The crypto asset treasury (DAT) is both a significant risk point and a key bullish factor.

Written by: Ignas

Translated by: Luffy, Foresight News

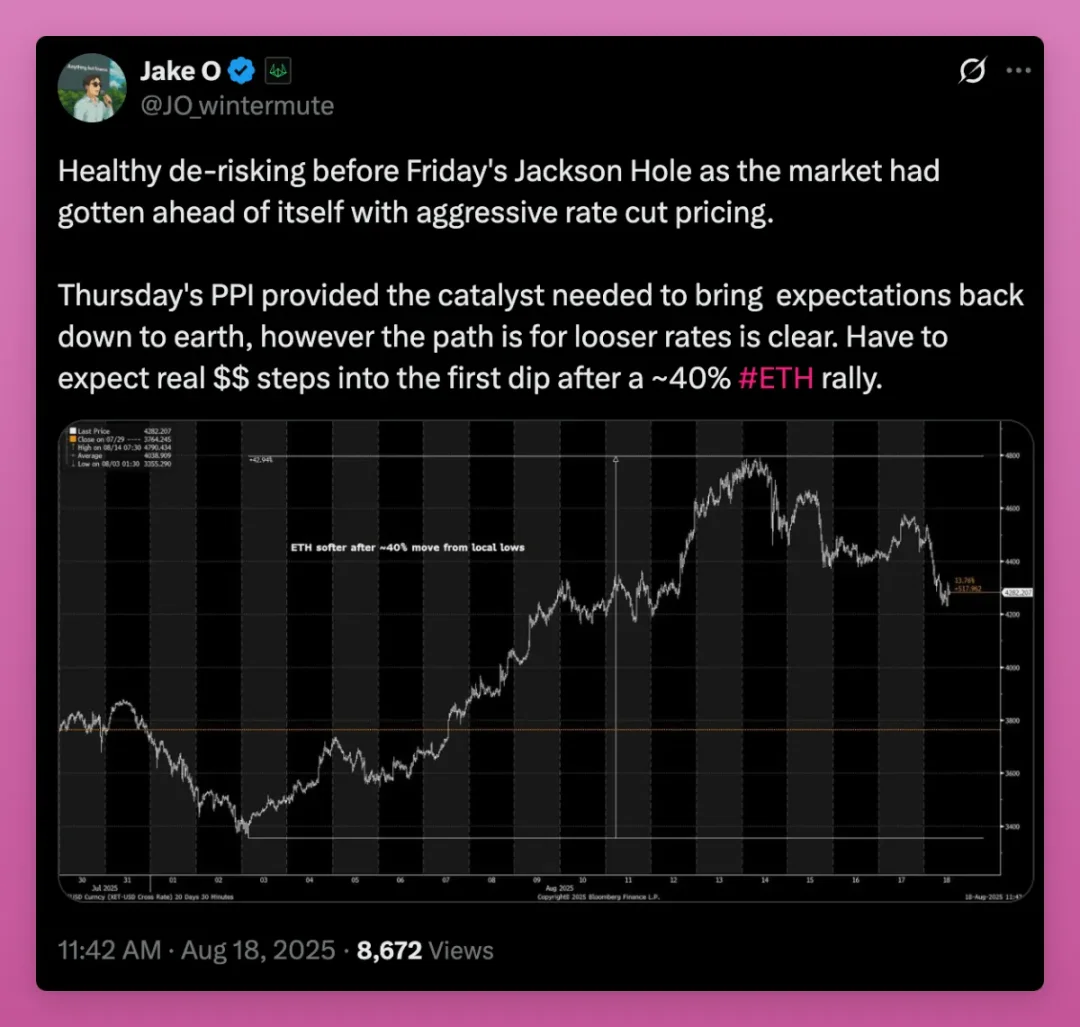

As I write this article, the biggest uncertainty in cryptocurrency in the short term is the trend of interest rates. There are two key points to watch: first, Powell's statement at the Jackson Hole meeting (Thursday, August 22), and second, how the Federal Reserve determines interest rates at the Federal Open Market Committee (FOMC) meeting on September 16-17.

- If dovish signals are released → 2-year U.S. Treasury yield and the dollar index fall → Bitcoin/Ethereum rise

- If hawkish rate cuts or maintaining high rates for longer occur → risk assets are sold off, altcoins plummet first

This is the conclusion of the ChatGPT 5 thinking model and Deepseek's Deepthink model. Many people on the X platform share the same view, which also explains the recent decline in altcoins.

To be honest, the cryptocurrency's dependence on macro factors is quite frustrating, but the fact that the last cycle peaked due to global interest rate hikes shows that we cannot ignore these factors.

However, as Wintermute trader Jack said, my AI model also depicts a bullish outlook: rate cuts will eventually come. The uncertainty lies in "when to cut, how many times, and by how much."

That said, the situation now is exactly the opposite of when the last cycle ended: rate cuts are approaching, so is the peak of the bull market still far away?

I hope so, but everyone I talk to around me plans to sell. So who is buying to offset the selling pressure?

The retail speculators we relied on in the last cycle have not yet entered the market (as can be seen from the data of crypto apps in the iOS App Store). Currently, the biggest buyers are:

- Spot ETFs

- Crypto asset treasury (DAT)

What worries me is whether the purchasing power of institutions, crypto asset treasuries, and other large players can offset one round of retail selling after another? Or will their purchasing power run out?

Ideally, this is a process that lasts for several years, where steady price increases gradually eliminate those who are not steadfast investors.

The most interesting outcome might be: even if most crypto "natives" sell off, cryptocurrencies continue to rise, leading to further bullish trends.

In any case, the crypto asset treasury is both a significant risk point and a key bullish factor, and I want to briefly discuss this.

Now it all depends on the crypto asset treasury

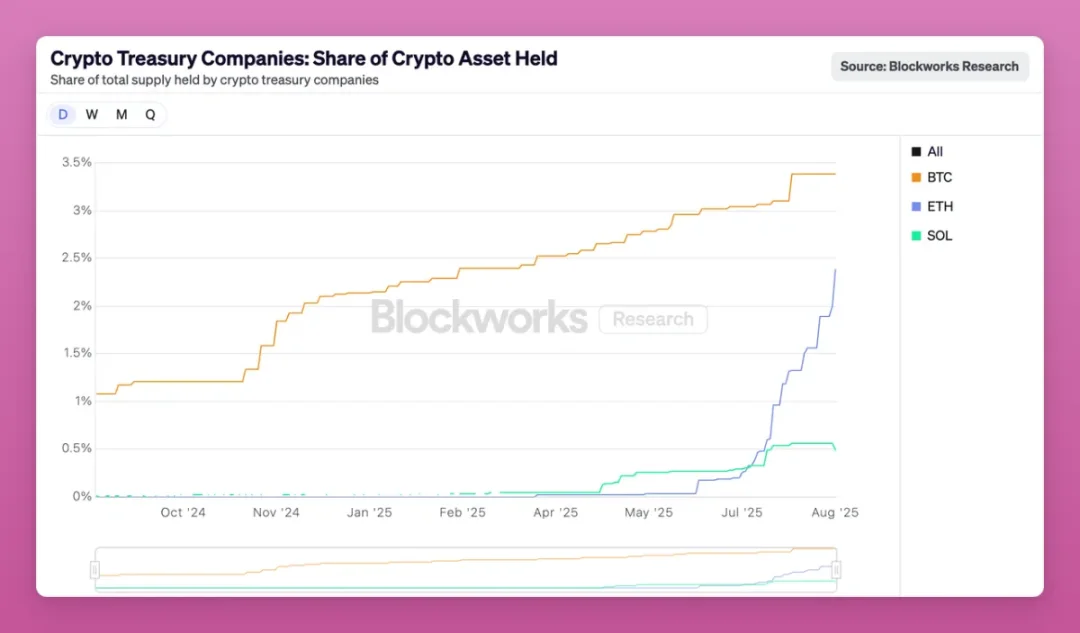

You can tell by the speed at which the crypto asset treasury is acquiring Ethereum.

The Ethereum crypto asset treasury has acquired 2.4% of the total supply of Ethereum in less than 3 months.

From another perspective: the largest Ethereum crypto asset treasury (Bitmine) now holds as much as the crypto exchange Kraken, surpassing exchanges like OKX, Bitfinex, Gemini, Bybit, Crypto.com, and even exceeding the holdings in the Base chain cross-chain bridge.

At this rate, the holding ratio of the Ethereum crypto asset treasury will exceed that of Bitcoin within a few months. In the short term, this is positive for Ethereum, but once the crypto asset treasury needs to liquidate its Ethereum holdings, the risk arises.

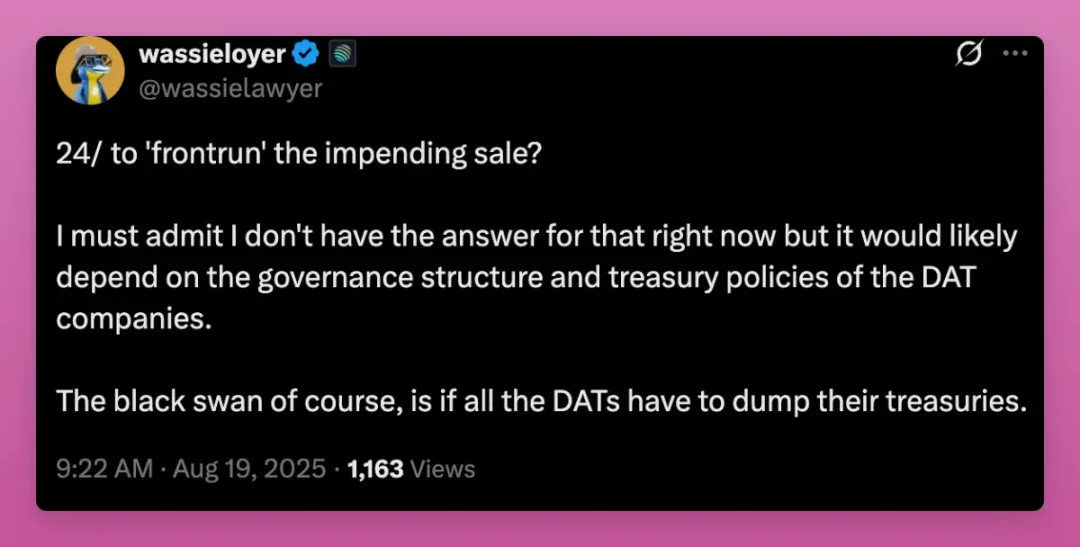

But even Wassie admits that what happens when the adjusted net asset value (mNAV) turns negative is still unclear for the crypto asset treasury.

There are many related speculations on the X platform, but my advice is to continuously track the data of the crypto asset treasury, especially to pay attention to whether the adjusted net asset value remains below 1.

As I write this article, the trading prices of SBET and BMNR are slightly above the adjusted net asset value of 1, while BTCS is below 1.

So what is BTCS doing?

To attract more stock buyers, BTCS announced its first "dual dividend": a one-time distribution of $0.05 in ETH dividends per share, along with a cash dividend of $0.35.

Most importantly, they offer… please read carefully… "We will provide a one-time Ethereum loyalty reward of $0.35 per share to shareholders who transfer their shares to our transfer agent and hold them until January 26, 2026."

For crypto natives, BTCS's operation feels like a traditional finance "staking mechanism," aimed at preventing shareholders from selling their stocks. Their motivation for issuing "dual dividends" stems from the adjusted net asset value being below 1 and to "guard against market manipulation"—to prevent stocks from being lent to short sellers.

Additionally, where do these dividends come from? They are actually paid from the Ethereum they have acquired.

It doesn't look too good, does it?

At least they haven't publicly sold off Ethereum yet. I suspect that the first crypto asset treasury to collapse and sell off will be those small companies that cannot attract stock buyers. So we need to track the following dashboards to identify crypto asset treasuries and study how they handle their crypto holdings.

Crypto Twitter may overlook small crypto asset treasuries, but their movements can help us predict how larger, systemically important crypto asset treasuries will act.

Here are some dashboards worth following:

It is important to note that different dashboards report slightly different data, which increases the difficulty of analysis. We need to closely monitor the movements of other crypto asset treasuries.

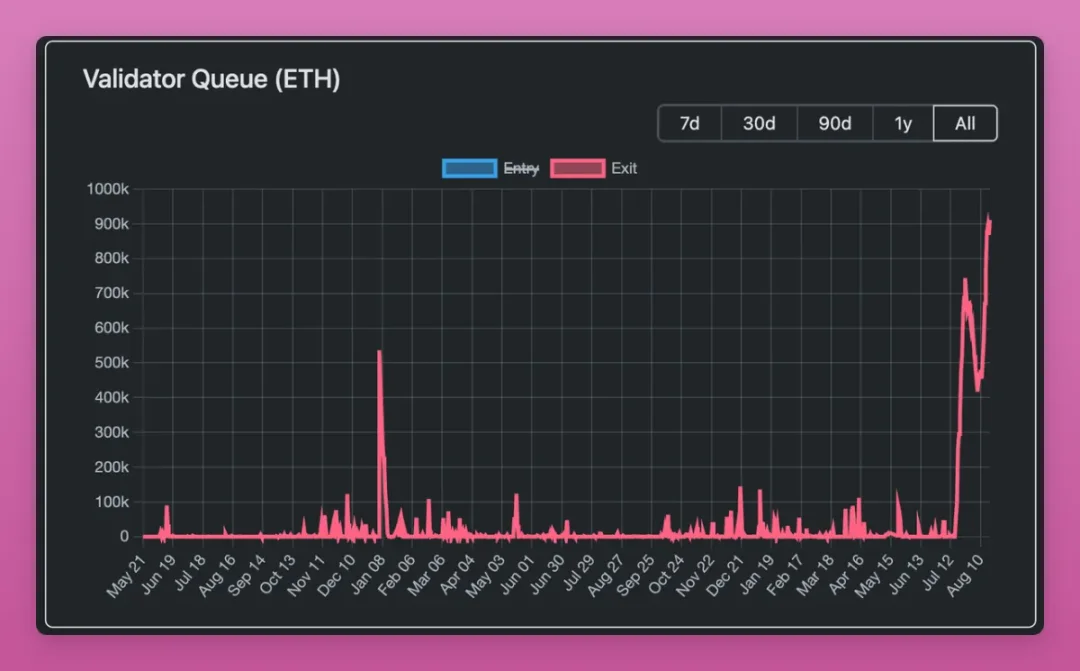

However, considering that the current adjusted net asset value premium is at a low level and the number of Ethereum unstaking queues has reached a record, it is not surprising that Ethereum's upward momentum may slow down for a few days or even weeks.

Before moving on to other topics, I want to add that I am becoming increasingly optimistic about altcoin crypto asset treasuries.

The bullish logic of altcoin crypto asset treasuries

In this cycle, the issuance of new tokens has reached record levels. Although most are worthless meme coins, the cost of token issuance has effectively dropped to zero.

Compared to previous cycles: proof-of-work forks required mining machines (like Litecoin, Dogecoin), or building staking infrastructure (like EOS, SOL, ETH). Even in the last cycle, issuing tokens required a certain level of technical knowledge.

Before this cycle, the number of noteworthy tokens was "controllable," including several lending protocol tokens, decentralized exchange tokens, a few public chain tokens, infrastructure tokens, etc.

Now, with the cost of token issuance at zero, more projects are launching tokens, especially with the rise of Pump.fun, making it increasingly difficult for altcoins to attract sufficient attention and capital inflow.

For example: I listed 11 numbers below, but what if there are thousands? It would be impossible to find a "Shearing Point" (the default consensus point among people without communication).

Previously, there was only a distinction between Bitcoin and "other coins." With MicroStrategy continuing to buy, only Bitcoin could rise.

However, altcoin crypto asset treasuries have changed this dynamic.

First, very few altcoin projects can plan a crypto asset treasury acquisition scheme. This requires specific knowledge and skills that most projects do not possess.

Second, only a limited number of altcoins are "worthy" of having a crypto asset treasury. For example, Aave, Ethena, Chainlink, Hype, or DeFi token indices.

Third, and perhaps most importantly: crypto asset treasuries give ICO projects an "IPO moment," allowing them to attract institutional funds that were previously unreachable. As I wrote on the X platform:

I used to think that altcoin crypto asset treasuries were just a crazy Ponzi scheme.

But upon closer thought, crypto asset treasuries allow altcoins to "go public"—transitioning from ICO to IPO.

The crypto asset treasury of BNB is like Binance's IPO, which Binance might not have been able to do properly.

Similarly, the crypto asset treasury of $AAVE allows traditional financial capital to invest in the future of the lending sector.

More of such crypto asset treasuries, please.

Finally, unlike Bitcoin and Ethereum, altcoins do not have ETFs to attract institutional investors.

Therefore, altcoin crypto asset treasuries are an area I will focus on. They bring different dynamics, such as absorbing venture capital's off-market sell-offs or acquiring tokens at discounted prices.

Ethena is already an early case, but I want to see what happens when a high-circulation altcoin has a crypto asset treasury.

Should I sell?

As I mentioned earlier, many people around me plan to sell. But they don't want to sell at the current price.

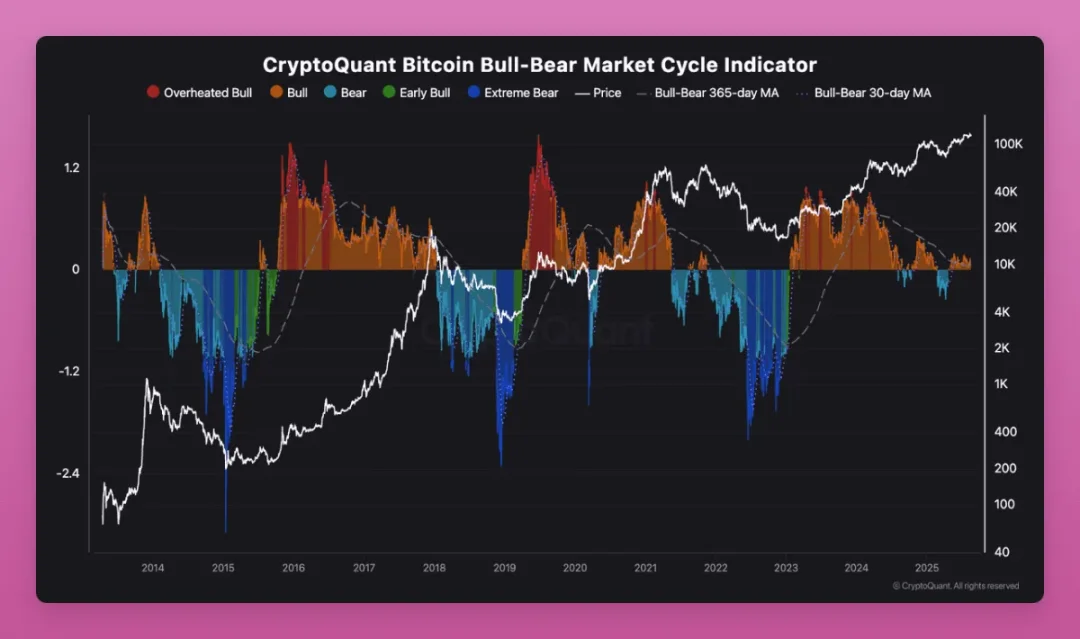

Why? Because all indicators still look surprisingly healthy. CryptoQuant's "Omni Momentum Indicator" tracks bull and bear cycles through the profit and loss index.

The core conclusion (which hasn't changed much compared to a few months ago):

- Bitcoin is in the mid-bull market.

- Holders are taking profits, but extreme euphoria has not yet appeared.

- There is still potential for price increases before valuations become excessive.

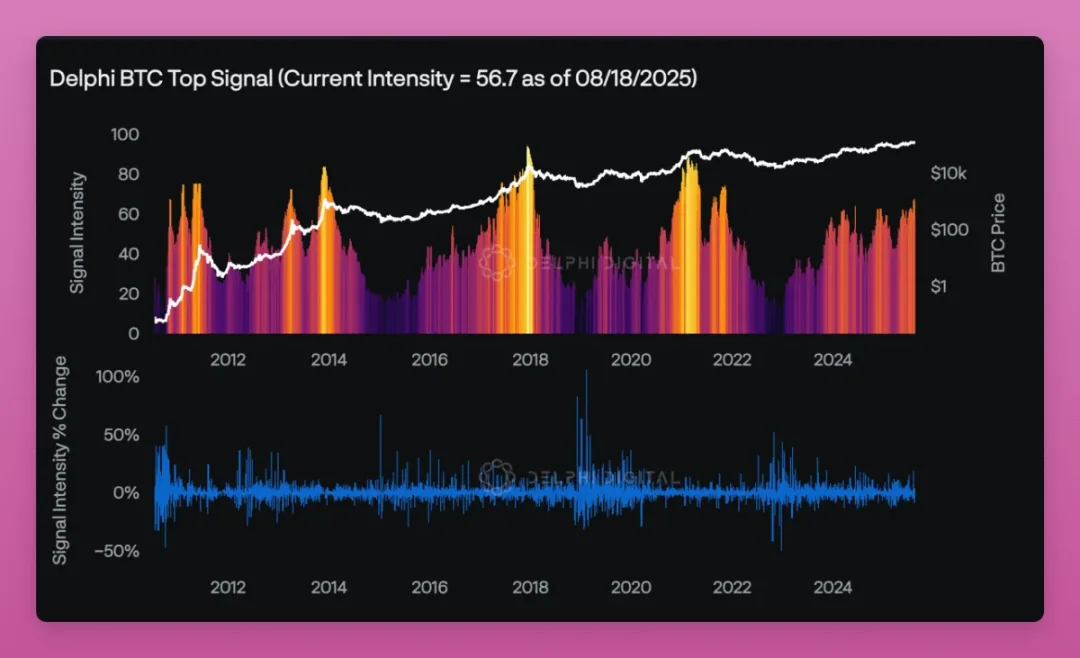

Nevertheless, Delphi's Bitcoin top signal dashboard shows that the market is approaching overheating but remains within a controllable range: the strength score is 56.7, while tops usually occur around 80.

The Fear and Greed Index has returned to neutral.

Additionally, among the 30 indicators tracked by Glassnode, none indicate that the market has peaked.

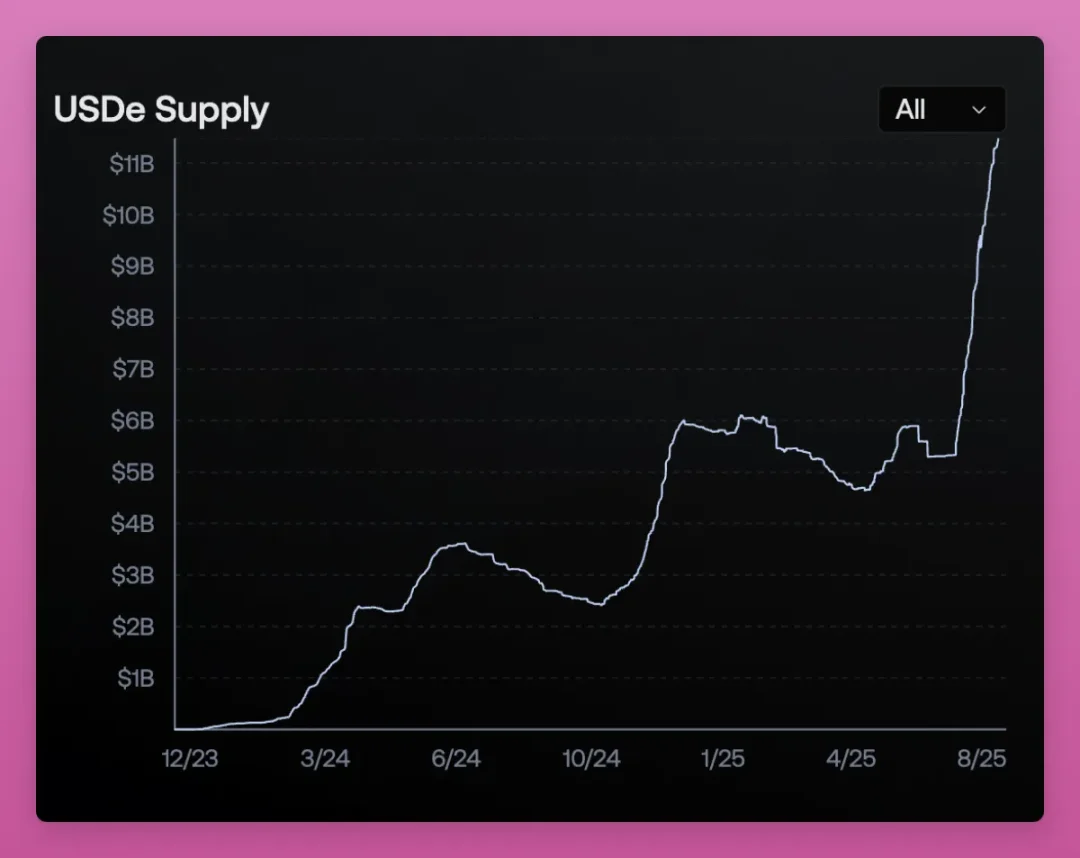

I used to judge market tops by the peak funding rates, but now I suspect this indicator has been distorted by Ethena.

Previously, high funding rates meant too many speculators were going long, which typically led to a subsequent crash. However, Ethena's USDe has broken this signal.

USDe mints stablecoins by going long on spot and shorting perpetual contracts, earning funding rates as profit. When funding rates rise, more USDe is minted, increasing short positions, which in turn lowers funding rates. This creates a cycle.

So now, high funding rates no longer mean the market is overheated; it may just be Ethena minting more USDe.

Why not switch to tracking the supply of USDe? From that perspective, the market does seem quite hot, as the supply of USDe has doubled within a month.

Overall, I think the market conditions are still decent. However, due to many speculative retail investors holding "life-changing" unrealized profit positions from the third and fourth cycles, every significant rise faces selling pressure.

I hope the crypto asset treasury and Ethereum can absorb this selling pressure.

Moreover, a bear market could unexpectedly return due to macro turmoil, which might expose hidden leverage in the crypto space that we have yet to discover.

Previously, in the first article of the "Market Status" series, I mentioned several areas where leverage might exist:

- Ethena: The collateral for USDe has shifted from mostly Ethereum to Bitcoin, and now it is turning towards liquidity stablecoins.

- Re-staking: Although the related narrative has quieted, liquidity re-staking protocols (LRTs) are being integrated into mainstream DeFi infrastructure.

- Circular arbitrage: Speculators leverage mining through circular operations to chase high yields.

Ethena was once my biggest concern, but now the crypto asset treasury has become the main focus. What if there is hidden leverage that we are completely unaware of? This thought keeps me awake at night.

What to do after selling?

After moving my tax base to Portugal, my investment strategy for cryptocurrencies has changed.

In Portugal, if you hold an asset for more than 365 days, the capital gains tax is 0%; additionally, trading between cryptocurrencies is not taxed.

This means I can convert to stablecoins, hold them for a year, and gain tax-free profits.

The question is: where should I store the stablecoins to maximize returns while being able to sleep soundly?

Surprisingly, there are not many sufficiently reliable protocols. Chasing high yields requires switching back and forth between different protocols, while also being wary of "treasury migrations" (such as during contract upgrades), and of course, there are hacker risks.

Aave, Sky (Maker), Fluid, Tokemak, and Etherfi's treasuries are the most mentioned, but there are many other options, such as Harvest Finance, Resolv, Morpho, Maple, etc.

The question arises: which protocol allows you to safely hold stablecoins for a year? Personally, I might only trust two.

The first is Aave. However, the growth of USDe and the circular arbitrage of LST ETH/ETH make me a bit worried about large-scale liquidations (though Aave's new "umbrella" mechanism helps).

The second is Sky. However, S&P Global Ratings gave it a "first stablecoin system credit rating," which is concerning—the rating is B-, categorized as "risky but not on the verge of collapse."

Weaknesses include:

- Concentration of depositors

- Governance still deeply tied to Rune (MakerDAO founder)

- Weak capital buffer

- Regulatory ambiguity

This means that while Sky's stablecoins (USDS, DAI) are considered credible, they are quite fragile. They may be fine in normal times, but during stress events like large-scale redemptions or loan defaults, they could be severely impacted.

As PaperImperium said: "This is a catastrophic rating for mainstream stablecoins."

However, traditional finance has a much lower risk tolerance than crypto natives, but putting all stablecoins in one protocol is definitely not a good idea.

This also indicates that cryptocurrency is still in its early stages, and there is currently no real "passive investment" aside from Bitcoin and Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。