Tom Lee's involvement with $BNMR has raised the stock issuance limit (ATM) to $24.5 billion, with plans to raise an additional $20 billion, all to be used for purchasing $ETH. Currently, it holds the largest ETH position among publicly listed companies globally (1,150,263 coins), with a goal of owning 5% of the total ETH supply.

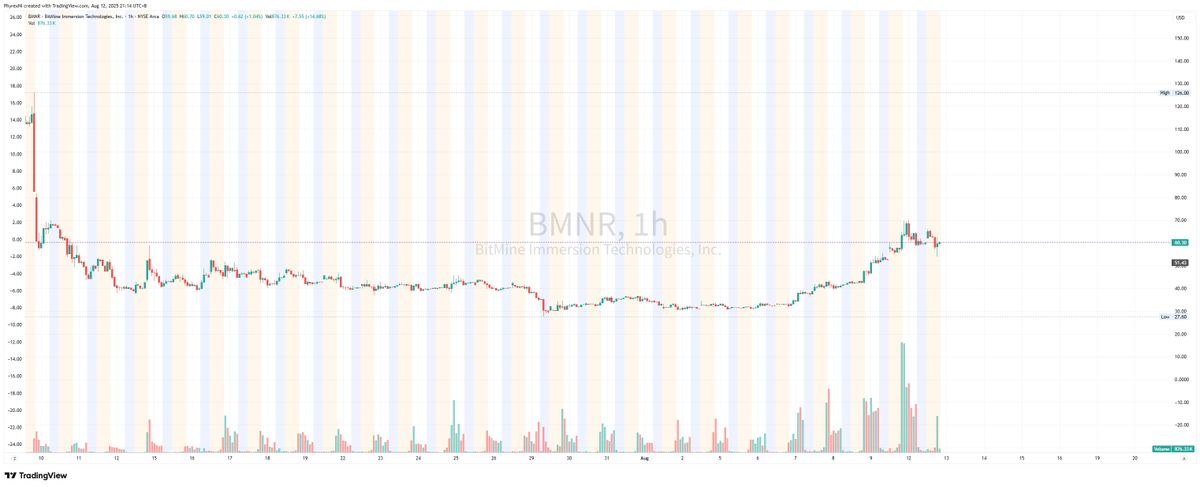

This is positive for ETH as it represents a significant potential buying demand, but it is somewhat unfriendly to BNMR shareholders. The pre-market stock price has already slightly declined. Referring to the experience of MSTR, after a large-scale ATM, stock prices often revert to the adjusted mNAV, diluting the premium.

If it can return to a reasonable valuation (premium) range, as a leading stock in ETH, it remains one of the most favored targets in the market for capital.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。