Solana Price Support Near $180 Key to Reversal

Solana price is showing strong signs of entering a short-term correction phase before potentially resuming its uptrend.

Technical patterns, on-chain data, and institutional activity suggest a short sell-off to the $180-$190 area before a rally.

Analysts are also bullish , with a view to the next few weeks moving to around the level of $360, assuming the current support levels are maintained.

Solana Technical Indicators Point Toward Final Dip

Several chart analysts point to an imminent short-term correction in the altcoin price, and the crypto is already stagnating just below the $200 mark.

Analyst ali_charts proposes a last chance to buy-the-dip around the $190-mark, followed by a run up to $360. A 12-hour chart displays a breakout of an ascending triangle with Fibonacci targets of $250 to $362.

Source : X

In the meantime, CryptosBatman states that SOL has made an inverted head-and-shoulders breakout and entered a bullish fair value gap (FVG).

He anticipates a retest of the bottom of the $178-$188 range before another leg higher.

MACD is positive on shorter time frames, and RSI is trending in a bullish zone, which indicates that momentum is still there.

Futures and ETF Activity Reveal Elevated Institutional Interest

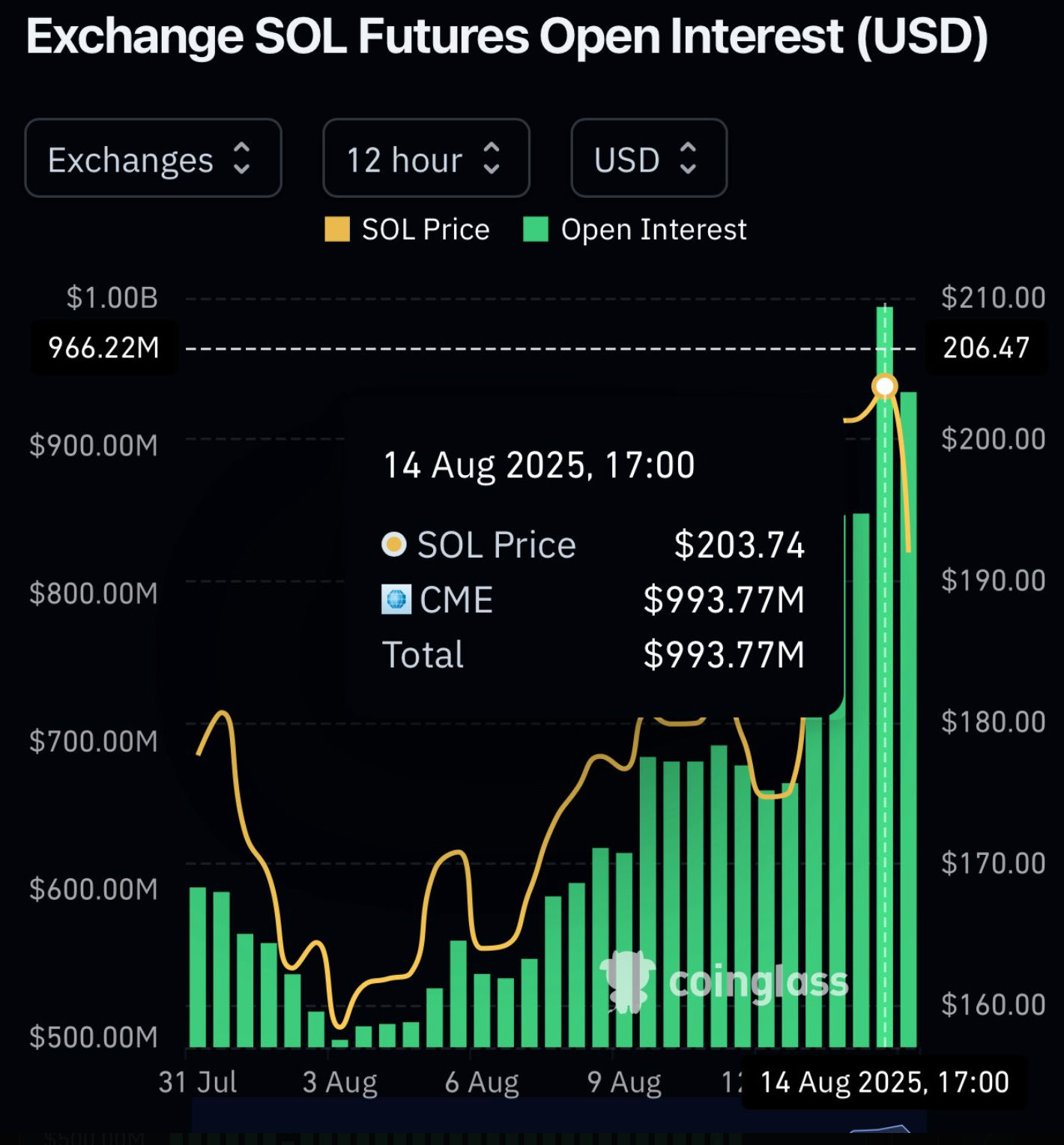

According to CoinGlass, SOL futures open interest reached a new high of $993.77 million on August 14.

This surge in open interest was accompanied by a price rally to $209, which means that traders are positioned strongly to take an extended move.

Exchange SOL Futures Open Interest | Source : Coinglass

Meanwhile, the REX-Osprey Solana + Staking ETF (SSK) has attracted assets of $182 million on its launch.

Solana trading volume has also increased by 10% during the last 24 hours, with $15 billion worth of SOL traded, encompassing 14% of its total supply.

As the inflows to ETFs are already increasing, the U.S. SEC has delayed the review of Solana ETFs submitted by Bitwise and 21Shares to October 16.

Investment experts such as Nate Geraci anticipate a series of crypto ETFs to be authorised in the near future that will further support Solana's long-term value. Should it come through, it can serve as an important driver to institutional adoption.

Derivatives Data Signals Short-Term Weakness, But Trend Remains Bullish

Derivatives also indicate short-term trader caution despite the bullish macro picture. Open interest declined by 6.24% to $11.61 billion, and the options volume sank by 56.44% to $2.41 million.

The 24-hour long/short ratio is 0.9357, which implies that there are a few more short positions across the larger market.

The liquidations totalled $60.70 million within the last 24 hours, of which $50.73 million belonged to long positions.

This liquidation event is regarded as the main cause of the SOL falling below $200 in Friday session. Nevertheless, the larger weekly increase of 11.11% shows that there is still a bullish outlook.

Accumulation and Fundamentals Strengthen Bullish Case

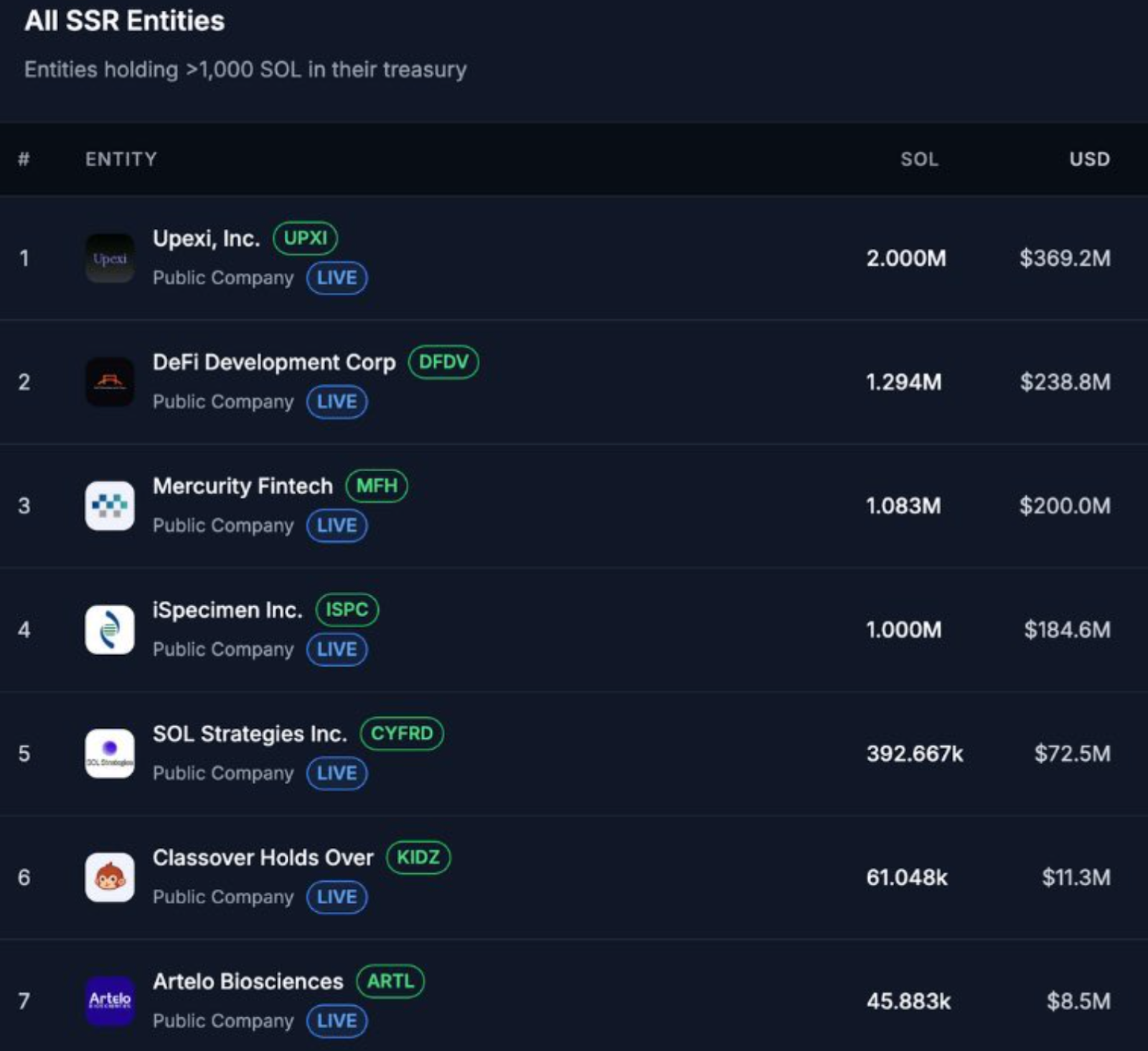

Public companies are still amassing SOL, according to data on ReserveSolana, which showed total holdings of 5.904 million SOL among eight entities.

These stakes have a market value of $1.15 billion, which equates to 1.03% of SOL's total supply. Some of the biggest holders include companies like Upexi, DeFi Development Corp, and Mercurity Fintech.

Source : X

Cas Abb found the concentration to be notable and made a post on the matter, noting that the reserves cut across fintech, DeFi, biosciences, and mining.

The build-up shows increasing institutional confidence in Solana as a long-term asset. This way, it restricts the supply in circulation, which may cause upward pressure on the price in times of high demand.

On the technology side, Solana is planning a SIMD 326 upgrade that should increase block finality to only 150 milliseconds.

The network is still appealing to developers and businesses and has been joined by its 65,000 TPS performance and sub-cent fees.

Platforms such as SAG3 Labs currently give Solana an overall outlook of 70/100 and a strong trade signal of BUY.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。