Author: J.A.E, PANews

On August 12, 2025, the Uniswap Foundation released a new proposal to register Uniswap Governance as a Decentralized Unincorporated Nonprofit Association (DUNA) in Wyoming, naming its entity "DUNI." This move will provide a compliant "cloak" for Uniswap's decentralized governance while laying the groundwork for activating the protocol's fee mechanism. If successful, this development could mark a significant turning point in the DeFi space, representing a profound transformation in protocol governance and value capture mechanisms.

As a leading DEX in the DeFi ecosystem, this action by Uniswap may set a new precedent for the compliance process of DAOs. In an environment where the crypto industry increasingly emphasizes compliance, this initiative offers new solutions for the protocol to achieve legal operation, risk control, and coordination of off-chain interactions.

In-Depth Analysis of the Wyoming DUNA Framework: A New Path for DAO Compliance

Over the past two years, the foundation has been seeking a legal structure that can provide more comprehensive liability protection for governance participants while maintaining protocol governance power without introducing centralization risks, enabling off-chain interactions. After in-depth research, legal consultation, and community proposals, DUNA was deemed an appropriate choice to meet these needs.

In March 2024, Wyoming, a crypto-friendly state in the U.S., passed legislation recognizing DUNA as a new form of legal entity, which took effect in July of the same year. It is specifically designed for DAOs and public chains, granting them legal status while preserving the essence of decentralized governance.

The core feature of DUNA is its nonprofit nature, meaning that while DUNA is allowed to engage in profit-making activities, all profits must be used for nonprofit purposes and cannot be distributed to members or token holders. However, DUNA can pay salaries or reimburse expenses to those providing services, such as paying wages to employees, incentivizing node operators or contributors, and reimbursing expenses.

The main advantage of DUNA is that it provides limited liability protection for DAO members and token holders, exempting relevant individuals from the obligations, debts, or legal liabilities of the DAO, effectively avoiding the risk of unregistered DAOs being treated as general partnerships, which could lead to unlimited liability for members.

The establishment of DUNI will enable Uniswap to perform off-chain operations, such as signing contracts, holding assets, hiring third-party service providers (like lawyers and auditors), and fulfilling potential regulatory and tax obligations. For a DeFi protocol, building a legal entity is a key step in connecting with the traditional business world. Once it has legal status, Uniswap can more smoothly collaborate with external institutions and expand its ecosystem.

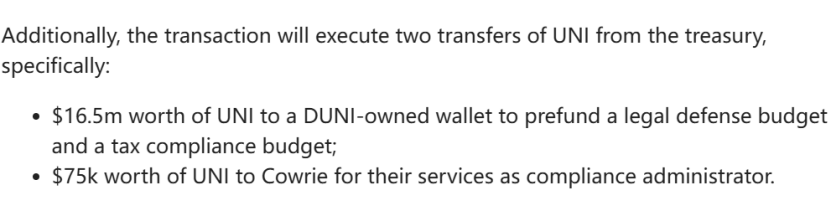

To ensure the normal operation and compliance of DUNI, the proposal plans to allocate $16.5 million worth of UNI from the treasury as a budget for legal defense and tax compliance. The foundation expects that the amount needed to resolve historical tax issues and penalties will be less than $10 million. Additionally, Uniswap will need to pay $75,000 to the tax consulting firm Cowrie as compensation for compliance administration. Notably, Cowrie co-founder David Kerr was deeply involved in drafting the Wyoming DUNA legislation.

Uniswap Foundation's General Counsel Brian Nistler stated that applying the DUNA framework will pave the way for activating protocol fees, allowing a portion of LP fees to be transferred to the DAO treasury. He pointed out, "Based on this legal framework, the scope of what DUNA can do, participate in, and trade will be greatly liberated, laying the foundation for future protocol fee voting, formalizing Uniswap's governance activities, and protecting participants in collective decision-making."

Protocol Fee Mechanism: Potential Benefits and Challenges of Uniswap's Economic Model Transformation

Currently, Uniswap sets transaction fees at 0.3%, with all fees proportionally distributed to LPs (liquidity providers). When a transaction occurs, the fees are directly deposited into the liquidity reserve, increasing the value of LP tokens and incentivizing LPs.

Both Uniswap V3 and V4 include a protocol fee mechanism that can be activated through governance proposals. Once activated, 1/6 of the 0.3% transaction fee, or 0.05%, will no longer flow to LPs but will be collected by the protocol's DAO treasury. The fees paid by traders will not increase, but the earnings received by LPs will be reduced.

The construction of the DUNA framework provides the necessary legal basis for the legitimate collection and management of protocol fees. Without a legal entity, the protocol's fee collection may face risks related to securities law and tax compliance, while DUNI can hold and manage its income with legal status.

If the protocol fee mechanism is activated, it is expected to bring substantial revenue to the Uniswap DAO, which can be used to fund protocol development, security audits, community donations, ecosystem incentives, and other strategic support, benefiting the protocol's sustainable development and solidifying its innovative and leading position in the DeFi market.

Under the DUNA framework, if the protocol fee mechanism is activated, it will also reshape Uniswap's business model. Previously, the protocol's business model was primarily based on trading, with costs borne by LPs and fees earned, while the protocol itself did not generate direct income. The DUNA framework provides a legal basis for the DAO to charge fees, redefining Uniswap's model to create direct income sources.

Although the nonprofit nature of DUNA limits the protocol's ability to distribute profits directly to token holders, the increase in its revenue can indirectly enhance the value of $UNI in various ways, such as the DAO being able to buy back and burn $UNI, thereby increasing its intrinsic value. Additionally, the revenue can be reinvested into the ecosystem, building a self-sustaining "nonprofit business model" for the DAO and achieving more proactive ecosystem expansion.

However, activating the protocol fee mechanism will also directly impact LP earnings, potentially leading some LPs to withdraw liquidity. Liquidity dilution means that users executing large trades on Uniswap may receive worse prices due to higher slippage, which could prompt users to turn to other DEXs, resulting in a decline in Uniswap's trading volume and creating a "negative flywheel effect": fees reduce LP earnings → LP withdraws liquidity → slippage increases → trading volume declines → LP earnings further decrease. Moreover, MEV traders are more sensitive to liquidity, and their activities are expected to decrease as TVL declines.

A report from Gauntlet previously warned of the existence of a "negative flywheel effect," indicating that while activating the fee switch may seem to immediately increase revenue, it could also trigger a series of chain reactions that undermine the protocol's key advantages—deep liquidity and competitive pricing.

Once the protocol fee mechanism is activated, the Uniswap DAO must closely monitor indicator data to avoid reaching the "point of diminishing returns." This situation also highlights the contradiction between protocol value capture and maintaining user experience.

Market Reaction: Polarized Views in the Uniswap Community

Upon the proposal's release, the price of $UNI briefly surged over 8%, reaching $11.86, indicating that the market holds an optimistic view of the news, potentially interpreting it as a long-term positive for $UNI's value capture capability.

Active discussions about the proposal have also taken place on Uniswap's social media and governance forums. Supporters believe that DUNA is a key step toward legalizing the DAO and activating the protocol fee mechanism, benefiting the protocol's long-term development. By establishing a legal entity, Uniswap will better interact with the off-chain world.

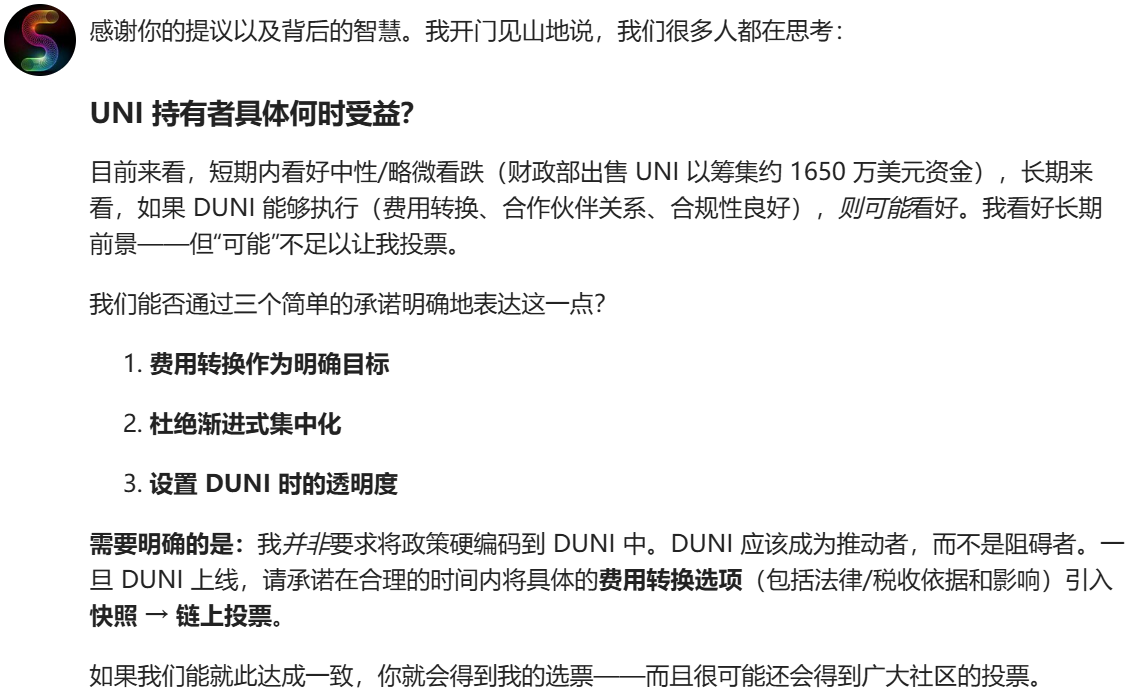

Conversely, some community members have expressed concerns about issues such as the timeline for activating the fee switch, centralization risks, transparency, and cross-border compliance. Therefore, despite the proposal's significant long-term impact, many users remain in a "wait-and-see" attitude due to their concerns.

The above comments reflect the complex trade-offs faced by the DAO community in pursuing innovation and compliance, as well as balancing short-term benefits with long-term value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。