Bitcoin ETF vs Ethereum Frenzy: Who’s Leading the Inflows Race?

Bitcoin ETFs Hit New Highs

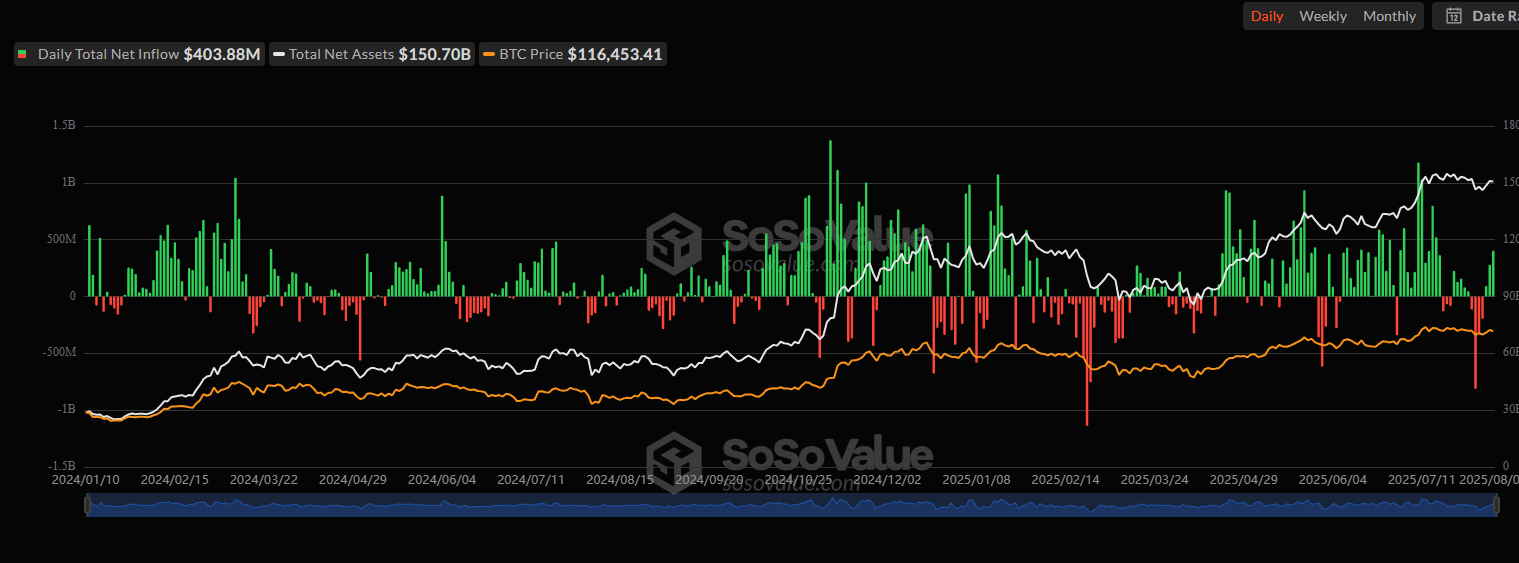

Bitcoin ETFs are making headlines as BTC currently trading at $121,199.38 which has increased by 2.58% in a day. This might be due to Institutional investors pouring $265M into Bitcoin ETFs by reversing recent outflows.

According to SoSoValue, as of August 8, 2025 it has shown an impressive net inflow of $403.88M with IBIT alone contributing the highest of $359.98M, Fidelity (FBTC) with $30.9M and Grayscale with $13.41M.

Source: SoSo Value

Whereas the BlackRock iShares Bitcoin Trust (IBIT) continues to dominate the Bitcoin ETFs list by signalling a robust performance. With a cumulative flow of $57.79B , a daily volume of 29.12 million and a market price of $66.13.

The total asset of s pot is $150.70B which is 6.48% of asset Market Cap.

Ethereum Experience Strong Growth

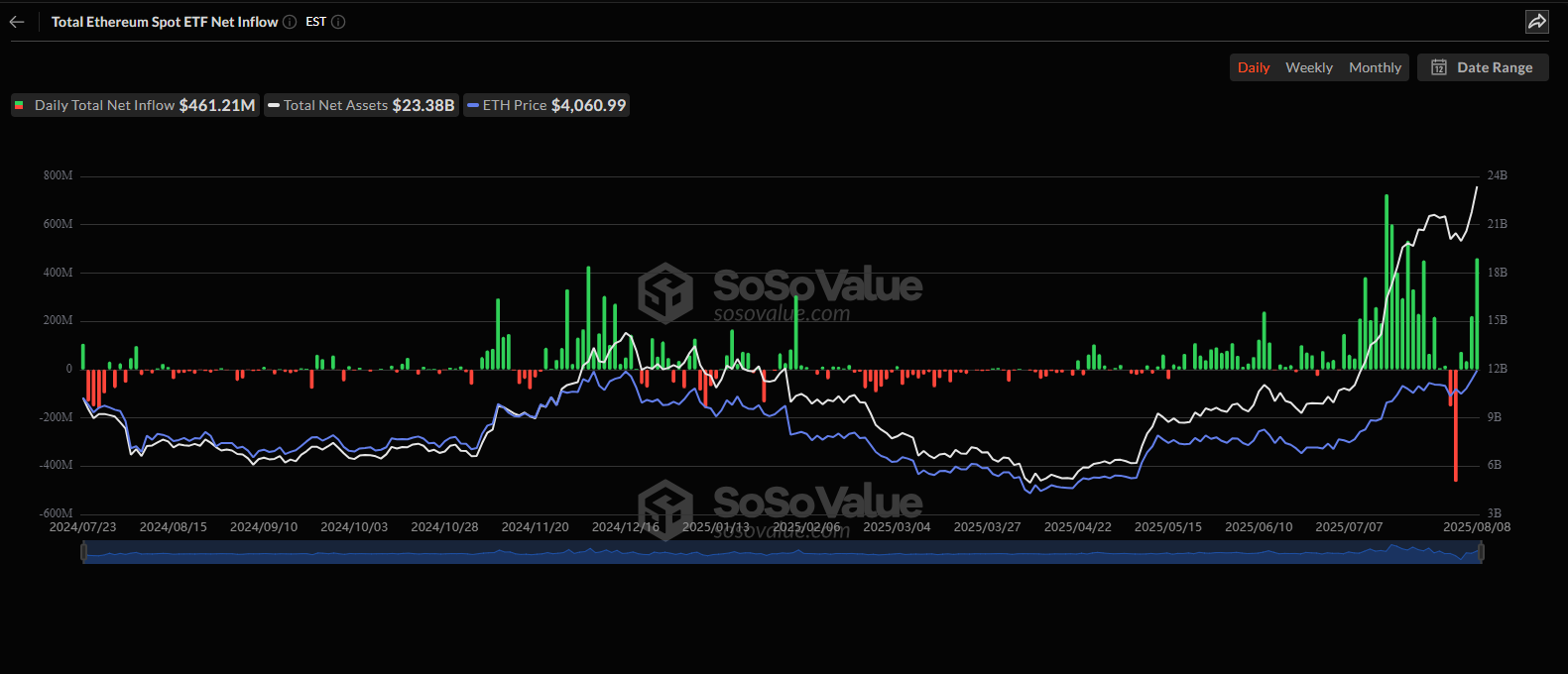

On the same day, Ethereum spot recorded an incredible overall flow of $461.21 million with total net asset of $23.38B and currently it is trading at $4,255.27, near its all-time high price, and is due to continuous buying and ETH accumulation by the big institutions.

Source: SoSo Value

The BlackRock (ETHA) led the charge with a single day inflow on August 8, 2025 of $254.73, Fidelity (ETHE) with $132.35 millions and Grayscale (ETH) with overall flow in one day of $38.25 million.

The iShares Ethereum Trust (ETHA) has a cumulative flow of $9.85 billion, market price at $30.79 and a daily volume of 54.73 millions.

Ethereum ETFs Gaining Momentum, Outpacing BTC

According to the data of SoSo Value, the weekly comparison of both asset shows a regular inflow since the last 4-5 weeks whereas Bitcoin ETF is showing inflows and outflows simultaneously.

This could lead the investors confidence towards ETH more as the price is rising continuously . Comparing data of the past 6 weeks then on July 3, 2025 the overall net of ETH was $219.19 million and current value of it is $326.83 millions. That signals a huge rise of $107.64.

On the other hand the overall Inflow of BTC ETF on July 3, 2025 was $769.60 millions and the current net value is $246.75 millions, which is a huge downfall of around $522.85.

This could lead to the investor’s interest towards ETH as it is giving a positive signal for the users to keep their asset secure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。