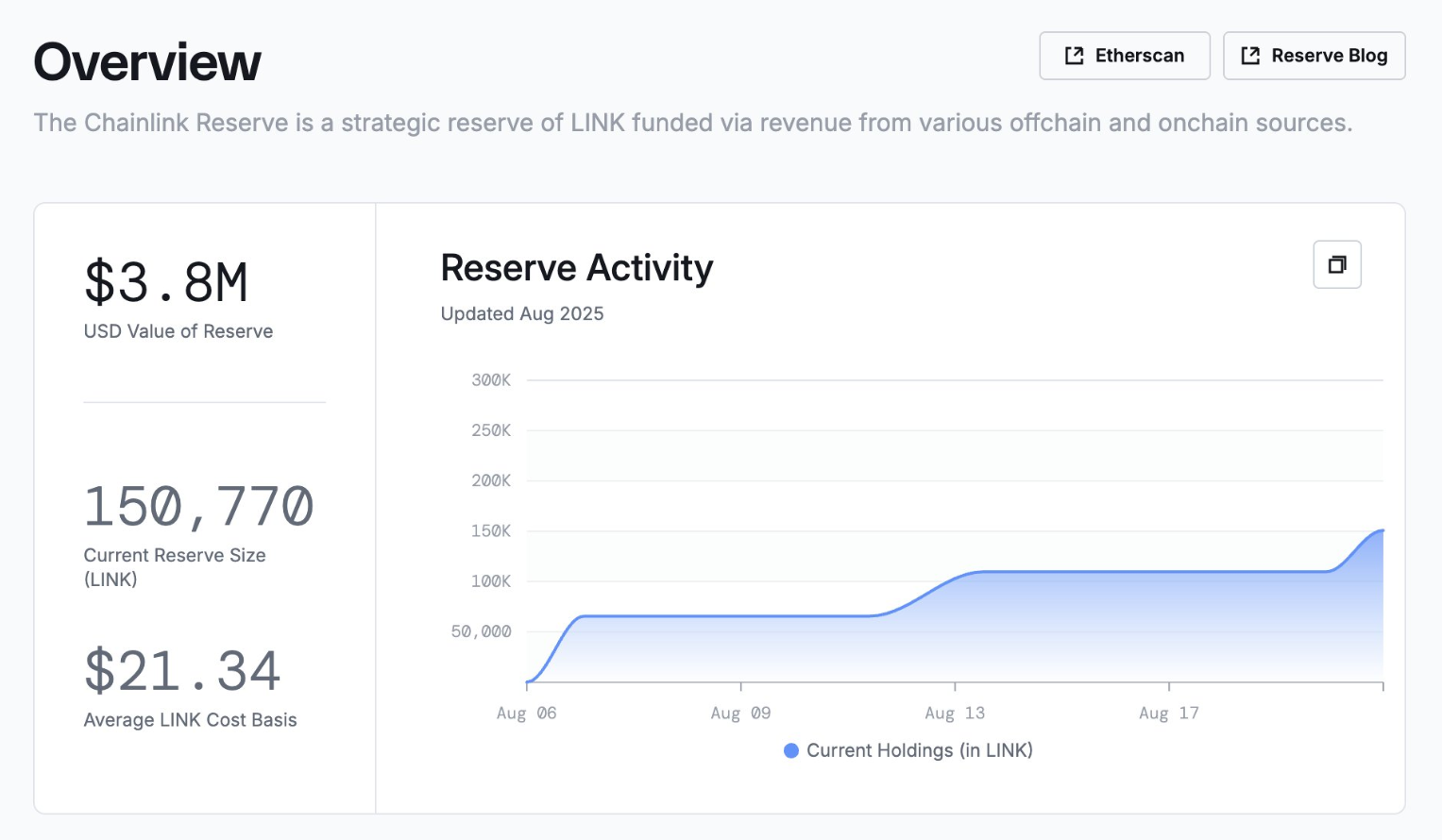

Chainlink Reserve Expands With New Inflows

The Chainlink Reserve expanded to 150,770 LINK with a value of $3.8 million. Its average cost basis is at $21.34 per token. The most recent inflow was 41,105 LINK, of which 90% were swapped in USDC on Uniswap and 10% were protocol fees.

Source : X

The reserves are covered by the enterprise income and on-chain utilisation every week, and no withdrawal is anticipated in the coming years. This increases the circulating supply and builds confidence in the economic sustainability of the protocol in the long term.

The constant increase in the reserves indicates the stable demand on both institutional deals and users.

Active Addresses Reach 8-Month High

The number of daily active Chainlink addresses reached nearly 10,000, which is the highest since late 2024, indicating a fresh wave of onchain activity.

The spike is a positive indicator of increased utilization of the platform's services, with analysts attributing it to the growing adoption of the CCIP technology.

LINK Daily Active Addresses : Source :X

The Cross-Chain Interoperability Protocol links private and public blockchains, allowing safe transfer of liquidity and data between networks.

Increasing address activity is often a sign of increased demand of the protocol and growth of the ecosystem.

The increase is an indication that retail users and developers are interacting with Chainlink infrastructure more actively.

Institutional Certifications Secure Compliance

Moreover, the platform achieved ISO 27001 certification and SOC 2 attestation of its Price Feeds, Proof of Reserve, and NAVLink services.

The audits were done by Deloitte & Touche LLP with the aim of adhering to the global security and operational standards.

https://x.com/chainlink/status/1958529673295434088

ISO 27001 attests to the information security system of the platform, whereas SOC 2 ensures that the operational controls are strong and reliable enough for the enterprises.

These certifications give guarantees that are needed by banks, governments, and asset managers when implementing blockchain-based integration. Notably, the platform achieved compliance approvals, which will enable it to fast track adoption among financial institutions that have to comply with the regulations.

LINK Price Action and Market Outlook

At press time, LINK traded at $24.97, a 2.44% decrease on the day, yet a 11.61% rise over the last seven days.

The token briefly broke through the $24 level and touched the $27 mark before being met with resistance, which raises concerns about short-term momentum.

Weekly chart forecast : Source : X

Analysts are divided : some set targets at 31 and 47, and others believe that it will fall back to 20-21.

Bearish divergence on lower timeframes is a possible indication of a correction, but the broader trends are still structurally bullish.

In general, the price trend of LINK will be governed by the ability to maintain the level of network activity, institutional adoption, and reserve build-up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。