Chainlink, as a leading project in oracle and cross-chain infrastructure, possesses unique strategic value in the wave of RWA tokenization.

Author: Huobi Growth Academy

1. Introduction

As a representative project of decentralized oracle networks, Chainlink has gradually established an irreplaceable position in the cryptocurrency industry since its launch in 2017. Oracles are key infrastructure that connects the blockchain world with real-world data, undertaking core functions such as price data, cross-chain communication, and access to real-world assets (RWA). In the context where decentralized finance (DeFi), cross-chain ecosystems, and asset tokenization are becoming the main narratives in the crypto industry, Chainlink's value and strategic position are increasingly prominent. The purpose of this report is to systematically analyze the investment logic and medium to long-term potential of LINK by integrating macro market trends, RWA industry development, Chainlink's technology and economic model, token value capture mechanisms, competitive landscape, and future outlook.

2. Macro Market Trends and Strategic Opportunities

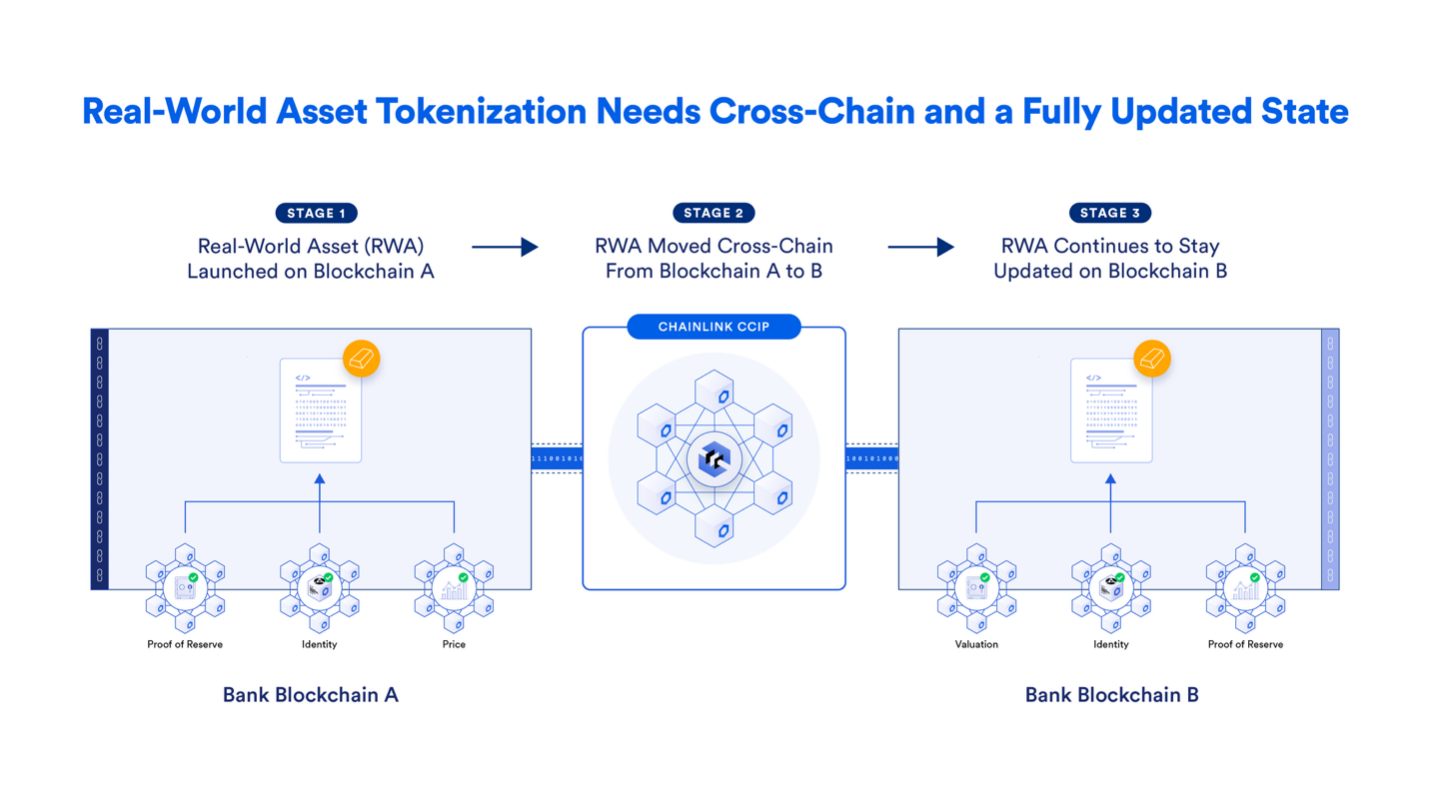

In recent years, the tokenization of real-world assets (RWA) has become one of the most关注的 growth tracks in the crypto market. RWA refers to the process of mapping real assets such as bonds, foreign exchange, real estate, certificates of deposit, gold, carbon credits, intellectual property, and even computing power resources onto the blockchain, achieving programmable, transferable, and composable characteristics through smart contracts. According to market research, the potential scale of the RWA market could reach hundreds of trillions of dollars. For instance, the total scale of the U.S. Treasury market tokenization has already exceeded $26 trillion, while the overall market capitalization of the crypto industry was only about $2.5 trillion at the beginning of 2025. This means that once RWA enters a stage of scaled development, it could drive the growth of the crypto market by more than tenfold. Research institutions like M31 Capital predict that global asset tokenization will reach a scale of $30 trillion within the next decade, becoming the largest force driving blockchain applications. Meanwhile, the attitudes of financial giants are also accelerating their transformation. BlackRock is promoting tokenized money market funds, JPMorgan is testing Treasury tokenization settlements through its Onyx platform, and SWIFT and DTCC are conducting blockchain experiments for cross-border payments and settlements, all indicating that traditional finance is gradually entering the on-chain economy through compliant pilots. As a bridge between on-chain and off-chain, oracles are key to whether all tokenized assets can realize their value. Chainlink, as the world's largest oracle network, accounts for over 80% of data calls on mainstream chains like Ethereum, making its position in RWA infrastructure irreplaceable. Therefore, in the macro context of RWA's explosive development, Chainlink has become the most strategically beneficial underlying asset.

RWA and institutional on-chain adoption have become the strongest mainline currently, requiring a "trusted data + cross-chain settlement + compliant execution" trio on-chain. Taking U.S. stocks and ETFs as an example, on-chain products not only need price data but also must recognize trading periods, circuit breakers/suspensions, data freshness, and other "scene metadata"; otherwise, clearing and risk control may be triggered incorrectly. Chainlink officially standardized this set of "data flow standards for traditional market contexts" into Data Streams in August 2025, which has already been adopted by leading protocols like GMX and Kamino, covering high-profile assets such as SPY, QQQ, NVDA, AAPL, and MSFT. At the same time, Data Streams are available on 37 networks, significantly lowering the barriers for developers to build compliant-level derivatives, synthetic assets, and protocols for collateral/lending. The current scale of the RWA market has been reported by industry data platforms to exceed $100 billion, and several leading institutions have long-term forecasts predicting it will reach the trillion-dollar level by 2030. In this mainline, oracles and compliant interoperability are "necessities," not "options." Additionally, Swift's multiple rounds of experiments and PoCs in 2023-2024 have validated the feasibility of "connecting banks to multiple chains using existing Swift standards + Chainlink infrastructure"; the DTCC Smart NAV pilot has put key reference data like fund NAV on-chain, clearly designating CCIP as the interoperability layer. These are key paradigms for traditional financial infrastructure to move "data - rules - settlement" on-chain.

Chainlink's core value lies in its oracle service capabilities. Ethereum and other public chains cannot directly access off-chain data; the task of oracles is to provide real, reliable, and decentralized data inputs. Chainlink maintains data accuracy through thousands of independent nodes, avoiding single-point attacks and manipulation. Its technical products cover multiple dimensions, including price feeds, verifiable random functions (VRF), and cross-chain interoperability protocols (CCIP). According to the latest statistics, Chainlink's total value secured (TVS) has exceeded $11.3 billion, accounting for about 46% of the oracle market, far ahead of competitors like Pyth and Band. In the Ethereum DeFi ecosystem, over 90% of lending protocols and derivatives platforms call Chainlink data, with core protocols like Aave, Synthetix, and Compound relying on Chainlink price sources. Compared to other high-market-cap tokens like XRP, which have limited applications, LINK's advantages in actual integration and revenue generation are more pronounced. Research shows that XRP's market cap was once more than 15 times that of LINK, but XRP's ecosystem integration and institutional adoption lag far behind Chainlink. This indicates that LINK is still significantly undervalued at the valuation level, with long-term potential for a value reassessment to achieve a catch-up.

3. Core Value Capture Mechanism and RWA Expansion

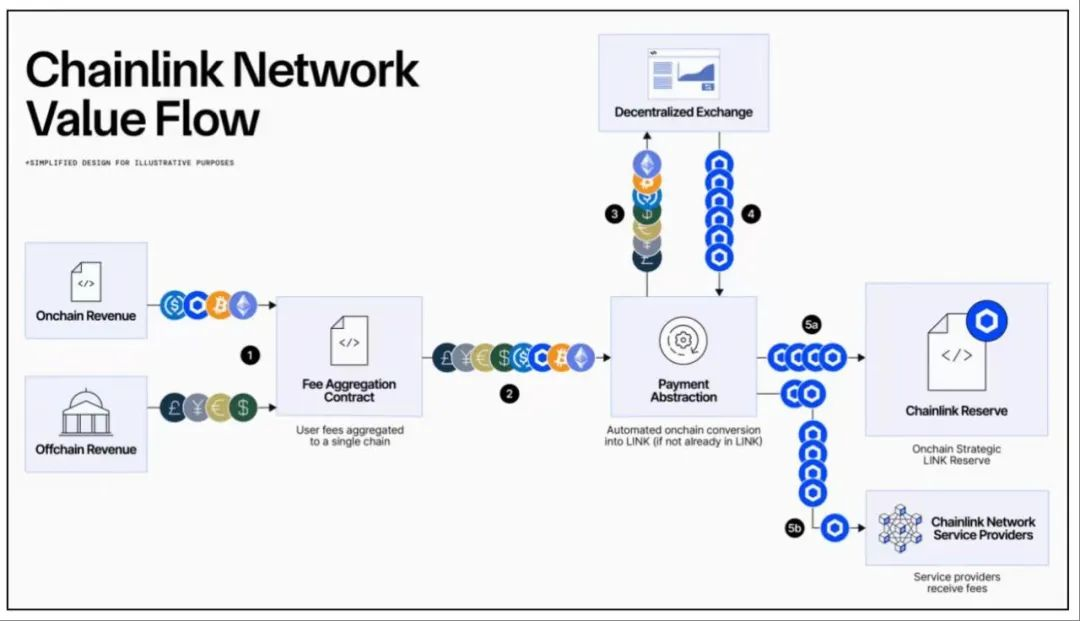

The most innovative aspect of Chainlink's economic model is its value capture flywheel mechanism. First, protocol users need to use LINK tokens to pay for data call fees, a portion of which goes to node operators, while another portion is incorporated into the "LINK Reserve" mechanism. The reserve mechanism automatically uses revenue to repurchase LINK and deposit it into reserves, thereby creating continuous buying pressure in the market, driving up the token price. Secondly, as the application of RWA and DeFi increases, the demand for high-frequency data calls and cross-chain communication will continue to grow, leading to exponential increases in protocol revenue. This further enhances the reserve repurchase force, driving LINK's value up. Additionally, LINK's staking mechanism provides holders with a stable annual yield (approximately 4.3%), attracting long-term holding and node participation, thereby reducing market circulation. Ultimately, adoption, revenue, repurchase, price increases, and ecosystem expansion form a positive cycle, constituting the flywheel effect of value capture. From the end of 2023 to the beginning of 2025, LINK's price has risen nearly 50%, fully reflecting the market's expectations for this mechanism.

In terms of economic benefits, Chainlink has begun to demonstrate its commercialization capabilities. According to statistics, its 30-day revenue exceeds $110,000, with a clear growth trend. Although this is still limited compared to the fee scale of DeFi giant protocols, considering that oracles are B2B infrastructure, their revenue growth has higher stability. At the same time, Chainlink maintains an overwhelming advantage in market share, with over 46% market share indicating that it has become the industry standard. Compared to competitors Pyth and Band, Chainlink has a higher number of nodes, deeper partnerships, and greater integration with financial institutions. Once RWA scenarios are implemented, the data call volume brought by asset tokenization will far exceed the current DeFi scale, significantly amplifying LINK's revenue potential.

Chainlink primarily operates on a "B2D/B2B2C" on-demand service fee model (price/data service fees, CCIP cross-chain fees, PoR audit/monitoring fees, Data Streams subscription fees, etc.), with fees routed through the network to nodes and security budgets, and linked to staking/collateral, alerts/penalties (slashing) within the Economics 2.0 framework to achieve a positive cycle of "higher economic security → higher willingness to pay → higher service fees → stronger security budget." Staking v0.2 expands the pool cap to 45 million LINK (approximately 40.875 million for the community, with the remainder for node operators), introducing an unbinding mechanism (28-day cooling + 7-day withdrawal window) to balance security and flexibility; the node collateral portion sets a baseline reward rate and can stack "delegated rewards." In the future, as the weight of user fee distribution increases, the "cash flow attributes" of staking are expected to strengthen. Media and research documents have mentioned the new element of "LINK reserve" (on-chain reserves, a mechanism for periodically purchasing LINK from sources like enterprise/service fees) multiple times in 2025, aiming to improve the floating liquidity and supply elasticity of exchanges. However, it should be emphasized that this mechanism is currently mainly described by media and industry analysis, and the official has not yet released a systematic white paper-style argument; therefore, we will treat it as a "scenario optional parameter" rather than a baseline fact in our valuation assumptions.

Additionally, Chainlink has been active in expanding RWA infrastructure. First, it has partnered with ICE to connect off-chain pricing of foreign exchange and precious metals to the blockchain, providing reliable quotes for tokenized assets. Secondly, the CCIP cross-chain interoperability protocol enables asset transfer and data exchange between different blockchains, which is a key condition for the liquidity of RWA assets in a multi-chain environment. Thirdly, Chainlink's products like the DeFi Yield Index attempt to generate traceable yield indices by combining multiple DeFi yields, providing financial institutions with integrable on-chain indexing tools. Furthermore, in various scenarios such as agricultural assets, intellectual property, computing power assets, and cross-border money market funds, Chainlink is becoming the standard interface for data and value on-chain. As a structural opportunity across multiple industries, the tokenization of RWA must rely on trusted data inputs and inter-chain settlements, thus Chainlink has built a deep moat.

4. Product Features and Ecosystem Cooperation

Chainlink's product family can be divided into four layers: (1) Data: Price Feeds, Proof of Reserve, State Pricing (pricing methods for DEX trading assets), Data Streams (low-latency high-frequency data and scene metadata); (2) Interoperability: CCIP (cross-chain messaging/value transfer, programmable transfers, CCT standards), with v1.6 in 2025 integrating Solana as the first non-EVM mainnet, significantly reducing cross-chain execution costs and speeding up expansion to new chains through architectural upgrades; (3) Computing and Automation: Functions, Automation, VRF, etc.; (4) Compliance and Governance: Risk control, monitoring, and compliance modules aligned with financial market regulations (officially introducing capabilities like ACE recently). Among them, CCIP v1.6 claims to support "57+ chains" on the mainnet in addition to Solana, designating multiple chains as "official cross-chain infrastructure (canonical)"; on the Solana side, networks like Zeus Network are among the first to integrate CCIP and PoR, facilitating cross-chain transfers of assets like zBTC between Base/Ethereum/Solana/Sonic, expanding BTCFi scenarios. On the data side, in August 2025, ICE Consolidated Feed was introduced as one of the institutional-grade data supplies for foreign exchange and precious metals, combined with Data Streams' low latency and anti-manipulation mechanisms, helping to operate asset classes favorable for institutional adoption, such as foreign exchange and gold/silver, on-chain with a lower signal-to-noise ratio.

Ecosystem and Cooperation Network: Chainlink builds network effects by targeting "financial institutions - public chains - DeFi protocols - data providers" from four fronts. On the institutional side: Swift's multiple experiments demonstrate the use of existing messaging standards to connect multiple chains with CCIP; the 2024 Swift/UBS/Chainlink pilot bridges tokenized assets with traditional payment systems; the 2024-2025 DTCC Smart NAV pilot clearly designates CCIP as the interoperability layer; in August 2025, ICE and Chainlink announced a data collaboration, inputting ICE's foreign exchange and precious metals consolidated feed into Data Streams, providing real-time data for over 2,000 on-chain applications and institutions; on the asset management and banking side, ANZ, Fidelity International, Sygnum, and others appear on Chainlink's official "capital market cooperation" list. On the public chain and protocol side: After CCIP steadily operates on Ethereum, Arbitrum, Optimism, Polygon, Base, Avalanche, and BNB chains, it incorporated Solana in 2025, with Kamino, GMX-Solana, and others already integrating Data Streams, further promoting the availability of U.S. stock and ETF data for institutional-level derivatives and collateral lending use cases in the non-EVM ecosystem. On the data side: In addition to traditional crypto market aggregation, it began extending to U.S. stocks/ETFs, foreign exchange/precious metals in 2025, forming multi-asset coverage.

5. Investment Valuation Logic and Potential Space

From a price technical perspective, LINK broke through the important resistance level of $20 at the end of 2024, currently forming a new support structure between $22 and $30. If this range can stabilize, it will provide a foundation for the next round of increases. Historically, after ETH broke through the $400 mark in 2020, it quickly entered an exponential growth phase, and LINK may replicate a similar structural trend. The flow of funds from whale addresses shows that a large amount of LINK is being transferred from exchanges to cold wallets or staking contracts, indicating that long-term capital is accumulating. Combined with the buying pressure from the reserve mechanism, both technical and capital aspects point to a bullish trend in the medium to long term.

From third-party data aggregation, Chainlink has long ranked first in the Oracles category, with overall market share estimated to fluctuate between approximately 46% and 68%; in the DeFi data supply of the Ethereum ecosystem, many studies or media estimate its share to be over 80%; this is related to its strategy of "high-value scenario priority + steady expansion." Meanwhile, competitors (such as Pyth) have seen significant increases in TVS growth through direct connections with exchanges and high-frequency market data in 2023-2024, but this has not rewritten the comprehensive advantage map of "high-value multi-scenario + institutional compliance." We highlight three points of differentiation in competitive comparisons: first, institutional-level interoperability and compliance routes—cooperation with Swift, DTCC, ICE, etc., is highly valuable in terms of compliance and standardization; second, the product matrix has shifted from "price" to "scenario data + risk control metadata," meeting traditional market contexts; third, coverage across EVM/non-EVM, with Solana's integration being an important milestone. The conclusion is that short-term share fluctuations are normal, but in the complex track of "multi-asset + multi-chain + compliance," the stickiness of standards and ecosystems is more important.

In terms of valuation logic, Chainlink can serve as both an infrastructure investment target and a leveraged beneficiary asset in the RWA bull market. M31 Capital research indicates that LINK has 20-30 times upside potential in RWA explosion scenarios. This judgment is based on two dimensions: first, the total scale of the RWA market could reach $30 trillion, while Chainlink has established itself as the standard data supply layer; second, LINK's current market cap remains undervalued, with a significant mismatch compared to projects like XRP. From a risk-reward perspective, LINK has both certainty in revenue support and potential for valuation reassessment, making it suitable for long-term investors to make mid-to-low-cost allocations.

The total supply cap of LINK is 1 billion tokens, with the common distribution narrative at the time of issuance being: 35% public sale, 35% node incentives/ecosystem rewards, 30% company/treasury (SmartContract.com/Chainlink Labs); this distribution structure has been reiterated by multiple research/educational sources such as Glassnode, Crypto.com University, and Sygnum. Staking v0.2 binds network security with value capture, and after the introduction of user fees, LINK's revenue path gradually shifts from "pure growth expectations" to a combination of "service fee cash flow + network security budget returns." We suggest distinguishing three layers of demand in valuation: first, "usage demand" (data/service/cross-chain fees paid after protocol integration); second, "security demand" (node collateral and community staking); third, "liquidity/strategy demand" (market making and governance, potential "reserve" purchases, etc.). On the supply side, the release rhythm and use of "node incentives/ecosystem rewards" in the coming years (directly supplementing nodes vs. market-based procurement services) will directly impact the supply-demand balance in the secondary market.

Industry media and third-party tracking have recorded Chainlink's TVS at hundreds of billions of dollars multiple times in 2025, maintaining a leading position in the number of protocols and multi-chain coverage; the official homepage also claims "cumulative on-chain transaction volume in the tens of trillions of dollars." On the fee side, aggregation platforms show that Chainlink's recent fees/income are still in a "climbing phase," but we observe that the penetration of high-quality scenarios (such as GMX/Kamino's adoption of Data Streams, and the activation of new categories like U.S. stocks/ETFs/foreign exchange/precious metals) is more likely to bring about a "qualitative change inflection point." The staking pool quickly reached its limit after the launch of v0.2, indicating the community and nodes' willingness to pay for the network security budget. We construct forward-looking indicators based on "unit TVS fee rate high-quality scenario weight chain coverage," rather than simply linearly extrapolating the entire network's rough TVS.

We break down LINK's value into three parts: (A) "platform option value": corresponding to the full explosion of RWA/institutional on-chain, with data and interoperability as "tax-like" infrastructure premiums; (B) "operating cash flow": estimated based on the number of active contracts across multiple product lines such as data services/cross-chain services/proof of reserve/automation multiplied by single contract ARPU, considering chain expansion and non-EVM penetration elasticity; (C) "security budget and collateral returns": gradually becoming explicit as staking/delegation scale and user fee sharing increase. We construct three scenario curves: the conservative scenario assumes only the expansion of crypto-native derivatives and stablecoin ecosystems, with LINK steadily growing its share in "high-quality scenarios"; the neutral scenario adds mid-to-high-frequency applications driven by Data Streams in U.S. stocks/ETFs/foreign exchange/precious metals, with ARPU significantly increasing; the optimistic scenario introduces institutional-level cross-border settlements and multi-market tokenization (including fund NAV distribution, custody, and settlement automation), with CCIP messaging/value transfer volumes increasing, enhancing user fees and profit sharing. Suggested indicators to track include: (1) active channels and number of protocols for Data Streams; (2) monthly cross-chain messaging and value transfer scale for CCIP; (3) asset scale monitored by PoR; (4) net inflow and node earnings from staking; (5) subscription and call frequency for ICE/U.S. stock ETF data; (6) milestones for "standard institutions" like Swift/DTCC.

6. Potential Risks and Strategic Recommendations

Although Chainlink is currently in a leading market position, potential risks still need to be monitored. First, changes in the competitive landscape. High-frequency market data and direct exchange connection models may have cost-performance advantages in specific tracks, potentially eroding market share in certain scenarios; second, the pace of fees and value capture may not meet expectations. If the commercialization curve of Data Streams/CCIP is more gradual, the realization of LINK's "cash flow attributes" will be delayed; third, compliance uncertainties. Regulations and licensing requirements for cross-border data/foreign exchange/securitized products may affect the product launch pace; fourth, technical and operational risks. Low-latency data and cross-chain messaging require long-term stable "defense depth" and node governance; fifth, new mechanisms mentioned by the media, such as "LINK reserve," if not systematically implemented by the official, should be treated cautiously regarding their marginal impact on secondary market supply and demand, and should not be given high weight in baseline valuations.

From an investor's perspective, LINK is suitable for a medium to long-term holding strategy, and reducing volatility risk through phased accumulation and dollar-cost averaging. For investors wishing to participate in staking, the 4.3% annual yield provides additional returns while helping to reduce circulation. For project teams, they should continue to deepen cooperation with financial institutions and enterprises, further standardizing the data sources and settlement mechanisms for RWA to expand the application scope. For ecosystem developers, Chainlink provides stable data and cross-chain service interfaces, which can be used as a foundation to build more DeFi, cross-chain applications, and RWA products in the future.

We position LINK (Chainlink) as a core asset of "Onchain Finance universal infrastructure + data/interoperability hub," driven by three long-term main lines: first, data and compliance-oriented oracles will run through the entire process from crypto-native to traditional asset on-chain. Chainlink has already become the de facto standard (third-party sources like DeFiLlama consistently show its dominance in the Oracles rankings; various statistics from media and research institutions estimate its market share in the overall oracle market to be around 46%–68%, with its share in Ethereum DeFi data supply estimated at over 80%); second, the cross-chain interoperability layer CCIP continues to transition from public chains to institutional-level applications, with a clearer network effect and standardization path from Swift to DTCC and now to Solana; third, the data product family (price oracles, Proof of Reserve, Data Streams, State Pricing, etc.) combined with institutional data supply (such as ICE) forms a product matrix of "high-frequency low-latency + compliance modularization," driving the expansion from crypto-native assets to a broader range of traditional asset data, including U.S. stock ETFs, foreign exchange, precious metals, and fund NAVs. In terms of on-chain value capture, Chainlink's economic model revolves around the "fees—services—collateral—nodes—ecosystem return" cycle (Economics 2.0 and Staking v0.2), supplemented by supply-side arrangements like the BUILD program and the mentioned "LINK reserve" in media reports, aiming to couple network usage fees with security budgets and ecosystem growth, gradually enhancing LINK's utility and potential cash flow attributes. Considering institutional-level collaborations (Swift, DTCC, ICE), multi-chain coverage, the explosion of RWA and cross-chain demand, as well as the inclusion of non-EVM ecosystems like Solana, we believe LINK still possesses asset characteristics of both β and α in the next cycle.

Conclusion

In summary, as a leading project in oracles and cross-chain infrastructure, Chainlink holds unique strategic value in the wave of RWA tokenization. Its value capture flywheel mechanism, LINK reserve buyback model, and staking incentive mechanism together form a robust economic model. As the RWA market scale gradually expands, Chainlink's applications will cover more financial scenarios, leading to continuous growth in revenue and token value. From a valuation perspective, LINK appears undervalued compared to other tokens with higher market caps but lacking application support, indicating significant potential for catch-up and revaluation in the future. Despite risks related to technology, competition, and compliance, from a long-term perspective, Chainlink is still expected to become an invisible winner in the on-chain economy, driving deep integration between the crypto industry and traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。