Author: Rhythm Worker, BUBBLE

Founders often embody a part of the narrative.

Whether it's Vitalik's geekiness, Jeff Yan's trader intuition, or Do Kwon's arrogance, they have, in some way, defined the soul of their projects. However, in recent years, these "crypto star founders" have gradually faded from the stage, one after another.

Recently, Jason Zhao, the founder of Story Protocol, announced his resignation as CEO, reigniting discussions. The young Korean-American, a startup prodigy from MIT's summer camp, a student in Fei-Fei Li's lab, and the youngest product manager at DeepMind—his script could have led him to a star-studded career in Silicon Valley. Yet, he chose to write his chapter in the crypto industry and, after three and a half years, decided to leave.

Rhythm BlockBeats has compiled a list of seven "disappeared" founders; some turned away voluntarily, while others were forced to withdraw. Some bid farewell with a gentle idealism, while others exited hastily amid scandals and controversies… Of course, they are just a microcosm, and more founders will likely leave after launching their tokens, embarking on what should be a decent next chapter in their lives.

From "Metaphysical" to "Realistic" Other People's Children

On August 16, Jason Zhao posted an emotional message on X, announcing that after founding Story for three and a half years, he would resign as full-time CEO and only serve as a strategic advisor, while diving into a new AI project, Poseidon (which just received $15 million in seed funding from a16z last month). He expressed that the new industrial revolution in cutting-edge fields like space and life sciences reignited his passion. However, this post, viewed by 5 million people, garnered only 2,000 likes.

Jason Zhao, a Korean-American, grew up in Austin, Texas. During high school, he began overseeing the local TEDx AustinYouth. At 19, while attending the MIT Launch training camp, he co-founded the political lobbying crowdfunding platform PolitiFund and, with a SAT score of 2400, chose Stanford University among full scholarship offers from nearly all Ivy League schools.

After obtaining a bachelor's degree in philosophy from Stanford, he continued to pursue a master's degree in computer science, focusing on artificial intelligence research, studying under "AI mother" Fei-Fei Li in the computer vision lab. After graduation, he joined Google's AI lab, DeepMind, becoming the youngest product manager. With this script, he is undoubtedly a life winner from any angle. If he were still working at a major AI company, he might even receive a "big money transfer" invitation from Zuckerberg, but fate had other plans for him.

The "DeFi Summer" of 2020 introduced him to blockchain. His background in philosophy and AI led him to think, "AI reshapes creativity and enriches content, while blockchain determines digital property rights and provides verifiable scarcity for data." The combination of IP + AI + Blockchain led to the birth of Story Protocol, which successfully raised $140 million by the age of 25. It aimed to program intellectual property (IP), track usage and distribution on-chain, and promote new business models for creator royalties, licensing, and AI training.

They launched Story Academy to promote the Builder program for entrepreneurs and developers. Collaborating with Yakoa to use AI to detect IP duplication and manipulation; integrating with Pastel Network to ensure certificate rarity and asset scarcity; partnering with Lit Protocol to enhance transaction security and privacy; and working with Stability AI to bring on-chain authorization and copyright tracking into AI model training.

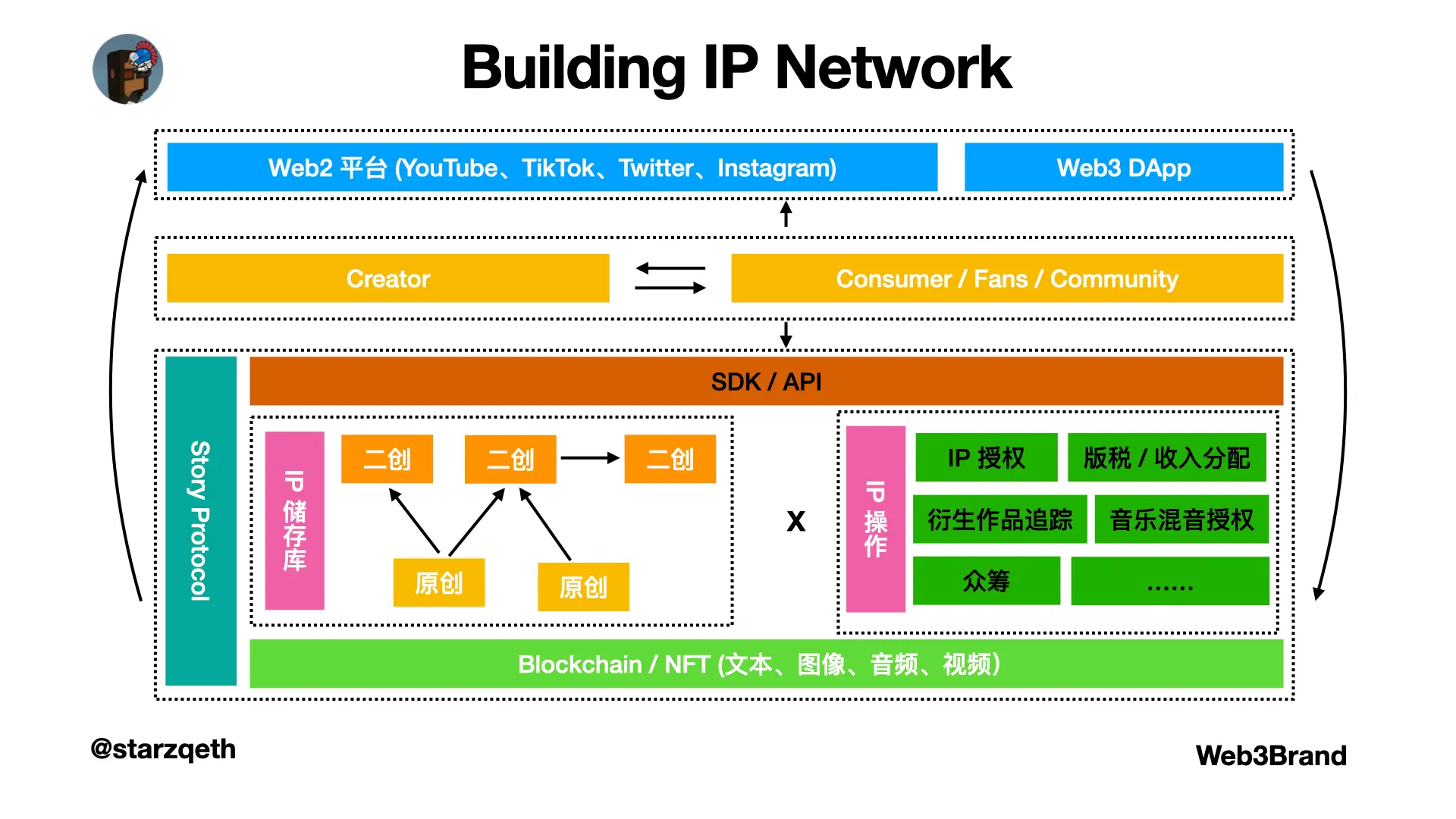

The business logic of Story, source: Starzqeth

However, linking on-chain with physical applications, while grand in narrative, seemed misaligned with the current crypto sentiment. In the six months following their Token Generation Event (TGE), they collaborated with well-known brands like Justin Bieber, BTS, BlackPink, Adidas, and Crocs, but this did not change the fact that Story's on-chain revenue was mostly in single or double digits. Notably, venture capital analyst Adam Cochran pointed out that the nearly $6 billion fully diluted valuation compared to this revenue raised questions about whether the project was more focused on "fancy presentations."

In fact, before Zhao's exit, Story still gained the trust of capital, with Grayscale launching the Story IP Trust and Heritage Distilling Holding Company (CASK) initiating the IP DAT plan with $220 million in private financing, leading to a new high in IP market value at the time of his departure. His exit may not have been graceful, but it wasn't disastrous either. Perhaps for this young man, who has traversed more than half a lifetime by the age of 26, his internal shift from "Plato" to "Aristotle" after this journey—from IP to the more tangible construction of physical AI—led him to dive into a new world, where perhaps broader horizons await his exploration.

Jason's "X" Banner—Raphael's "The School of Athens," with Plato on the left pointing upward "Ideas/Metaphysical," and Aristotle on the right with his palm down "Experience/Real Order."

Gavin Wood, Who Disappeared for a While, Is Returning

Gavin Wood is making a comeback.

As Ethereum attempts to break the $4,000 mark again, some suddenly think of this early core co-founder of Ethereum, the author of the Ethereum Yellow Paper, the creator of the Solidity language, and the founder of Polkadot, Gavin Wood.

In October 2022, Gavin Wood announced that he would resign as CEO of Parity Technologies. This was a voluntary withdrawal from Polkadot. For the industry, this marked his exit from a second project after Ethereum.

Gavin Wood was born in Lancaster, England, and holds a PhD from Cambridge University, focusing on music visualization and human-computer interaction. Before entering the crypto world, he was a researcher at Microsoft and an active contributor to several open-source communities.

In 2013, he met Vitalik Buterin and became one of the earliest co-founders of Ethereum. He not only wrote the first version of the Ethereum Yellow Paper but also personally implemented Ethereum's first client and invented the Solidity language. He laid the initial foundation for the usability of "smart contracts."

However, in 2016, he chose to leave Ethereum due to ideological differences. He envisioned a blockchain that was not just a single virtual machine environment but a multi-chain interconnected world. This ideal ultimately materialized as Polkadot. In 2017, Gavin Wood co-founded Parity Technologies with Björn Wagner and others, subsequently promoting the design and implementation of Polkadot. The Substrate framework he proposed made building blockchains as easy as "assembling Legos," while Polkadot's relay chain and parachain design aimed to solve multi-chain interoperability and shared security issues.

In a sense, Gavin Wood is quite similar to his once-close partner Vitalik. In the Polkadot community, Wood has always been the most symbolic engineer. His identity is more that of an architect and thinker rather than a manager. He excels at writing code, documentation, and manifestos, but not at managing large teams and complex interests.

Thus, in October 2022, Gavin Wood announced his resignation as CEO of Parity Technologies, handing the position to Björn Wagner. "The role of CEO was never my dream job. I can serve well as CEO for a while, but it's not where I can find eternal happiness." This statement carries a typical engineer's idealism. In the following two years, his public appearances gradually diminished: in the summer of 2024, he was seen on stage at EthCC7 in Brussels with Vitalik and Lubin, and at the Polkadot developer boot camp, he appeared as a DJ, seemingly more inclined to immerse himself in the world of music and code.

However, a dramatic turn occurred recently. At the end of August, Gavin Wood announced his return to Parity, once again taking on the role of CEO.

In his statement, he mentioned that he had devoted all his energy to protocol development over the past few years, and now that the foundation had been laid, it was time to "leverage" it; only by reuniting vision and execution could Polkadot run faster. He expressed gratitude to Björn for his leadership over the past three years, maintaining delivery even during the bear market, and now he would take over to start a new chapter. This time, Gavin's identity is no longer just that of an "architect," but he steps back into the management spotlight. He described it as "making Polkadot the launch platform for all new chains and Web3 applications, with Parity being the team ready to fuel the rockets at any time."

Gavin Wood's story resembles a cycle: from engineer to CEO, then back to engineer, and now returning to CEO. He may still not love power, but as Polkadot enters a critical next phase, he chooses to step back into the spotlight.

After Leaving EOS, BM Is Studying Theology

"Looking back at EOS seven years later," Li Xiaolai's words from back then still carry significant weight, and now they seem to have come true in some way.

In the year 2025, the year of the seven-year agreement, the EOS community has separated from its parent company, while Block.one, the parent company, took away over $4 billion raised for EOS, exchanging it for 160,000 bitcoins. This massive liquidity has also been brought by Block.one to a new trading platform, Bullish. Born with a golden key, Bullish has become the second crypto trading platform to go public in the U.S. after Coinbase, with a market value of about $10 billion.

In an apparent attempt to sever ties with the past, EOS's token has now been renamed to A, with a current market value of $321 million, less than one-twentieth of Bullish's. Meanwhile, Daniel Larimer, the most central figure of EOS back in the day, resigned as CTO of Block.one in 2020. In the crypto industry, Daniel Larimer is better known by the name "BM."

BM was born in Virginia, USA, and is a staunch libertarian. He claims that his most admired work is "Atlas Shrugged," believing that free markets and anti-censorship technological tools can protect individual life, property, and freedom.

After entering the crypto industry, he rapidly founded projects: in 2009, he attempted to develop a crypto exchange; in 2013, he founded BitShares, introducing early models of decentralized exchanges (DEX) and stablecoins; in 2016, he founded Steemit, promoting the first large-scale experiment in "blockchain social media"; and in 2017, he teamed up with Brendan Blumer (referred to as BB) to establish Block.one and launch EOS.

In Block.one, this "family business" of BB, BB's sister was parachuted in as Chief Marketing Officer, with her only visible "achievement" being the change of EOS's brand color from tech blue to a "softer Morandi gray." BB's mother runs a venture capital fund, which invested in the social application Voice, which had less than 10,000 users a year after its launch, yet cost $150 million.

BM had very little say; he self-deprecatingly remarked on Twitter that he "had no decision-making power." This co-founder, known as a "genius programmer," became a sidelined shadow within the parent company. Thus, in 2021, the EOS community initiated a "fork uprising," attempting to sever Block.one's control. BM resigned from his position as CTO of Block.one and left the community.

After that, BM's personal footprint became vague, with few crypto-related posts. In the past two years, his Twitter content has been highly focused on biblical interpretations, apocalyptic prophecies regarding geopolitical conflicts, and critiques of mainstream Christianity.

Dirty Backroom Operations

"Who exactly messed up Movement?" When the MOVE token was delisted by Coinbase due to scandal, many began to question this young co-founder of Movement Labs, who was just in his early twenties, the one who once passionately proclaimed in hackathons and podcasts that "Move will change Ethereum's security model," how he could exit the stage in such a dramatic fashion.

Rushi Manche was born in Illinois, USA, and majored in computer science and data science at Vanderbilt University. Like many Gen-Z individuals, he became immersed in hackathons, AI labs, and blockchain code repositories during his college years. In 2022, he and his classmate Cooper Scanlon founded Movement Labs in their dormitory. The inspiration was not complex; their internship experience at Aptos made them see the potential of the Move language—a new smart contract language that is safer than Solidity and capable of parallel processing. However, Aptos also had clear limitations: a lack of liquidity and a limited developer base. Thus, they came up with a bold idea: "bring Move to Ethereum."

The startup quickly attracted the attention of capital. In the pre-seed stage, they brought in over a dozen angel investors, raising $3.4 million. A year later, Movement Labs completed a $38 million Series A funding round, with well-known funds like Polychain, Placeholder, and Archetype all participating. In the industry's narrative, Movement Labs became the "flagship project of the Move language in the EVM world."

Rushi quickly became the spokesperson for Movement. He frequently appeared on podcasts, tech conferences, and industry interviews, embodying the typical passion of a young entrepreneur. His voice was lively, his speech rapid, always carrying a confidence that "the industry needs newcomers to reshape it." Under his push, Movement Labs announced the development of M2 Rollup (a ZK-based Move Layer 2) and Shared Sequencer, hoping to represent the next generation of scaling solutions for Ethereum.

By the end of 2024, the MOVE token was launched. At the moment of the Token Generation Event (TGE), Rushi seemed to truly stand at the center of the stage, but problems began from there.

Shortly after the launch, some in the community questioned the airdrop list being "pre-determined." Movement's "shadow advisor" Sam Thapaliya revealed that over 75,000 wallets were designated by co-founder Cooper, allowing them to acquire 60 million Move tokens through a "mouse warehouse," profiting far beyond ordinary users. Sam was not a "good guy" either; subsequent business memos showed that Movement Labs had signed agreements with two "shadow advisors" (including Sam Thapaliya), promising to provide up to 10% of the MOVE token supply (worth over $50 million), which became the first crack in the project.

A few months later, the real storm arrived. In April 2025, CoinDesk revealed that Movement had signed a market-making agreement with an obscure intermediary, Rentech. Rentech gained control of 66 million MOVE tokens on the day of the TGE and sold about $38 million worth the next day, causing the token to plummet. Binance even urgently froze accounts to quell the chaos. Contracts further revealed that Rentech acted as both the agent for the Movement Foundation and a subsidiary of Web3Port, playing a dual role in the transaction.

This was the last straw that broke the camel's back.

On May 2, 2025, Movement Labs announced that Rushi Manche was temporarily suspended. Five days later, he was officially removed from his co-founder position, and a new leadership team took over the project. When the news was released, Rushi did not publicly respond. His image shifted from a young engineer passionately advocating for a "blockchain security revolution" to the center of a token scandal.

Rushi's exit appeared hasty and chaotic, even carrying a sense of "being expelled." No one knew what had happened in between; various parties held different views. After MOVE was delisted by Coinbase, he himself sued Movement Labs in Delaware court, seeking clarification of responsibilities. To this day, Rushi's last post remains a retweet from May 8 regarding the disclosure of Sam's business memo. And who exactly messed up Move? This question has now become irrelevant and no one cares to ask. Like many blockchain projects, after exiting the historical stage, they left behind a mess.

From IO to OI, from "Decentralized Computing Power" to "Super AI"

When the IO token launched on Binance Launchpool, a question kept circulating in the crypto community: "Why did Ahmad Shadid suddenly step down?" This entrepreneur, with a background as an advisor to the Ethereum Foundation, was once one of the most notable founders in the DePIN field. On June 9, 2024, just two days before the public offering of the IO token, he suddenly announced on X that he was resigning as CEO of io.net, with COO Tory Green taking over.

Ahmad Shadid's story did not begin with GPUs or AI, but with quantification. He initially worked as a data analyst at a small to medium-sized business in Saudi Arabia, Cordoba Partnerships, and later expanded his technical expertise related to GPUs while working as a quantitative systems engineer at ArabFolio Capital and Whales Trader. Starting in 2018, he began developing the ML-driven risk management engine DarkTick, a tool for developing and testing highly automated quantitative trading strategies using quantitative/statistical techniques, applicable to stock/non-stock and statistical arbitrage strategies.

In 2022, he began consulting for the Ethereum Foundation, focusing on the scalability of smart contracts and infrastructure. As the multi-chain and L2 narratives matured, he turned his attention to another overlooked area: computing power.

In 2023, the wave of generative AI swept the globe. ChatGPT drove a surge in demand for computing power, and GPU supply became one of the most strained resources in Silicon Valley. Shadid keenly realized that if DeFi could liberate finance, DePIN could liberate physical resources. His answer was io.net, a network connecting idle GPUs to provide decentralized computing power for AI models.

In his narrative, IO was not just a company but "the world's largest decentralized AI supercomputer." This slogan quickly attracted the attention of capital and the community. From studios to cloud service providers, it seemed that everyone was providing computing power for IO.

However, just before the token was about to launch, Shadid stepped down. "I resigned as CEO not because of external doubts about me, but to allow the project to grow without interference," he wrote on X. Prior to this, some in the community had accused io.net of exaggerating the GPU computing power it promoted, expressing concerns that he might take the opportunity to cash out.

Faced with these doubts, Shadid chose a sunny approach to deliver: "donating 1,000,000 IO tokens to the Internet GPU Foundation to promote ecological development, emphasizing that all team members, advisors, and investors' tokens have a four-year lock-up period, with partial unlocking starting after June 2025." Although this action sparked speculation, in the "shadowy" DePin industry, it seemed quite "sunny" from the perspective of a donation exit.

After leaving IO, he launched a new project, O.XYZ, with its governance token OI, claiming its concept is a "sovereign super AI" governed by the community. He also introduced an index token for Solana AI called "Osol" (the top 100 AI project tokens on Solana) and recently launched "AI CEO." However, the product claims of "connecting over 100,000 AI models" and "20 times faster than competitors" also faced community skepticism, and the market value of the project token continued to decline. After the transition from IO to OI, Shadid became less popular, possibly due to the market's repeated disappointments with the "CryptoAI" narrative.

Mihailo, the ZK Evangelist Leaving Polygon

On a morning in May 2025, Mihailo Bjelic decided to step down from the board of the Polygon Foundation and the daily affairs of Polygon Labs. This marked his formal farewell to the project that had accompanied him for eight years. For the crypto industry, he was the third co-founder to leave Polygon; for him personally, it was a turn marked by relief and divergence.

Mihailo hails from Serbia and studied information systems and computer science at the University of Belgrade. He entered the crypto world relatively late, starting to engage with the Bitcoin and Ethereum communities in 2013, gradually immersing himself in the question of "how to make blockchain truly usable." After graduation, he participated in a startup providing AI/machine learning solutions for the automotive industry and tried several small software projects, but none truly ignited his passion. His real obsession was to find answers in the maze of blockchain scalability.

In 2017, he met the team then known as "Matic Network." Ethereum was experiencing network congestion due to CryptoKitties, with high transaction fees causing developers great distress. Mihailo recognized this as the direction where he could invest all his passion: to create a truly usable Ethereum scaling solution.

Within Polygon, Mihailo was known as the "evangelist of ZK." He led the technical strategy, particularly the zero-knowledge proof (ZK) route. Under his push, Polygon spent hundreds of millions acquiring Hermez and Mir, heavily investing in ZK technology, laying the groundwork for the later Polygon zkEVM.

He played a role not only in technical direction but also as a representative voice for Polygon's external narrative. Whether in podcasts, tech summits, or long articles in research communities, he was one of the voices "telling the story" of Polygon: it was not just a sidechain but a multi-chain universe, a key piece in the Ethereum scaling landscape. His presence was seen in media interviews and on developer conference stages, embodying both an engineer and a promoter.

However, as the project expanded and matured, cracks began to show. In 2023, Anurag Arjun, one of the four co-founders, left first to create his own modular chain, Avail; in October of the same year, another co-founder, Jaynti Kanani, also announced his departure from daily affairs. The once-close camaraderie among the founders was gradually diluted by the passage of time and the increasing complexity of the project.

Two years later, Mihailo became the third to leave. In his statement, he mentioned "vision divergence" and admitted that he could no longer contribute at his best. Afterward, the foundation was solely led by Sandeep Nailwal. Mihailo's story did not involve escape, scandal, or a dramatic collapse; his words were gentle, appearing quiet and clean.

Stepping Down as Morph CEO, She Left Behind the "Foot Photo Meme"

Cecilia's departure from Morph can be summarized as being swept away by internal strife, power struggles, and external controversies.

In June of this year, Morph co-founder and CEO Cecilia Hsueh announced on social media that she was officially stepping down as CEO, handing the position to former YGG executive and Binance veteran Goltra. She stated that this was a "well-considered decision," and she would continue to support the team as an advisor.

Cecilia was born in Taiwan and is based in Singapore. Her entry into the crypto industry began at the exchange Phemex, where she served as Chief Marketing Officer and briefly acted as CEO. Prior to this, her resume mainly focused on marketing and operations. In 2023, she was selected by Bitget and Foresight Ventures, teaming up with former Gitcoin member Azeem Khan to become co-founders of the newly incubated public chain Morph. Cecilia took on the role of CEO, aiming to build Morph into a "consumer-grade public chain," attempting to find the next L2 breakout point after Coinbase's Base chain.

In March 2024, Morph completed a $20 million seed round financing, with a valuation of $125 million. Once the financing news broke, Morph's popularity surged, and the community anticipated it could become a competitor to Base. However, cracks quickly appeared: Cecilia and Khan, who were originally strangers, were "forced to pair" as founding partners, and their ideological differences became apparent—Khan emphasized emerging markets, while Cecilia focused on external image and marketing. As time passed, the conflicts gradually intensified.

Afterward, Morph frequently made headlines for its extravagant spending and strategic chaos: spending hundreds of thousands of dollars at Token2049 in Singapore, inviting K-pop group tripleS and DJ SODA; renting an office on the 77th floor of the World Trade Center in New York, sharing it with Foresight and The Block; paying over $200,000 in development fees for the project BulbaSwap, which aimed to replicate Uniswap v2, but that DEX only ranked in the top 200 globally.

Meanwhile, Morph's mainnet trading volume remained sluggish, averaging only 16,000 transactions per day, far less than Base's millions. The planned token issuance was repeatedly delayed, and there was significant internal staff turnover, with some even failing to receive clear token contracts.

In early 2025, Khan announced his exit from Morph to start a new blockchain, Miden. Cecilia still held the title of CEO, but her real power further diminished. Ultimately, in June 2025, she chose to leave.

More dramatically, the true helm of Morph may never have been the CEO on the surface. According to Blockworks, Foresight Ventures co-founder Forest Bai was referred to by employees as the "ghost helmsman." Although he was not part of Morph's management, he was deeply involved in strategy, budgeting, and personnel, even being formally added to the Slack channel, directly influencing the team. This raised significant questions about Morph's governance and power structure.

Somewhat abstractly, in the minds of most in the crypto community, Cecilia's image has always been vague. However, because she once posted photos of her feet on social media, it left the deepest impression of her feet on the outside world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。