From the perspective of mNAV, which is worth buying, $SBET or $BNMR?

Recently, with the rise in $ETH prices, both of these U.S. stocks as strategic reserves have been reported by many friends, and both stocks have experienced increases of several times followed by declines of several times. So, are these two stocks still worth buying?

The main reasons for the decline of SBET and BNMR were basically ATM (simply understood as issuing more shares to sell) and mNAV (simply understood as the premium rate of the stock). Both of these reasons for decline were previously experienced by $MSTR. The significant drop of MSTR after it rose to $543 was largely due to the high premium rate of ATM + mNAV.

According to MSTR's approach, as long as mNAV is not excessively high, for investors, it is like a leveraged $BTC. Holding MSTR is equivalent to going long on BTC, and since MSTR is the only legitimate "Bitcoin" in U.S. stocks, as long as the price of BTC rises, MSTR's performance should not be too poor.

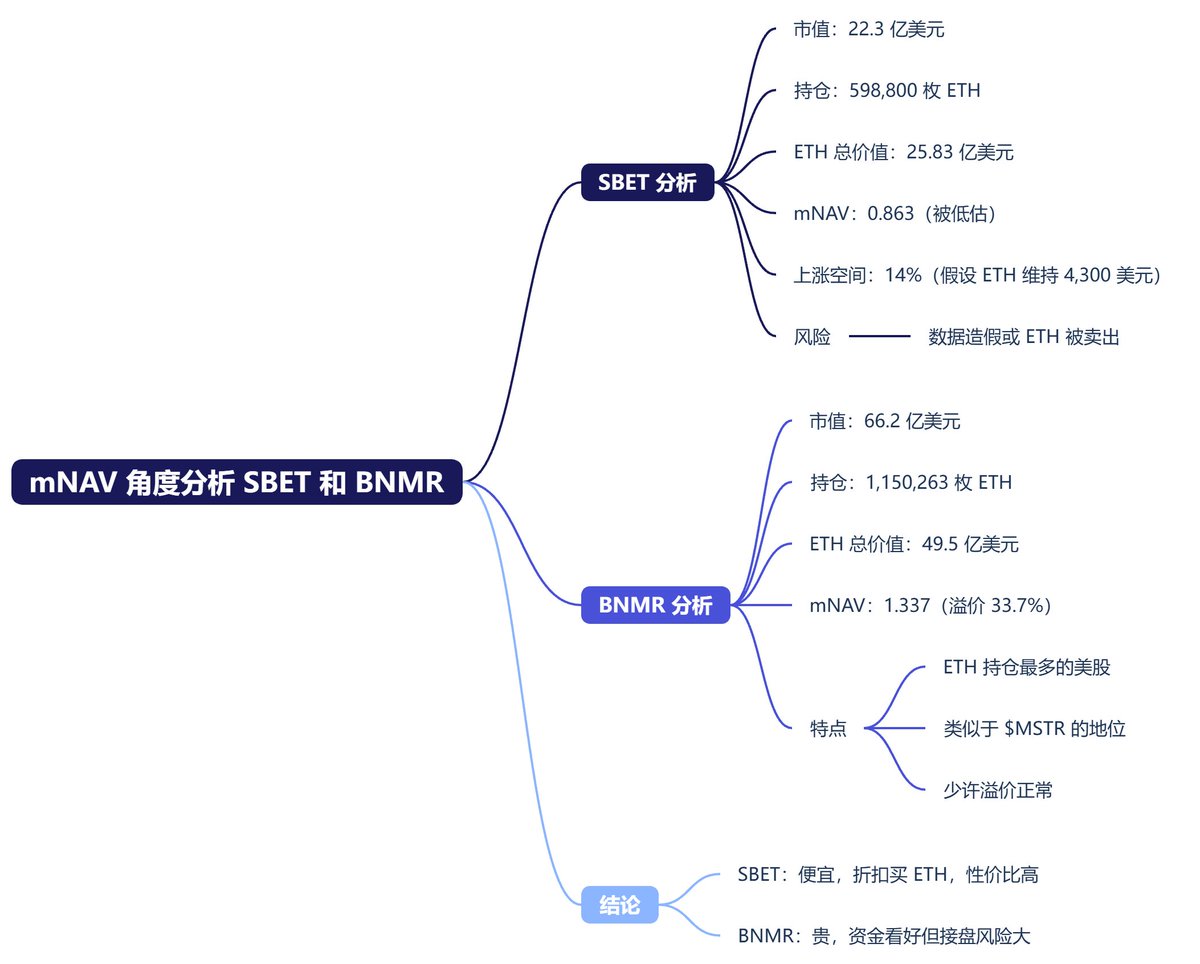

From the current mNAV of SBET, as of today, SBET's market value is $2.23 billion, holding 598,800 ETH. Based on the current price, this amounts to $2.583 billion, meaning SBET's mNAV is less than 1, at only 0.863. This indicates that SBET's total value is lower than the total value of the ETH it holds, which can be understood as SBET being undervalued.

Of course, this is only part of the understanding. If SBET falsifies data or sells part of its ETH, that would be another matter. So, based on the current data, if the price of ETH maintains at $4,300, SBET should have a 14% upside potential.

Remember, the premise is that if the price of ETH remains at $4,300, SBET's market value equaling the total value of the ETH it holds is within a normal range.

Using the same method, let's look at BNMR. BNMR's total market value is $6.62 billion, holding 1,150,263 ETH, with a total value of $4.95 billion. This indicates that BNMR's total market value is higher than the total value of the ETH it holds, resulting in an mNAV of 1.337. Theoretically, if BNMR has no other business, its market value is somewhat high, exceeding by 33.7%.

Of course, this cannot be calculated directly, as BNMR currently holds the most ETH among U.S. stocks. Its position is similar to MSTR, both being leaders in the crypto stock sector, so a slight premium is also normal.

So my personal view is:

SBET falling below net asset value is an opportunity for me to buy ETH at a discount, approximately a 14% discount, which is equivalent to buying ETH at $3,700 when the current price is $4,300, making it a good value.

BNMR has a 1.33 times premium, indicating that funds are very optimistic about BNMR as a leading asset, but the higher the premium, the greater the risk of taking over.

In simple terms, SBET is cheap, and BNMR is expensive. If you want to pick up a bargain, look at SBET; if you want to gamble on sentiment, look at BNMR.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。