Major global exchanges are launching their own chains to explore new sources of revenue, and Upbit and Bithumb are not without the possibility of joining this competition.

Written by: Tiger Research

Translated by: AididiaoJP, Foresight News

- Major global exchanges are launching their own public chains to explore new sources of revenue, and Upbit and Bithumb are not without the possibility of joining this competition.

- There are four possible scenarios: Layer2 based on OP Stack, infrastructure for Korean won stablecoins, leveraging the liquidity characteristics of the Korean market, and tokenization of unlisted stocks. Each of these could become a differentiated approach reflecting the unique market environment of Korea.

- Of course, regulatory restrictions and technical complexities remain significant obstacles. Achieving this in the short term is not easy. However, in the context of declining trading volumes and increasing global competition, it is clear that these two exchanges must seek new growth drivers.

The Prelude to Exchange Public Chain Competition

Cryptocurrency exchanges are officially beginning to join the competition for blockchain infrastructure. With the introduction of Coinbase's Base, Kraken's Ink, and the recent entry of Robinhood, the competitive landscape is becoming more intense.

Behind this fierce competition is the limitation of the existing fee-based business model. While the fee model of exchanges is the most stable and proven source of revenue in the cryptocurrency industry, it is highly dependent on market conditions due to its structural characteristics, necessitating revenue diversification. Additionally, it is noteworthy that in the past, exchanges competed within limited domains of their respective jurisdictions, but now the competitive stage has expanded to a global level. Meanwhile, decentralized exchanges (DEX) that once held over 25% market share are challenging the status of centralized exchanges.

At the same time, as the cryptocurrency industry integrates into the traditional financial system at an accelerated pace, from the perspective of exchanges, opportunities for derivative businesses utilizing blockchain infrastructure are rapidly opening up beyond merely being trading intermediaries. Ultimately, these changes intertwine, making the competition for exchange public chains likely to accelerate further in the future.

What if Upbit and Bithumb Launch Their Own Public Chains?

In the context of global exchanges rushing to launch their own public chains, a natural question arises: "Is it possible for Korean exchanges Upbit and Bithumb to do the same?" To assess this, it is necessary to examine the current status of these exchanges and their past attempts.

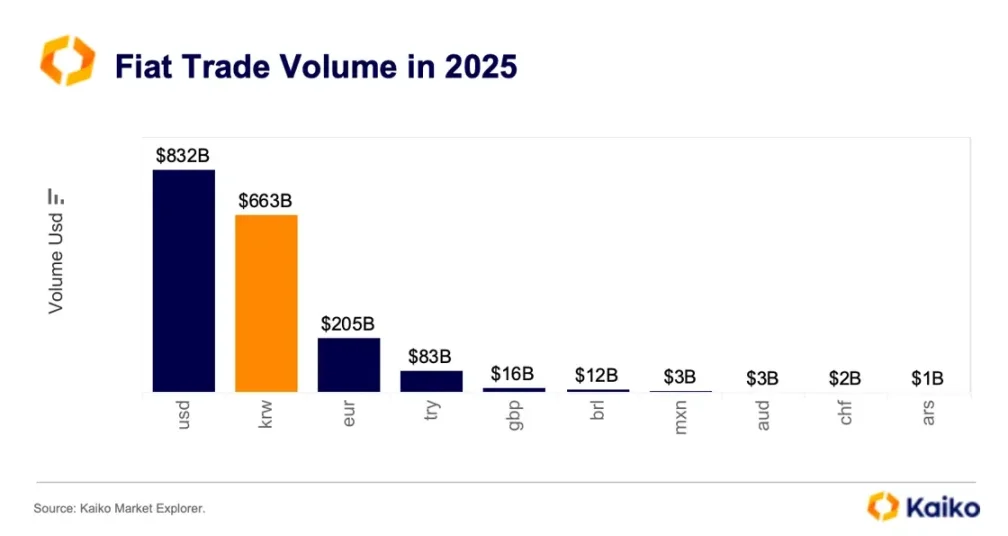

Korea occupies a unique position in the global cryptocurrency market. In terms of fiat currency, the trading volume of the Korean won (KRW) ranks second globally, only behind the US dollar (USD), and sometimes even surpasses it. It is extremely rare for such a large trading volume to be generated by users from a single country. Thanks to this market environment, Upbit and Bithumb have grown into large enterprises with total assets exceeding 50 trillion won.

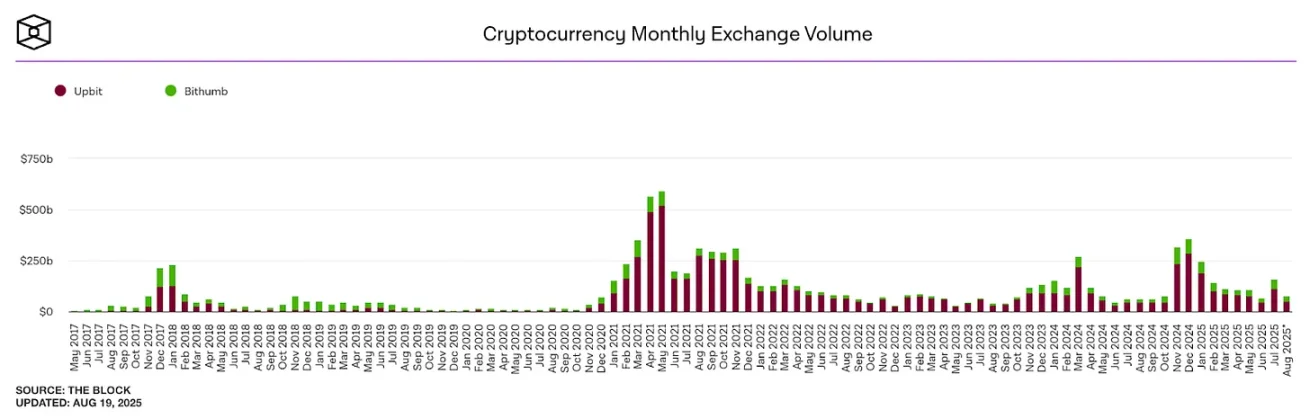

Source: The Block

However, this seemingly solid structure is also changing. Since trading volumes peaked in 2021, the trading volumes of both exchanges have been on a downward trend. This is because domestic users are shifting to global exchanges like Binance and Bybit or decentralized exchanges (DEX). This indicates that the environment where domestic exchanges can rely solely on Korean liquidity characteristics is coming to an end.

The exchanges have also noticed this change. Upbit and Bithumb have both attempted to enter the global market by establishing overseas subsidiaries and diversifying their businesses. However, relying solely on the "Korean exchange" brand abroad has proven difficult to ensure differentiated competitiveness. Additionally, while they have launched various platform-based businesses, most have strayed far from the inherent competitive advantages of exchanges and have not achieved significant results. Of course, regulatory sanctions may also have limited their business diversification.

But now, a wind of change is blowing. The pro-cryptocurrency policies of the Trump administration have improved the global regulatory environment, allowing exchanges to more actively seek new growth strategies. Against this backdrop, the launch of public chains by Upbit and Bithumb is certainly a viable option to consider.

If they were to launch public chains, different outcomes could be expected compared to the past. They could directly leverage the inherent advantages of a large user base and rich liquidity of the exchanges. Particularly, if combined with the unique characteristics of the Korean market, it is entirely possible to create differentiated value.

Expected Scenario 1: Building Layer2 Based on OP Stack

If these exchanges build their own chains, the likelihood of choosing Layer2 is higher than that of Layer1.

The main reason is the complexity of development and the scale of resources required. Developing and operating Layer1 requires enormous resources. Even with the lowered entry barriers of Layer2 due to Rollup services, a considerable amount of specialized talent is still needed; the fact that Kraken's Ink project invested about 40 developers is a testament to this. From the perspective of exchanges, independently building and operating such infrastructure would inevitably be a heavy burden. Moreover, their goal is to expand business based on infrastructure rather than focusing on building high-performance infrastructure itself.

Additionally, there are regulatory risks. Layer1 must issue a native token, but under Korea's regulatory environment, token issuance is practically impossible, and there is a high likelihood of facing sanctions from authorities. Therefore, a Layer2 model that can operate without issuing a native token, as adopted by Coinbase, will become the most realistic alternative.

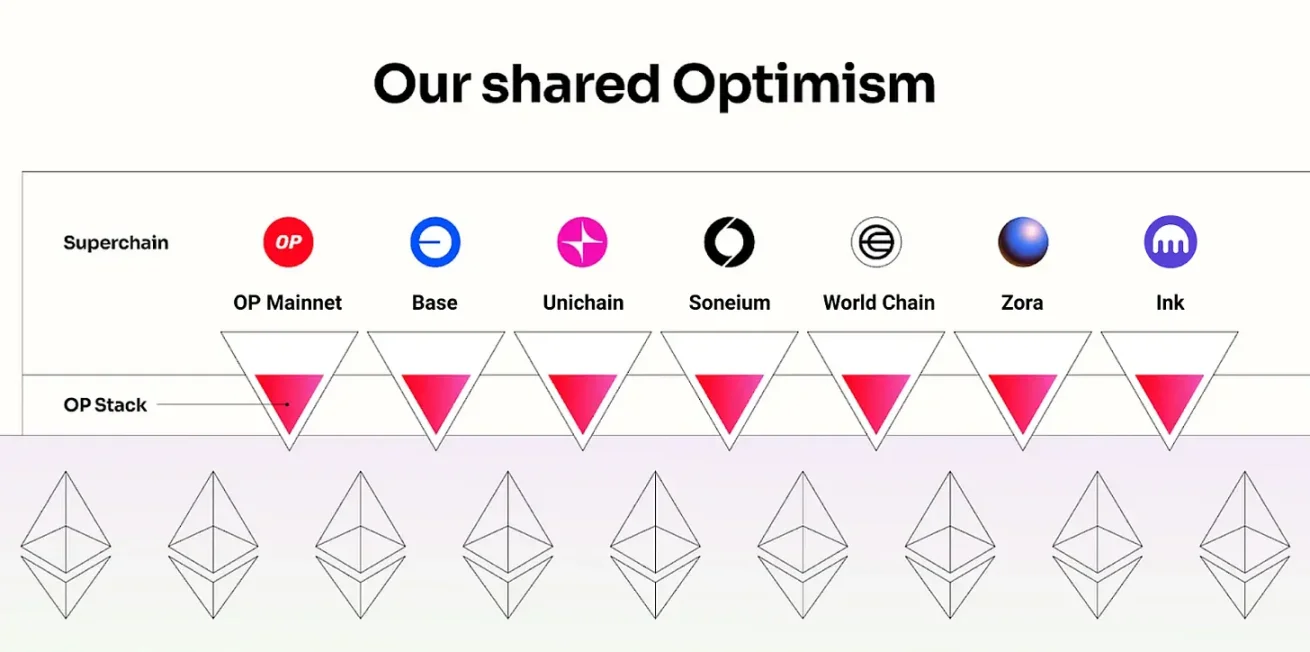

Source: Optimism, Tiger Research

While there are various stacks for Layer2 development, global exchanges currently almost uniformly adopt the Optimism (OP) Stack as a standard. Coinbase's Base and Kraken's Ink are built on this and have become reference models for exchange types. Robinhood, on the other hand, chose Arbitrum due to its different strategic objectives. Coinbase and Kraken pursue broad ecological expansion with interoperability as a priority, while Robinhood focuses on bringing its financial services on-chain, making Arbitrum, which offers greater customization flexibility, more suitable.

Upbit and Bithumb have similar goals to Coinbase. Both exchanges need to overcome the limitations of the existing fee-centered model and leverage their large user base to expand into on-chain services to create new sources of revenue, for which openness and interoperability are key. Therefore, if Upbit and Bithumb were to launch their own chains, the most likely choice would be a Public Layer2 based on OP Stack.

Expected Scenario 2: Infrastructure for Korean Won Stablecoins

Another scenario for Upbit and Bithumb launching their own chains is to build dedicated infrastructure around Korean won stablecoins.

Upbit's KRW stablecoin trademark, Source: KIPRIS

In fact, both exchanges have shown positive movements towards the stablecoin market. Upbit and Bithumb have applied for trademarks related to stablecoins, particularly Upbit's collaboration with Korea's leading easy payment service Naver Pay, officially announcing plans to enter the Korean won stablecoin market. Focusing on Upbit, which has the highest likelihood, a realistic scenario is that Naver Pay issues a stablecoin based on the Korean won, with Upbit providing the blockchain infrastructure. This is because the "Virtual Asset User Protection Act" prohibits exchanges from trading virtual assets issued by themselves or related parties.

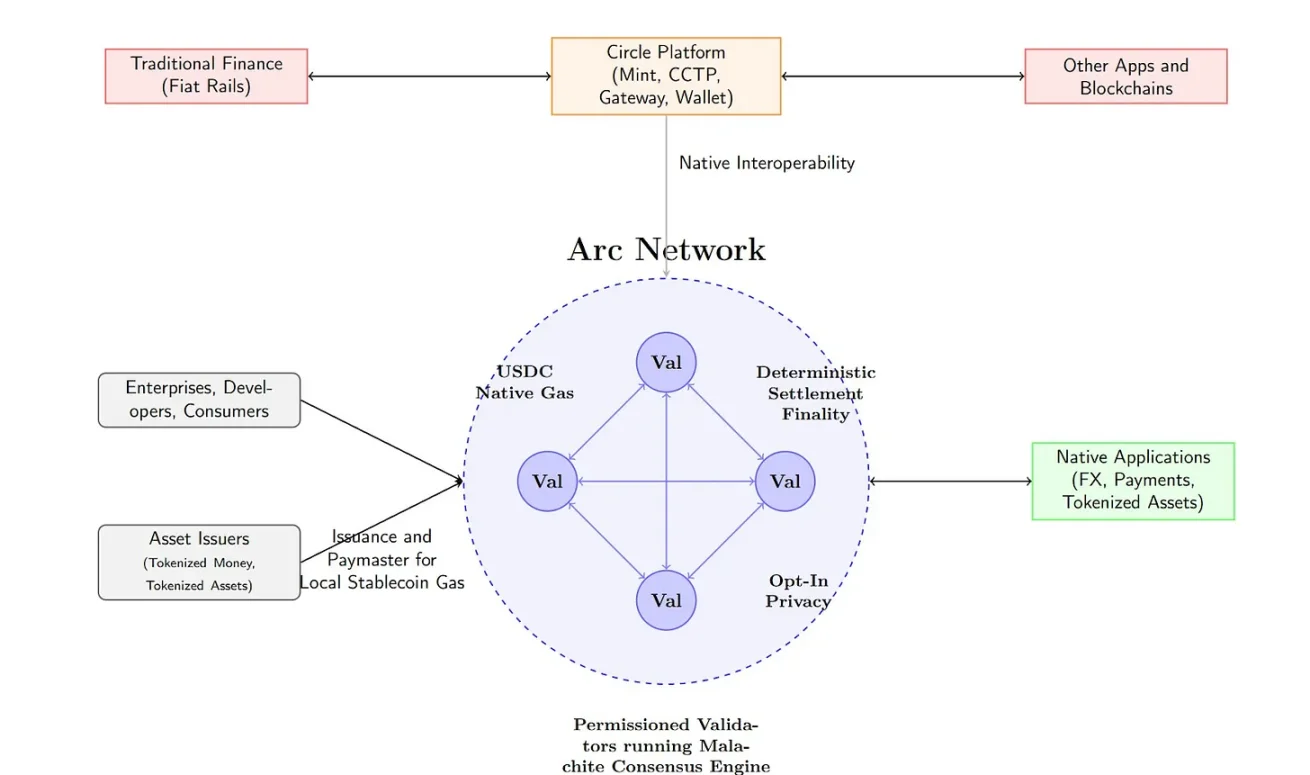

Source: Circle

In this case, the core lies in building dedicated infrastructure optimized for stablecoins. Features such as daily payment or privacy protection can be added to achieve differentiated services, and a structure can be designed for using Korean won stablecoin payment network Gas fees. This is similar to the model of USDC's Arc Network, aiming to build an ecosystem where all transactions revolve around stablecoins. This structure provides users with a stable cost structure while creating actual demand for Korean won stablecoins, laying the foundation for sustained use.

However, there are technical limitations. Optimism defaults to using Ethereum as Gas fees and does not support custom Gas token functionality. Therefore, in this case, a Layer2 based on customizable Arbitrum, or building Layer1 with Korean won stablecoin as the native token, may be a more suitable choice.

Expected Scenario 3: Strategies Utilizing Korean Liquidity Characteristics

One of the strategies that Upbit and Bithumb could attempt is to leverage the liquidity characteristics of Korea. Currently, Korea has enormous liquidity, ranking second globally in terms of fiat currency, but this liquidity remains confined within the internal systems of exchanges.

Source: LlamaRisk

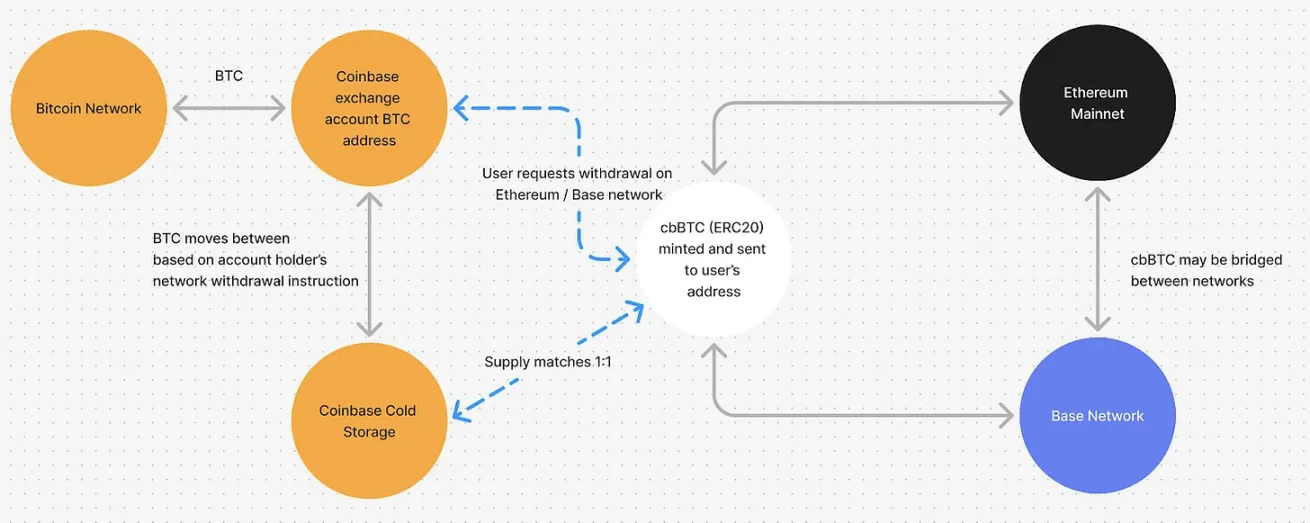

Exchanges can issue wrapped tokens like upBTC and bbBTC based on custodial assets. Coinbase's cbBTC is a representative case. Although these wrapped tokens can also be used on other chains, if the exchange provides conveniences like one-click integration within the application, users are likely to remain on the chain built by the exchange rather than moving to external options. In this case, project teams looking to leverage rich liquidity would have reasons to choose that chain, activating the ecosystem and allowing the exchange to ensure revenue based on infrastructure. Furthermore, it is expected that wrapped tokens could be used to personally explore additional business models such as lending.

Expected Scenario 4: Entering the Pre-IPO Tokenization Market

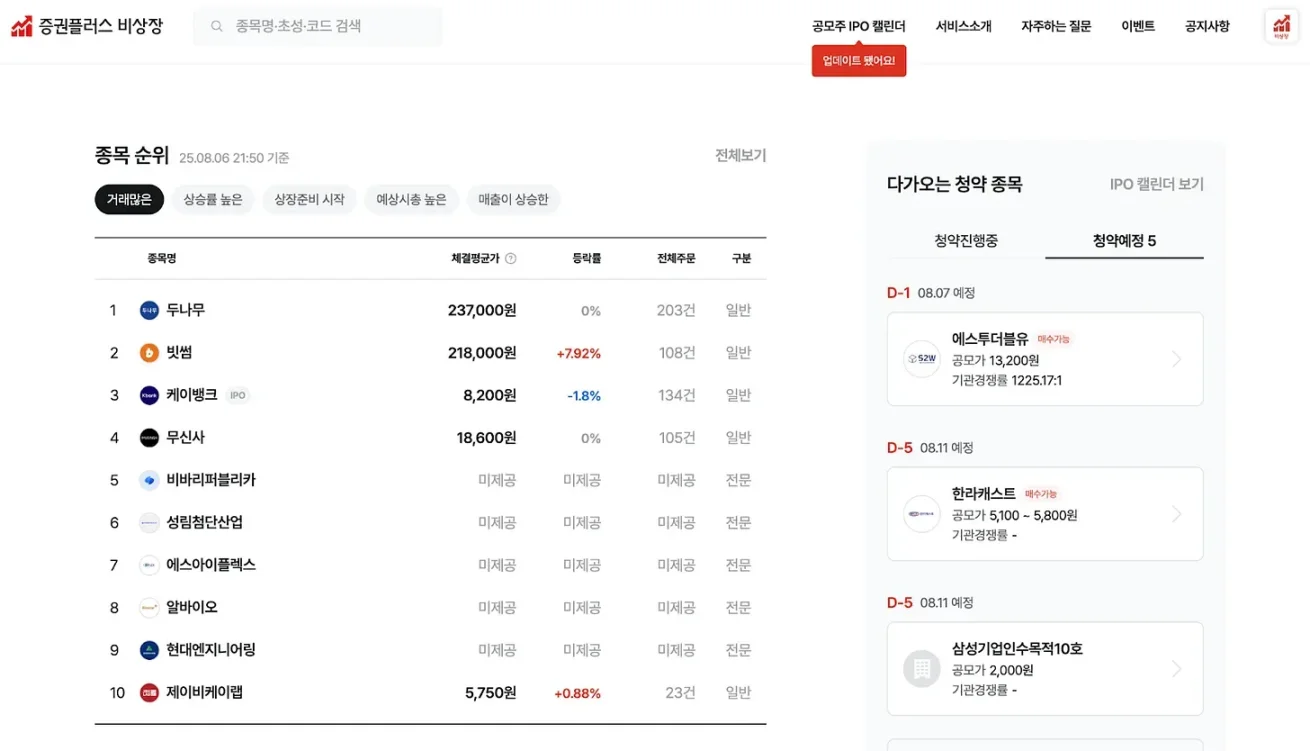

Another strategy that Upbit and Bithumb could choose is to enter the non-listed stock tokenization market. Upbit's operator, Dunamu, has long operated a non-listed stock trading platform through the Securities Plus platform and has accumulated experience, but this ultimately remains a P2P trading model that connects buyers and sellers. There are structural limitations, such as low transaction completion rates and limited liquidity.

Source: Ustockplus

If non-listed stocks are tokenized based on their own chain, the situation would be different. Tokenized stocks could be traded in real-time through liquidity pools or market makers, and ownership transfers would be automated and transparently handled through smart contracts. In addition to simply improving trading efficiency, features such as automatic dividends, conditional trading, and programmable shareholder rights could be realized on-chain, making it possible to design financial products that existing securities systems cannot achieve.

Recently, it is noteworthy that Naver is advancing the acquisition of Dunamu's non-listed shares in Securities Plus. If Upbit provides the chain infrastructure and Naver is responsible for platform operations and physical stock management, this could become a realistic division of labor under the regulatory environment. That is, by separating trading infrastructure and securities management roles, institutional risks could be reduced, allowing entry into the tokenization market to compensate for the limitations of existing services.

Conclusion

We have explored various scenarios for Upbit and Bithumb to launch their own blockchains. However, the reality is that they face numerous challenges. The biggest obstacle is regulation. Korea adopts an active regulatory model, making it difficult to introduce services that are not explicitly defined by law. Both exchanges are designated as group enterprises, further increasing the regulatory burden, and the lack of Web3-native leaders like Jesse Pollak from Base is also seen as a limiting factor. Additionally, the technical complexity and the slim possibility of realizing a self-owned blockchain in the short term are significant hurdles.

Nevertheless, there is still considerable room for experimentation. Domestic trading volumes have been declining since peaking in 2021, and global competition is intensifying. The existing fee model has clear growth limitations, and previous attempts at revenue diversification have not achieved significant results. Sustained growth requires new driving forces, and bold attempts like building their own blockchains may be one such avenue. This could be the most realistic business diversification strategy, fully leveraging the competitive advantages of both exchanges, including their user base and liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。