Chamath SPAC Returns with 13th Listing to Invest in High-Growth Sector

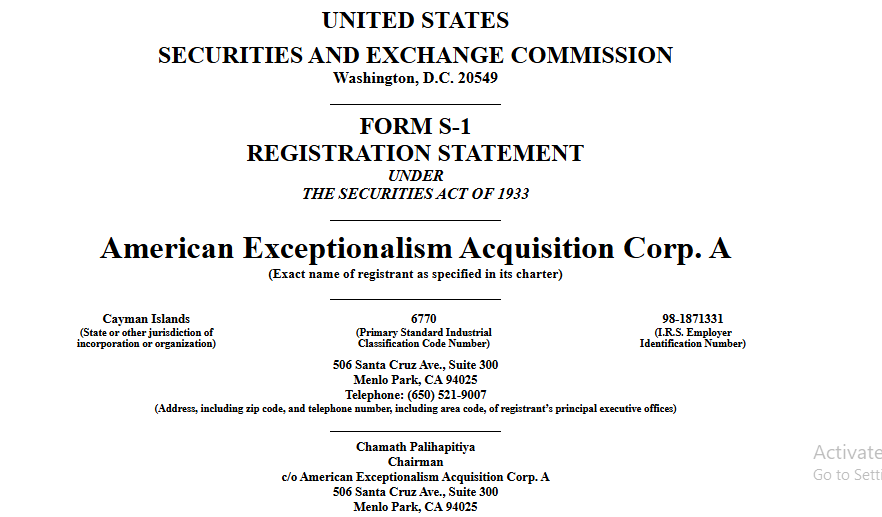

New SPAC Filing: American Exceptionalism Acquisition Corp.

Chamath Palihapitiya, famously known as “SPACs King”, is back in the field. According to a new SEC filing, he is setting up to launch a new SPAC called American Exceptionalism Acquisition Corp., here SPACs are basically a company created to buy another company and its public.

The new Chamath SPAC is aiming to raise $250 million through common share sales ($10 each and 175,000 private placement shares) and listing on the New York Stock Exchange (NYSE). The company is using 24 months time to find a suitable private firm to merge with and take public.

Target Sectors: AI, DeFi, Clean Energy

In the filing it is mentioned that Chamath SPAC will focus on industries that support America’s strength and reduce global risks. The key areas include:

-

Artificial Intelligence (AI)

-

Decentralized Finance (DeFi)

-

Warfighting robotics and drones (Defence)

-

Clean energy innovation, i.e. nuclear and solar power

The plan is to find and support companies that can help the U.S. stay strong and ahead of other countries in upcoming years.

DeFi Integration and Finance Accumulation Plan

Palihapitiya, a longtime Bitcoin supporter, highlighted DeFi as a key focus. He said the next big step will be combining traditional finance with distributed finance

A clear example he mentioned is Circle’s USD Coin (USDC) , which has a market cap of 68 billion and stablecoins, which are now processed in billions of dollars daily, showing how on-chain money is already working alongside banks and card networks. This is why Palihapitiya sees DeFi as moving from experiments into mainstream finance.

A Look Back: The “SPACs King” Track Record

The upcoming is the 13th number. He has started 12 SPACs before with his company, Social Capital. Some famous companies that became public through his SPACs are:

-

Virgin Galactic: A space tourism venture

-

Opendoor: Real estate technological Startup

-

Clover Health: Health insurance

-

SoFi: A fintech platform

The previous initiative structure shows that Chamath SPAC followed every possible field. And as for now it takes big on digital terms.

Risk: The Companion of Innovation

The filling clearly says this investment is very risky. Palihapitiya said that even though they want to find a great company at a great price, there is still a chance of losing everything.

The things are maybe said in the context of previous scenarios. In the past, SPACs raised billions, but many later lost 70% to 95% of their highest value, which has made investors more careful.

Why’s now and What’s Next?

Chamath SPAC comeback comes as tokenisation of stocks is getting more attention. Companies like Kraken and Robinhood are finding ways for regular investors to access private markets using on-chain stock versions.

If the new Chamath SPAC raises $250 million, it will enter a more potentially competitive market than during the 2020-21 boom. Its success will depend on finding a fast growing area in the targeted area.

So, let’s see will this new framework work or going to add in other previous syllabus.

Also read: Crypto News Today: Why Market Is Down & Global Trends Update免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。