The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

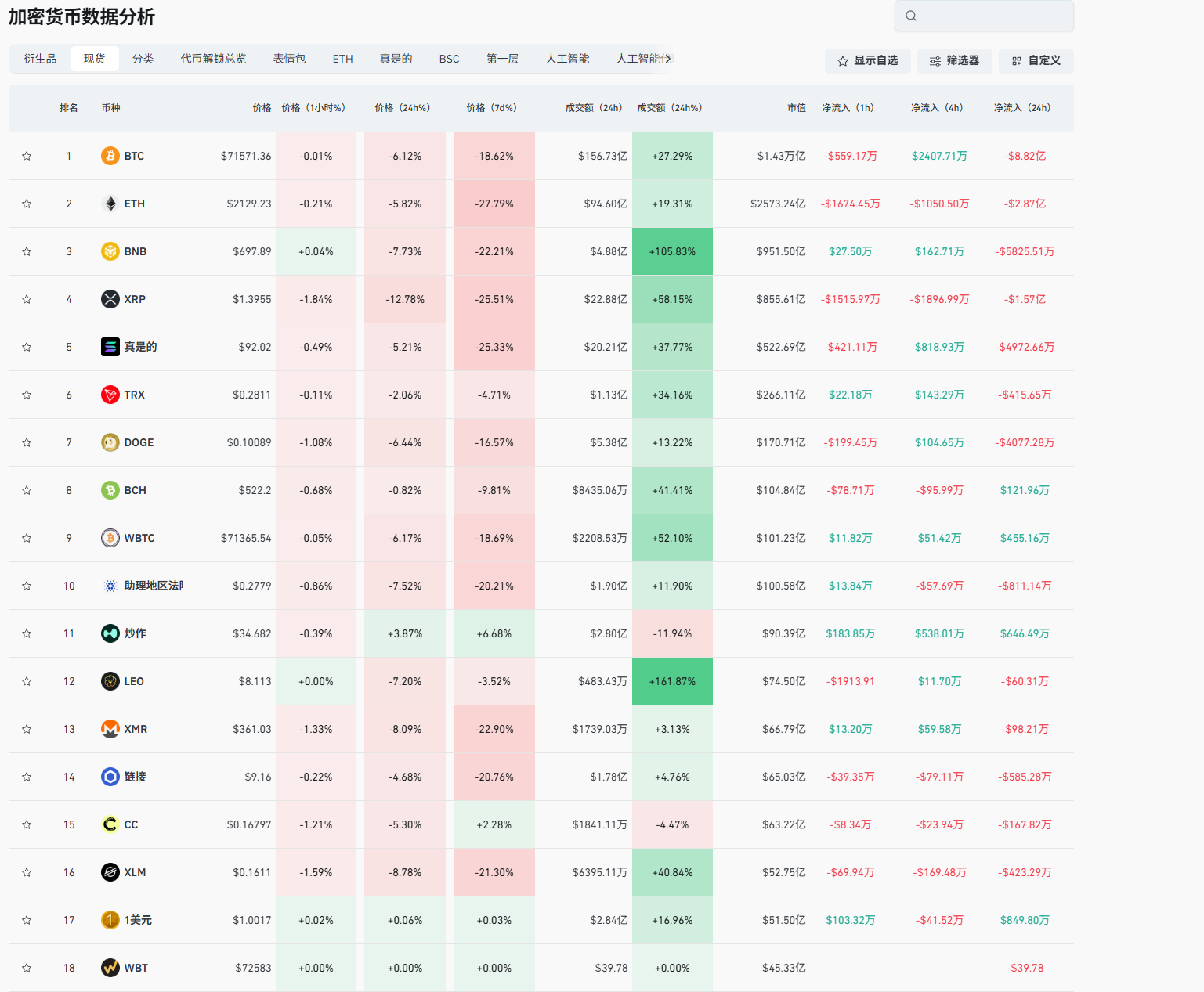

Recently, I have been very busy. Whether it is spot users or contract users, they have been frequently communicating with me, both online and offline, making it quite chaotic. This has also led to many of my viewpoints not being communicated in a timely manner. The recent question is simply about where the low point is. To be frank, I cannot predict this low point; I only know that in the short term, it will still fall, and to stop this fall, at least a rapid spike is needed. Many friends have complained to me, knowing the downward situation, why the take-profit for short positions is basically at key points. For Bitcoin, it is generally a take-profit of 2000-3000 points, while a downward trend of over 10,000 points can only yield 6000 points? I have never been optimistic about the downward trend and am also a believer in the bull market of 2026. This round of decline is essentially a collaboration between giants and platforms, coupled with the visible issues you see. The liquidation of Yili Hua also occurred in the Ethereum 1800-1900 range, which seems to be aimed at it.

Such liquidations of whales will inevitably cause panic in the market. Many friends predict new lows here, but in fact, this liquidation effect will last at least 300-500 points. This is what we call, a strong spike must occur for a rebound; the market makers cannot hold on. At this point, some friends may start to wonder, where do the coins that are being dumped come from? I have talked so much about market makers and giants not flowing out; why is the coin price still going lower? This clue is also extremely clear; it is retail investors like me who, after purchasing coins, start to stake. The collaboration between wallet companies and platform companies must also have the shadow of BlackRock behind it. Under the costless dumping, it will cause the coin price to fall. Once the coin price falls, the platform can repurchase the coins to achieve returns for everyone, forming a complete industrial chain. The more users stake, the harder it is to predict the bottom space.

Especially at this stage, with no positive news released, even a rebound is worrisome; whether I comfort you or not, I hope to give everyone confidence. The price in the coin circle is basically close to the bottom position. For those who are shorting, be sure to set a good take-profit position and do not gamble on new low prices. The House of Representatives has approved the funding bill to end the government shutdown, and this news is also very important. The American shutdown has led to delays in the release of various data, which is also the source of the lack of positive news. For the coin circle to rise, the core is still the positive news from the American side, and many users see that Trump will sign the cryptocurrency market structure bill as positive news. This conclusion is somewhat hasty; from my understanding, it is probably not positive but more like a layer of confinement for the liquidity of the coin circle, which is not conducive to circulation. In the long run, it is likely to be a negative message.

Let me give you some information. I have been monitoring on-chain data for almost half a year; recently, BlackRock's operations have triggered my multiple bullish sentiments. The signals given to me are very clear; this is not a test but a layout. After seeing BlackRock's operations, I am very confident that by the end of 2026, we will at least touch the previous new highs. On-chain data cannot deceive people. In a recent operation, BlackRock deposited over 1,100 Bitcoins and 35,000 Ethers into Coinbase at once, which, at current prices, directly injects 170 million USD. Their released hints indicate that they will continue to increase their positions, clearly stating it is not a sell signal but a buy signal. This is no longer a gradual accumulation signal; it is a clear entry signal. The release of this news does not mean for everyone to bottom-fish in contracts; it must be a long-term hold. Many friends take my articles as an opportunity to enter contracts, which will definitely lead to losses.

Since tracking on-chain data, everyone should be clear that once Yili Hua's long positions are liquidated, MicroStrategy's holdings will inevitably be impacted; MicroStrategy has incurred losses of tens of billions of USD since Bitcoin's peak, and its stock has also plummeted. The choice they face now is also very important; it can be said that the cycle of the two is extremely terrifying. To save the stock market, they must sell Bitcoin, but selling Bitcoin will inevitably cause the coin price to fall, and the stock price will continue to decline. Should they neglect the stock market or abandon the Bitcoin market? This choice is very likely to cause a collapse in the coin price; it is crucial because MicroStrategy's collapse will definitely lead to a collapse in the coin market, which is more intuitive than Yili Hua. My theory is also very straightforward; when value surpasses previous perceptions, the questions we investors need to consider are not whether the market will start again or whether new highs will appear, but how the market proves it deserves this price.

This statement, since Nvidia set a historical personal company high with a market value of 500 billion, reminds us of Bitcoin's 300 billion market value, both facing the same problem. The decline of Bitcoin has already given everyone the answer, which is that it currently does not have the capacity to bear such a huge value. The price decline makes it reasonable for everyone to sing the blues about the coin circle, but it does not mean that Bitcoin will not have another bull market. The definition is too hasty; the arrival of a bull market will definitely require other markets to be sluggish. Gold, silver, and heavy metals have all shown significant corrections, including the US stock market, which has finally not continued its previous offensive trend. The outflow of funds has finally shown a side of calm thinking. The upcoming test is simply whether they will choose to enter the coin circle? And to get a definite answer, the coin circle must prove that it can accommodate more capital inflows. For the cryptocurrency market, giants are more willing to choose the stablecoin market, especially companies related to foreign trade.

In summary, the current coin price does not have any bullish news flowing out, but the entire market in February will not be more terrifying than the previous downward market. Many friends have also overlooked that Bitcoin's new high in January was above 97,000, and February, referencing January's high, seems far away. This downward trend may continue for a while; I have already given you the signals for a rebound and the overall structure. There must be a strong spike signal; otherwise, the continued downward trend will not change anything. In the last article, I made it very clear that what everyone needs to do now is to short, especially in small coin contracts, as the short profits will definitely be greater than going long. At this stage, for Bitcoin, maintaining short profits at 2000-3000 points is the most stable, while small coins, including Ethereum, have uncontrollable new lows. For those who have shorting ideas, small coins are more worth choosing. For those who are not familiar, just replenish your spot and directly stake, waiting for half a year to a year, and you will likely be able to take out profits that will not be too low. Everyone must go with the trend; going against it is not advisable.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and plans for the big picture, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short, only competing for short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。