The hotter-than-expected inflation data in the July PPI has thrown a hint of uncertainty into the equation. While traders still heavily favor a rate cut at the Sept. 17, 2025, Federal Reserve meeting, CME Fedwatch data shows it’s no longer the near-certainty it once seemed.

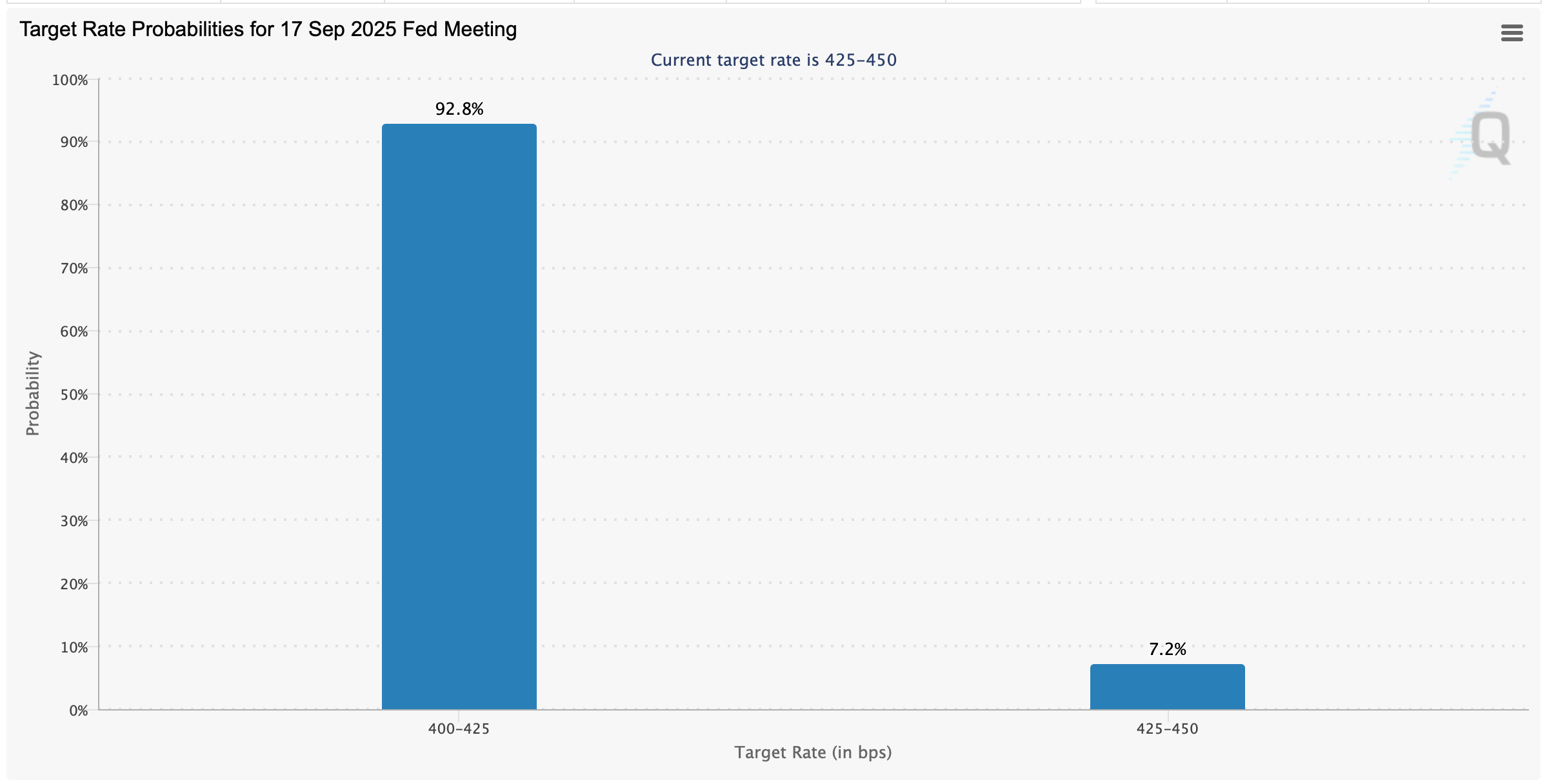

CME Fedwatch tool odds on Aug. 15, 2025.

Fedwatch data shows a hefty 92.8% probability that the target range will drop to 4.00%–4.25%, down from the current 4.25%–4.50%. Before the PPI release, the probability was sitting above the 96% mark. Roughly 7.2% of traders expect the Fed to keep rates unchanged. In short, most of the market is betting on a cut — but a hint of doubt has now slipped into the conversation.

Kalshi traders are nearly unanimous that the Fed funds rate will remain above 3% in September, keeping odds at 97% or higher for every level up to 3.75%. Confidence slips only slightly at 4%, where traders still assign a 96% chance. Once past 4.25%, the odds tumble to 21%, signaling most anticipate a cut by that point. That, too, shifted a bit after the inflation report made the rounds.

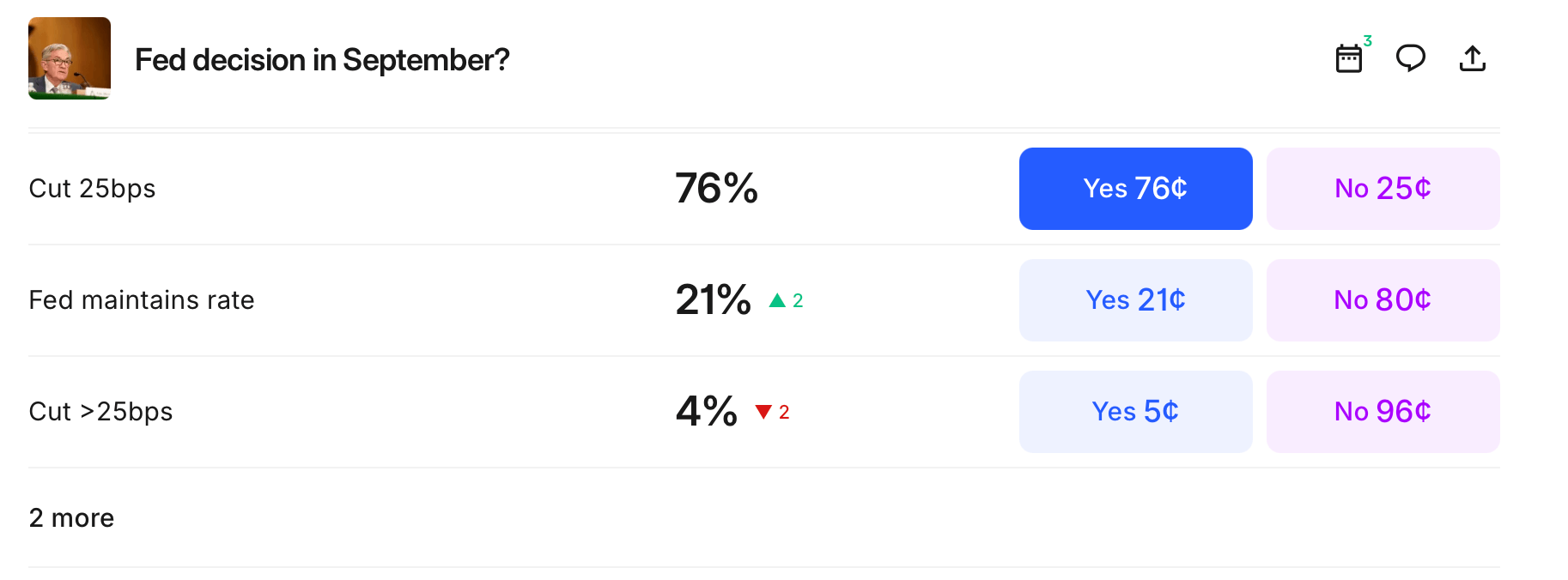

In another market, Kalshi traders are heavily favoring a modest cut at the September Fed meeting, with 76% betting on a 25-basis-point (bps) trim. The odds of the Fed holding steady are at 21%, up slightly in recent sessions, while just 4% see a larger cut of more than 25 bps as likely. In short, the market’s money is on a small but meaningful reduction, with any bigger move viewed as a long shot.

Polymarket traders are also firmly behind a quarter-point cut in September, assigning it a 72% chance despite a minor dip in confidence. A larger 50-basis-point cut sits at just 5%, while the odds of no change have risen to 23%. Virtually no one is pricing in a hike, with a 25+ basis-point increase sitting at just 1%. The bottom line: markets overwhelmingly expect a trim, but they’re not betting on anything beyond 25 bps.

Polymarket odds on Aug. 15, 2025.

Still, the odds on both Kalshi and Polymarket were once considerably higher. The shifting probabilities reflect a market grappling with fresh inflation signals and recalibrating expectations in real time. While confidence in a modest September cut remains high, the cracks in the consensus hint at a more cautious outlook. Traders may be bracing for surprises, knowing that one unexpected data point could tilt the entire rate-cut narrative overnight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。