Fed Rate Cut in September Could Shape Markets and Sentiment

U.S. Treasury Secretary Scott Bessent has called for the Federal Reserve to take bold action at its upcoming September 16–17 meeting.

As reported by Bloomberg, Bessent said the Central bank should deliver a 50-basis-point Fed Rate Cut , pointing to newly revised labor data that showed weaker job growth in May and June than earlier believed.

Weak Job Data Fuels Calls for Action

The Work Report of July exposed that 258K jobs were erased and only 73k nonfarm payrolls were added in July.

The slowdown in hiring, combined with signs of cooling inflation, has strengthened arguments for a bigger-than-usual cut.

According to Bessent, a half-point move could help restore confidence in the economy and keep momentum alive as businesses and households face tighter credit conditions.

Stephen Miran Nomination Adds to Speculation

Bessent also expressed hope that President Donald Trump’s nominee, Stephen Miran , will be confirmed to the Federal Reserve Board of Governors before the September meeting.

Miran, who currently serves as chair of the Council of Economic Advisors, was nominated on August 8 to replace Adriana Kugler , who resigned earlier this week. His term will go till January 31, 2026.

These activities that also hint at the Termination of Federal Reserve Chair Jerome Powell, due to his stance of keeping the rates steady.

If approved, Miran’s presence could tilt the Fed toward a more accommodative stance, increasing the likelihood of another Fed Rate Cut later this year.

Market watchers note that Miran’s views on policies align closely with Trump’s preference for lower rates to accelerate growth.

Potential Impact on Crypto Markets

A half-point Fed Rate Cut would not just affect traditional markets, It could be a “big boost” for cryptocurrencies.

In the past, the extreme and abrupt rate reduction has led to liquidity waves. It presses investors to seek out more returns beyond traditional finance.

-

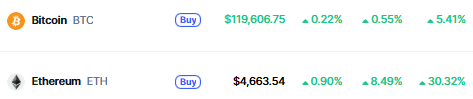

History demonstrates that Bitcoin (BTC), Ethereum (ETH) have been likely to go on a rally following such activities.

-

Altcoins follow and also get the benefits of changes in re-speculative flows.

The traders believe that once the Federal Reserve acts fiercely in September, it may provide a huge jump in overall prices as well as increased trading volumes in the crypto market.

As of now the crypto market cap stands at $4.07 Trillion with an increase of more than 2% in the last 24 hours.

Bitcoin is currently trading at $119,606 with an increase of 0.55%. Ethereum is trading at $4663.54 with an increase of more than 8%.

Source: CoinMarketCap

Source: CoinMarketCap

Markets Already Positioning

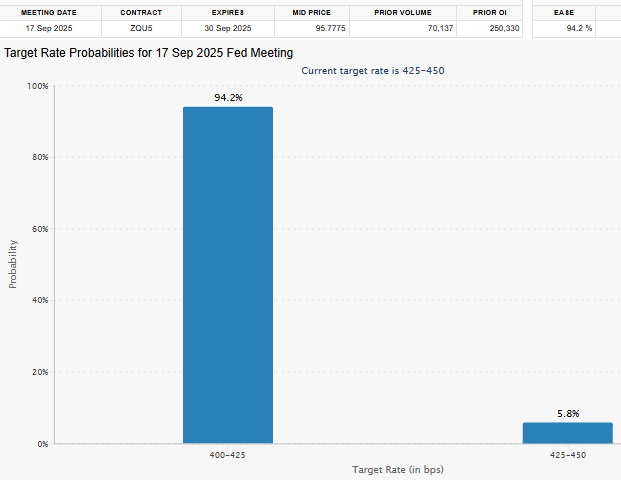

In recent weeks, futures markets have priced in growing odds of a Fed Rate Cut , though most traders had been expecting only a quarter-point move.

Bessent’s comments paired with the weaker job data have shifted some sentiment toward the larger 50-point scenario.

As per the FedWatch Tool, the probability for a Fed Rate Cut on 17 September meeting is 94.2%.

Source: FedWatch Tool

If the Central Bank surprises with a bigger cut, it could mark a turning point for risk assets. Stock markets, high-yield bonds, and digital assets could all benefit from favourable financial situations.

On the other hand, making only a small move could disappoint investors who are hoping for a clear and strong policy change.

A Defining Moment Ahead

The next September meeting now takes on even more significance. On the one hand, there is pressure to act boldly and provide a Fed Rate Cut substantial enough to offset weakening growth.

On the other hand, there is the danger of acting too quickly and returning inflation pressures.

Conclusion

With the possible entry of Stephen Miran to the Federal Reserve board and Bessent's public call for a bold move, the coming weeks will be instrumental in establishing market expectations.

Also read: Kazakhstan Launches Central Asia’s First Bitcoin ETF Starts Today免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。