Latest Crypto News Today: Whale Movements And Corporate BTC Purchases

The total crypto market capitalization is currently at 3.89 trillion, which is an increase of 2.5% over the past 24 hours. The total trading volume was over $166 billion, with Bitcoin dominance being 58% and Ethereum at 12.8%. The cryptocurrencies tracked till now are 18,228.

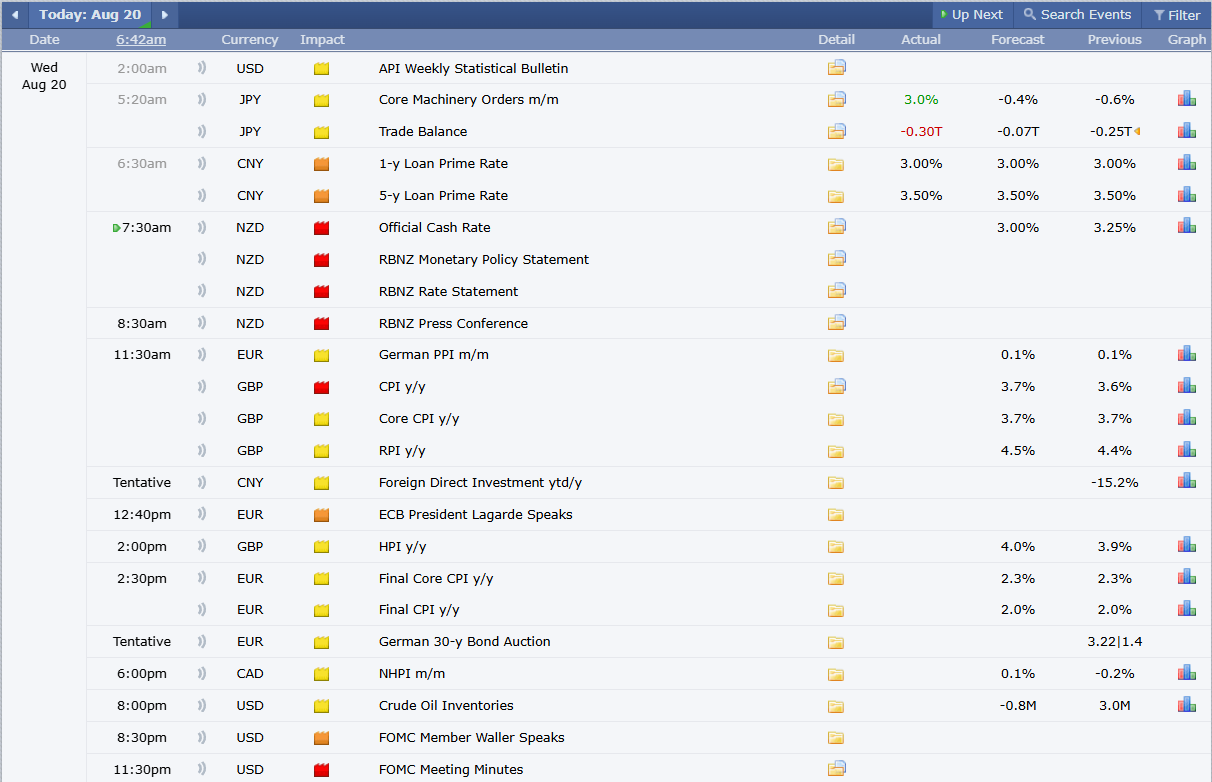

Major Crypto Events Today

Source: Forex Factory

24 Hour Crypto Update

Bitcoin is priced at $113,197, up 2.9% over the past day, with a market cap of $2.25 trillion and a massive $42.5 billion in trading volume. Bitcoin is the largest asset, which holds 58% of the market dominance.

Trending Crypto coins: Wiki Cat, Ethereum, and Pudgy Penguins are trending. Wiki Cat surged nearly 29.7% at $0.062331 with $11.1 million volume. Ethereum fell 5.5% to $4,110.43 with $44.2 billion. Pudgy Penguins dropped 6.2% at $0.02978 with about $494 million traded.

Top Gainers: Wiki Cat jumped 37.3% to $0.062352 with $13.6 million in volume. Api3 rose 44.5% to $1.26 with $751.8 million. OKZOO AIOT climbed 25.3% to $1.70 with $365.5 million traded.

Top Losers: Codatta fell 26.8% to $0.01075 with $64.5 million in volume. Strike dropped 25.8% to $8.49 with $135.6 million. MYX Finance slid 22.1% to $1.09 with $31.1 million traded.

The stablecoin market cap is 287 billion today, which is a slight 0.5% growth. Stablecoins have a 24-hour trading volume of $124.69 billion and provide liquidity and security in times of volatility in the wider crypto market.

The current DeFi market cap is at 158 billion, which is a decrease of 4.5% over the past 24 hours. Daily trading volume is at about $9.99 billion, with DeFi contributing 4.1% of the total market activity, indicating a slowing interest in the short term.

Fear And Greed Index Today

Source: Alternative Me

The Crypto Fear & Greed Index is at 44, which is a move into Fear. The index was at a high of Greed above 70 last week and yesterday. This fall represents increasing investor caution following a time of optimism, as uncertainty in the crypto market increases.

Major Market News

Healthcare company KindlyMD has purchased 5,743.91 BTC worth approximately 679 million through its subsidiary Nakamoto, bringing the total BTC holdings to 5,764.91 BTC - the first purchase since the recent merger. The company, which is seeking to hold 1M BTC in the long run, is an indication of increased corporate interest in Bitcoin as a strategic reserve asset in the face of tightening institutional demand.

Bullish (NYSE: BLSH) has become the first company to ever conduct an IPO entirely settled in stablecoins like USDCV, EURCV, USDG, PYUSD, and RLUSD. The milestone underscores the increasing importance of crypto in conventional finance and the de-emphasis of Tether dominance by a variety of issuers, such as Circle, Ripple, and Societe Generale.

Point72 Asset Management and ExodusPoint Capital have invested 4% and 4.75% equity positions, valued at 26.7M and 32.1 M, respectively, in crypto payments firm Alt5 Sigma, indicating institutional interest in blockchain finance. Although Alt5 has powerful enterprise solutions and is aligned with the current trends of digital currency on a global scale, its recent stock and token decline indicate a more modest short-term outlook.

The White House has created an official TikTok account, with Trump saying, I am your voice. In an attempt to reach the platform, 170M U.S. users. Legislators are still worried about Chinese access to their data as the dates to sell the U.S. operations of ByteDance were still pending.

Federal Reserve Governor Michelle Bowman indicated a significant regulatory transition to blockchain and digital assets and encouraged banks and supervisors to stop being overly cautious. Her comments are a sharp contrast to her previous criticisms of CBDC and are in line with Harvard data of 30% efficiency gains in blockchain and McKinsey estimates of $2T tokenization by 2030, which is driving banks to quickly adopt crypto.

Whale Alert reported that a large whale transferred 1,600 BTC valued at $180.7 out of Coinbase Institutional to a new address, which indicates that it is more likely to accumulate and less short-term selling pressure. Although the volume of Bitcoin increased by 29.1%, the market is still cool with a bearish MACD and outflows of ETFs. The decision is in anticipation of the upcoming halving cycle.

President Donald Trump criticized Fed Chair Jerome Powell for maintaining higher interest rates, saying it is killing housing. He called for a significant rate reduction as shelter prices were increasing, which increased by 3.8% year-over-year in July 2025. Although research demonstrates that increased rates are detrimental to affordability, the Fed remained unchanged in July as it balanced the risk of inflation amid political pressure.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。