关键要点

- 全球加密货币总市值为 4.2 万亿美元,较上周 3.77 万亿美元,本周内加密货币总市值上升 11.4%。截止至发稿,美国ETF 累计总净流入约 544.3亿美元,本周净流入2.46 亿美元;美国ETF 累计总净流入约 98.2 亿美元,本周净流入 3.26 亿美元。

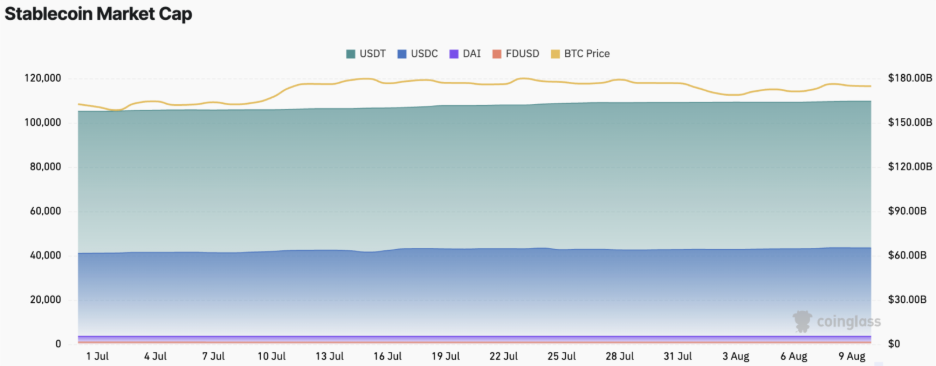

- 稳定币总市值为 2,659 亿美元,其中 USDT 市值为 1,645 亿美元,占稳定币总市值的 61.86%;其次是市值为 652 亿美元,占稳定币总市值的 24.52%;DAI 市值为 53.7 亿美元,占稳定币总市值的 2.01%。

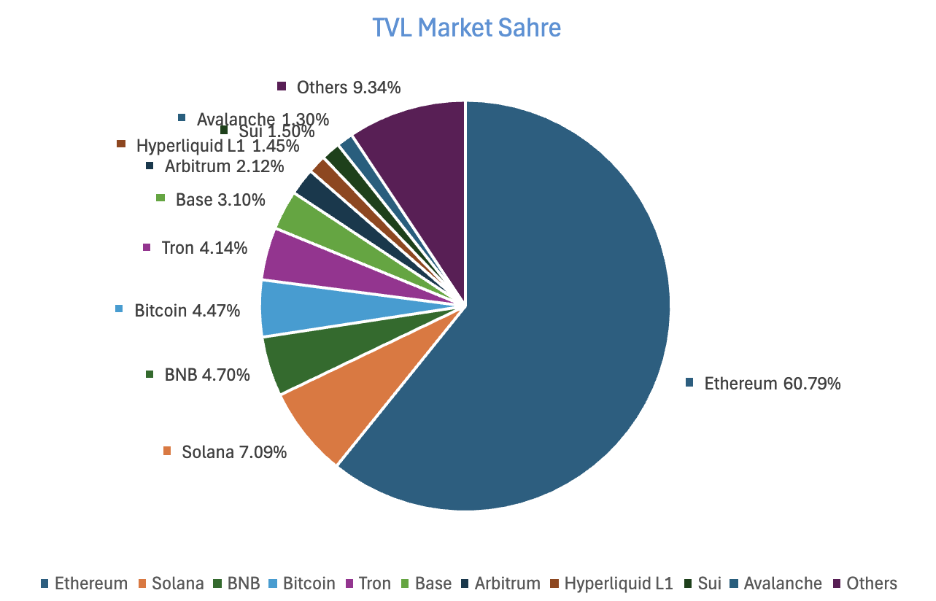

- 据 DeFiLlama 的数据,本周DeFi 总 TVL 为$1,449 亿,较上周$1,329 亿,上升约 9.02%。按公链进行划分,其中 TVL 最高的三条公链分别是,占比 60.79%;,占比 7.09%;BNB Chain,占比 4.7%。

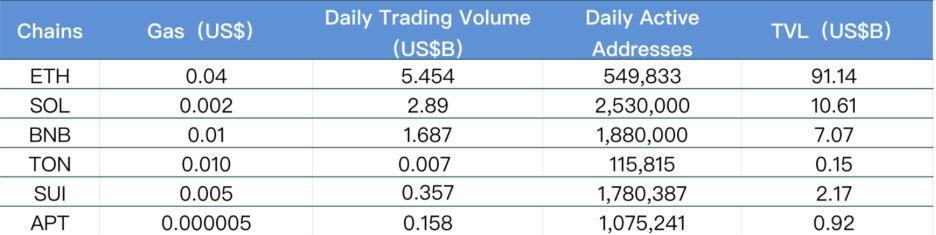

- 从链上数据看,本周公链数据整体向好:在日成交量方面,除 TON 下跌 92.76%外,其余均上涨,其中 Solana 涨幅最大(+109.42%),其次为 Sui(+55.22%)、Ethereum(+32.7%)、BNB Chain(+18.8%)、Aptos(+12.86%)。交易费用方面,BNB Chain 持平,Solana 和 Aptos 分别下降 37.36%与 31.22%,Ethereum(+100%)、TON(+226%)、Sui(+5.48%)上涨。日活跃地址中,除 BNB Chain 下降 19.66%外,其余均增长,Aptos(+62.3%)和 Sui(+54.84%)涨幅领先,Solana(+14.48%)、Ethereum(+13.53%)、TON(+5.56%)增幅较稳。TVL 方面,仅 TON 微跌 5.63%,其余上涨,Ethereum(+16.03%)和 Solana(+11.61%)领涨,BNB Chain(+5.84%)、Sui(+9.49%)、Aptos(+3.03%)涨幅温和。

- 新项目关注:Perle Labs 是一家基于 Web 3 的人工智能项目,专注为 AI 团队提供高保真数据流水线,涵盖代码、先进推理、多语言内容、卫星图像等安全关键领域。TradeTideAI 是一个高度自动化的跨链加密策略平台,具备趋势预测、策略制定和执行功能,依托智能自动化系统和深度加密资产原生集成,可实现从市场趋势识别到交易执行的一体化操作体验。Juicy.meme 是聚链(Juchain)生态下的一个 Meme 公平启动平台,致力于为社区用户提供一个去中心化、公平透明的代币发行和参与环境。

目录

关键要点

目录

一.市场概览

1. 加密货币总市值/比特币市值占比

2. 恐慌指数

3. ETF 流入流出数据

4. ETH/BTC 和 ETH/USD 兑换比例

5. Decentralized Finance (DeFi)

6. 链上数据

7. 稳定币市值与增发情况

二.本周热钱动向

1. 本周涨幅前五的 VC 币和 Meme 币

2. 新项目洞察

三.行业新动态

1. 本周行业大事件

2. 下周即将发生的大事件

3. 上周重要投融资

四.参考链接

一.市场概览

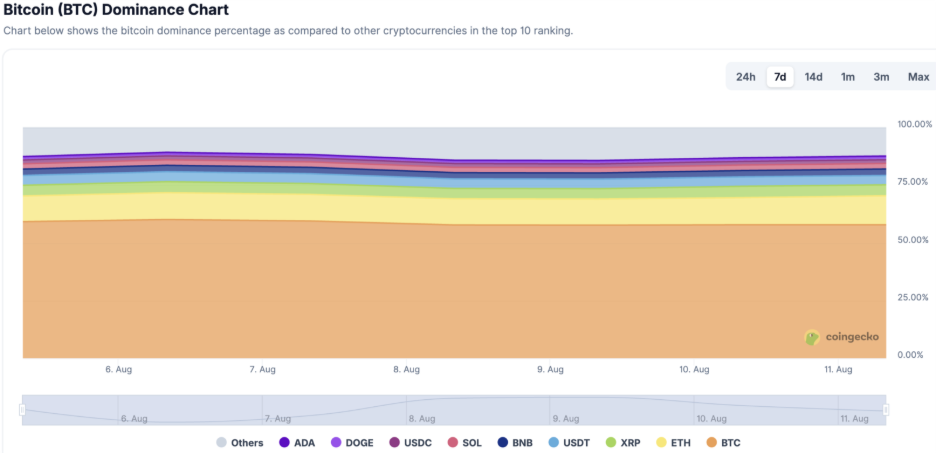

1. 加密货币总市值

全球加密货币总市值为 4.2万亿美元,较上周 3.77 万亿美元,本周内加密货币总市值上升 11.4%。

数据来源:cryptorank

数据截止至 2025 年8 月 10 日

截止至发稿,的市值为2.37万亿美元,占加密货币总市值的56.4%。与此同时,稳定币的市值为2,659亿美元,占加密货币总市值的6.33%。比特币

数据来源:coingeck

数据截止至 2025 年8 月 10 日

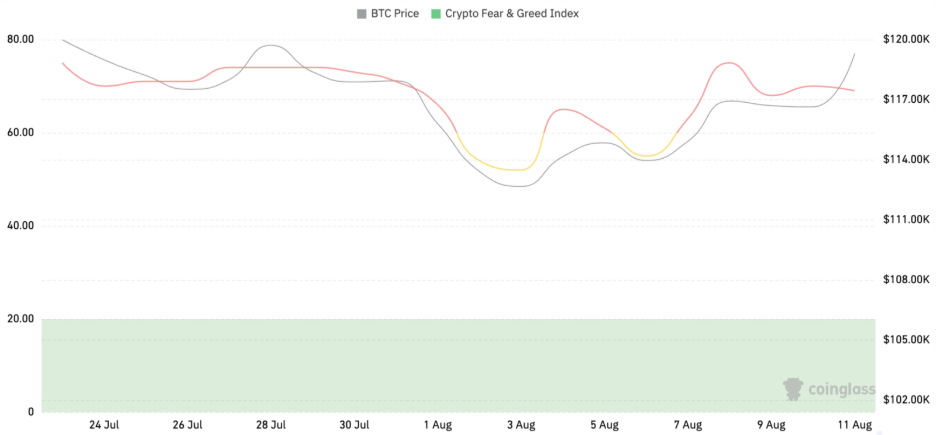

2. 恐慌指数

加密货币恐慌指数为69,显示为贪婪。

数据来源:coinglass

数据截止至 2025 年8 月 10 日

3. ETF 流入流出数据

截止至发稿,美国比特币现货 ETF 累计总净流入约544.3亿美元,本周净流入2.46亿美元;美国以太坊现货 ETF 累计总净流入约98.2亿美元,本周净流入3.26亿美元。

数据来源:sosovalue

数据截止至 2025 年8 月 10 日

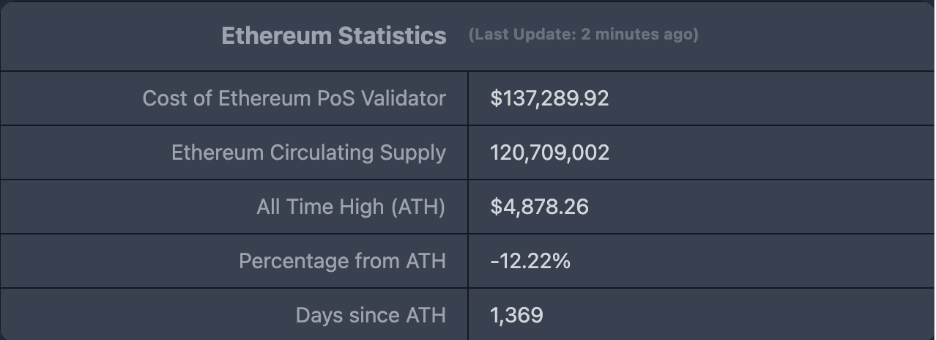

4. ETH/BTC 和 ETH/USD 兑换比例

ETHUSD :现价$4,287.98,历史最高价$4,878.26,距最高价跌幅约12.22%

ETHBTC :目前为0.035988,历史最高为 0.1238

数据来源:ratiogang

数据截止至 2025 年8 月 10 日

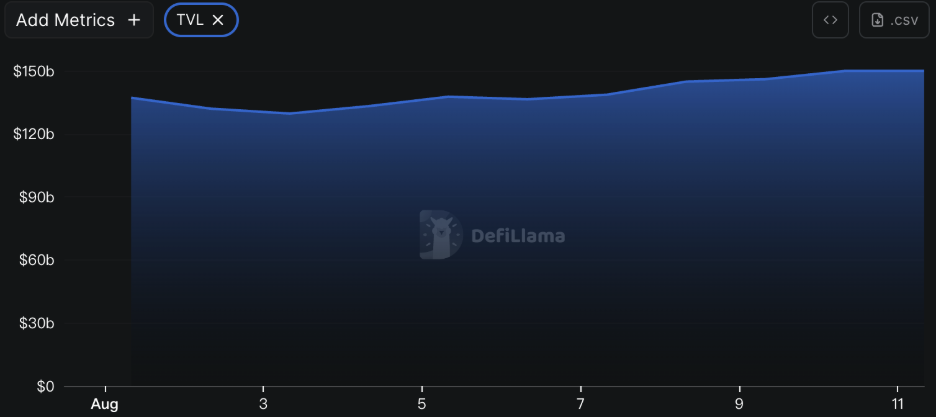

5. Decentralized Finance (DeFi)

据 DeFiLlama 的数据,本周 DeFi 总 TVL 为$1,449亿,较上周$1,329亿,上升约9.02%。

数据来源:defillama

数据截止至 2025 年8 月 10 日

按公链进行划分,其中 TVL 最高的三条公链分别是 Ethereum 链,占比60.79%;Solana 链,占比 7.09%;BNB Chain,占比4.7%。

数据来源:CoinW 研究院,defillama

数据截止至 2025 年8 月 10 日

6. 链上数据

Layer 1 相关数据

主要从日交易量、日活跃地址、交易费用分析目前主要 Layer 1 含 ETH、SOL、BNB、TON、SUI 以及 APT 的相关数据。

数据来源:CoinW 研究院,defillama,Nansen

数据截止至 2025 年8 月 10 日

- 日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。日成交量方面,本周仅 TON 下跌 92.76%,其余链均上涨。Solana 链涨幅最大,为 109.42%,其余分别为 Sui(+55.22%)、Ethereum(+32.7%)、BNB Chain(+18.8%)、Aptos(+12.86%)。在交易费用方面,本周BNB 链较上周持平;Solana 和 Aptos 分别下降 37.36%和 31.22%;其余各链均有上升,分别为 Ethereum(+100%)、TON(+226%)、Sui(+5.48%)。

- 日活跃地址与 TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL 反应了用户对平台的信任程度。本周,仅 BNB Chain 日活跃地址较上周下降 19.66%,其余链均有所增涨。Aptos 和 Sui 链分别上涨 62.3%和54.84%;其余链涨势分别为(+14.48%)、Ethereum(+13.53%)以及 TON(+5.56%)。TVL方面,仅TON出现小幅下跌(-5.63%),其余公链均实现上涨。其中,Ethereum和Solana分别增长16.03%和11.61%;BNBChain、Sui和Aptos增幅较小,分别为5.84%、9.49%和3.03%。Solana

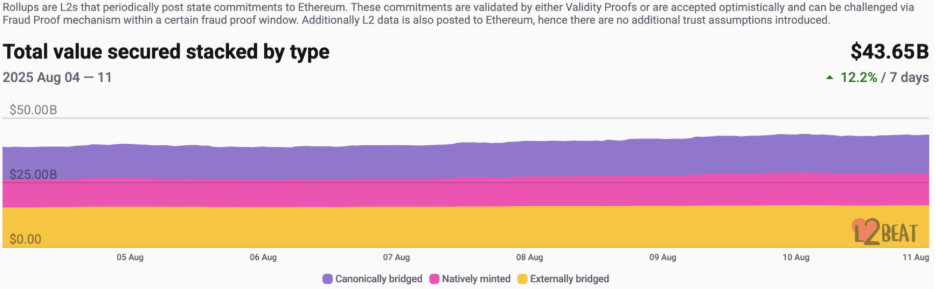

Layer 2 相关数据

据 L 2 Beat 数据显示,以太坊 Layer 2 总 TVL 为436.5亿美元,本周较上周($387.8亿)整体涨幅为12.55%。

数据来源:L 2 Beat

数据截止至 2025 年8 月 10 日

Base和 Arbitrum 分别以37.92%和 34.58%的市场份额占据前排,Base链过去一周市场份额略有下降,Arbitrum 有所上升。

数据来源:footprint数据截止至 2025 年8 月 10 日

7. 稳定币市值与增发情况

据 Coinglass 数据,稳定币总市值为2,659亿美元,其中 USDT 市值为 1,645亿美元,占稳定币总市值的 61.86%;其次是 USDC 市值为 652亿美元,占稳定币总市值的 24.52%;DAI 市值为 53.7亿美元,占稳定币总市值的 2.01%。

数据来源:CoinW 研究院,Coinglass

数据截止至 2025 年8 月 10 日

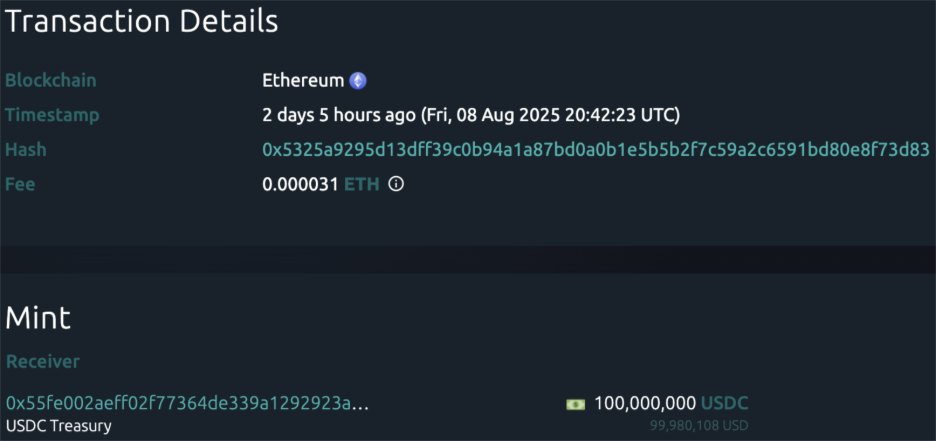

据 Whale Alert数据显示,本周 USDC Treasury 总计增发26.06亿枚,TetherTreasury 本周总计无增发USDT。本周稳定币增发总量为26.06亿枚,较上周稳定币增发总量(24.5亿枚)增加 6.36%。USDC

数据来源:Whale Alert

数据截止至 2025 年8 月 10 日

二.本周热钱动向

1. 本周涨幅前五的 VC 币和 Meme 币

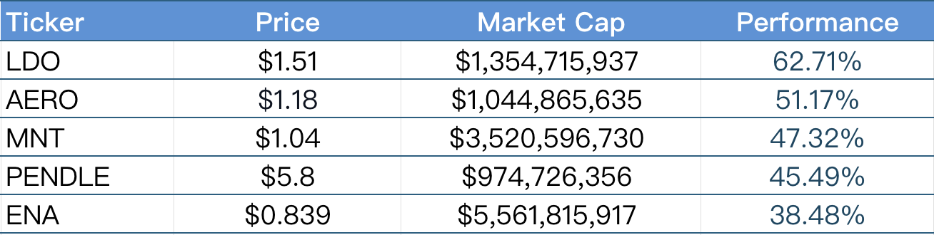

过去一周内涨幅前五的 VC 币

数据来源:CoinW 研究院,coinmarketcap

数据截止至 2025 年8 月 10 日

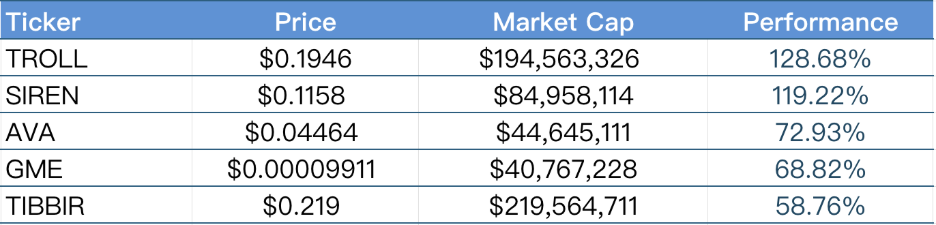

过去一周内涨幅前五的 Meme 币

数据来源:CoinW 研究院,coinmarketcap

数据截止至 2025 年8 月 10 日

2.新项目洞察

- Perle Labs 是一家基于 Web 3 的人工智能项目,专注为 AI 团队提供高保真数据流水线,涵盖代码、先进推理、多语言内容、卫星图像等安全关键领域。与依赖零工经济方式不同,PerleLabs 通过一张经审计的全球专家网络提供标签和评估服务,确保数据质量与安全性。

- TradeTideAI 是一个高度自动化的跨链加密策略平台,具备趋势预测、策略制定和执行功能,依托智能自动化系统和深度加密资产原生集成,可实现从市场趋势识别到交易执行的一体化操作体验。

- Juicy.meme 是聚链(Juchain)生态下的一个 Meme 公平启动平台,致力于为社区用户提供一个去中心化、公平透明的代币发行和参与环境。该平台通过公平发放机制,鼓励用户积极参与生态建设与互动,推动聚链生态内的 Meme 文化发展和社区活跃度提升,助力打造创新且包容的链上社群生态体系。

三.行业新动态

1. 本周行业大事件

- 8 月 8 日,SuperpFoundation 官方宣布将在代币发行(TGE)时共计分配 5%的代币用于空投,其中已有 2%代币完成发放,剩余 3%将于下周一次性解锁并分发。预计空投领取页面将于 8 月 12 日(周二)正式上线。

- 8 月 7 日,Linea 生态内的 MetaDEX 项目 Etherex 顺利完成了 REX 代币的首次发行(TGE)。截至目前,REX 市值已达到 2.03 亿美元,24 小时内成交额突破 870 万美元。作为 Nile Exchange 的升级版本,Etherex 由 Linea、Consensys 和 Nile 三方联合打造,致力于为用户提供更高效、安全和流畅的去中心化交易体验,推动生态繁荣和数字资产的广泛应用。

- 8 月 7 日,MagicEden 正式公布完成第二季空投,共计发放 1000 万枚 ME 代币。此次空投旨在感谢社区支持、扩大用户福利,推动平台生态活力进一步提升。

- 8 月 5 日,Meme 币永续合约 DEXSuperp 推出内容激励活动,时间为 8 月 4 日 18:00 至 8 月 11 日 18:00(UTC+8)。用户在 X 发布并@Superp 的相关内容后,提交链接和邮箱即可参与。内容涵盖产品体验、创新机制和未来展望等。积分将根据内容质量和互动量人工评定,并影响后续空投比例,积分将在提交后三天内发放。

2. 下周即将发生的大事件

- SuzakuNetwork(SUZ) 的代币首次发行将于 2025 年 8 月 11 日至 12 日启动,计划融资 15 万美元,代币发行价为 0.135 美元,出售 1,111,111 枚 SUZ,并将在 TGE 时 100%解锁。这是一个专为 Avalanche Layer‑1 链打造的重质押基础设施协议,支持双重质押(原生代币及优质资产)以增强经济安全性,同时构建验证者市场和抗审查的跨链通信机制。

- AfriCred(IFT)将于 2025 年 8 月 14 日至 8 月 16 日举行代币首次发行,目标筹资约 20 万美元,发行价定为 0.13 美元,共计发售约 1,538,462 枚 IFT,TGE 时将解锁 20%,剩余代币将在两个月内线性释放。AfriCred(IFT)是一个区块链驱动的金融科技平台,通过 Africred 代币连接全球资本与非洲中小企业(SME),为投资者提供 15–20% APY 的高收益机会,同时助力填补非洲约 3300 亿美元的中小企业信贷缺口。

- Emmet Finance将于 2025 年8月 18日至8月20日进行代币首次发行,总计出售 750 万枚 EMMET 代币,单价 $0.02,共计划募资 $150,000。TGE(代币生成事件)将实现 100% 解锁,无锁仓期与归属期。Emmet Finance 是一个跨链去中心化金融(DeFi)平台,支持 Ethereum、Bitcoin、TON、Solana 等多个区块链网络,致力于解决链间资产转移、流动性共享和互操作性问题。

3. 上周重要投融资

- 硅谷智能机器基础设施公司 OpenMind 宣布完成 2000 万美元融资,由 Pantera Capital 领投,红杉中国、Coinbase Ventures、DCG、Lightspeed Faction、Primitive Ventures 等多家知名 Web 3 投资机构参投。OpenMind 正在构建面向机器人行业的去中心化 AI 网络,其核心产品 OM 1 操作系统与 FABRIC 协议,支持机器人在全球范围内实现跨平台身份验证、安全协作与数据共享,被视为“机器人世界的以太坊”。(2025 年 8月 4 日)

- Web 3 游戏工作室 SuperGaming 宣布完成 1500 万美元 B 轮融资。本轮融资由 Skycatcher 和 SteadviewCapital 领投,a 16 zSpeedrun、BandaiNamco 021 Fund、Neowiz 及 Polygon Ventures 等参投。SuperGaming 专注于开发融合区块链技术的跨平台游戏,致力于打造公平、有趣的 Web 3 游戏体验。(2025 年 8 月 6 日)

- Tether 通过旗下投资机构 Tether Ventures 领投西班牙加密交易所 Bit 2 Me 的 3000 万欧元融资,并获得少数股权。Bit 2 Me 是首家获得欧盟 MiCA 牌照的西班牙语加密金融科技公司,已获得西班牙证券监管机构授权。此次融资将用于加速其在拉美市场的扩张,重点布局阿根廷业务。此举也标志着 Tether 正在通过战略投资推动全球加密合规化与市场渗透。(2025 年 8 月 7 日)

- Ripple 以约 2 亿美元收购稳定币支付平台 Rail,旨在加强 Ripple 在全球数字支付和稳定币领域的布局。Rail 是一家专注于通过稳定币实现跨境支付和结算的金融科技公司,提供高效、安全的支付基础设施,支持企业和金融机构简化资金流转,降低交易成本。此次收购将助力 Ripple 扩展其支付网络,推动稳定币在全球支付中的应用落地,加速构建更开放、快速且低成本的跨境支付生态。(2025 年 8 月 7 日)

四.参考链接

- OpenMind:https://openmind.org/

- SuperGaming:https://www.supergaming.com/

- Bit 2 Me:https://bit 2 me.com/

- Rail:https://rail.io/

- Perle Labs:https://x.com/PerleLabs

- TradeTideAI:https://tradetide.cc/

- Juicy.meme:https://www.juicy.meme/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。