Author: Nancy, PANews

Currently, the divergence between bulls and bears in Ethereum is becoming increasingly apparent. As the price of ETH hits new highs, the demand for staking withdrawals has significantly increased, and concerns about potential downside risks are growing. Will there be a large-scale sell-off of Ethereum as expected?

Multiple Factors Drive Ethereum Staking Withdrawals to New Highs

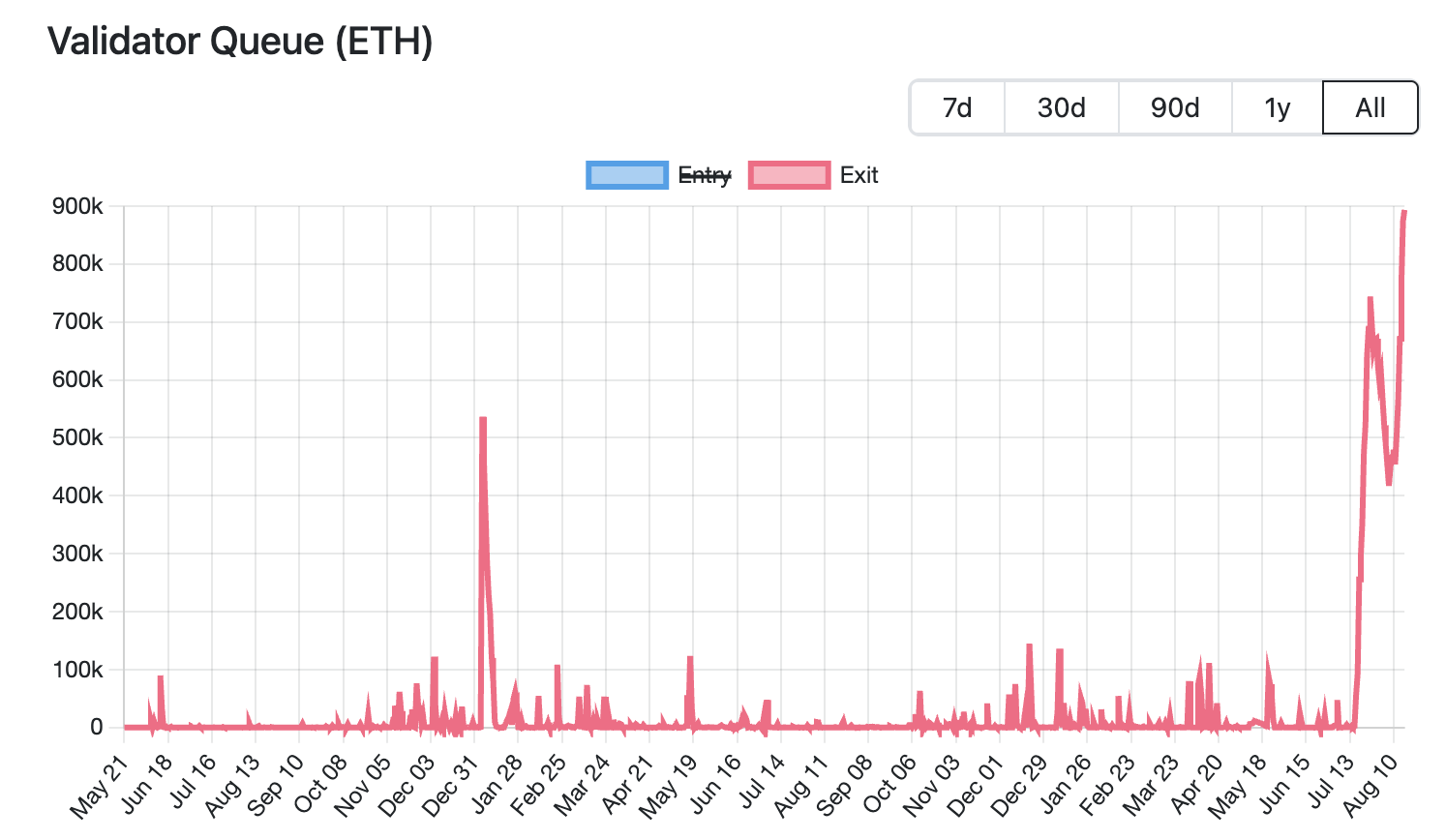

As of now, the scale of Ethereum staking withdrawals has reached a historical peak. According to Validator Queue data, as of August 18, over 87,000 ETH (worth approximately $3.76 billion) are queued to exit the Ethereum network, setting a new historical record and increasing for six consecutive days, with an expected wait time of 15 days and 4 hours. In contrast, the new staked ETH waiting to enter is only about 26,000 ETH (approximately $1.12 billion), with an expected activation delay of about 4 days and 12 hours.

As of now, the scale of Ethereum staking withdrawals has reached a historical peak. According to Validator Queue data, as of August 18, over 87,000 ETH (worth approximately $3.76 billion) are queued to exit the Ethereum network, setting a new historical record and increasing for six consecutive days, with an expected wait time of 15 days and 4 hours. In contrast, the new staked ETH waiting to enter is only about 26,000 ETH (approximately $1.12 billion), with an expected activation delay of about 4 days and 12 hours.

This round of large-scale staking withdrawals is driven by multiple factors, including market strategy adjustments, institutional fund flows, and profit-taking demands due to price fluctuations.

Soaring Lending Rates Trigger Liquidation of Circular Strategies

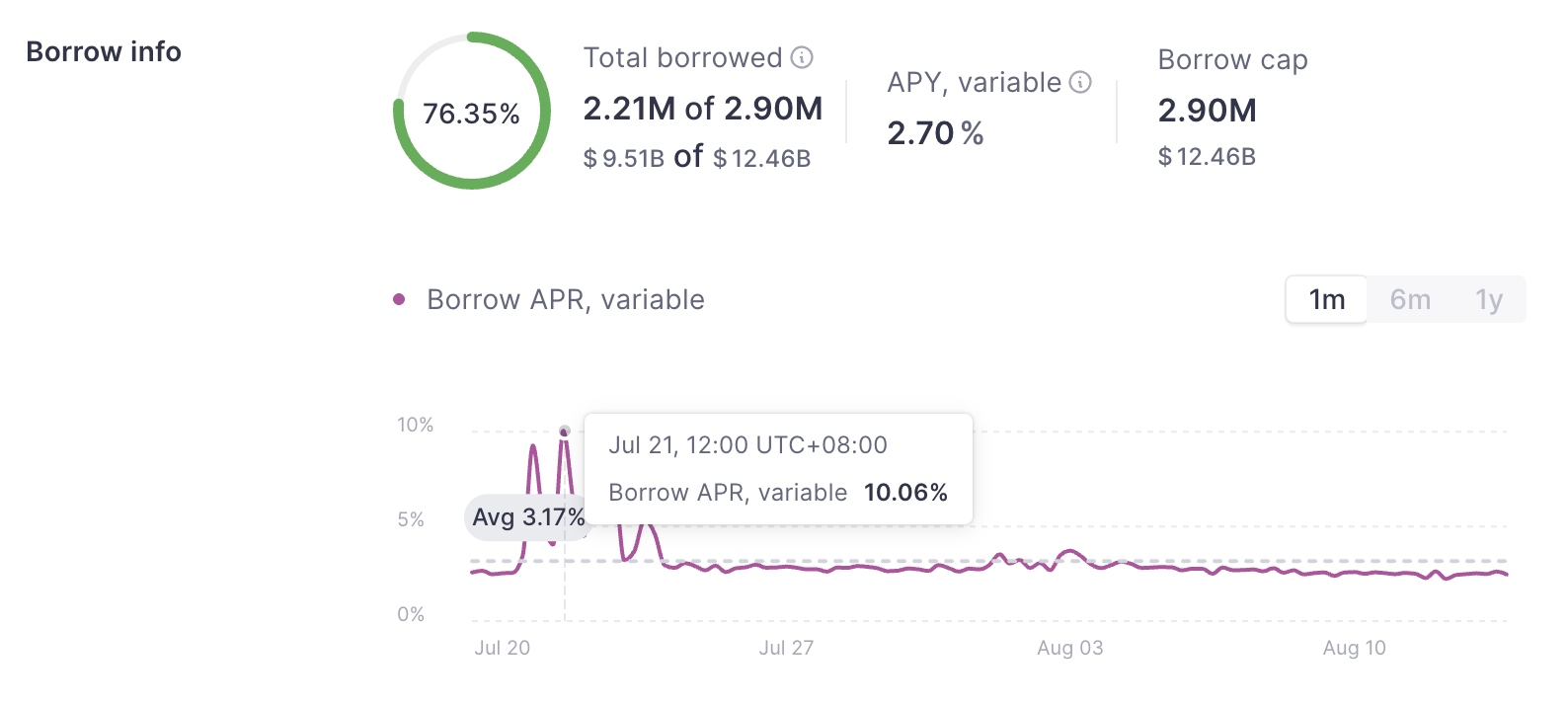

The significant rise in ETH lending rates has impacted leveraged strategies, prompting a wave of validators to exit the queue. Last month, a large amount of ETH was withdrawn from the Aave lending pool, leading to a tightening of ETH supply on the platform and causing lending rates to soar. According to official data, in July, Aave's annual ETH lending rate surged from about 2.5% to 10.6%, far exceeding Ethereum's staking yield of about 3% at that time.

This rise in rates has disrupted the trading logic of circular arbitrage. Originally, investors could use staked ETH as collateral to borrow more ETH for leveraged operations. However, this leveraged model lost its appeal after the rate spike, forcing traders to close their positions, unstake to repay loans, or reduce leverage, thereby intensifying the demand for exits.

LST/LRT Decoupling Amplifies Arbitrage and Liquidation Risks

The rise in lending rates has also exacerbated the decoupling of LST/LRT (such as stETH, weETH) from ETH. For instance, Dune data shows that in July, the discount rate of stETH to ETH reached as high as 0.4%. This prompted arbitrageurs to buy liquid staking tokens at low prices in the secondary market and exchange them for full ETH value after unstaking, profiting from the price difference, which further congested the Ethereum staking queue.

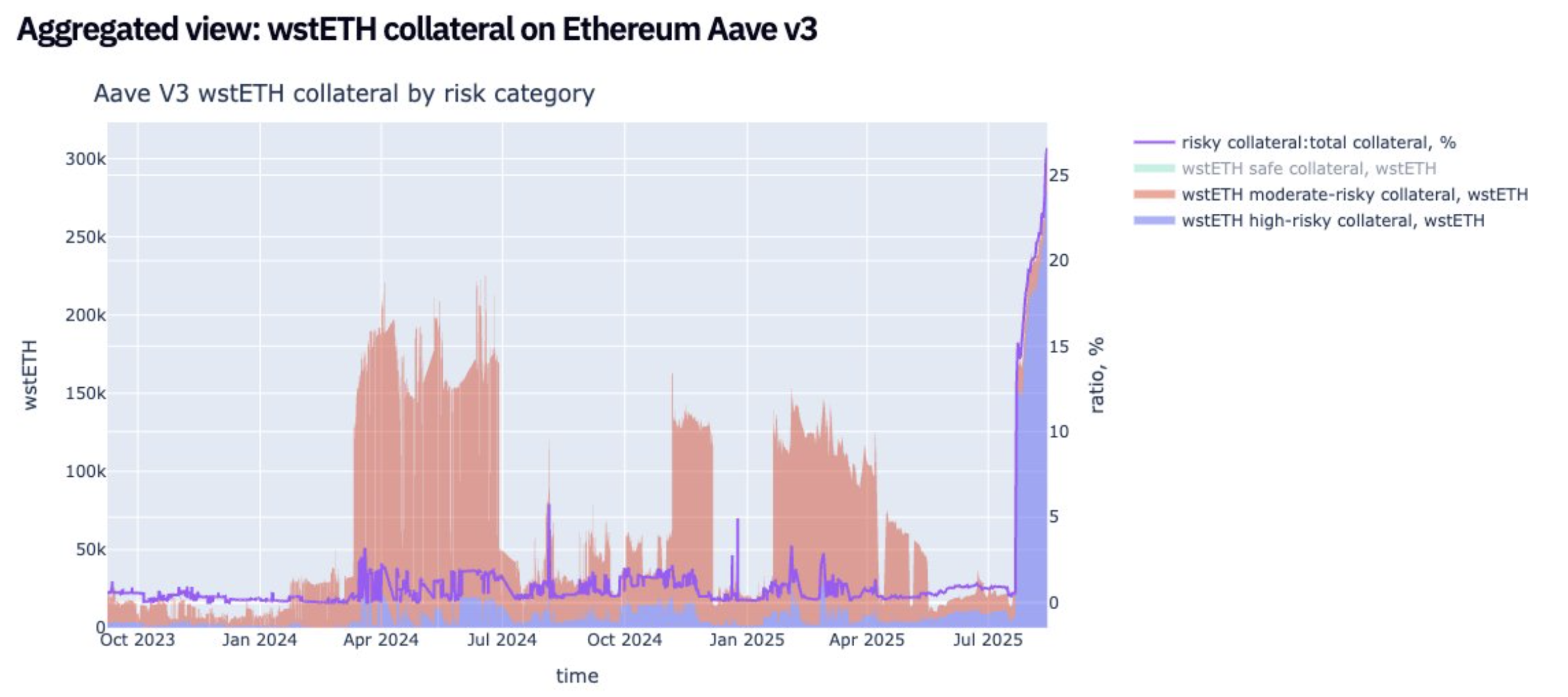

Meanwhile, although the market has not yet experienced systemic liquidations due to price decoupling, the potential pressure has prompted investors to exit early. According to recent analysis by Jlabs Digital analyst Ben Lilly, stETH is currently being withdrawn from Lido, with 32% of stETH (wstETH) used as collateral for lending protocols, and decoupling could indicate large-scale liquidations of lending protocols. Additionally, 278,000 wstETH are in a "high-risk" state (defined as a health factor between 1 and 1.1).

Bitwise senior investment strategist Juan Leon also stated that staking tokens like stETH can trade at a discount, which reduces the value of collateral, leading to risk reduction, hedging, or even liquidation, ultimately resulting in ETH spot sell-offs. Leveraged stETH circular trading through DeFi protocol liquidity pools would no longer be profitable, and traders would create synchronized sell pressure by closing positions and selling ETH to repay loans.

As a result, many investors have chosen to exit, with some large whales opting to cut losses for quick cashing out. For example, Lookonchain recently monitored a whale that abandoned the queue to exit staking, directly exchanging 4,242.4 stETH for 4,231 ETH (worth $18.74 million) and depositing it into Kraken for sale, incurring a direct loss of 11.4 ETH (about $50,500).

Institutional Fund Migration Changes Staking Ecosystem Landscape

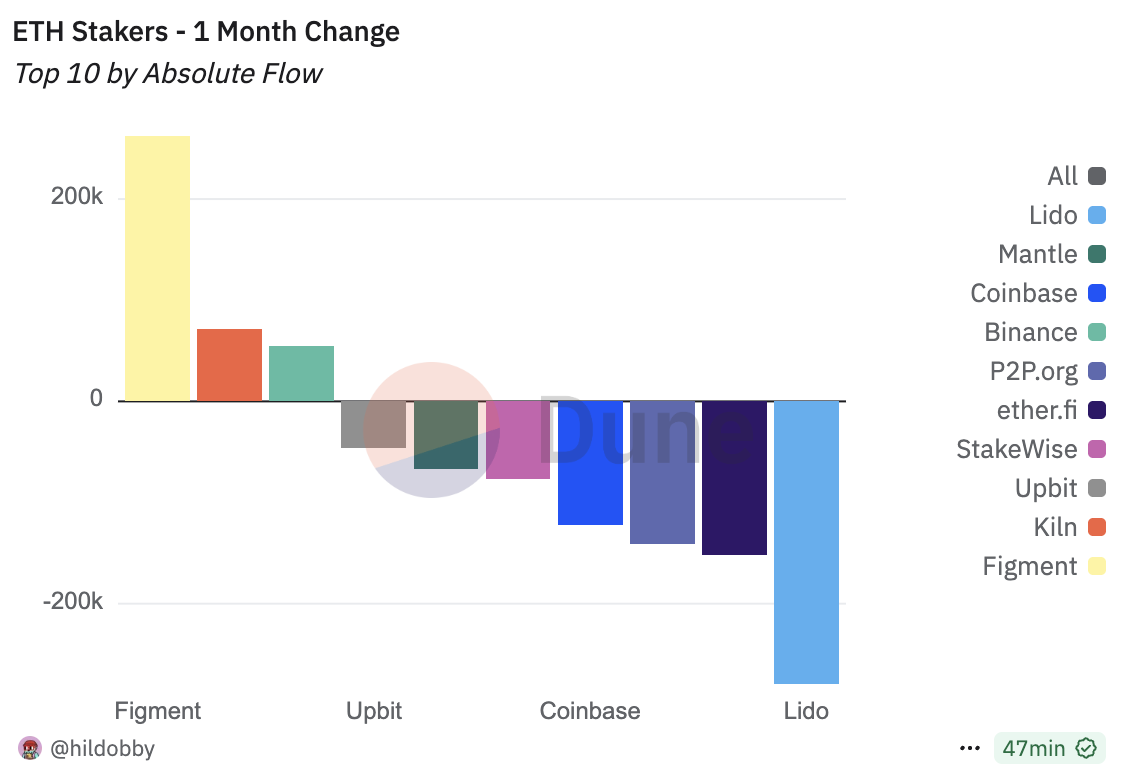

The large-scale exit from ETH staking is also related to funds shifting towards new staking protocols. As the main investors in Ethereum shift from retail to institutional, the staking market landscape is undergoing significant changes. Dune data shows that as of August 18, three of the top five staking protocols are centralized institutions: Binance, Coinbase, and Figment. In the past month, Lido, ether.fi, and P2P.og have seen the largest outflows of ETH, with Lido alone experiencing an outflow of over 279,000 ETH in a month, reducing its market share to 24.4%, a historic low; conversely, Figment saw an inflow of over 262,000 ETH in the same period, becoming the biggest winner.

This migration trend is driven by multiple demands from institutions for compliance and stability. For instance, institutions require clear legal entities and compliance processes, which decentralized protocols struggle to meet; decentralized network nodes are dispersed, making comprehensive audits difficult and global KYC nearly impossible; centralized institutions can clearly assume responsibility for node failures, while decentralized protocols have dispersed responsibilities that do not meet risk management expectations; the uncertainty of DAO voting mechanisms lacks decision-making stability for institutions. In short, institutional funds place greater emphasis on compliance, accountability, and stability rather than the ideology of decentralization. This also means that in the ETH staking market, decentralized protocols are gradually shifting to a defensive posture, while centralized staking institutions are continuously expanding their share through compliance and stability.

Price Increase Stimulates Profit-Taking

Behind the surge in ETH staking withdrawals, the demand for profit-taking driven by price increases is also one of the factors. CoinGecko data shows that since April of this year, the price of ETH has rebounded approximately 223.7% from its low. Such a rapid increase has provided early stakers with considerable unrealized gains, prompting some investors to choose to unstake and lock in profits, thereby increasing the liquidity supply pressure on ETH in the short term.

Large-Scale Sell Pressure Difficult to Release Directly in the Short Term, Market Still Has Some Support Space

Although the scale of Ethereum staking withdrawals has reached a historical high, raising concerns about sell pressure, the limited release pace and continued institutional accumulation may provide some support for ETH.

On one hand, as mentioned earlier, this round of unstaking is driven by multiple factors, including liquidation of circular strategies, arbitrage demands, and migration to other staking providers. This means that not all unstaked ETH will directly enter the market for sale.

On the other hand, Ethereum's PoS mechanism imposes strict limits on validator exits, requiring each validator to stake 32 ETH to participate in network consensus, and to ensure network stability, only 8-10 validators are allowed to exit per epoch (approximately 6.4 minutes). As the demand for validator exits increases, the waiting queue will significantly lengthen. Currently, it is estimated that the unstaked ETH will take about 15 days and 4 hours to be truly released into the market, thus not impacting liquidity supply in the short term.

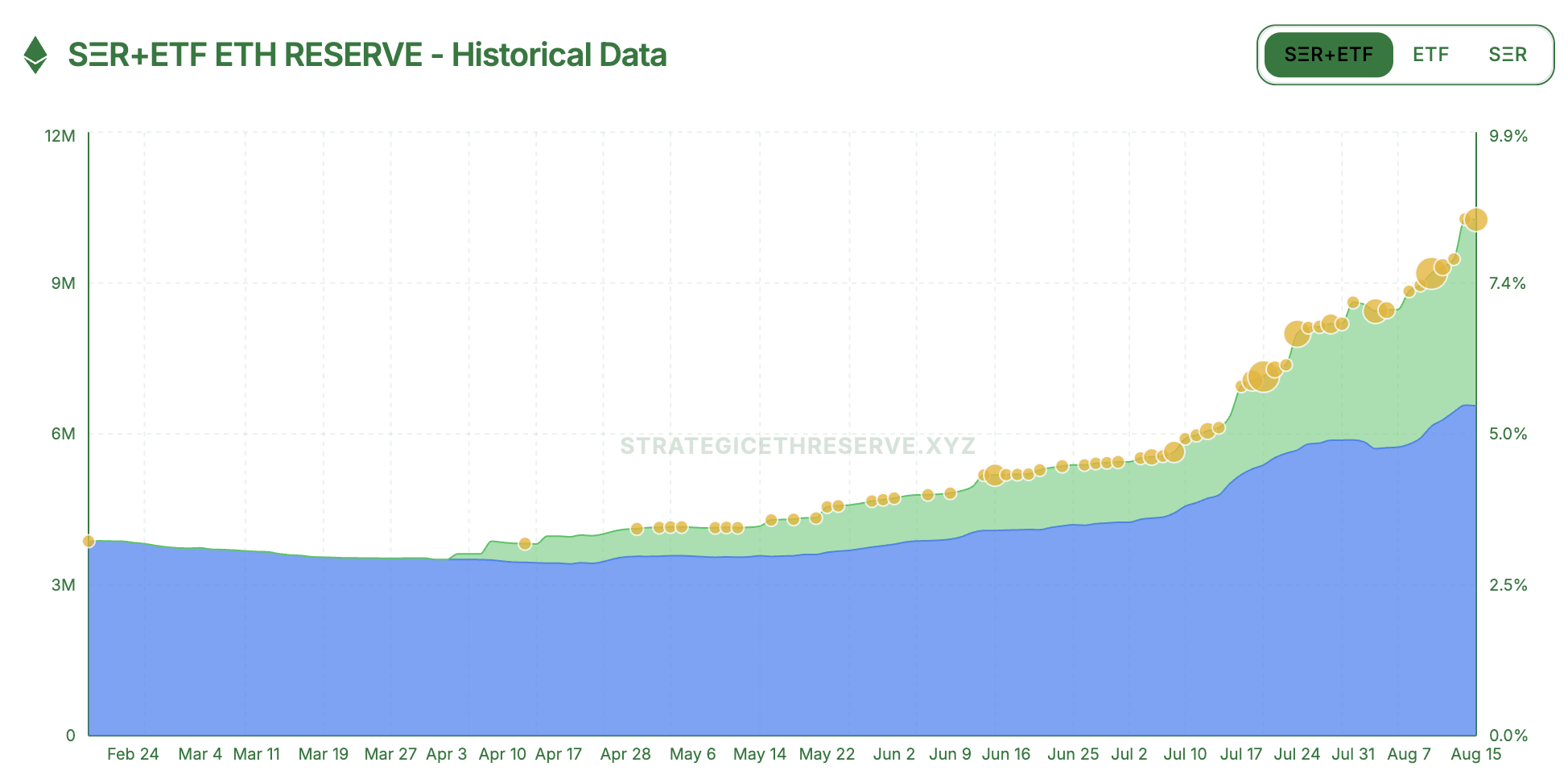

Additionally, from market data, there is currently a demand for over 61,000 ETH to exit staking, but the accumulation by institutional investors can cover potential sell pressure. According to strategicethreserve.xyz data, as of August 18, the cumulative holdings of Ethereum reserve companies and various ETH spot ETFs reached 10.26 million ETH, accounting for over 8.4% of the total Ethereum supply. In the past half month, institutions have accumulated over 1.83 million ETH, far exceeding the current scale of unstaking. If the accumulation trend continues, it could effectively absorb potential sell pressure.

In summary, the recent high volatility of ETH prices may be a natural response to profit-taking and market sentiment fluctuations. Although there is some uncertainty and short-term volatility pressure in the market, overall confidence in Ethereum remains strong, especially as the continued presence of institutional funds further enhances market resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。