Introduction: Market Echoes of Extreme Conditions

In August 2025, the crypto market was once again ignited by a wave of fervent MEME sentiment. A project named MYX surged from a quiet price of around $0.1 to a peak of $2.17 in just 48 hours, achieving a staggering nearly 20-fold increase.

Data Source: Binance MYX/USDT Market Screenshot

This extreme volatility not only created massive waves in the spot market but also triggered a large-scale game in the perpetual contract market of centralized exchanges (CEX). Statistics show that at the peak of MYX's price, the funding rate for MYX contracts on Binance dropped to an extreme level of -2%, with a settlement frequency of up to once per hour. This phenomenon intuitively reflects the high demand for hedging in the market, and the short positions remained stubborn despite the continuous "punishment" of the funding rate.

During this capital frenzy, the 24-hour contract trading volume of MYX soared to $8.963 billion, a month-on-month increase of 31.91%, with the contract open interest reaching $136 million. Accompanying this was a staggering $16.22 million in liquidations, a figure only surpassed by Bitcoin and Ethereum, illustrating the remarkable domino effect of leverage in the MYX perpetual contract market.

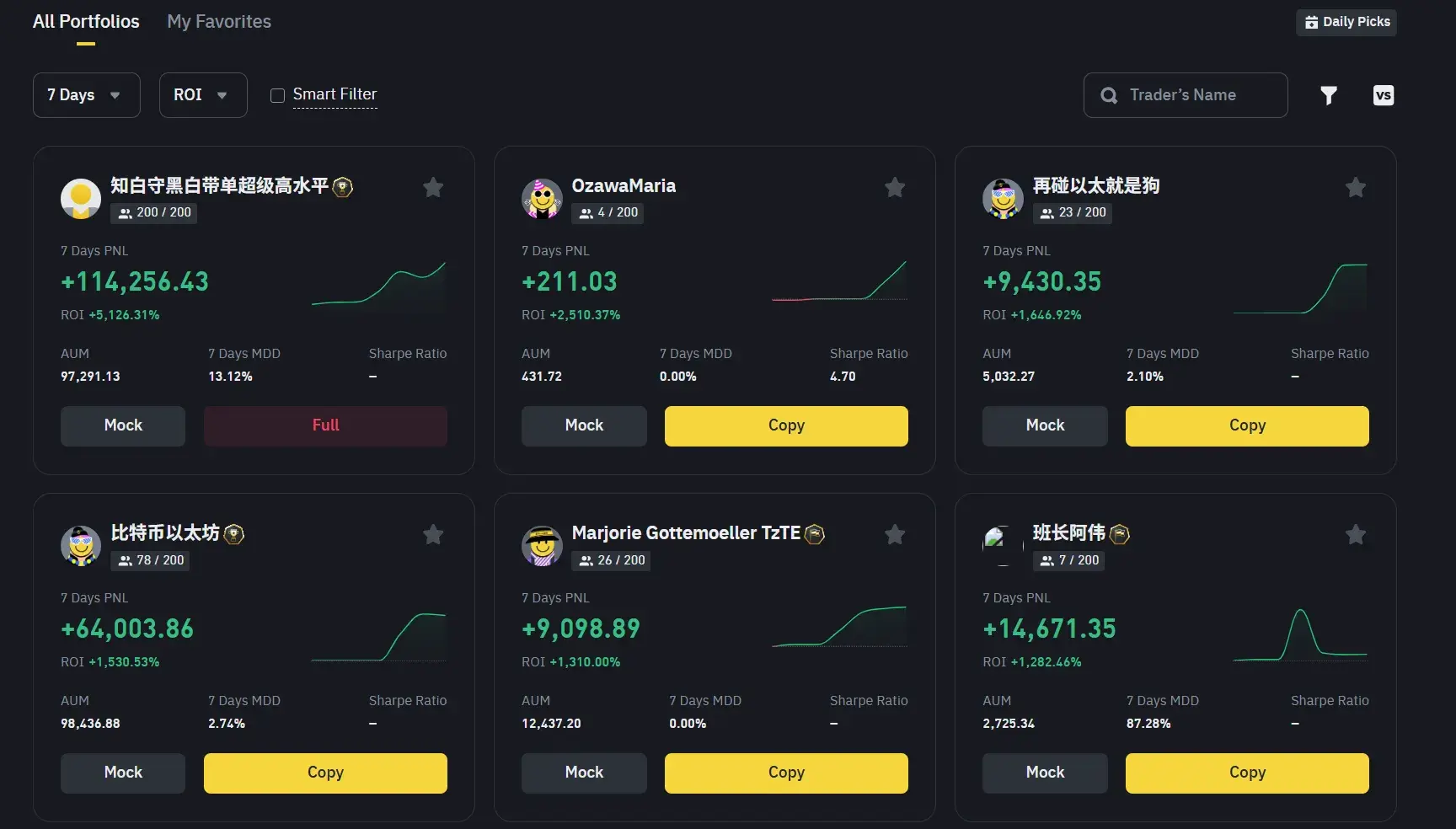

Data Source: Binance Copy Trading Page Screenshot

In the CEX copy trading ecosystem, the popularity of MYX was directly reflected in the copy trading leaderboard. Traders who successfully captured the MYX market saw their 7-day PNL (Profit and Loss) and ROI (Return on Investment) data shine brightly, as if they had mastered the wealth code overnight. However, behind this glamorous data lies a stark contrast in trading strategies and risk perceptions. This article will analyze two typical cases to deeply explore the "mortal states" of successful and unsuccessful traders in the MYX market, revealing their behavioral patterns and psychological games in extreme market conditions.

1. Winner Profile: Phased "Market Hunter"

We first analyze a copy trader who achieved astonishing wealth growth in the MYX market. Data from his social account shows that through successful operations with MYX, he increased his assets under management (AUM) from zero to 100,000 USDT in just 7 days, with copy trading slots being snapped up instantly.

His trading strategy was not static but resembled that of an experienced hunter, employing different hunting methods based on the various stages of the market.

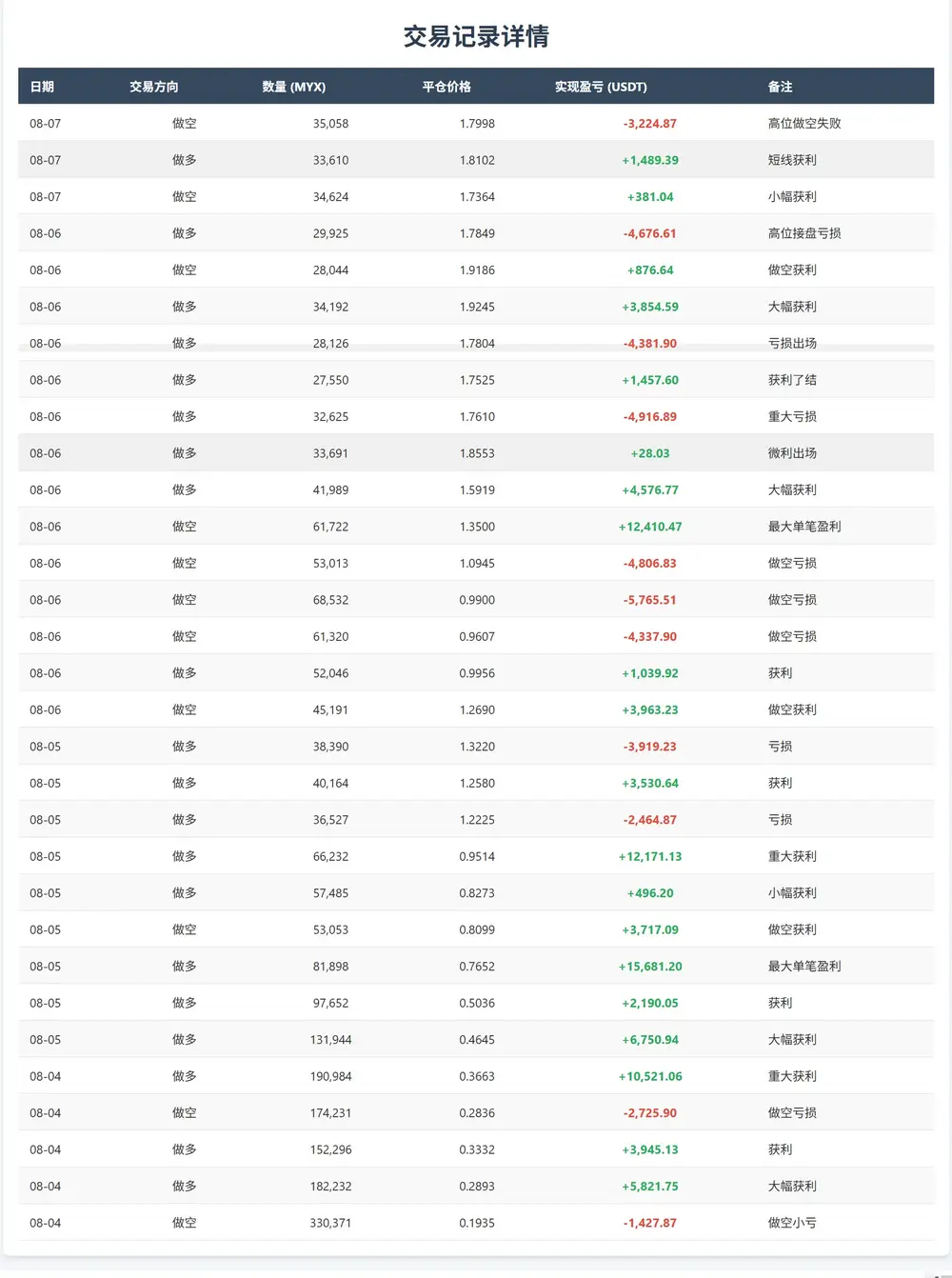

Data Source: Binance Copy Trader "Zhi Bai Shou Hei" Copy Trading Details

Phased Trading Strategies and Position Management

First Stage (August 4): Bottom Building - The "Gambler's" Precise Bet.

When MYX was still in the low range of $0.19-$0.37, he demonstrated strong conviction and dared to build a large position. Single positions reached as high as 100,000 to 300,000 MYX, which required not only strong insight into the project's fundamentals (or market sentiment) but also substantial capital strength and psychological resilience. This successful "bottom fishing" allowed him to accumulate significant initial capital, laying the financial foundation for his subsequent operations.

Second Stage (August 5): Trend Following and Swing Trading - Flexible Switching of "Guerrilla Warfare."

As the price entered a rapid rise period of $0.48-$1.29, he no longer adhered to a one-sided long position but flexibly switched between long and short positions. By operating in both directions, he successfully captured the main upward trend and shorted at high points during local pullbacks, maximizing his profits. This strategy indicates his strong adaptability, allowing him to adjust tactics based on market dynamics.

Third and Fourth Stages (August 6-7): High-Frequency Oscillation Trading and High-Point Games - "Dancing on the Edge of a Knife."

After the price surged to a high oscillation range of $0.89-$1.95, his trading became more frequent. Although he continued to operate in both directions, some high-point chasing operations also led to losses. On August 7, he even built a large position in the peak range of $1.92-$2.05. This seemed risky, but his strict stop-loss discipline kept his maximum single loss to only $5,765 USDT, which was relatively controllable compared to his maximum single profit of $15,681 USDT.

Data Source: Wolfdao Copy Trading Analysis (https://insights.wolfdao.com/)

Psychological Profile of the Successful Trader

The success of this trader is not merely a result of "good luck," but a comprehensive reflection of the following key traits:

Phased Risk Awareness: He understood that building positions at low levels is a high-return, relatively low-risk operation, thus he dared to take large positions. At high levels, he viewed risk as a primary consideration, using small positions and high-frequency guerrilla tactics to secure profits, avoiding the massive risks of single trades.

Strict Stop-Loss Discipline: Despite engaging in chasing at later stages, he did not let losses spiral out of control. His win-loss ratio (average profit to average loss) reached 2.73:1, revealing his core risk management philosophy: let profits run and cut losses at the root.

Capital Management Strategy: He used the profits gained from bottom-heavy positions as "ammunition" for subsequent trades, ensuring that even in high-risk trades later on, losses would not harm his principal. This strategy of "risking the money earned" is a common trait among many successful traders.

Data Source: Wolfdao Copy Trading Analysis (https://insights.wolfdao.com/)

2. Loser Profile: The Gambler Devoured by "Greed"

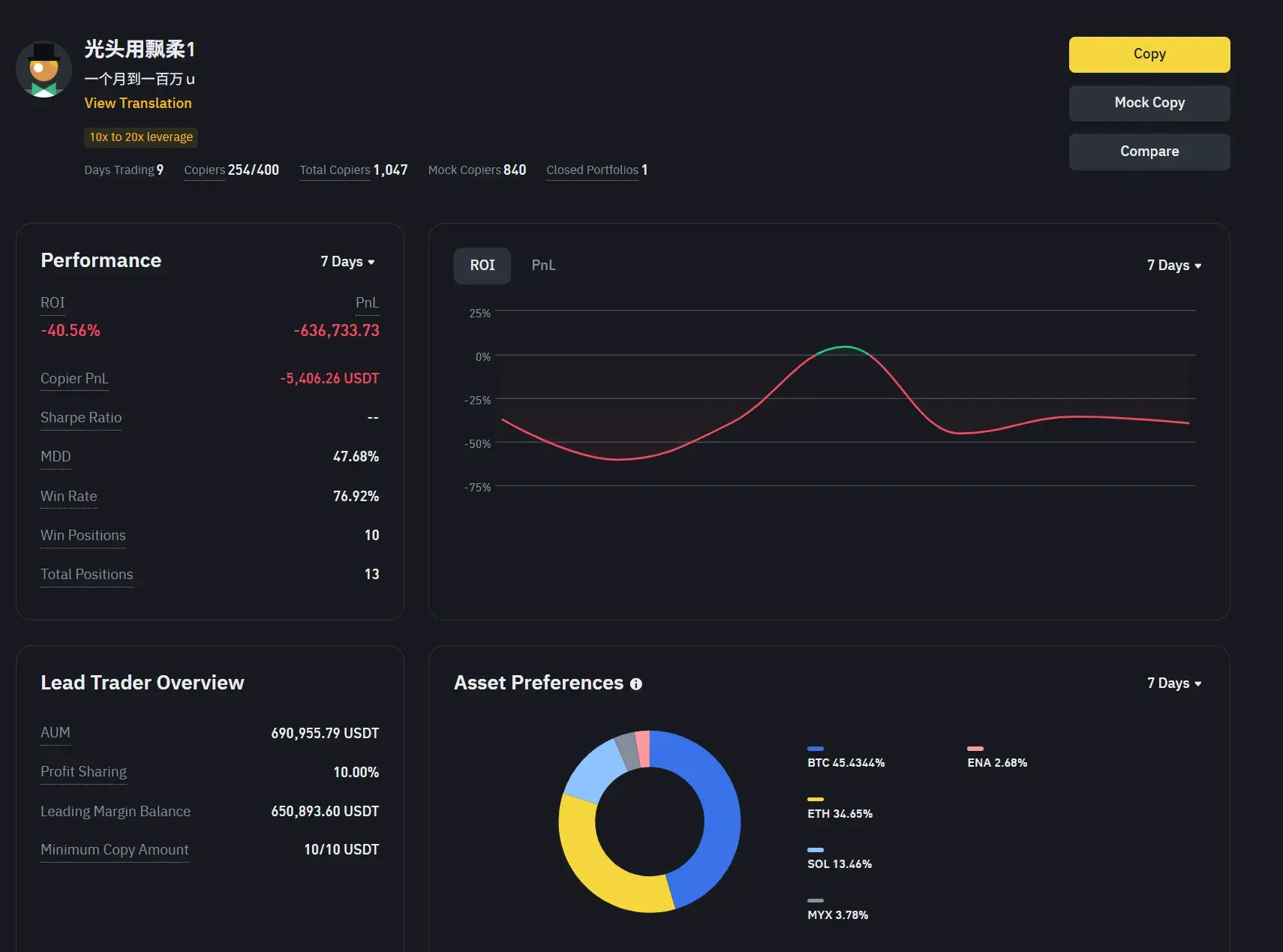

Data Source: Binance Copy Trader "Bald Head Using Rejoice 1" Copy Trading Details

In stark contrast to the successful trader, another copy trader faced a devastating blow in the MYX market. Data shows that he lost over 636,000 USDT in 7 days, with the vast majority of losses stemming from MYX trading.

Trading Data Analysis

Data Source: Wolfdao Copy Trading Analysis (https://insights.wolfdao.com/)

This trader's total realized profit and loss on MYX was -497,981.50 USDT. Although he had 63 trades on MYX with a win rate of 55.6%, which seems impressive, his dismal outcome reveals a harsh truth in trading: win rate does not equal profitability; the win-loss ratio is the key determinant of survival.

Data Source Statistics: Wolfdao Copy Trading Analysis (https://insights.wolfdao.com/)

Successful Bottom Building but Failed to Hold the Gains: He successfully went long at the low range of $0.41-$0.42 on August 5, accumulating profits of over 15,000 USDT. However, this success became a poison, amplifying his confidence and causing him to overlook subsequent risks.

Chasing Highs, Position Out of Control: When the MYX price skyrocketed to around $1.4, he completely lost his rationality. He executed three large long trades in succession, with single positions reaching as high as 265,000 MYX. This aggressive Martingale-style scaling and chasing behavior ultimately led to catastrophic consequences when the price reversed.

Fatal "No Stop-Loss": This trader's maximum single loss reached $265,784.86 USDT, nearly half of his total losses. This figure starkly contrasts with his maximum single profit of $10,491 USDT, resulting in a win-loss ratio as low as 1:18, which completely violates the basic principles of risk management. He failed to "hit the brakes" when losses expanded, instead attempting to "recover" through larger positions, ultimately being mercilessly devoured by the market.

3. Final Conclusion: The Essence of Trading is Not "How Much You Earn," but "How Long You Survive"

Data Source: Wolfdao Copy Trading Analysis (https://insights.wolfdao.com/)

Detailed Return Rate Comparison:

The starkly different fates of these two copy traders in the MYX market provide us with valuable lessons:

Trading is Risk Management, Not Profit Prediction: Successful traders prioritize risk control, protecting their principal through strict stop-loss and position management. In contrast, unsuccessful traders are blinded by "greed," equating high risk with high return, ultimately placing themselves in irretrievable situations.

Phased Strategy Adaptability is Crucial: Adopting different trading strategies in varying market environments is an essential skill for professional traders. At the bottom, one must dare to take large positions; at the top, caution is needed to take profits, or even reverse positions.

Emotional Control is a Trader's "Basic Skill": Successful trading is a meticulously planned campaign, with every decision made after careful consideration. In contrast, unsuccessful trading is often an emotionally driven gamble, propelled by fear and greed.

In the jungle of the crypto market, filled with temptations and traps, surviving longer is the key to becoming the ultimate winner. The essence of successful traders lies not in "how much they can earn," but in "how long they can survive."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。