Author: Filippo Armani

Translation by: Tim, PANews

PANews Editor's Note: This article is selected from the third part of "The Money Layer: LATAM Crypto 2025 Report", specifically the section on stablecoins, focusing on the current development status of local stablecoins in Latin America. The following is the translated content.

Stablecoins have become the backbone of on-chain economic development in Latin America. Dollar-pegged stablecoins and local currency stablecoins have replaced volatile assets, becoming the core of crypto applications, and continue to maintain several times growth momentum.

Key Points:

- By July 2025, USDT and USDC accounted for over 90% of all exchange transfer volumes, a significant increase from about 60% in 2022.

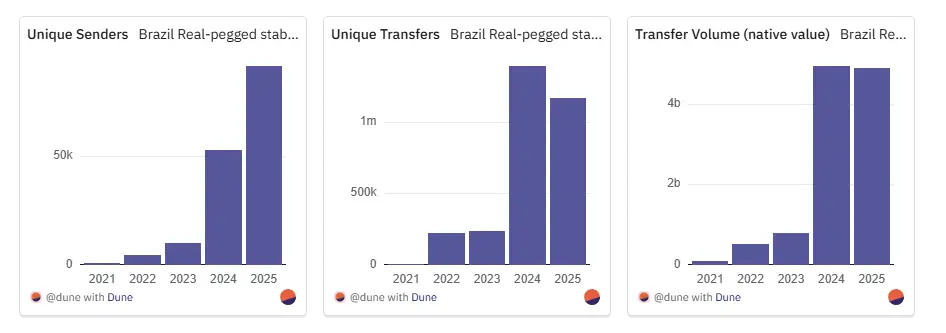

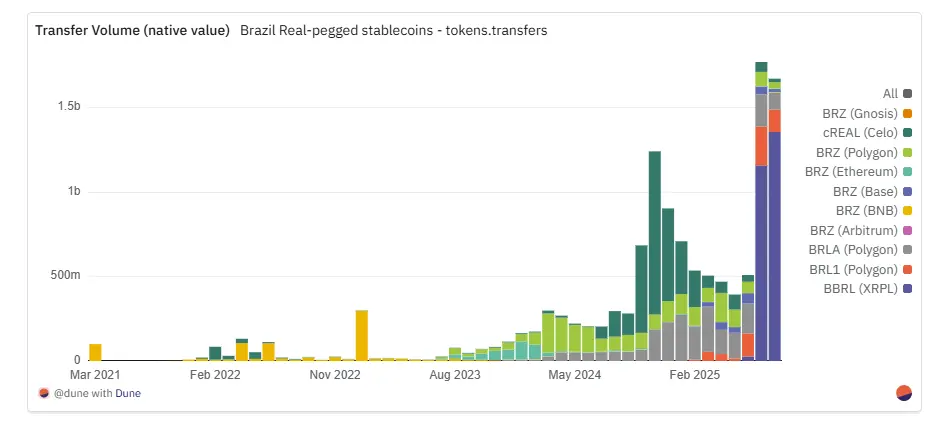

- Brazil leads in both the number of active local stablecoins and overall trading volume. As of July 2025, the trading volume of Brazilian Real stablecoins reached $906 million, nearly matching the total for the entire year of 2024 at $910 million, with an estimated annual trading volume of about $1.5 billion based on current growth rates.

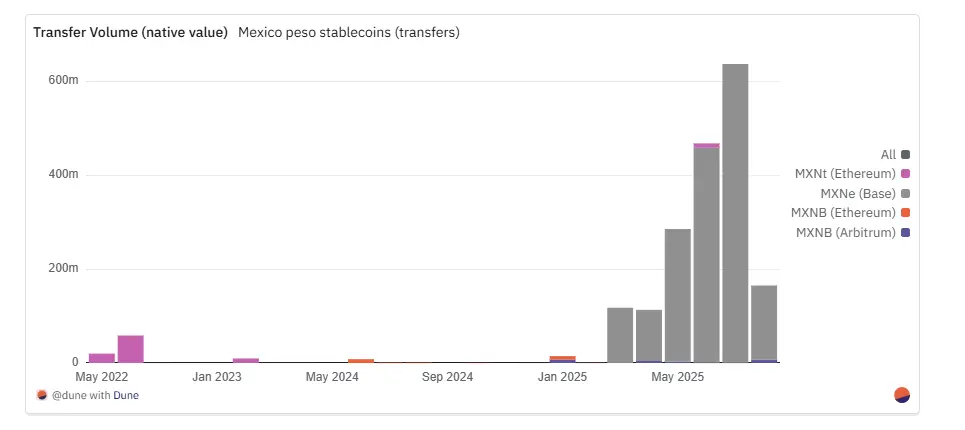

- The total market capitalization of the Mexican Peso-pegged stablecoins (MXNB + MXNe) reached approximately $3.4 million by July 2025, achieving about 638 times year-on-year growth from 1 million pesos (approximately $53,000) in July 2024.

- Leading local stablecoins on major blockchains: Polygon (BRLA, BRZ), Celo (cREAL), Base (MXNe), and Arbitrum (MXNB)

Main Text

Stablecoins have become the financial cornerstone of cryptocurrency adoption in Latin America, with applications far beyond speculation. Throughout the region, stablecoins serve as savings tools, payment channels, cross-border remittance pathways, and inflation hedging instruments, becoming the most practical and widely used form of cryptocurrency. Currently, the application of stablecoins in real-world scenarios in Latin America is leading globally: according to the "2025 Stablecoin Status Report" released by Fireblocks, 71% of respondents use stablecoins for cross-border payments, and 100% of enterprises have launched, are testing, or are preparing stablecoin strategies. Equally important, 92% of responding institutions indicated that their wallet and API infrastructure supports stablecoin operations, which not only confirms market demand but also highlights technological maturity. For millions of people in Latin America, stablecoins have become a digital equivalent to the dollar, serving as an accessible inflation hedging tool and an effective way to bypass capital controls. In many cases, this is even the only viable channel for the public to hold dollarized assets.

In countries like Argentina, Brazil, and Colombia, stablecoins have surpassed Bitcoin to become the preferred cryptocurrency for everyday use, primarily due to their price stability and direct anchoring to the dollar's value (according to the "2025 Stablecoin Status Report," Fireblocks). In exchange transfer volumes, USDC and USDT account for over 90%. For example, in Argentina, 72% of the cryptocurrency purchase volume on the Bitso platform in 2024 came from these two stablecoins, while Bitcoin accounted for only 8% (Bitso 2024 data). Colombia shows a similar pattern, with stablecoin purchases accounting for 48% due to restrictions on dollar bank accounts and ongoing currency fluctuations. Brazil's transformation is even more pronounced, with local exchange stablecoin trading volume growing year-on-year by 207.7%, far exceeding other crypto assets (Chainalysis October 2024). Besides transfers, 39% of cryptocurrency purchases in Latin America in 2024 involved stablecoins, a significant increase from 30% the previous year (Bitso 2024).

Current Development Status of Local Stablecoins

Although in Latin America, dollar-pegged assets remain the mainstream application form of stablecoins (primarily used for hedging inflation), local currency-pegged stablecoins have seen explosive growth over the past two years. These tokens pegged to local currencies like the Brazilian Real and Mexican Peso are increasingly being used for domestic payments, on-chain business activities, and integration with local financial systems. By eliminating the cumbersome exchange process between dollars and local currencies, these stablecoins reduce costs for merchants and users while accelerating local trade settlements. For businesses, they can connect directly to payment systems like Brazil's PIX, enabling instant transfers without bank involvement while meeting tax compliance requirements. In high-inflation economies, these stablecoins also play the role of "bridge assets," allowing users to transact in stable local currency units while being able to convert to dollars or other value storage means for risk hedging when necessary.

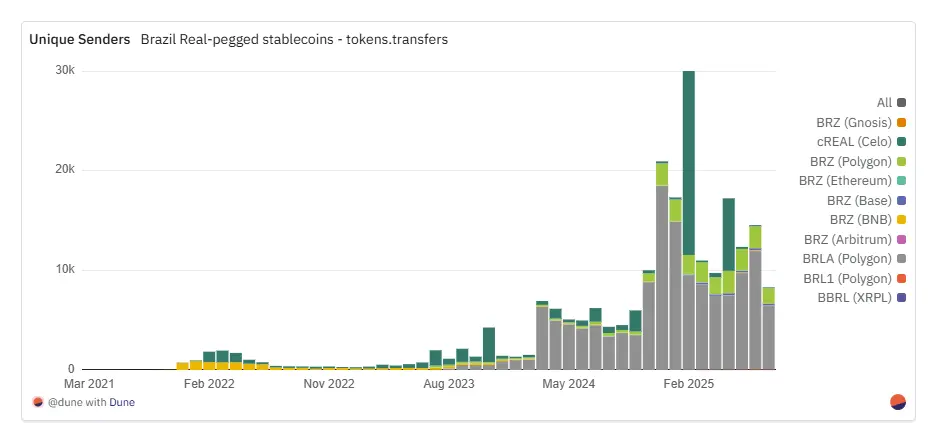

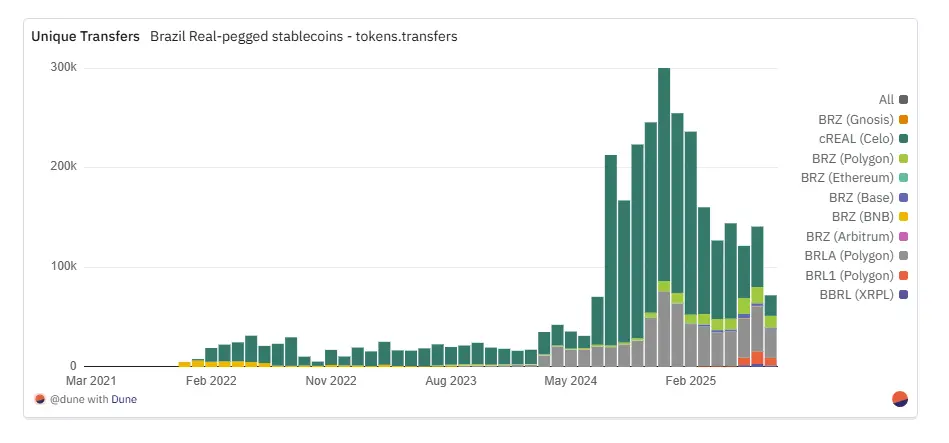

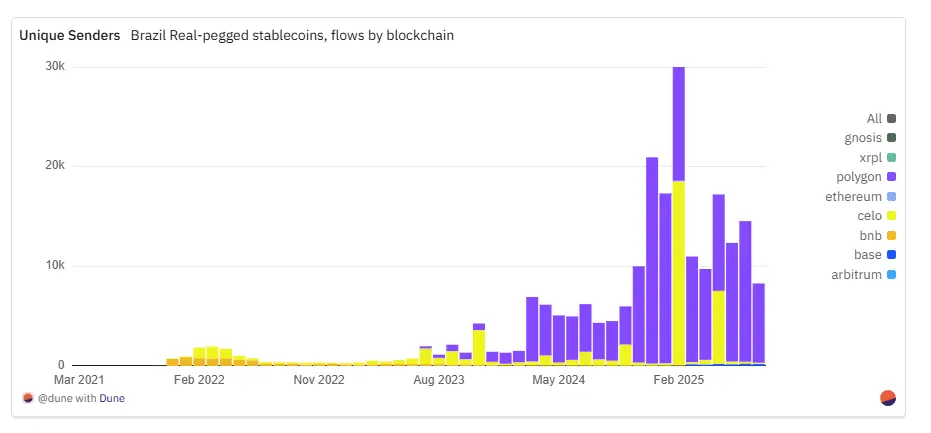

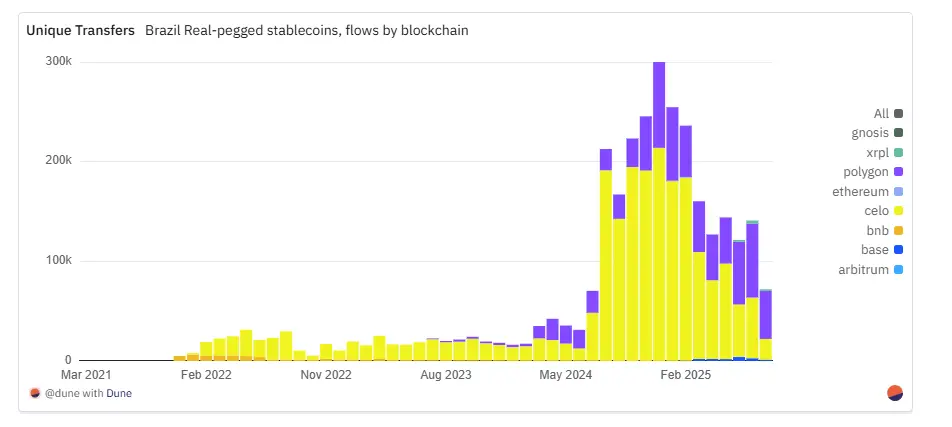

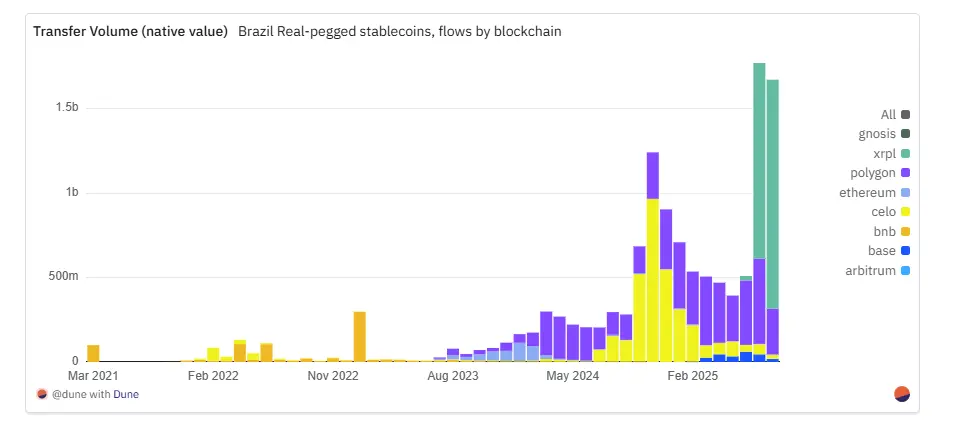

Brazil provides the clearest case study for this trend, with stablecoins pegged to the Brazilian Real showing astonishing year-on-year growth. The number of transactions surged from just over 5,000 in 2021 to over 1.4 million in 2024, maintaining a high level of 1.2 million transactions so far in 2025, an increase of over 230 times compared to four years ago. The number of independent senders also grew exponentially: from fewer than 800 in 2021 to over 90,000 in 2025, with an 11-fold increase since 2023. The on-chain native transfer volume jumped from about 110 million Reais (approximately $20.9 million at the time of writing) in 2021 to nearly 5 billion Reais (approximately $900 million) by July 2025, almost matching the total for the entire year of 2024. Including data from August to date, the total transfer volume in 2025 has already surpassed that of the entire year of 2024. This innovation, which began as a marginalized experiment, has rapidly grown into the core pillar of Brazil's on-chain economy within just a few years, achieving explosive growth in transaction scale, user base, and transfer value.

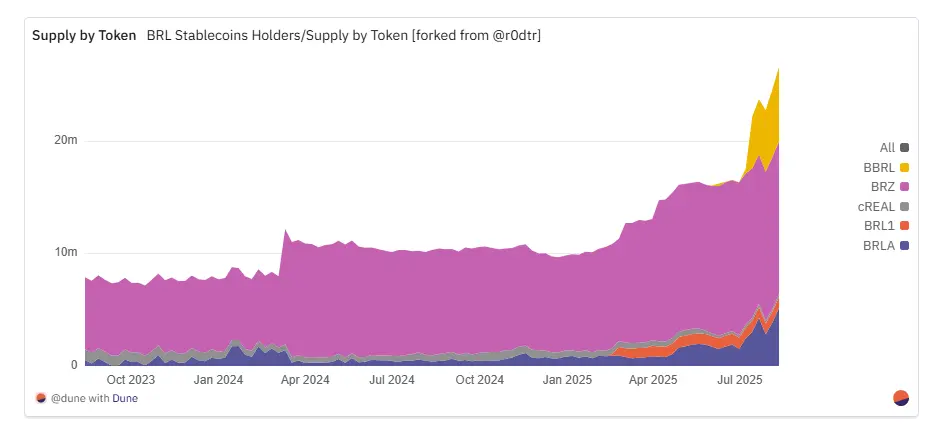

As of June 2025, five different stablecoins pegged to the Brazilian Real are actively circulating, reducing market concentration and marking a sign of ecosystem maturity. Among them: BRZ, issued by fintech company Transfero, provides blockchain infrastructure solutions for banks and payment institutions in Latin America; cREAL, issued by the Celo public chain, focuses on mobile-first DeFi integration solutions; BRLA, developed by BRLA Digital and Avenia, focuses on compliant fiat-to-crypto bridge services; BRL1, supported by exchanges like Mercado Bitcoin, Bitso, and Foxbit, aims to establish industry-wide standards; and BBRL from the Braza Group is positioned to serve regional trade and payment scenarios.

Despite the growth in market size, Brazilian Real stablecoins are still in the early stages of development, with a circulation volume of about $23 million.

According to an analysis by Iporanga Ventures in its latest "Brazilian Real Stablecoin Report," the landscape in this field is rapidly evolving. Although there is currently no clear market leader, a deep analysis of project-level data reveals specific leading advantage areas.

Among them, the BRLA stablecoin ranks first in the "unique remittance users" metric, indicating it has the broadest retail user coverage.

cREAL dominates in the number of transfers, reflecting its early appeal in retail and small payment sectors.

In terms of native transfer volume, BRZ maintained an absolute lead until mid-2024, but this situation was suddenly disrupted in the second half of that year by the rapidly rising cREAL. As 2025 began, with steady growth of BRLA, Celo's advantage in transfer volume gradually diminished. Then in July 2025, BBRL made a strong entry, and although its number of active sending addresses is relatively limited, its explosive growth following its launch on XRPL (XRP Ledger) saw its monthly native transfer volume share soar to about 65%.

Unlike dollar stablecoins, which are concentrated in issuance and transfer transactions on the Ethereum mainnet, the trading activity of Real stablecoins is primarily concentrated on Layer 2 networks and other public chains. Polygon has become the dominant channel with its native transaction volume and active user count: in July 2025, it recorded about 74,000 transactions (involving 14,000 independent users), with a monthly transaction volume reaching a historic record of 500 million Reais (approximately $50 million).

Celo ranks second, maintaining a historical peak transfer record of 213,000 transactions, which occurred in December 2024, driven by the rapid development of cREAL in early retail scenarios and small payments. Although the number of unique payers in 2025 has decreased, the scale of repeated payment flows formed through merchants, aggregators, and liquidity pools still keeps Celo's transaction volume at a considerable level.

XRPL, as an emerging participant, experienced explosive growth following the launch of the Brazilian Real stablecoin (BBRL) in July 2025: the number of transfers surged from just over a hundred in May to about 3,000 in July, while the native transaction volume skyrocketed to approximately 1.16 billion Brazilian Reais, marking the formation of a new high-value channel.

The Base chain showed stable growth in 2025, peaking in June; while the BNB chain has seen a significant decline in transfer volume and active address numbers since 2022, leading to a continuous shrinkage of market share. The Ethereum mainnet only intermittently handles large, low-frequency transfers, serving a limited role, although the BRZ token briefly dominated network trading activity from late 2023 to early 2024.

In addition to the raw data, Iporanga Ventures' report reveals the practical scenarios and high-value driving characteristics of stablecoins in Brazil: B2B payments lead the market, with companies using stablecoins to pay overseas suppliers or employees, and then completing local settlements through the domestic PIX system; in cross-border capital inflow scenarios, dollars are converted into Brazilian Real stablecoins for domestic payments. These stablecoins are becoming key infrastructure for Brazil's tokenized asset ecosystem, enabling on-chain settlements without bank custody. In the gig economy and small to medium-sized enterprises, stablecoins support payroll payments, risk hedging, and capital protection functions, with merchant integration solutions like CloudWalk's BRLC and Mercado Pago's dollar stablecoin driving mainstream market adoption.

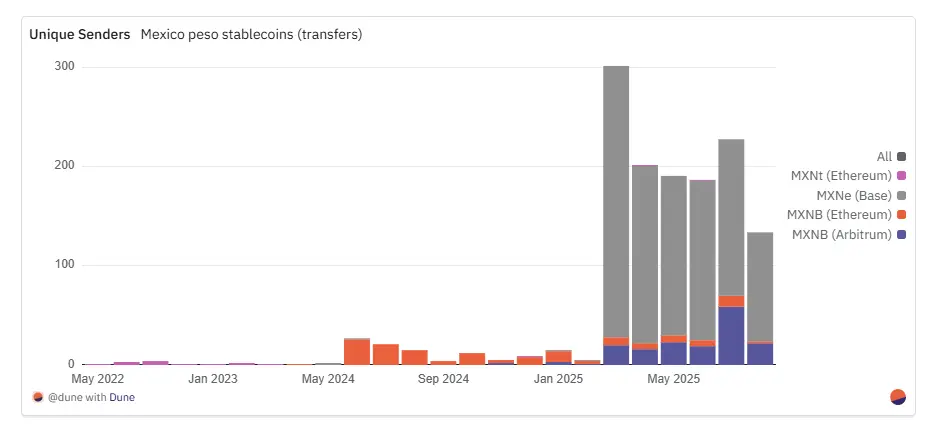

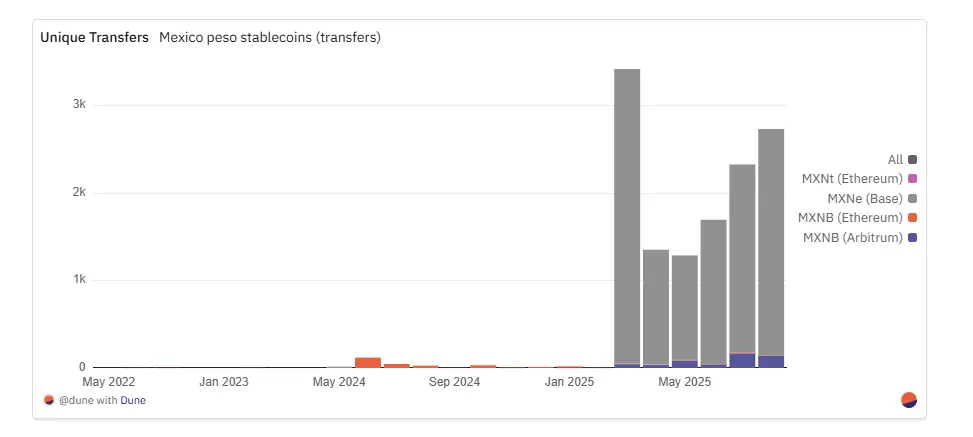

Brazil has the most diverse and mature local currency stablecoin ecosystem, while the Mexican Peso stablecoin market is forming around two main projects: Juno and Bitso's MXNB, and Brale's MXNe, with distinctly different development trajectories. The circulation model of MXNB has evolved from sporadic large-scale issuances at the end of 2024 to a more stable and widespread circulation pattern since 2025.

The growth of MXNB in 2025 marks a significant shift towards everyday usage scenarios. In July 2025, the platform completed 179 transfers involving 70 independent senders, a staggering increase of 339% and 290% compared to 46 transfers and 21 senders in the same period last year.

Although transaction volume peaked in January 2025, achieving 14.5 million Mexican Pesos (approximately $750,000 at the time of writing) with fewer transactions, by July of the same year, the volume was only 480,000 Mexican Pesos (approximately $25,000), but came from more small payments. The average transaction amount has decreased from about 28,700 Mexican Pesos in July 2024 to 3,600 Mexican Pesos. This shift is accompanied by a clear migration direction: towards Arbitrum. In 2024, about 99% of transfers occurred on Ethereum; however, since the second quarter of 2025, approximately 94% of transfers have moved to Arbitrum, making the low-fee Layer 2 solution the default choice.

MXNe, issued by Brale, takes the opposite approach by exclusively operating on the Base chain, becoming the largest Mexican Peso-pegged stablecoin by trading volume.

The aforementioned activities peaked in March 2025, with 274 senders conducting a total of 3,367 transfers that month; although subsequent transaction frequency slowed, the total transfer amount continued to rise. In July 2025, 2,148 transfers from 158 senders created a historical high of approximately 637.7 million Mexican Pesos. This has raised the average transaction size to nearly 297,000 Pesos, indicating the possibility of large transactions and institutional operations.

The contrast is striking: MXNB now dominates small retail payment scenarios, while MXNe focuses on large settlements. Compared to the more decentralized ecosystem of the Brazilian Real, the Mexican market remains concentrated around these two issuers and a few settlement channels, but this has not hindered liquidity growth. Since mid-2025, the DEX trading volume of the Mexican Peso currency pair has rapidly risen to the top, marking an increasingly mature market structure.

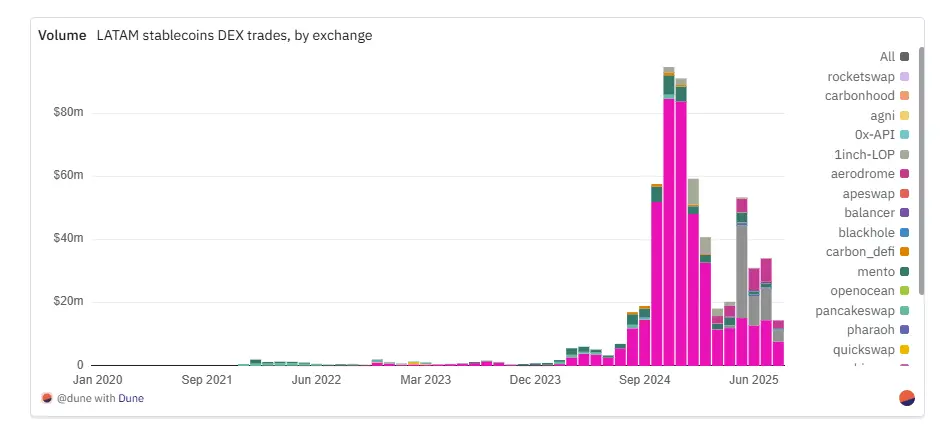

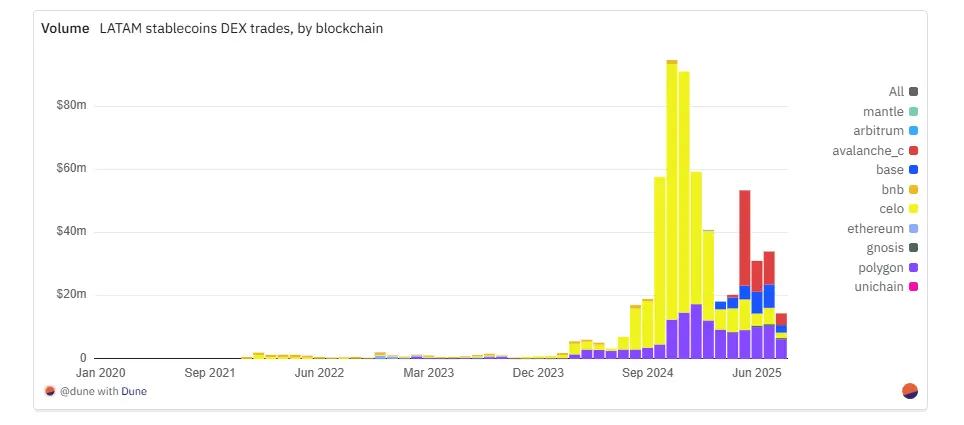

DEX Liquidity and Trading Patterns

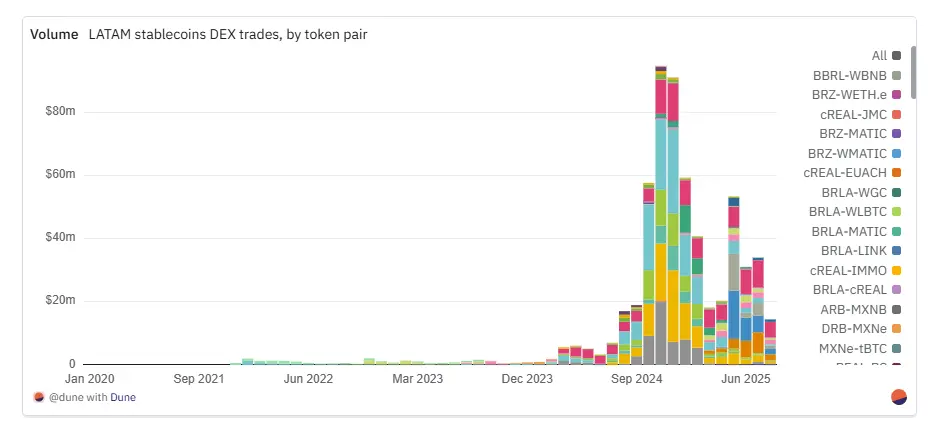

The applications of stablecoins pegged to the Brazilian Real and Mexican Peso in Latin America are surpassing payment categories, establishing substantial liquidity support on DEXs by forming on-chain foreign exchange channels between local currencies and global stablecoins.

Among BRL-related assets, cREAL is the core trading hub. Its largest trading pair, CELO–cREAL, has accumulated a trading volume of approximately $126 million, supported by the deep liquidity of the Celo native DEX ecosystem. cREAL also anchors mainstream cross-stablecoin markets: cREAL–USDT ($87.7 million), cREAL–cUSD ($59.1 million), and non-dollar trading pairs like cEUR–cREAL ($48.6 million) and cKES–cREAL ($24.9 million), fully demonstrating cREAL's dual function as both a channel for the Brazilian Real fiat currency and a base currency for multi-currency swaps. However, after reaching a peak monthly trading volume of $80 million in November 2024 (accounting for 85% of the total stablecoin trading volume that month), cREAL's monthly DEX trading volume has continued to decline, dropping to $5 million by July 2025, reverting to levels seen in July 2024.

BRLA has now become the main dollar channel, with BRLA-USDC ($97.5 million) and BRLA-USDT ($21.3 million) leading in trading volume. Since March 2025, BRLA-USDC has consistently been the highest dollar-denominated DEX trading pair in this dataset, aside from stablecoins (only in May 2025 did the MXNB trading pair briefly surpass it). Although BRLA has never reached the historical peak trading volume of cREAL, the total trading volume of BRLA trading pairs reached $9 million in July 2025, nearly double the trading volume of cREAL during the same period, and has doubled compared to its own trading volume in July 2024.

BRZ maintains stable and highly integrated liquidity, primarily distributed across three trading pairs: BRZ-USDC ($15.1 million), BRZ-USDT ($14.7 million), and BRZ-BUSD (approximately $9.1 million). Among Brazilian Real stablecoins, BRZ has the most extensive trading pair combinations. Although its trading volume is still lower than that of cREAL and BRLA, it has achieved continuous growth, rising from $26,000 in July 2024 to $3 million in July 2025, and reaching a peak of $477,000 in April of the same year.

In May 2025, during a period of large transactions and liquidity influx, the largest trading pairs for the Mexican Peso-pegged stablecoin MXNB, MXNB-WAVAX ($29.7 million) and MXNB-USDC ($18.6 million), saw a surge in trading volume. Since then, the trading pairs for the Mexican Peso have continued to maintain strong momentum, with three MXN trading pairs still ranking in the top ten for local stablecoin DEX trading volume, indicating that this surge is not a temporary phenomenon.

MXNe operates exclusively on Base, with its liquidity concentrated in the MXNe-USDC trading pair (valued at approximately $18.3 million). Its trading volume on DEX has steadily increased from $1.13 million in March 2025 to $6.6 million in July, aligning with Base's strategy to integrate local stablecoins into dollar liquidity pools. Interestingly, while MXNe leads in on-chain transfer volume compared to MXNB, MXNB has a higher DEX trading volume. This indicates that MXNe primarily plays the role of high-value transfers and integration into the dollar ecosystem, while MXNB focuses on the active trading area on-chain.

BRL1 and BBRL's DEX trading volumes remain low, with cross-currency stablecoin trading activity also being minimal, with only three trading pairs showing significant activity, the largest being the BRLA–BRZ combination, which peaked at approximately $400,000 in April 2025.

Stablecoin trading volume is highly concentrated on a few platforms, each tied to specific local stablecoin ecosystems. Uniswap remains the liquidity leader with a total trading volume of $426 million, occupying a core position in the Brazilian Real and Mexican Peso-pegged stablecoin markets on Ethereum and Layer 2. Each native chain DEX maintains absolute dominance in its corresponding stablecoin domain: Trader Joe ($52.8 million) and PancakeSwap ($13.3 million) monopolize BRZ liquidity on the Avax and BNB chains, while Mento ($50.8 million) serves as the dedicated trading platform for cREAL on the Celo chain. The 1inch limit order protocol adopts a different operational mechanism, positioning itself closer to an aggregation settlement layer rather than a liquidity provider, primarily reflected in handling large one-time swap transactions rather than maintaining deep liquidity pools.

One of the most significant developments in 2025 is the rise of Aerodrome. The platform has accumulated a trading volume of $25.8 million, with nearly all of its trading volume coming from MXNe-USDC transactions since the second quarter. Aerodrome serves as the core infrastructure for native stablecoins on Base, similar to Mento's role in the Celo ecosystem. Smaller but noteworthy trading venues, such as Carbon DeFi ($4.8 million), Pharaoh ($1.95 million), and Balancer (approximately $1.8 million), cater to decentralized or niche cross-asset pools. Overall, the liquidity of on-chain native stablecoins continues to grow in absolute terms and is increasingly deeply integrated with the on-chain DEX infrastructure. The rapid rise of Aerodrome exemplifies this trend most clearly in 2025.

The liquidity patterns of stablecoins remain deeply tied to their native chains and mainstream DEXs. Celo leads with a total trading volume of $363 million, with cREAL–cUSD and USDC transactions on the Mento platform dominating, as this trading pair consistently led dollar-denominated trading volume from July 2024 to February 2025. Polygon ranks second with $136 million, providing diversified liquidity for Brazilian Real stablecoins (especially BRLA and BRZ) through Uniswap and QuickSwap, highlighting its dual function in stablecoin transfers and the DeFi and payment ecosystem. Avalanche ranks third with approximately $54.8 million, primarily driven by the surge in MXNB–WAVAX trading on Trader Joe in May 2025, with Uniswap, Pharaoh, and the 1inch limit order protocol further supplementing liquidity in the Brazilian Real and Mexican Peso markets. Base follows closely with approximately $26.2 million, with its liquidity almost entirely derived from MXNe–USDC transactions on the Aerodrome platform, reflecting synchronized growth with Base's strategy to focus on local stablecoins in 2025.

The core points are very clear: local stablecoins have an ecological anchoring property in DEX liquidity, with each mainstream public chain pairing its mainnet assets with a few dominant trading venues. The two explosive growth cases in 2025—Trader Joe operating MXNB on the Avalanche chain and Aerodrome operating MXNe on Base—vividly demonstrate how the strategic importance of local stablecoins can mutually reinforce the on-chain application ecosystem and the dominant position of exchanges.

In addition to Brazil and Mexico, several other countries in Latin America have also attempted to launch local stablecoins, but most are still in the early development stage or limited pilot programs. In Argentina, extreme currency volatility has hindered the sustained attention of peso-pegged tokens like Transfero's ARZ and Num Finance's nARS. Colombia has launched several stablecoin projects, including nCOP (Num Finance), cCOP (Celo/Mento), COPM (Minteo), and COPW (Bancolombia), targeting remittances and domestic payments, but adoption rates remain low. Chile's CLPD (on-chain peso) on Base and Peru's nPEN (Num Finance) and sPEN (developed by Anclap on the Staller chain) are also limited to niche areas, with use cases primarily concentrated in pilot projects and specific payment channels. Although these projects reflect the growing interest in the region, their trading volumes remain limited, highlighting the critical role of local conditions, particularly currency stability and regulatory clarity, in driving adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。