People in Japan, not doing the Japanese market.

Author: AB Kuai.Dong

The year is 2025, and before I knew it, I have been in Tokyo, gradually getting used to the life of a big city. If 2023 marked the beginning of the trend of industry professionals moving to Japan, then the first half of 2025 can be described with the word "crowded."

This article has been modified and edited based on my "Digital Nomad's Guide to Japan" by @starzqeth and @rubywxt1, focusing mainly on the basis and environment.

This wave of migration is mainly influenced by the following factors:

Continuous tightening of visa renewals and permanent residency (PR) in several developed regions.

The continued weakness of the yen exchange rate (1 USD = 146 JPY).

Lower thresholds and timeframes for obtaining work visas and transitioning to PR.

The establishment of financial special zones (English administrative procedures).

➡️ The main content of this article covers:

🔹 The local market structure (what can be done?)

🔹 What types of visas do people hold (12 months to apply for PR?)

🔹 Rapid changes in policies (tax issues?)

🔹 The scale of foreign companies locally (like Binance?)

🔹 The daily lives and activity ranges of local peers.

I hope the above content is helpful to you. ❤️

🎯 Japan's Web3 Market

Overall, although Japan is one of the more developed countries in Asia with a population of 124 million, the number of young people is gradually decreasing. Amidst the continuously rising local stock market, people's attention to cryptocurrencies is far less than before.

(The main reason is that the development demands of other industries are also surging, such as real estate, retail, tourism, and elderly care, which reduces young people's motivation to focus on Crypto).

🔹 Characteristics: Middle-aged individuals are keen on stock trading, young people heavily rely on social media X to express opinions, local Crypto discussions are interest-driven, and there is a diverse community culture.

In terms of time, many Chinese peers view the entire circle as divided into: pre-pandemic and post-pandemic.

Before 2023, the Chinese Crypto circle in Japan had only a few hundred people, mainly engaged in local compliance businesses, full-time trading, and outsourcing development.

After 2023, this scale rapidly expanded, with a large number of project teams, trading teams, top-tier exchange employees, and industry retirees gradually landing in Japan. This group mainly engages in settling and working in Japan, not doing the Japanese market, but focusing on Greater China or global business.

Currently, the active Chinese practitioners and bloggers in Japan number between 10 to 20, and those who have been there for a longer time and have influence in the Chinese-speaking world include Yishi @ohyishi (Tokyo), Suji @suji_yan (Tokyo), Guo Yu @turingou (Tokyo), Cat Master @catmangox (Osaka), and 𝘁𝗮𝗿𝗲𝘀𝗸𝘆 @taresky (Fukuoka). Additionally, Kay Shen @keyahayek recently also officially moved (to Tokyo).

Therefore, later arrivals generally view Japan as a place for work, residence, and raising children, while maintaining communication with Japanese foundations and colleagues visiting for business.

The conclusion is: People in Japan, not doing the Japanese market.

🪪 What types of visas do people hold

Since 2023, the Japanese government has relaxed restrictions on highly skilled professionals (J-Skip), mainly to attract more high-net-worth or highly knowledgeable individuals to start businesses, work, and invest in Japan (ultimately still for tax collection), lowering the threshold for requirements.

This means that if you are employed by a Japanese company or plan to start a capital-intensive company, you can submit a permanent residency (PR) application as early as the 12th month after landing in Japan, provided you meet the scoring criteria for the highly skilled professional visa.

According to statistics from daily communications, the new wave of Chinese practitioners in Japan are mostly on highly skilled professional visas. They have received many points due to master's degrees, higher tax contributions, or longer work experience, thus obtaining the highly skilled professional visa.

Currently, many of the peers who obtained the highly skilled professional visa in 2023 have already received permanent residency (which can be understood as a Japanese green card). Those interested can search for: Highly Skilled Professional 1, Highly Skilled Professional Visa. (Consult @0xdannytoma).

⁉️ Rapid changes in policies (tax issues?)

The reason why many Crypto companies that have landed in Japan only use Japan as an office and research base, without engaging in the local market, is primarily because cryptocurrencies are still regarded as miscellaneous income in Japan, rather than traditional financial income.

This means that if you buy 30 million yen worth of BTC through a local compliant exchange and make a profit, the following year you will have to pay 45% miscellaneous income tax + 10% resident tax, totaling about 55%.

However, starting in 2025, various policies and trends are changing this situation, such as:

Microstrategy Company: The company holds tokens, and investors only need to buy shares (already realized).

Spot ETF: Investors only need to invest normally (in progress).

Tax rate reduction: From a maximum of 55% to a unified 20% (in progress).

After profits from the above three, investors will ultimately only need to pay a maximum of 15.315% national tax and 5% local resident tax. Moreover, once this tax is paid, it is equivalent to being completely onshore, and no further taxes are required. For corporate investors, they only pay 15.315% national tax and can exclude local taxes.

This has led to a large number of practitioners landing in Japan without actively engaging in the Japanese market, but rather focusing on policy changes. Some have also tested the waters in the Japanese stock market with the microstrategy model and have already launched several companies.

However, with the leading SBI group beginning to promote spot BTC and XRP ETFs, the Japanese Financial Services Agency is also pushing for related tax rate reductions. Recently, Japanese microstrategy stocks have started to adjust due to news.

For more information on this topic: link

🔐 The scale of foreign companies locally (like Binance?)

Currently, the number of full-time Chinese practitioners in the crypto space in Japan is estimated to be around a hundred, including companies like Binance, Backpack, OSL, OK Japan, SBI Group and its affiliated market makers or funds, as well as secondary trading teams in Tokyo, which have taken on a large number of employees.

Additionally, OneKey, Mask, and Alpha (formerly KEKKAI) have also hired many peers interested in coming to Japan, all of which are companies based in Tokyo.

Currently, only four areas have been designated as financial special zones by Japan in 2024, enjoying unique channels and English administrative processes. These areas are: Tokyo, Osaka, Fukuoka, and Hokkaido.

Currently, the head of Binance Japan is Takeshi Chino (千野剛司), who was previously the legal representative of Kraken in Japan and has worked at PwC and the Tokyo Stock Exchange, graduating from the University of Oxford.

However, from a compliance perspective, Binance Japan is limited to serving local Japanese users. Chinese language needs are still handled by the global site.

🧋 The daily lives and activity ranges of local peers

Compared to Hong Kong, Singapore, Shenzhen, etc., local gatherings and events are frequently held. Chinese people in Japan mainly prefer dispersed activities (each living their own lives, not disturbing my Japanese life).

Thus, Japan has become a gathering place for offline I-people and online E-people.

Currently, 90% of full-time Crypto practitioners live in Tokyo and its surrounding areas, with about 30% of offline company offices located in the Toranomon area of Minato. This is mainly because this area is centrally located and has many WeWork shared offices, with single-room rental prices starting around 10,000 RMB.

🔹 Living situation

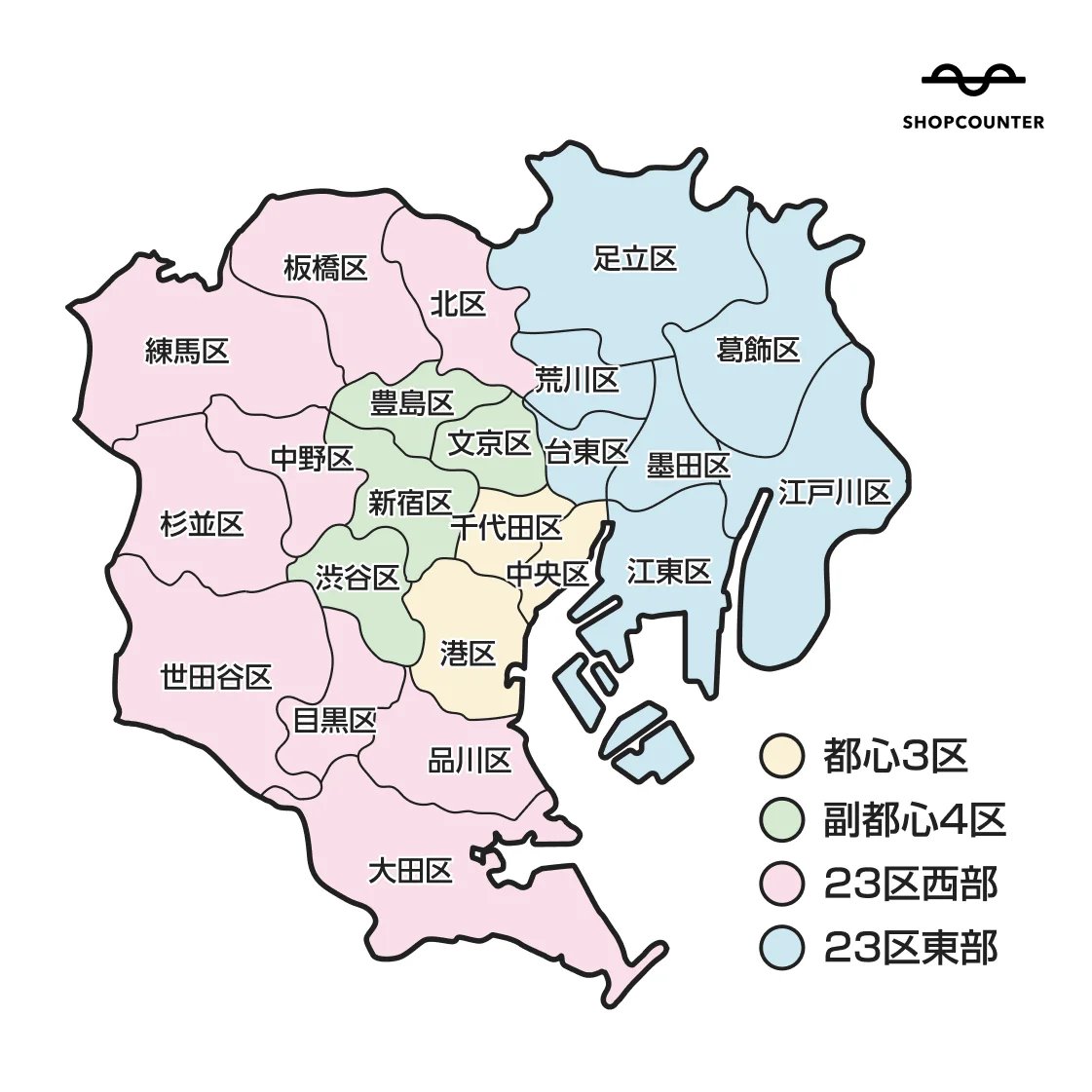

Tokyo is said to have six core districts, representing the six most central areas of Japan: Chiyoda, Chuo, Minato, Shinjuku, Shibuya, and Bunkyo. For example, the area where people often work offline is Minato; the area where events are frequently held is Shibuya.

However, most peers do not live in these districts. Besides the small living space and high housing prices, the biggest issue is that living in the central area feels like not having left the country, lacking the tranquility of a small town depicted in anime, and the local administrative pressure is high due to the surge in residents, leading to slower processing efficiency.

🔹 Schooling situation

The vast majority of practitioners in Tokyo send their children to international schools. Among them, about 30% attend the British School in Tokyo (BST) located in Minato, with annual tuition fees of 2.73 million yen, which, after national and local education subsidies, amounts to about 110,000 RMB.

Classes are taught in Japanese and English, alternating daily.

🔹 Dining situation

Uber Eats prices are similar to those in the core areas of Beijing and Shanghai, but delivery fees start at 1,000 yen (50 RMB), and there are many chain stores, including McDonald's and Domino's, which can deliver in about 10 minutes.

For offline dining, it mainly consists of local restaurants or cooking at home. Meat and vegetables like wagyu, cabbage, bean sprouts, and tomatoes are not expensive locally, but special items like fruits (melon, watermelon, peaches, etc.) are relatively expensive.

🔹 Hotel situation

Due to the surge in tourism in recent years and the insufficient number of people willing to work as hotel staff, hotel prices in Tokyo have increased by 2 to 3 times compared to 2023.

This phenomenon is also occurring in places like Kyoto and Osaka. Hotel prices in central Tokyo even exceed those in Singapore. However, rents have not seen significant fluctuations.

🔹 Living situation

With a monthly rent budget of 10,000 RMB, if you want to live in a new apartment in Ueno or Shinagawa, you can only get a 20 square meter unit. However, in nearby areas, a few train stops away, you can find places ranging from 50 to 80 square meters.

As a result, many peers do not live in the six districts of Tokyo but rather in the pink and blue areas.

❤️ The above is about relocating to Japan for Web3 and local living. I hope the content is helpful to you. Thank you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。