Original|Odaily Pionex Daily(@OdailyChina)

Author|Wenser(@wenser 2010)

This morning, the price of BTC briefly surpassed $122,000, and Bitcoin has also jumped to become the 6th largest asset in the world. Meanwhile, its ratio with gold has once again become the focus of the market, and the title of "digital gold" that BTC has long been crowned with may be coming to an end.

Looking back at BTC's growth over the past decade, it has transformed from being ignored to being widely recognized, from being unknown to being well-known, from a niche asset to a mainstream asset. What has changed is BTC's price and the degree of cryptocurrency mainstream acceptance, while its "only comparable to gold" transcendent status and increasingly reinforced strategic reserve value remain unchanged.

In 2018, former Coinbase CTO Balaji Srinivasan stated at the Coindesk Consensus Conference: "Currently, there are three types of investors entering the market: the first wave focuses on digital gold, the second wave is smart contracts, and I believe the third wave will be micro-payments." Looking back today, the investment targets he mentioned correspond to BTC, ETH, and stablecoins, demonstrating his foresight. Today, we will discuss — How did BTC become "digital gold"?

BTC's Digital Gold History: From Obscurity to Global Recognition

Before discussing how BTC truly grew to hold equal value to physical gold as "digital gold," its background of emergence involves not only the subprime mortgage crisis that swept the globe in 2008 but can even be traced back to 1997.

"Cybermoney" Under "The Sovereign Individual": The Emergence of BTC

In 1997, "The Sovereign Individual: Mastering the Transition to the Information Age," co-authored by William M. O'Grady, a former editor of The Times of London, and American investment master and conservative propagandist James Dale Davidson, was officially published. The book boldly predicted: "Digital technology will greatly enhance the competitiveness, inequality, and instability of the world, society will become more fragmented, and governments will gradually shrink. In the future society, there will be two types of states: one controlled by government employees and the other controlled by 'clients.' The former is limited by the self-interests of government departments, deviating from the original intention of democracy, operating at high costs, and being inefficient, continuously extracting wealth from the public under the pretext of providing 'protection services,' maintaining its violent capacity; only a state truly dominated by 'clients' can solve the 'inefficiency of democracy' problem." Such statements were quite radical at a time when capitalism was flourishing.

The book also systematically outlined the fundamental logic of human social structure, pointing out that with the development of digital technology, the traditional organizations' monopoly on violence, knowledge, and wealth would gradually disintegrate, and decentralized and sovereign individuals would rise. Additionally, the book specifically mentioned a type of "cybermoney," characterized by:

- Composed of encrypted multi-prime sequences, unique, anonymous, and verifiable.

- Capable of accommodating maximum transactions and divisible into the smallest units.

- Traded through keystrokes in a borderless multi-trillion-dollar wholesale market.

- Decoupled from the state, allowing holders to escape state power through inflation.

Initially, the book did not receive much attention, but with the occurrence of the 2008 subprime crisis and the emergence of BTC, more and more people began to regard it as a guiding principle, including Silicon Valley investment mogul and "Paypal Mafia" leader Peter Thiel — who stated in a 2014 interview with Forbes that "The Sovereign Individual" influenced him more than any other book. In 2020, when the book was reissued, he excitedly mentioned in the preface, "The development of information technology has given elites the ability to control the direction of the 'mob' and even everything for the first time. Artificial intelligence makes 'centralized control of the entire economy possible,' and the most important tool in the hands of sovereign individuals is the 'strong encryption technology' representing liberalism, which can bring about a 'decentralized and personalized world.'" After Trump's rise to power, this trend further highlighted Peter Thiel's burning ambition, with cryptocurrencies represented by BTC becoming the best tools for elite individuals to challenge and slowly infiltrate authoritarian states.

As quoted at the beginning of "The Sovereign Individual," referencing Tom Stoppard's play "Arcadia": the future is disorderly. The future world is dominated by non-linearity and asymmetry, which is also the world background in which BTC was born.

From Peer-to-Peer Electronic Cash System to Digital Gold: The Glamorous Transformation from Currency to Speculation

In 2008, with the collapse of Lehman Brothers, the subprime mortgage crisis swept the globe like a bomb, causing immeasurable damage to the most crucial part of the global economic system — the U.S. economy. The paper currency recklessly issued by authoritarian governments and the fragile real estate circular loan economy became a nightmare for countless people.

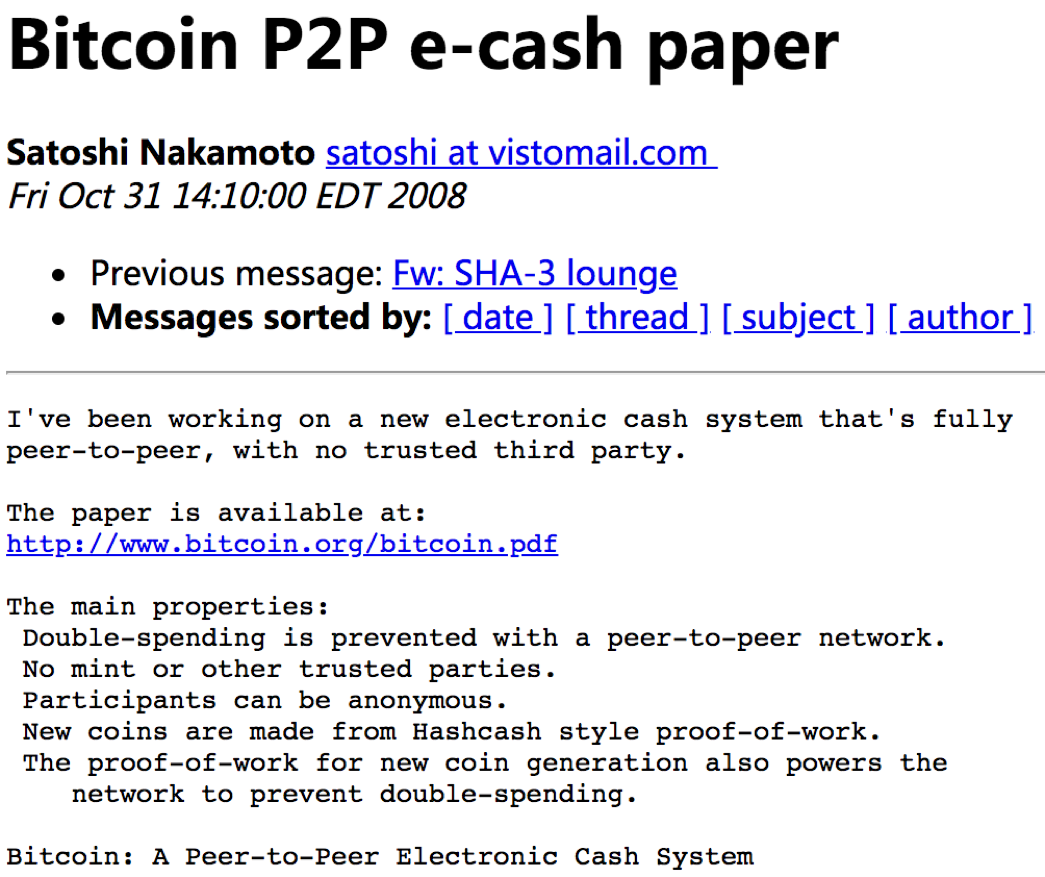

It was also in this year, on October 31, that a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" appeared in the metzdowd cryptography mailing list (some say it was published on a P2P website forum), attracting the attention of many tech geeks. On January 3, 2009, the Bitcoin network officially launched, with the inventor Satoshi Nakamoto inscribing the front-page headline of that day's Times: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

A glimpse of the Bitcoin white paper email

Whether it was the description of the modern banking industry's predicament in that day's Times or the identity of William M. O'Grady, the former editor of The Times, many speculated that Satoshi Nakamoto's invention of Bitcoin might have been inspired by "The Sovereign Individual," and he himself might also be British. From the characteristics of Bitcoin, it indeed shares many similarities with cybermoney, especially in terms of decoupling from the state and inflation resistance. Specifically, Bitcoin's characteristics include:

- Decentralization: No central authority, based on blockchain technology.

- Fixed supply: A total of 21 million coins, controlled by a halving mechanism every four years.

- Anonymity and privacy: Transaction addresses are not directly linked to real identities but can be tracked through analysis.

- Global transactions: Can be transferred instantly worldwide via the internet without cross-border fees.

Moreover, the book mentioned that cybermoney would "reduce the ability of world nation-states to decide who becomes a sovereign individual," which aligns with Bitcoin being viewed as a tool to combat traditional financial systems and state control. It is precisely based on these characteristics that early Bitcoin community members began to compare it with gold.

Nevertheless, at that time in the geek circles, Bitcoin was more like a "computational power game" rather than a "wealth code." Even Satoshi Nakamoto's "online neighbor," early Bitcoin developer, and the first recipient of a BTC transfer, Hal Finney, might not have anticipated that one day Bitcoin could grow to a value of over a hundred thousand dollars.

As a cryptocurrency resistant to inflation and government minting systems, Bitcoin's first physical transaction can be traced back to May 22, 2010, when Florida programmer Laszlo Hanyecz purchased two pizzas from Papa John's for about $40 using 10,000 BTC, which was bought by another British person for $25. In other words, BTC's monetary journey began with a unique "OTC transaction," marking the first exchange rate between BTC and fiat currency, with a BTC:USD rate of approximately 1:0.0025. This is also the origin of the "Pizza Day" celebrated by the global crypto community today, signifying that BTC was no longer just a cold digital asset but had real purchasing power.

Subsequently, the first Bitcoin trading platform, Mt. Gox, was established in July 2010, giving BTC its own "secondary trading market." Following that, BTC gained external attention during the WikiLeaks incident due to its censorship resistance, and soon many charitable organizations began accepting BTC donations. Additionally, it is worth mentioning that the emergence of the "American dark web" Silk Road also made a significant contribution to the popularization of BTC.

From then on, it embarked on its own price surge journey:

- In early 2011, the market began to see GPU-based BTC mining equipment; by the end of the year, the BTC price was around $2.

- In September 2012, the Bitcoin Foundation was established, at which time the BTC price was $12.46.

- In April 2013, BTC reached an all-time high, with the price soaring to $266.

- In June 2013, a decision was made at a German conference: holding Bitcoin for more than a year would be tax-exempt, which was interpreted in the industry as a de facto recognition of Bitcoin's legal status; at that time, the BTC price fell to $102.24.

- In November 2013, the BTC trading price hit a historic high of $1,242, while the price of gold at the same time was $1,241.98 per ounce, marking the first time the price of Bitcoin surpassed that of gold.

From then on, BTC became inextricably linked with the term "digital gold," and its role gradually evolved from electronic cash to a speculative asset with substantial returns and high-risk volatility.

The "Digital Gold" Evangelists of Those Years: From Journalists to Investors

It is noteworthy that although many people discuss and compare BTC with gold, the term "digital gold" was first coined by journalist Nathaniel Popper in his 2015 book "Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money."

This book details the origins, development, and stories of early adopters of Bitcoin, including "Bitcoin Jesus" Roger Ver, ShapeShift founder Erik Voorhees, and the Winklevoss twins (founders of the cryptocurrency exchange Gemini, who previously sued Zuckerberg over the founding of Facebook).

Cover of "Digital Gold"

Additionally, Xapo founder Wences Casares is considered an early promoter of the "digital gold" narrative. Between 2014 and 2016, he repeatedly referred to Bitcoin as "digital gold" in public appearances. At the 2016 Consensus Conference, he boldly stated, "Bitcoin may be the best store of value in human history; it is easier to store and transfer than gold." As an early evangelist of BTC, he raised $20 million from LinkedIn founder Reid Hoffman and PayPal founder Max Levchin and gained attention for successfully persuading Bill Gates to use electronic currency in his work.

Bitcoin evangelist Andreas Antonopoulos compared Bitcoin's decentralized characteristics to the scarcity of gold in his book "Mastering Bitcoin," and in a 2017 speech, he stated, "Bitcoin is not a substitute for gold; it is an evolved version of gold in the digital world."

In addition to individuals, many investors are also staunch supporters of the "digital gold" narrative, including Paul Tudor Jones, founder of Tudor Investment Corporation and hedge fund manager, who likened Bitcoin to "the gold of the 1970s," calling it a tool against inflation. He once stated, "If I had to choose one asset to hedge against future uncertainty, Bitcoin would be one of my choices." Cathie Wood, founder of Ark Invest, has consistently been bullish on BTC, previously claiming that the price of BTC would rise to $2 million per coin and has repeatedly emphasized Bitcoin's scarcity and potential as a store of value, calling it "the gold of the digital age."

Nick Tomaino, founder of 1confirmation, expressed optimism about Bitcoin's future value in a 2018 interview, although he did not believe that BTC would reach $10,000 again. However, he predicted that Bitcoin's value would exceed $100,000 in the next five years. He also emphasized, "In the next decade, Bitcoin will play the role of 'digital gold,' while Ethereum will be seen as 'digital oil.'"

Tyler Winklevoss, co-founder of the U.S. cryptocurrency exchange Gemini (one of the Winklevoss twins mentioned earlier), stated in 2019 that Bitcoin's market capitalization was about $140 billion, while gold's market capitalization was about $7 trillion. Due to the difference in market capitalization, Bitcoin was undervalued, and he described Bitcoin as "gold 2.0," capable of rivaling or even surpassing gold. The differences between the two also help propel Bitcoin to a higher level than gold. For example, gold is low-risk and low-return, while Bitcoin is high-risk and high-return. Additionally, gold is controlled by the futures market, while digital gold is not subject to any government control.

Wall Street financial analyst and Bitcoin supporter Max Keiser also stated in 2019 that to truly achieve Satoshi Nakamoto's vision, Bitcoin is peer-to-peer gold, which is Bitcoin's achievement. He strongly disagreed with the World Gold Council's report claiming that Bitcoin is not a substitute for gold. He further stated, "Bitcoin may seem 'insignificant' as digital cash, but as digital gold, it is changing the world."

From the perspectives of industry insiders, it can be confirmed that around 2019, the view that "BTC is digital gold" had basically been recognized by the cryptocurrency industry and some traditional financial sector individuals. This can also be seen from the statements of representative figures in the industry, such as Rune Christensen, founder of MakerDAO, who stated in a podcast in December 2019 that Bitcoin's current use case has shifted to digital gold, which is good. Of course, he later admitted, "Although this was not its original intention as digital cash." This view was later supported by Ethereum co-founder Vitalik.

In 2020, the camp of BTC's "digital gold" supporters welcomed new adherents.

Strategy and El Salvador Leading the "BTC Hoarding Wave": When BTC Became a Corporate and National Reserve Asset

In 2020, MicroStrategy (later renamed Strategy) and the payment company Square (later renamed Block), founded by Twitter's Jack Dorsey, began incorporating Bitcoin into their corporate balance sheets, reinforcing its status as "corporate gold." Meanwhile, in 2021, El Salvador also launched its own "one BTC per day acquisition plan," thus making BTC "national gold."

Strategy and Block Join the BTC Hoarding Battlefield

On August 11, 2020, the U.S. publicly traded company MicroStrategy purchased over $250 million worth of Bitcoin as part of its asset allocation. In response, MicroStrategy CEO Michael Saylor stated, "Bitcoin is digital gold, stronger, faster, and smarter than any currency before it. We expect its value to grow with technological advancements, expanded applications, and network effects, which have driven the rise of many category killers in this era."

Michael Saylor also stated that year, "Bitcoin is a better store of value asset than gold; it is the corporate reserve asset of the digital age."

Thus, a grand "U.S. Public Company Bitcoin Hoarding Plan" was launched, which has now become a global wave five years later.

In October 2020, as an online payment company that had supported the purchase of BTC since 2017 and was publicly traded in the U.S., Square invested $50 million to buy 4,709 BTC for the first time. In February 2021, the company purchased approximately 3,318 BTC again for $170 million, with an average purchase price of $51,000. Notably, shortly after, BTC fell to around $46,000; despite this, Jack Dorsey remained confident in BTC. In contrast, then U.S. Treasury Secretary Janet Yellen criticized BTC, calling it "highly speculative" and "inefficient" for transactions. She stated, "Bitcoin is an extremely inefficient way to conduct transactions, consuming an astonishing amount of energy while often being used for illegal financing." Yellen also mentioned that it was time for the U.S. Treasury to study the advantages of a digital dollar. A blockchain-based digital dollar launched by the Federal Reserve could provide faster, safer, and cheaper payments, but many issues need to be researched, including consumer protection and money laundering.

Looking back at the passage of the "Anti-CBDC National Surveillance Act," the dramatic effect is heightened.

El Salvador's Twisted Hoarding Journey: From Losing Tens of Millions to Floating Gains of $400 Million

In June 2021, under the strong push of El Salvador's President Nayib Bukele, Bitcoin was recognized as legal tender in the country, and this event was recorded in Bitcoin block 686604, marking another milestone in the cryptocurrency industry—this meant that BTC became one of the legal currencies of a sovereign nation for the first time, and the cash system envisioned by Satoshi Nakamoto had become one of the national currencies.

In September of that year, President Nayib Bukele announced that El Salvador had purchased its first batch of 200 BTC, stating, "As the deadline approaches, our brokers will buy more." Thus, accompanied by the fluctuating price of BTC, El Salvador embarked on a misunderstood and controversial path of BTC reserves. At that time, both the International Monetary Fund and the citizens of El Salvador held negative views on this initiative, highly disapproving of the related measures.

But time would reveal the answers behind the choices:

In 2022, media reported that in the first year of adopting Bitcoin, El Salvador's GDP grew by 10.3%;

In 2023, President Bukele stated, "We have seen the benefits of adopting Bitcoin. The tourism industry has grown by 95%, and we have received a lot of private investment."

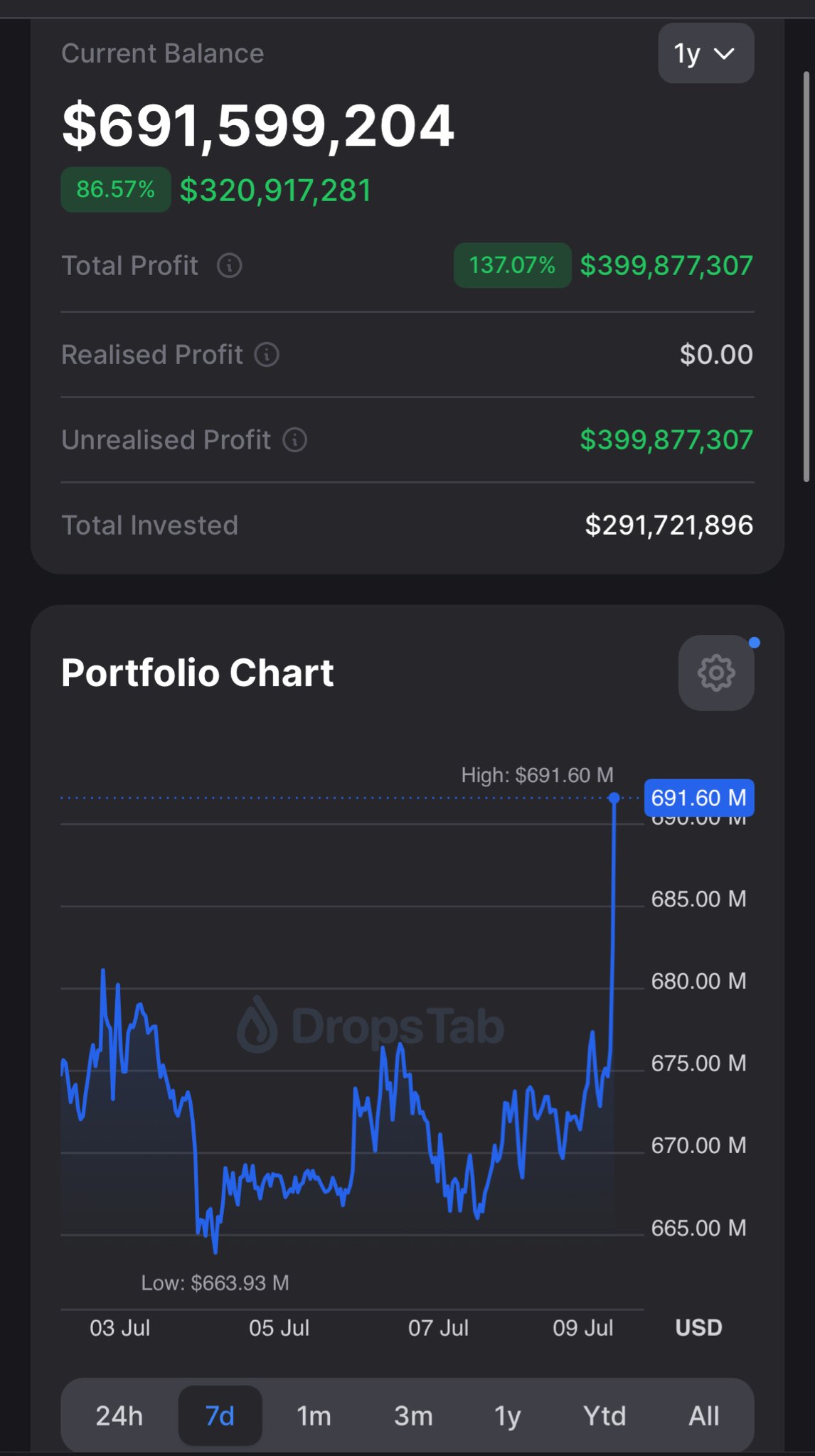

In the same year, El Salvador officially announced it would start purchasing one BTC daily. On July 10 of this year, President Nayib Bukele posted to showcase the government's profits from accumulating Bitcoin, with screenshots showing that after Bitcoin's new high, the Salvadoran government's holdings had floating gains of about $400 million. The current total value of its holdings reached $691 million.

What once seemed like a stubborn decision has now become a far-sighted choice.

El Salvador's floating profit data

Bitcoin Spot ETF Approval: Sounding the Offensive Horn of "1 BTC > 1 KG of Gold"

As we enter 2024, after more than a decade of accumulation and about four crypto cycles, the Bitcoin spot ETF has finally received approval from the U.S. SEC, and the price of BTC has finally broken through the new high of $70,000, thus launching a renewed offensive on the value of BTC against gold on the financial stage.

BlackRock CEO Stands Up: BTC Represents Priceless Freedom

In July 2024, BlackRock CEO Larry Fink, in an interview with CNBC, stated that he had previously misunderstood Bitcoin but changed his view through learning, reiterating that Bitcoin is digital gold and that he is now a Bitcoin believer. Notably, in a previous interview, when asked about the value of BTC, he countered, "What is the value of freedom?" This was a brilliantly crafted rhetorical response.

Data Interpretation: BTC ETF Annual Net Inflows Are 81 Times That of Gold ETF

In fact, after the BTC ETF was approved, many began to compare it with gold ETFs in various aspects.

In March 2024, Bloomberg's senior ETF analyst Eric Balchunas stated that Bitcoin ETFs would eventually surpass gold ETFs unless some black swan event occurred. The asset management scale of the ETF at its launch was $28.9 billion, while the total asset management scale of the 11 spot Bitcoin ETFs currently stands at $61 billion. Against the backdrop of significant capital inflows and rising Bitcoin prices, the scale of Bitcoin ETFs is approaching that of gold ETFs, which have a total asset management scale of about $97 billion.

In August 2024, Deribit's Asia-Pacific business head Lin Chen posted, "This year's overall inflow performance for ETFs has been excellent. IBIT (BlackRock's Bitcoin spot ETF) ranks third, with a net inflow of $20 billion this year; the most popular gold ETF is GLD, which currently has an asset management size of $68.88 billion; this means that compared to the most popular gold ETF, the BTC ETF's asset management could triple." This fully demonstrates the confidence of industry insiders in the inflow of BTC ETFs.

According to Radar's post on platform X, as of November 10, 2024, BlackRock's Bitcoin ETF asset value officially surpassed that of its gold ETF assets, accumulating approximately $33.2 billion in assets in just 10 months. In comparison, the asset value of BlackRock's gold ETF IAU at that time was around $32.9 billion.

By the end of December 2024, according to statistics, in the inflows of Bitcoin and gold ETFs in 2024, the total net inflow of Bitcoin ETFs was $36.8 billion, while the total net inflow of gold ETFs was $454 million. The former was about 81 times that of the latter.

Representative Figures of the "Digital Gold Theory" in 2024: Trump, Michael Saylor, Trader Cobie

At this point, both insiders and outsiders not only view gold as BTC's "competitor" but also express strong confidence that BTC will surpass gold.

At the Bitcoin conference held in Nashville, Tennessee, at the end of July 2024, then-presidential candidate Trump boldly stated, "According to the current trend, Bitcoin will have the opportunity to surpass gold's market value in the future."

In November 2024, MicroStrategy founder Michael Saylor stated: "Bitcoin will consume gold. It has all the advantages of gold without any of its flaws."

That month, cryptocurrency trader Jordan Fish (pseudonym Cobie) also posted: "Bitcoin flipping gold is just a reminder for us to return to rational reality. The multiple at which it flips is the more interesting question. Perhaps 5-10 times is a fair valuation that is approaching in this process." TheBlock researcher Steven asked in the comments, "(Do you mean) the price of a single BTC is between $4 million and $9 million???" He then responded, "That sounds like a good price for BTC." Additionally, he added: "Honestly, while gold will also face serious competition from Bitcoin's competing assets, Bitcoin is essentially interstellar digital gold. Therefore, as the writing on the wall predicts, as humanity becomes a multi-planetary species, mineral rocks and gold investors on Earth may choose superior assets. Many other gold scenarios: perhaps some future intelligence can perform alchemy, or maybe future humans who conquer the stars will be able to mine infinite gold in space. In contrast, we seem unlikely to find any Bitcoin in space."

This viewpoint was supported by Paradigm co-founder Matt Huang, with reports indicating that a giant asteroid in space contains gold worth $70 trillion.

BTC Digital Gold History Final Chapter: 1 BTC > 1 KG of Gold Has Become a Foregone Conclusion

In January 2025, Trump, waving the flag of crypto-friendliness, officially took office as the 47th President of the United States, bringing another wave of enthusiasm for BTC and the entire cryptocurrency industry. As the price of BTC continued to break through $110,000 and $120,000, the norm of 1 BTC > 1 KG of gold became established in the market.

BTC Stands Above $110,000 to Maintain Greater than 1 KG of Gold

According to the latest information from Kinesis, the current value of one kilogram of gold is $107,757.50; in comparison, 1 BTC is currently valued at $118,017.7.

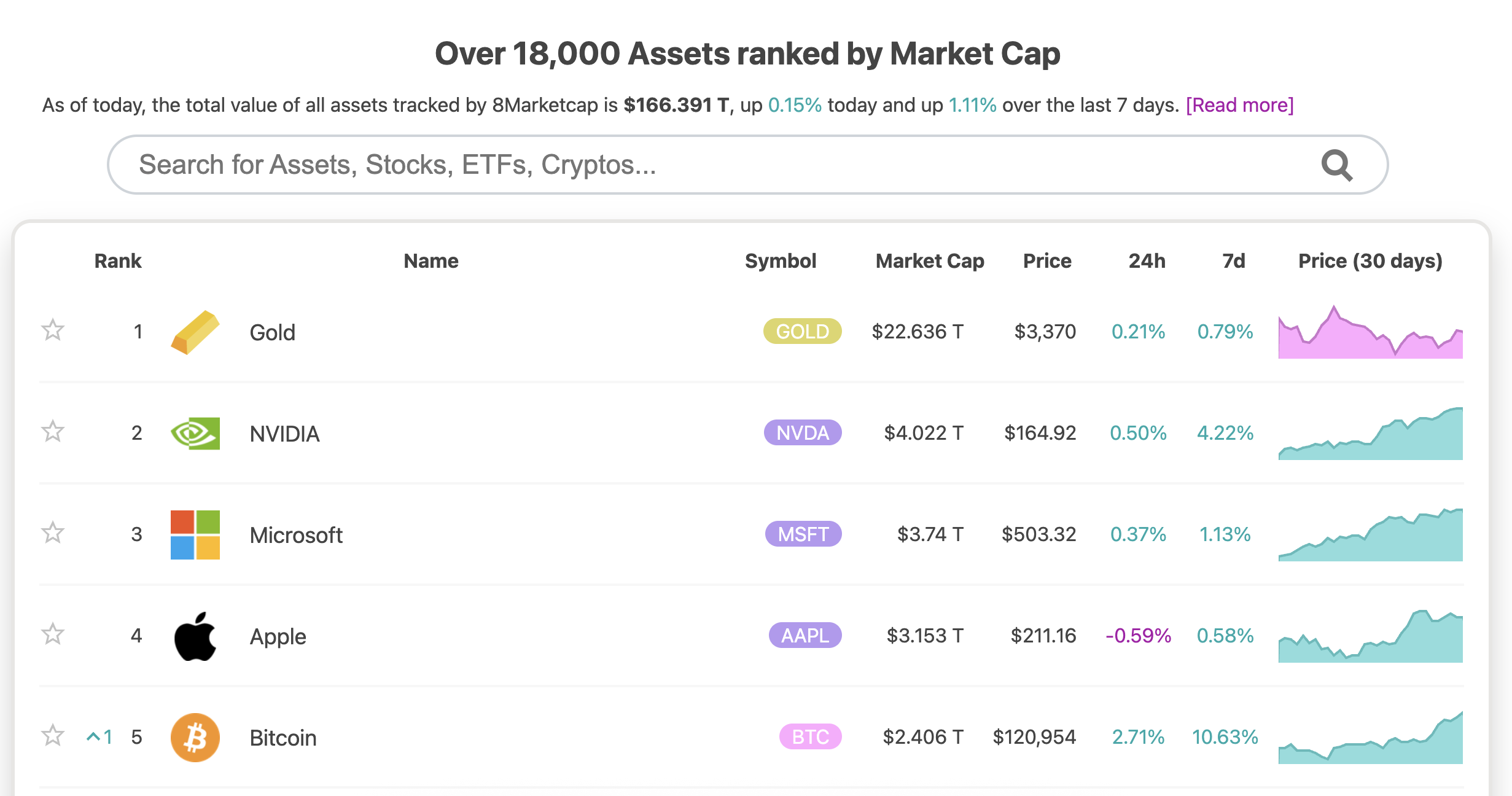

Additionally, according to 8marketcap data, the total market value of gold is approximately $22.6 trillion, ranking first among global assets; the total market value of BTC is about $240 billion, ranking fifth among global assets, with the gap in total market value narrowing from about 12 times to around 9 times.

Top Five Global Asset Market Values

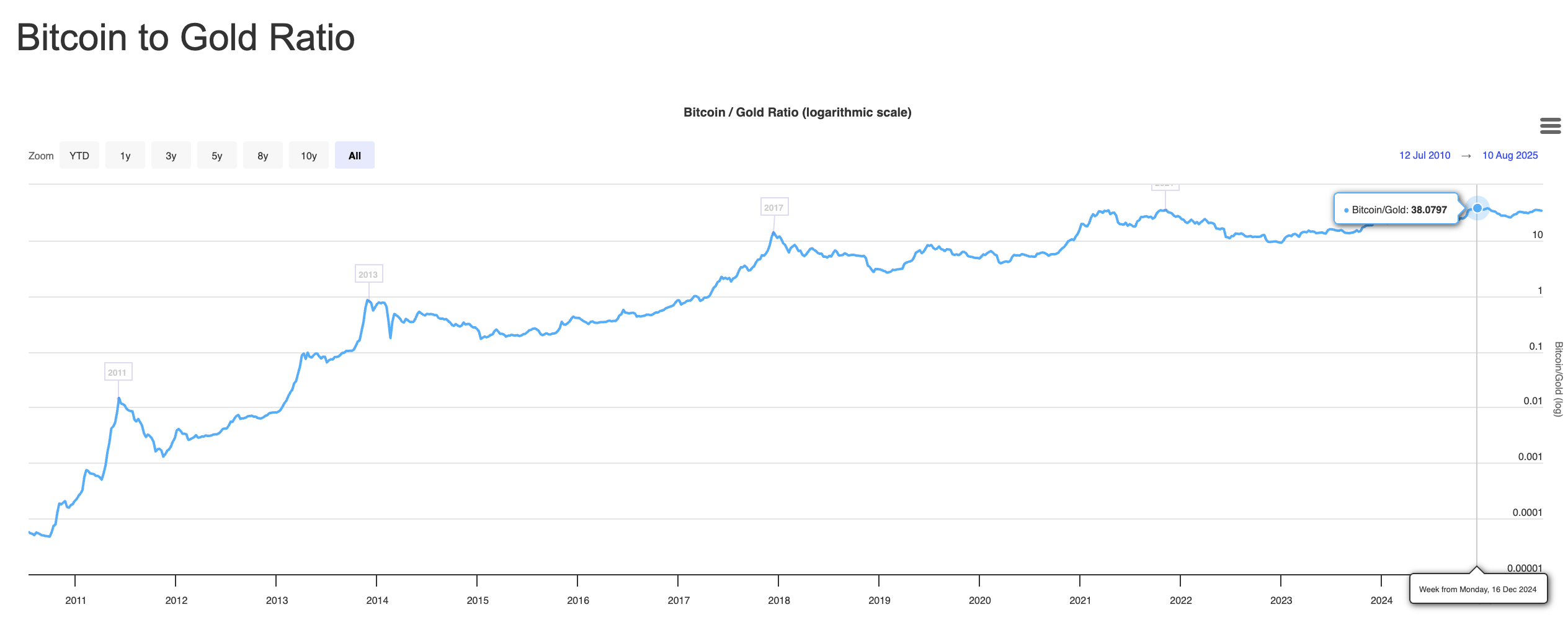

Furthermore, for comparison, on December 16 of last year, the BTC to gold exchange rate rose to an all-time high, with 1 BTC being exchangeable for 38.0797 ounces of gold, currently maintaining above 34 ounces of gold.

BTC: Gold Exchange Rate Chart

Of course, such historical achievements are not always accompanied by support and praise; there are also denials and criticisms.

As early as the beginning of 2020, as gold prices reached a seven-year high of $1,670 per ounce that week, rising 10% for the year; in contrast, Bitcoin had fallen below the critical support level of $9,300 at that time. Economist and gold supporter Peter Schiff had stated: "The decline of Bitcoin shows that Bitcoin is digital risk, not digital gold."

Coincidentally, at that time, former Deputy Governor of the Bank of China Wang Yongli wrote in a Sina column that although Bitcoin highly mimics the mechanism of gold, it is fundamentally not real gold, but merely digital "virtual gold" or "virtual assets." Due to the impact of the COVID-19 pandemic, the prices of Bitcoin and other "digital currencies" plummeted, with prices dropping two-thirds within a week. People should fully recognize that they cannot become "digital gold," nor can they become strong currencies or safe-haven assets, and should completely rid themselves of fantasies about various "digital currencies," gaining a clear and accurate understanding of currency.

But looking back five years later, one can only sigh: "The great wall is indeed as strong as iron, yet now we step forward anew. Stepping forward anew, the mountains are like the sea, and the setting sun is like blood."

Recommended Reading:

- Introduction to Bitcoin Projects

- The True Fifteen Big Shots in the Crypto Circle

- The War of "Sovereign Individuals" Elites Against All Nations

- Dialogue with Nathaniel Popper, Author of "Digital Gold"

- Foresight Ventures: A Chronicle of Crypto Thought (1997 - 2022)

- 《CRYPTOCURRENCY: How Digital Money Could Transform Finance》

- 《Sovereign Individual》: A book that inspired Satoshi Nakamoto to invent Bitcoin but is little known

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。