The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

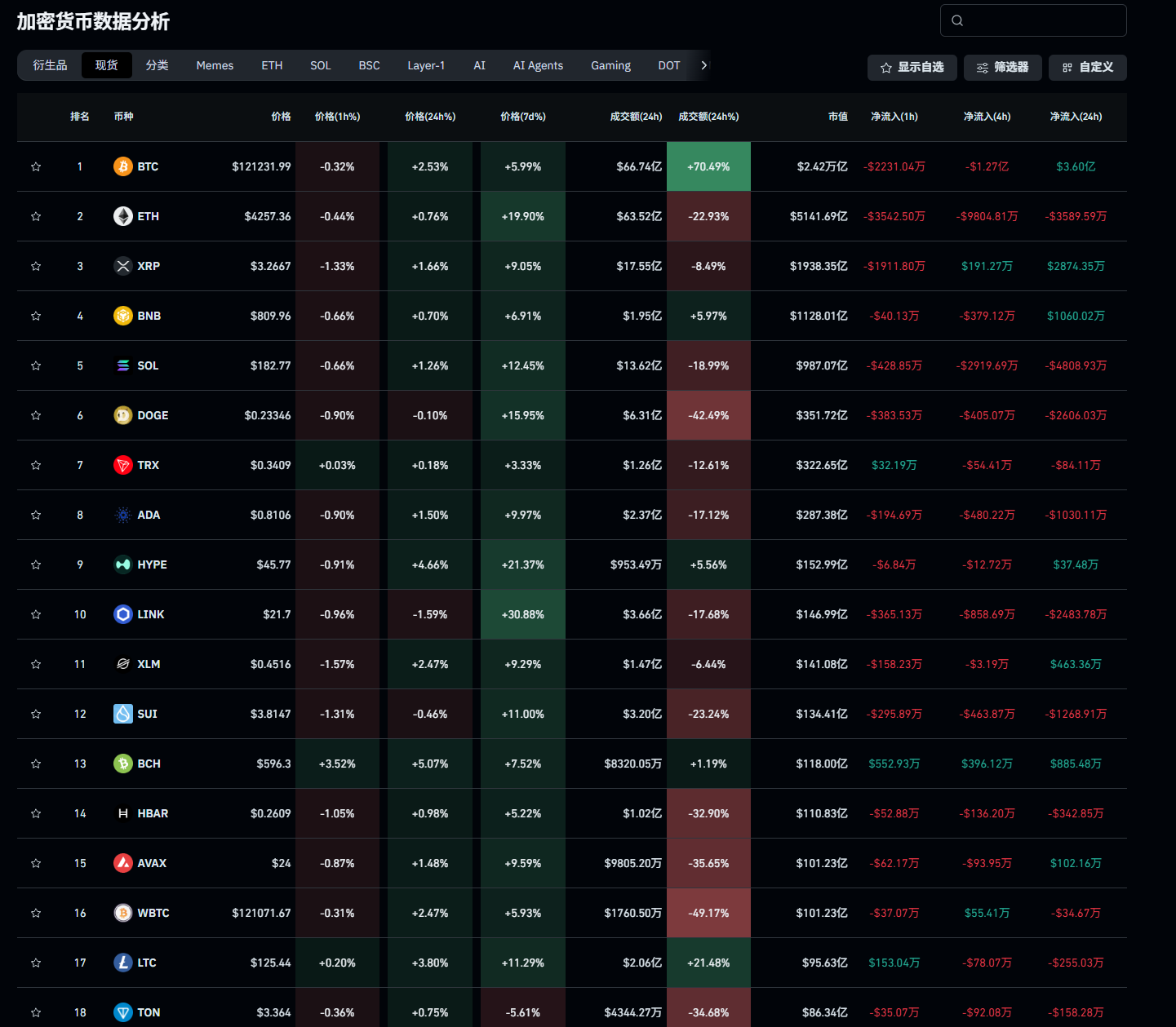

The market continues to rise, and analysis has little significance now. Some friends still say that the bull market has not yet arrived, and at this stage, it can only be said that their understanding is shallow. The meeting for interest rate cuts is getting closer, and I hope everyone can be more conservative. Since Ethereum hit a new low on April 9, I have been advising everyone to focus on long positions and prepare for the bull market. As of now, it has been a full four months, rising from the 1384 position to over 4300. If you still want to enter the market at this stage, I cannot be sure whether you are truly in the game. The best time is always before the bull market starts, and now we can only look at the timing of the next phase. For cryptocurrencies like Bitcoin and Ethereum, I do not recommend holding large amounts. Even though both still have a third of growth potential, the capital requirement is too high, and the risk is also considerable. At this stage, entering these two types of cryptocurrencies is not a good strategy; one should seek growth opportunities in smaller coins.

Of course, the trends of these two types of cryptocurrencies are undoubtedly very stable for contract users. As long as you operate with a bullish trend, you are unlikely to incur losses; spot users can simply give up. If you seek stability, BNB might be a better choice. Many institutions are pouring into the Ethereum market, with holdings reaching 3.5 billion dollars, a tenfold increase compared to earlier. This is thanks to the use of stablecoin channels. Additionally, yesterday's news reported that Harvard has already entered the cryptocurrency space, and a significant proportion of American pensions will also be involved in the cryptocurrency market. It seems that the cryptocurrency space is entering a bull market phase. Often, one may be in a bull market without realizing it. You can also compare with coins that have not seen significant growth; DOGE has shown a very strong upward trend this time. Some users feel that my previous bearish stance was biased. I just want to say that we should compare with products from the same period; such coins have no competitiveness during a bull market. If you could have chosen Ethereum or SOL at the beginning of the year, your funds might have already warmed up, and dealing with them early would have been the best strategy.

Many friends do not understand Bitcoin's continuous growth, and every wave of Bitcoin's rise inevitably causes panic in Ethereum. If you observe patiently, it is not difficult to find that this worry is somewhat unfounded. The rise of Bitcoin itself is a way to absorb chips in the market. Looking further ahead, it is generally the case that when Bitcoin starts to rise, smaller coins will experience a short-term pullback before Ethereum explodes. The timing for the bull market to start is no longer Bitcoin playing the vanguard role; under the changing dynamics, Ethereum has already sounded the charge. This can also serve as a signal for you to judge the market; as long as Bitcoin continues to grow, it proves that this trend will continue. It is impossible for Bitcoin and Ethereum to show opposite trends. Bitcoin's surge is mostly during the Asian and European trading hours, while Ethereum is driven by the American market. The distribution of these two giants does not belong to one person.

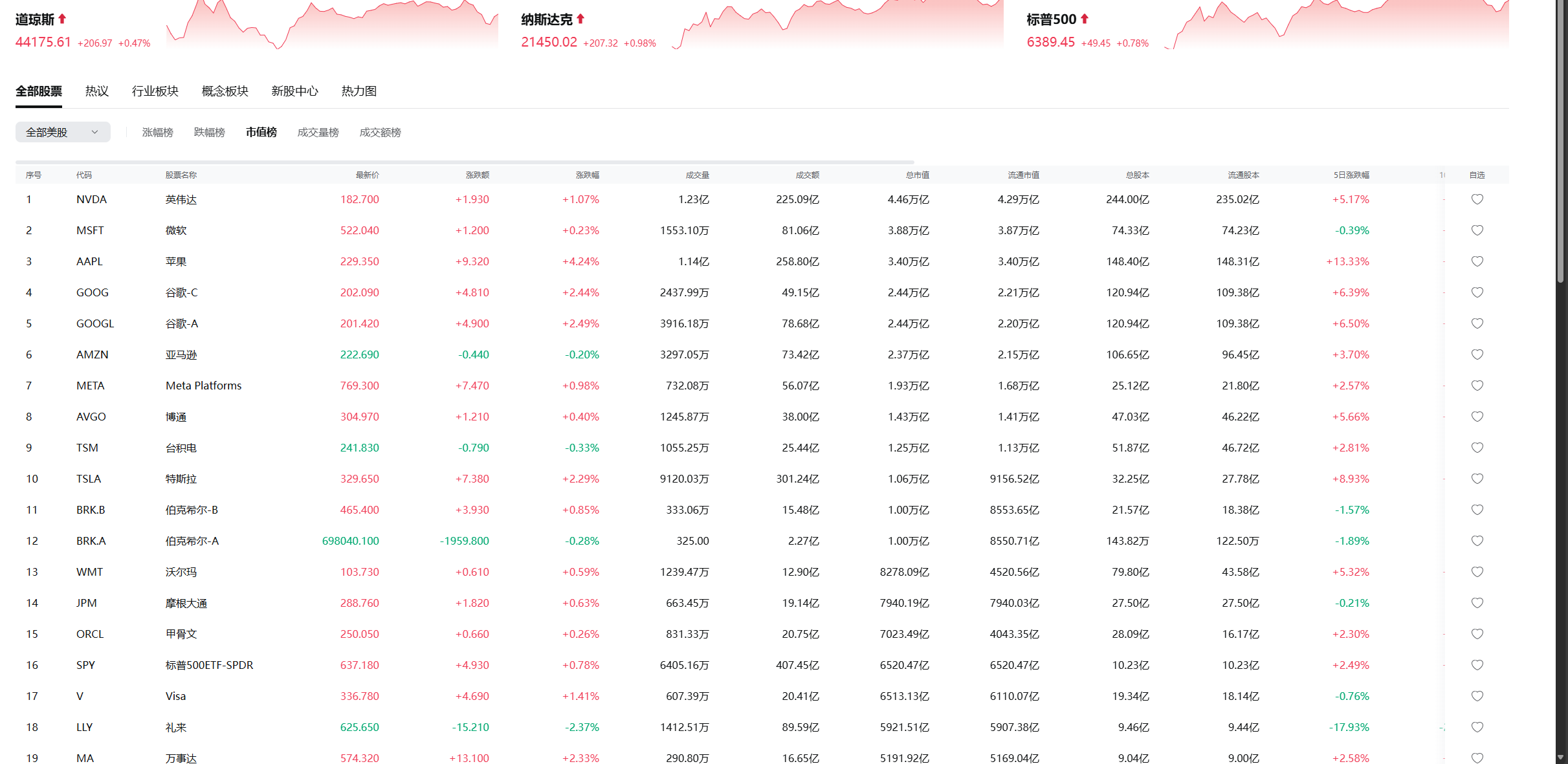

You need to correctly understand the bull market. The pullback after a surge is meant to clear out supporters who do not belong to the cryptocurrency space. Therefore, the trend of the cryptocurrency market this year cannot be compared to last year. A simple way to understand is that after Trump took office last year, Bitcoin had a daily growth potential of over ten thousand points, while this year can only be said to continue last year's trend. The retail investors entering the market are not the same batch of users; it is just that newcomers highlight the greatness of the cryptocurrency space. This includes the performance of the US stock market, especially at the beginning of the year when I suggested everyone target Nvidia and other computing power stocks, which have now doubled. The performance of the US stock market makes me extremely worried. This trend has already transcended our control; undoubtedly, the future pinnacle of technology may indeed be led by Nvidia. It can be said that the cryptocurrency space has made a significant contribution to Nvidia. As long as the cryptocurrency space is in a bull market phase, Nvidia's growth will not slow down. The US stock market is almost linked to the cryptocurrency space at this stage, which is also an indicator you need to reference.

The total market value of the cryptocurrency space has once again surpassed 4 trillion. Many analyses are summarizing the end of this round of the bull market, while my views are almost contrary to most analysts. If you have not entered the market in spot trading, you should now seize the short-term trends. For contracts, you can consider entering long positions with light positions. Holding in spot trading is no longer the first choice; the current price is somewhat too high. During the bull market phase, do not always think about the end of the bull market. This year's bull market will not easily start a downward trend. If there is no pullback throughout August, it can only indicate that the bull market will continue. The stablecoin side has not yet truly exerted its strength, including the upcoming interest rate cuts and the listing of smaller coins. After a series of measures appear, it will still push up the market value of the cryptocurrency space. Global funds are almost still competing in the dollar-pegged market. Do not easily give up the chips in your hands; looking back at the end of the year, the current market situation may still be considered this year's low point.

Nvidia still has room for growth, along with AMD. For those interested in US stocks, you can selectively hold some of these two; their growth this year is unlikely to be weaker than that of the cryptocurrency space. Regarding the cryptocurrencies available for selection, I have already provided them to you. Among them, Ethereum's upward trend will at least return to a trillion market value, and I estimate that SOL will reach at least 500 billion in market value. Both of these still have a long way to go. To avoid misunderstandings, you should be clear that due to mechanism limitations, achieving this market value may not only be linked to the unit price. Due to its special over-issuance system, perhaps an increase in quantity can achieve such an accomplishment. Do not expect the unit price to be too high; reaching your expectations means you can exit directly. The outflow data from interest rate cuts will definitely be greater than the current capital volume. For those who have fantasies about DOGE, you can still make a profit; just do not use previous trends as a basis for judgment.

In summary, looking at the overall trend, everyone currently surviving in the market can achieve certain gains. There is not much to analyze regarding trends and points at the moment. My role at this stage can only provide you with mental encouragement. If you miss this bull market, it will be almost impossible to enter spot trading later; you can only look at some valuable coins that have not yet surged, mainly SOL. As for the market after the interest rate cuts, you do not need to think too much. As long as you are making a profit at this stage, there is no need to look too far ahead; being profitable is enough. If you are in the spot market, there is no need to enter contracts. Do not easily believe the bears; the downward trend will not open at this stage. Even if there is a downward trend, it cannot last for two weeks. As long as there is a decline, you should actively enter the market. Regarding the upper limit point, you do not need to consider it; just remember one thing: there will be no high points before the interest rate cuts, and there will be a surge after the interest rate cuts. If there are users who are still stuck or in loss, turn back as soon as possible, and do not go against the market. If there are still places you do not understand, feel free to message me directly, and I will still reply to everyone!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。