_Author: _FinTax

Introduction

For a long time, Vietnam's legal classification of cryptocurrencies has been ambiguous, and tax policies have consequently fallen into a "gray area," leaving market participants shrouded in uncertainty. However, this situation underwent a significant change on June 14, 2025, when the National Assembly of Vietnam passed the Law on Digital Technology Industry, which for the first time incorporated crypto assets into the national legal framework and implemented clear classification regulations, officially granting them legal status and marking a milestone in the country's crypto asset regulatory process.

The new law categorizes digital assets into two types: "virtual assets" and "crypto assets," excluding financial instruments such as securities and digital fiat currencies, while granting the government the authority to formulate implementation details. It also emphasizes strengthening requirements for cybersecurity, anti-money laundering, and counter-terrorism financing. The law is set to take effect on January 1, 2026, with the core objective of improving the relevant legal system, aligning with international regulatory standards, and helping Vietnam exit the FATF gray list as soon as possible.

This article will attempt to analyze the restructuring effect of this legislative breakthrough on Vietnam's digital economy landscape, elucidate the latest dynamics and future trends of its tax system, and compare the evolution of the Vietnamese government's policies from cautious observation to actively building a regulatory framework, alongside practices in other representative countries in Southeast Asia and globally regarding cryptocurrency taxation and regulation. Additionally, it will look ahead to Vietnam's strategies in balancing risk prevention and innovative development, predict specific policies that may be introduced in the coming years, and assess the potential impact of these policies on Vietnam as an emerging digital economy.

1 Vietnam Clarifies the Legal Status of Crypto Assets

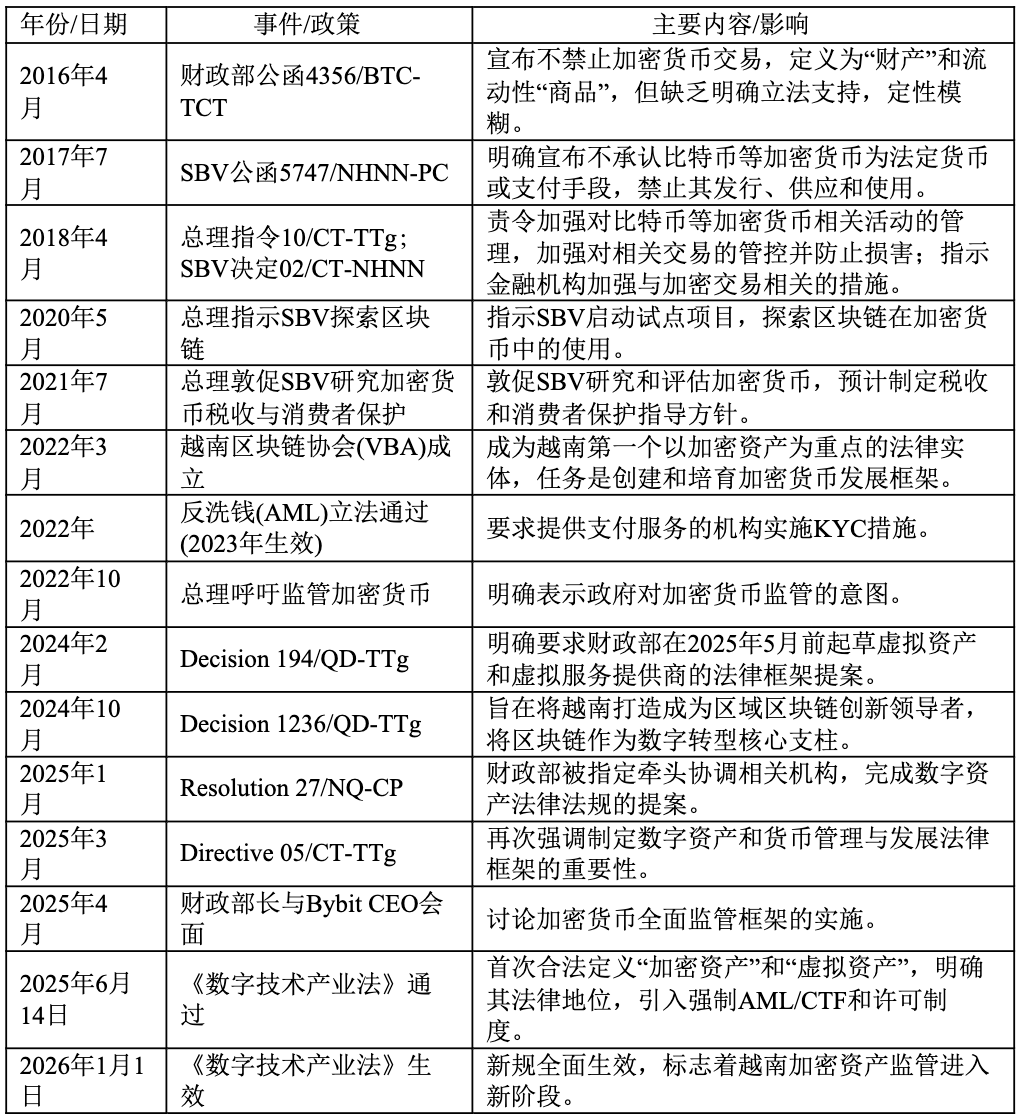

Before the enactment of the Law on Digital Technology Industry, Vietnam's legal classification of cryptocurrencies had remained in a state of ambiguity and constant evolution. Initially, the Vietnamese government's attitude towards cryptocurrencies was primarily reflected in strict restrictions on their use as a means of payment and risk warnings. For example, in a letter issued by the State Bank of Vietnam (SBV) in July 2017, it was clearly stated that cryptocurrencies such as Bitcoin and Litecoin are not recognized as legal tender or means of payment in Vietnam, and their issuance, supply, and use are explicitly prohibited, with violators facing administrative or criminal sanctions. Subsequently, in April 2018, the Prime Minister issued Directive 10/CT-TTg, requiring relevant departments such as the General Statistics Office, the Ministry of Finance, and the Ministry of Public Security to strengthen the management of cryptocurrency-related activities to enhance control over related transactions and prevent potential harm.

Although the Ministry of Finance announced in a letter in April 2016 that it would not prohibit cryptocurrency trading and defined it as "property" and a liquid "commodity," the lack of clear legislative support left this directive in an ambiguous position in practice, complicating compliance and enforcement related to crypto trading. Furthermore, according to Article 105.1 of Vietnam's 2015 Civil Code, which defines assets to include various items, currency, monetary instruments, and property rights, digital assets such as cryptocurrencies clearly do not fall into any of these categories, meaning that under current Vietnamese law, these assets are not considered physical assets. This lack of classification created a significant legal void, directly affecting the handling and regulatory approach to these assets within the legal framework.

However, this ambiguous state underwent a fundamental transformation on June 14, 2025. The National Assembly of Vietnam passed the landmark Law on Digital Technology Industry, which will officially take effect on January 1, 2026. This law clearly defines "digital assets" for the first time in the Vietnamese legal system and further categorizes them into "crypto assets" (secured by cryptography and blockchain technology) and "virtual assets" (primarily used for trading and investment, excluding securities, stablecoins, and central bank digital currencies). This legislative breakthrough ended years of uncertainty regarding the legal status of crypto assets in Vietnam, formally recognizing crypto assets as legal property under civil law, thereby providing a solid legal foundation for individuals and organizations to establish and exercise property rights legally.

This strategic shift from "non-recognition" to "legalization" is not coincidental, as the Vietnamese government has recognized the immense potential of the crypto economy. Despite regulatory obstacles, Vietnam has one of the highest cryptocurrency ownership rates globally, ranking fifth in the world, with approximately 20.95% of the population holding crypto assets and annual inflows exceeding $10 billion. At the same time, Vietnam faces the need to respond to international anti-money laundering (AML) and counter-terrorism financing (CTF) pressures, as it has been placed on the gray list by the Financial Action Task Force (FATF), requiring it to strengthen virtual asset management. Therefore, legalization is a necessary prerequisite for attracting investment, promoting digital economic development, and effectively regulating this emerging industry. This indicates that the Vietnamese government has shifted from mere risk prevention to actively embracing the opportunities brought by the digital economy, attempting to guide and regulate this emerging industry through the establishment of a sound legal framework rather than simply suppressing it.

2 Vietnam's Shift in Cryptocurrency Regulatory System

The shift in the Vietnamese government's attitude towards the legal classification of cryptocurrencies reflects a significant change in its regulatory system. In the past, Vietnam's crypto regulatory framework was characterized by inadequacies and passive responses, often employing a one-size-fits-all regulatory approach. However, with the rise of the global cryptocurrency wave and changes in Vietnam's leadership, the current cryptocurrency regulatory system is rapidly improving, having formed an initial division of regulatory responsibilities and actively advancing discussions and implementations of multiple regulatory pilot projects, striving to effectively address challenges such as AML and CFT while embracing new technologies.

2.1 Evolution of the Regulatory Framework

Vietnam's cryptocurrency regulatory framework has undergone a significant evolution from non-existence to active guidance.

From 2016 to 2022, Vietnam's cryptocurrency regulatory framework transitioned from non-existence to a phase of exploration and research.

In April 2016, the Ministry of Finance announced that it would not prohibit cryptocurrency trading, but its classification remained ambiguous. Subsequently, in July 2017, the SBV explicitly prohibited cryptocurrencies like Bitcoin as means of payment and emphasized their illegality. In April 2018, the Prime Minister issued directives to strengthen the management of cryptocurrency-related activities, while the SBV also instructed financial institutions to enhance measures related to crypto trading, reflecting the government's early cautious and risk-averse stance.

In May 2020, the Prime Minister instructed the SBV to initiate pilot projects exploring the use of blockchain in cryptocurrencies and to study and evaluate the pros and cons of cryptocurrencies. In March 2022, the Vietnam Blockchain Association (VBA) was established as the first legal entity focused on crypto assets in Vietnam, tasked with creating and nurturing a framework for cryptocurrency development. That same year, Vietnam passed anti-money laundering (AML) legislation, which took effect in 2023, requiring payment service providers to implement Know Your Customer (KYC) measures, marking an important step in its international compliance efforts. In October 2022, the Prime Minister again called for regulation of cryptocurrencies, indicating the government's urgent need for standardization in this field.

After 2023, especially following changes in Vietnam's leadership in 2024, the regulatory attitude towards cryptocurrencies gradually softened.

In February 2024, the Prime Minister issued Decision 194/QD-TTg, instructing the Ministry of Finance to draft a legal framework for virtual assets, clearly demonstrating the government's legislative determination. In October of the same year, the Prime Minister signed Decision 1236/QD-TTg, promulgating the National Strategy for Blockchain Technology Development and Application in Vietnam 2025, looking ahead to 2030, aiming to position Vietnam as a regional leader in blockchain innovation. This strategy clearly identifies blockchain as a core pillar of digital transformation and emphasizes "Made in Vietnam" blockchain platforms, indicating that the government views blockchain and digital assets as important driving forces for the country's digital economic development.

In June 2025, the Law on Digital Technology Industry was passed, establishing a tolerant and prudent regulatory framework through clear classification of digital assets (crypto assets, virtual assets), mandatory implementation of AML and CTF measures, the introduction of a licensing system, and incentives for emerging technologies such as artificial intelligence, semiconductors, and advanced computing, promoting broader digital economic development.

The maturation of the regulatory framework from "passive response" to "active guidance" is a key feature of Vietnam's policy evolution in the digital asset field. Early regulation of cryptocurrencies in Vietnam primarily focused on "prohibiting their use as a means of payment" and "risk warnings," reflecting a passive and preventive stance. However, in recent years, from the Prime Minister's directives for research and the establishment of the Blockchain Association to the promulgation of the Law on Digital Technology Industry and the national blockchain strategy, the regulatory focus has clearly shifted towards actively constructing a framework that incorporates crypto assets into the national digital economic development strategy. This marks a transition for Vietnam into a more mature and pragmatic stage of digital asset regulation, where the goal is no longer merely to control risks but to unleash innovation potential, attract domestic and foreign investment, and enhance its position in the global digital economy by establishing a clear and predictable legal environment.

2.2 Overview of Vietnam's Existing Regulatory Structure and Division of Responsibilities

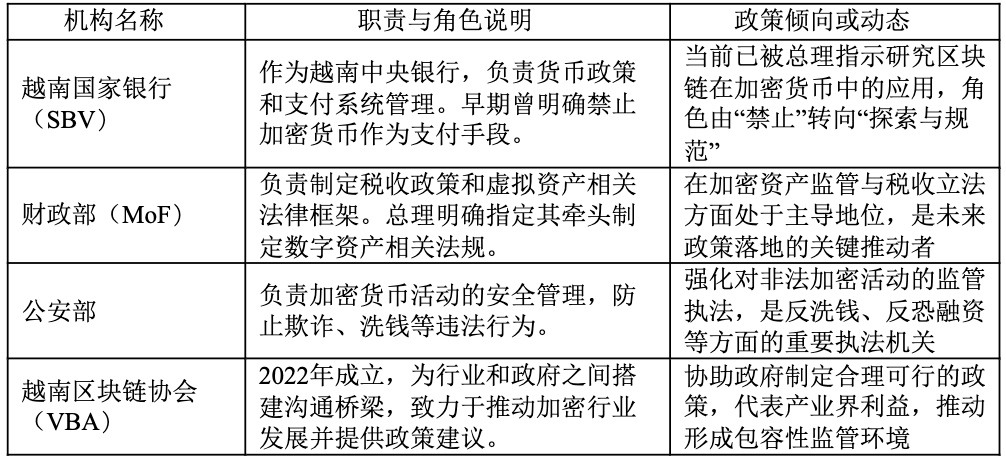

Vietnam's current cryptocurrency regulatory framework is primarily divided among various ministries, forming a "loose regulatory" pattern. Several key institutions, including the State Bank of Vietnam (SBV), the Ministry of Finance (MoF), the Ministry of Public Security, and the Vietnam Blockchain Association (VBA), collaborate to build and improve the regulatory framework, with specific divisions of responsibilities outlined in the table below.

2.3 Regulatory Sandbox Pilot Projects and Risk Compliance Construction in the New Normal

To explore innovative applications of digital assets under controllable risks, the Vietnamese government is actively introducing regulatory sandbox mechanisms and pilot projects.

The Vietnamese government is discussing the establishment of regional and international financial centers, with one key aspect being the introduction of controlled testing policies (sandboxes) for financial technology (Fintech), particularly for business models involving crypto assets and cryptocurrencies. This sandbox mechanism allows for small-scale testing of new financial technologies and business models in a controlled environment, enabling the assessment of potential risks and benefits before full-scale implementation. For example, Da Nang has been authorized to pilot a special mechanism, including a project for international tourists to make payments using stablecoins (USDT), seen as an important attempt to explore the application of digital payments in the tourism industry. These pilot projects aim to accumulate practical experience to provide data and basis for a more comprehensive regulatory framework in the future.

Additionally, Vietnam is actively exploring the development of a central bank digital currency (CBDC) — the digital dong. The Prime Minister has repeatedly called for the SBV to study the pros and cons of digital currencies and to initiate pilot cryptocurrency projects based on blockchain. Although the issuance of the digital dong is still in the evaluation stage, its potential legal status and complementary role to the traditional financial system are important components of Vietnam's digital economic development.

Of course, while promoting innovation in the regulatory framework, compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) remains a core focus for Vietnamese authorities, especially after being placed on the gray list by the Financial Action Task Force (FATF).

Vietnam is currently on the "increased monitoring list" (gray list) of the Financial Action Task Force (FATF), primarily due to its shortcomings in anti-money laundering practices related to cryptocurrencies. Being placed on the gray list indicates that the country has strategic deficiencies in combating money laundering and terrorist financing, which could affect its international financial reputation and ability to attract foreign investment. To be removed from the gray list, Vietnam must develop policies for managing virtual assets and strengthen relevant law enforcement.

The passage of the Law on Digital Technology Industry is a significant measure for Vietnam in response to FATF pressure. The law explicitly requires all digital asset activities to strictly implement anti-money laundering (AML) and counter-terrorism financing (CTF) measures to enhance security and transparency. This means that future cryptocurrency exchanges and related service providers must comply with global standards such as KYC and AML, and may be required to maintain compensation funds to protect users from cyberattacks, thereby reducing the risk of financial crime.

3 Vietnam's Cryptocurrency Tax Policy and Its Latest Developments

The evolution of Vietnam's cryptocurrency tax policy has almost coincided with its regulatory policies regarding cryptocurrencies. Initially, due to the ambiguous and contradictory classification of cryptocurrencies by Vietnamese authorities, the regulatory policies were broad and one-size-fits-all, making it unrealistic to impose taxes on cryptocurrencies. However, the rapid expansion of cryptocurrency trading volumes forced the government to confront its legal status, compelling Vietnamese authorities to study cryptocurrencies. Particularly entering 2024, the government has shown a stronger urgency in establishing a clear legal framework.

3.1 Current Tax Ambiguity in Cryptocurrency Trading in Vietnam

For a long time, due to the lack of clear legal definitions and regulatory frameworks, cryptocurrency trading in Vietnam has remained in a tax ambiguity. As mentioned above, the Ministry of Finance's letter 4356/BTC-TCT in 2016, while not prohibiting cryptocurrency trading and defining it as "property" and "goods," did not address specific tax regulations. Furthermore, the State Bank of Vietnam (SBV) in its letter 5747/NHNN-PC in 2017 also explicitly stated that it does not recognize cryptocurrencies like Bitcoin as means of payment, further exacerbating legal uncertainty and making it difficult for tax authorities to effectively tax cryptocurrency activities. Additionally, Vietnam's 2015 Civil Code does not include digital assets in its definition of property, creating significant obstacles for the taxation of cryptocurrencies.

In contrast to Vietnam's clear stock trading tax system, activities in the cryptocurrency sector have long been exempt from tax obligations. This situation has made Vietnam a de facto "tax haven" in the crypto space, attracting a large number of crypto investors but also leading to a significant tax gap for the government.

3.2 New Regulations Outline a Legal Framework for Cryptocurrency Taxation

The Law on Digital Technology Industry, which will officially take effect on January 1, 2026, marks a key step for Vietnam in terms of cryptocurrency tax policy. Although it does not directly enact a cryptocurrency tax law, it lays the legal foundation for future taxation. While excluding securities, stablecoins, and central bank digital currencies (CBDCs), this new law for the first time clearly defines "crypto assets" and "virtual assets" at the legal level. This landmark definition changes the previously ambiguous legal status of cryptocurrencies in Vietnam, making it likely to be regarded as legal property.

Against this backdrop, the Ministry of Finance is finalizing a draft resolution regarding a pilot program for the issuance and trading of cryptocurrencies. This pilot will assess the feasibility of applying value-added tax (VAT), corporate income tax (CIT), and personal income tax (PIT) to cryptocurrency asset trading. The pilot program will be conducted on a small scale and closely monitored by national regulatory agencies to study how to determine the income from crypto assets, thereby establishing transparent regulations to avoid budget losses and protect investor rights.

Regarding the proposed tax rates, various discussions are currently underway. One suggestion proposes a 0.1% transaction tax on crypto trading, similar to stock trading, which is considered to generate substantial revenue without overly suppressing market vitality. If cryptocurrencies are classified as investment assets, trading profits may be subject to capital gains tax similar to stocks or real estate. For businesses engaged in cryptocurrency trading, a standard corporate income tax of 20% may be required. Additionally, there are suggestions to impose a personal income tax of 5-10% on profits from non-fungible tokens, and a withdrawal fee of 1-5% on profits for foreign investors, while considering a 10% corporate income tax incentive for pilot exchanges (for the first five years) and exempting digital asset trading from VAT to promote liquidity.

4 Outlook on Vietnam's Cryptocurrency Policy

The attitude of Vietnamese authorities towards crypto assets has undergone a significant shift from early caution and restrictions to current active exploration and regulation. This transformation reflects a pragmatic balance between controlling financial risks (such as money laundering and fraud) and seizing opportunities for digital economic development. Authorities may have recognized that simply banning or ignoring crypto assets would lead to a brain drain and capital flight, missing the opportunity to secure a place in the global digital economy wave. In fact, Vietnamese authorities have included blockchain technology, digital assets, and cryptocurrencies in the national strategic technology list, alongside cloud computing and artificial intelligence. This indirectly indicates that Vietnam views digital assets as key elements in driving national digital transformation and economic growth.

Based on current development trends and clear signals from the government, it is reasonable to believe that the future direction of Vietnam's cryptocurrency policy will continue to exhibit characteristics of "inclusive prudence." Specifically, the following predictions can be made regarding the future direction of Vietnam's cryptocurrency policy:

First, more regulatory details will be introduced and enforced. With the enactment of the Law on Digital Technology Industry, more supporting regulations and guidelines will be issued to clarify licensing requirements, operational standards, consumer protection measures, etc., for crypto asset service providers. Regulatory sandboxes will continue to play a role, providing a controlled testing environment for new business models and technologies to accumulate experience and refine the long-term regulatory framework, ensuring innovation occurs under manageable risks.

Second, the tax framework will gradually improve and be implemented. It is expected that after the Law on Digital Technology Industry takes effect, the Ministry of Finance will accelerate the introduction of specific tax details, clarifying the taxation methods, rates, and collection processes for various crypto activities. The successful experience of the e-commerce platform tax system is likely to be introduced to crypto trading platforms to enhance tax efficiency and compliance. Vietnam may also develop differentiated tax policies for different types of crypto activities and consider a combination of capital gains tax and turnover tax to achieve fairness and effectiveness in taxation.

Third, digital assets will gradually integrate with the traditional financial system. The Vietnamese government will continue to promote the integration of digital assets with the traditional financial system, such as exploring the development of crypto banks, national crypto exchanges, and stablecoins to build a more modern financial infrastructure.

In summary, Vietnam may become a model of "compliance innovation" in the Southeast Asian crypto economy, competing with Thailand and Malaysia in the Southeast Asian crypto market. Vietnam has a large base of crypto users and a relatively clear digital economic development strategy. The recently passed Law on Digital Technology Industry and the ongoing tax pilot programs and sandbox mechanisms indicate that it is transitioning from a "gray area" to "clear regulations." This transformation will enable it to stand out in Southeast Asia as a market that embraces innovation while ensuring compliance. Vietnam's experience may provide a viable template for other emerging markets and developing countries on how to gradually establish a sound regulatory and tax system for crypto assets without stifling innovation, thereby transforming the potential of the crypto market into a driving force for national economic growth.

Click to learn about job openings at ChainCatcher

Recommended Reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。