Bitcoin OG Exit Sparks Ethereum Whale Buying $295M, Pre–Cut Rally Now

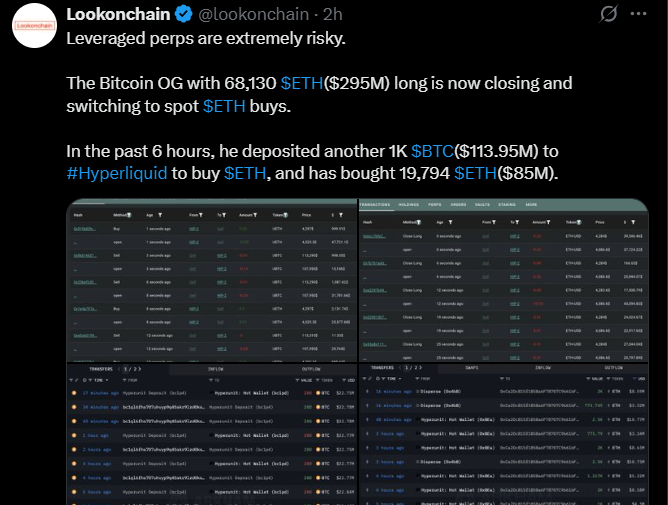

One Altcoin currency is suddenly at the center of market drama. According to Lookonchain ETH whale buying data , a legendary Bitcoin OG holding 68,130 ETH ($295M) has closed leveraged longs and switched to spot $ETH buys.

Within six hours, he even sent 1,000 BTC ($113.95M) to Hyperliquid, converting it into 19,794 altcoin tokens ($85M).

This isn’t just another shuffle of coins, it comes right before the U.S. Fed’s September rate cut decision, which many believe could be the trigger for pre-rate cut rally. The spotlight on Ethereum Whale Buying is stronger than ever.

The Whale Domino Effect: Big Players Signal Next Direction

-

Bitcoin OG Switch: Closed risky leveraged positions and built a safer, longer-term spot ETH stack, which shows confidence in the asset outperforming $BTC.

-

The U.S. Government Buy: They have Accumulated 332,460 tokens ($281M), which results in a strong backing ahead of potential price rise.

-

BlackRock Sells Big: Offloaded 63,280 altcoins ($271.9M), it could be a shakeout before a breakout, or smart profit-taking ahead of volatility.

All of these activities in the last 24 hours adds to the mixed narrative of institutional moves in crypto news today.

Ethereum Vs. Bitcoin Price Analysis: The Tale of Two Charts

-

Bitcoin price is trading at $113,386. Weak RSI at 42 for now, but sellers are in control. It may risk slipping to $110K.

-

According to the Tradiview price chart data, second largest cryptocurrency price increased, currently sitting at $4,296. Healthy RSI at 57 represents a strong demand near $4,200, and it is also ready to break $4,400 resistance.

Side by side, altcoin looks resilient while $BTC looks exhausted. The charts echo what this whale buying has been signaling: the next big play may belong to the the altcoin's market.

Carl Moon’s Twist in Ethereum Whale Buying News : Rate Cut Rally or Risk?

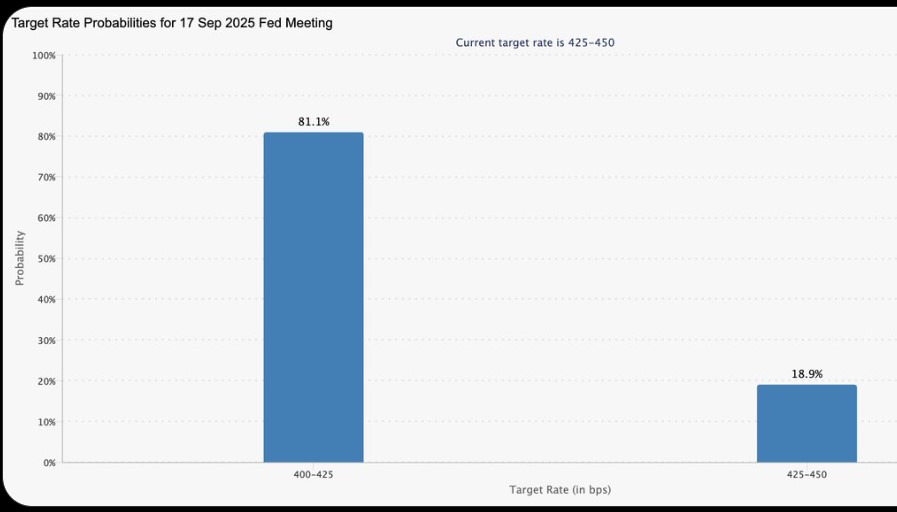

Crypto analyst Carl Moon highlighted an 81.1% chance of a Fed rate cut in September. His bold advice:

“BUY ANY ALTCOIN NOW… SELL IN DECEMBER.”

At the same time, its futures trading volume has surpassed Bitcoin’s. This isn’t just another number — it’s proof that traders and institutions are shifting focus. Analysts are linking this surge directly to Ethereum $5000 prediction levels .

Connecting the Dots: Ethereum Pre-Cut Rally in Motion?

Let’s piece this together:

-

A Bitcoin OG closes leverage and stacks spot $ETH.

-

The U.S. government quietly accumulates hundreds of thousands of this assets.

-

BlackRock sells, perhaps to reset the board.

-

Analysts scream “altcoin season” before the Fed rate cut September decision .

-

Charts show our current asset is stronger than BTC.

This isn’t random noise. This is Ethereum Whale Buying turning into orchestration — a coordinated buildup before $ETH price prediction breaking its all time high come true.

Whether it’s a pre-rate cut rally or just big players playing profit games, one thing is certain: This whale news is the loudest signal in the market right now and the next move could redefine its role against Bitcoin.

Also read: Tomarket Daily Combo 21 August 2025: Boost Your Earning免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。