Original Author: @shaundadevens

Preface

With the continuous development of decentralized finance (DeFi), various innovative yield strategies are emerging. Recently, Blockworks analyst Shaunda Devens (@shaundadevens) provided a detailed analysis of how Ethena's USDe stablecoin saw a supply surge of $3.7 billion in just 20 days, driven by the PT-USDe rotation strategy launched by Pendle and Aave. This strategy significantly amplifies yield potential by splitting principal and yield tokens and combining them with lending leverage. At the same time, the potential risks cannot be ignored. This article will summarize the core mechanisms, yield composition, and risk considerations of this strategy based on Devens' analysis.

I. Supply Surge and Mechanism Overview

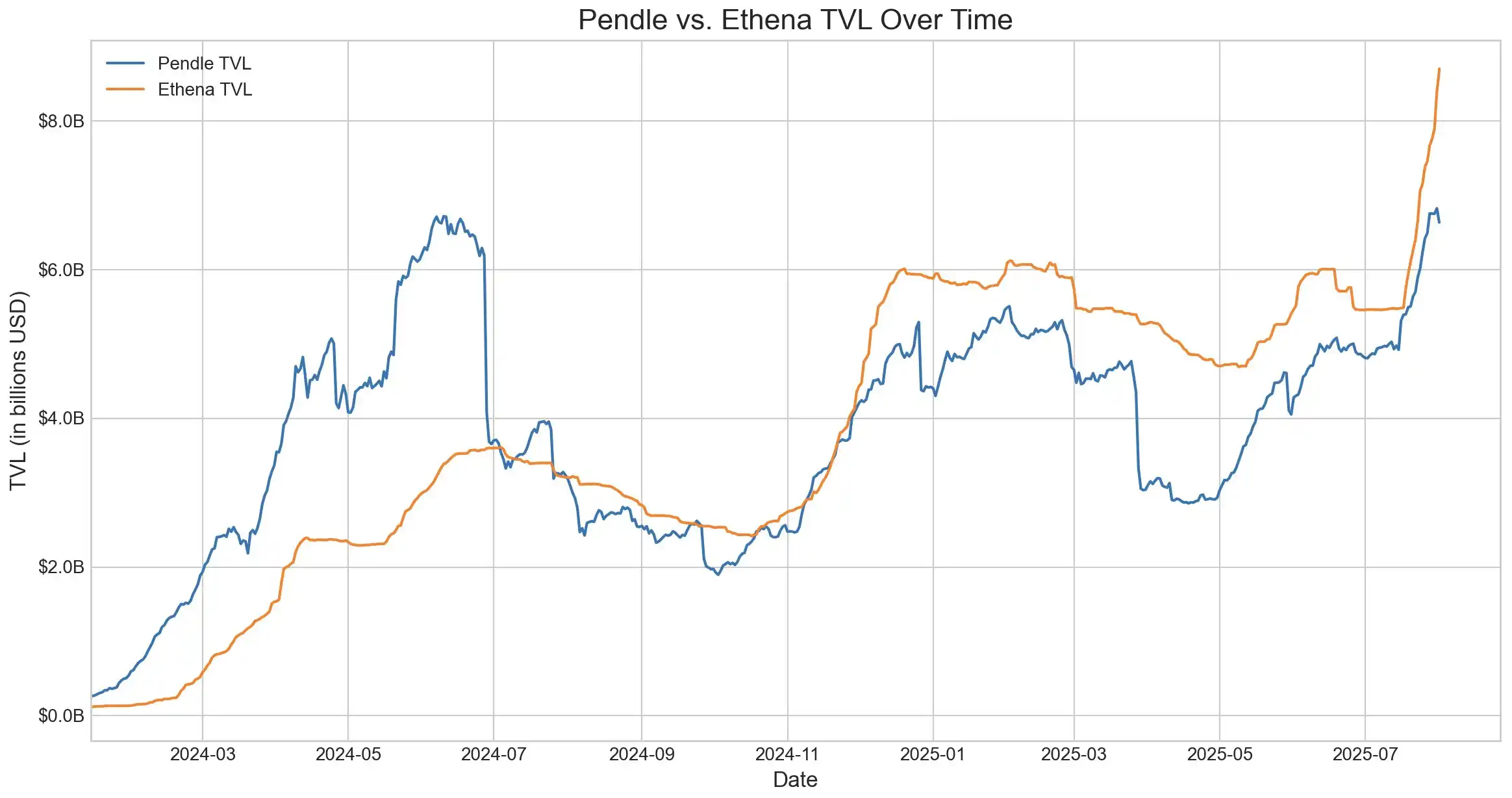

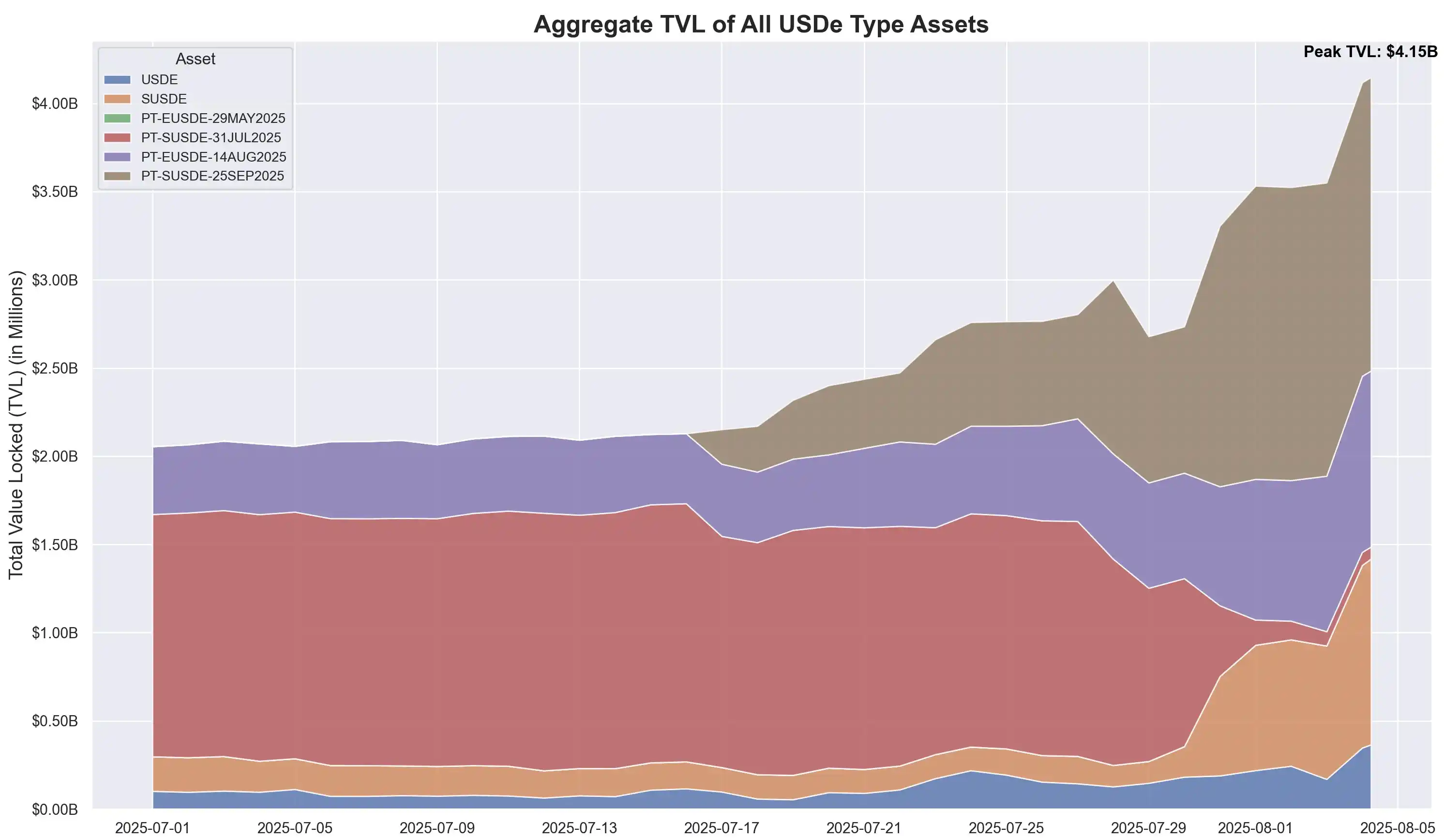

In a tweet published on August 6, 2025, Shaunda Devens pointed out that the supply of Ethena's USDe increased by $3.7 billion within 20 days, primarily driven by the PT-USDe rotation strategy based on Pendle and Aave. Currently, approximately $4.3 billion (60% of the total USDe supply) is locked in Pendle, with another $3 billion deposited in Aave.

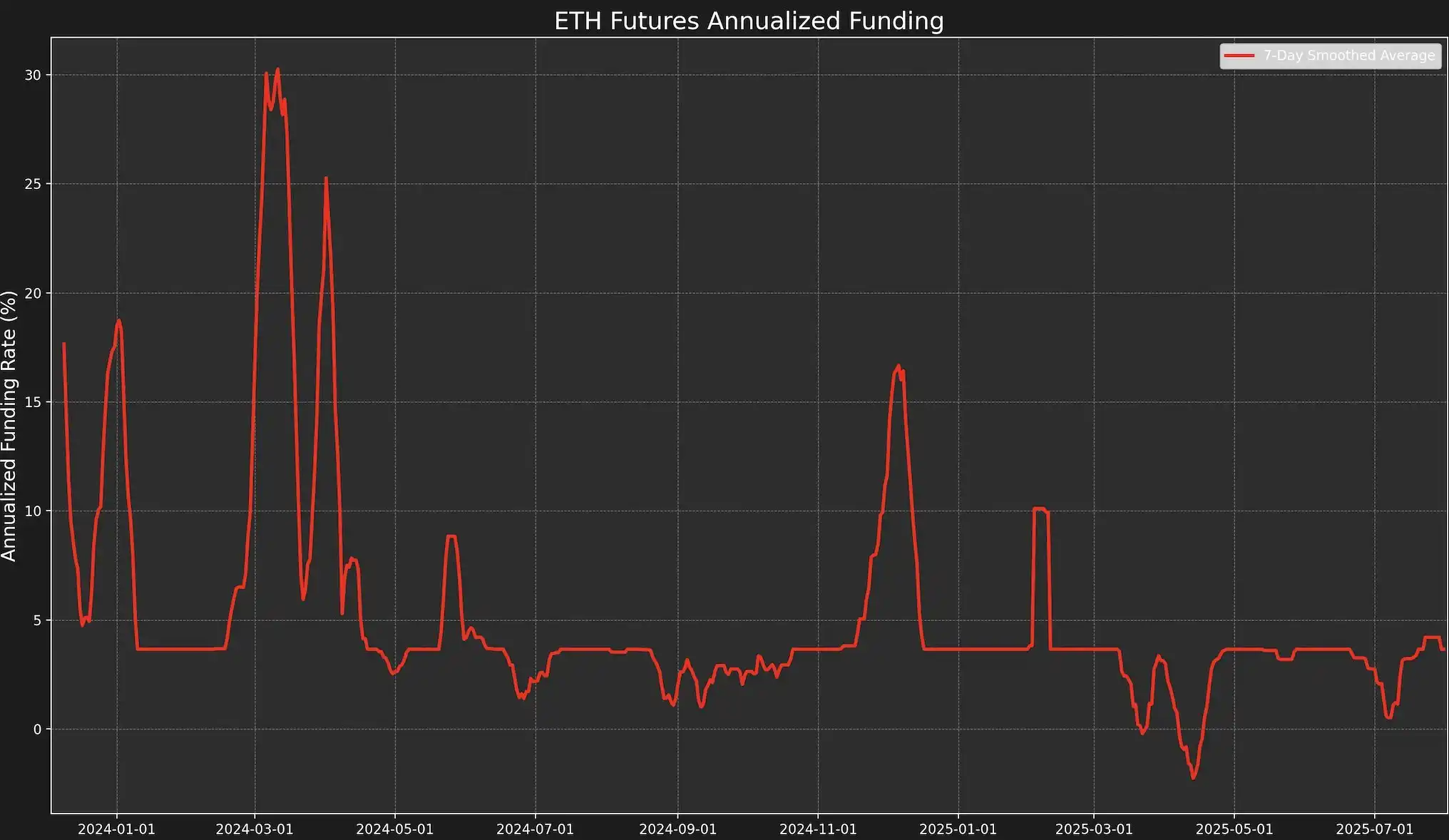

USDe is a decentralized stablecoin that maintains its peg to the US dollar through a directional hedging algorithm using ETH perpetual contracts, while generating yield through spot staking and funding rates of perpetual contracts. However, this yield is highly dependent on funding rates, which are closely related to the premium or discount of perpetual contract prices compared to ETH spot prices.

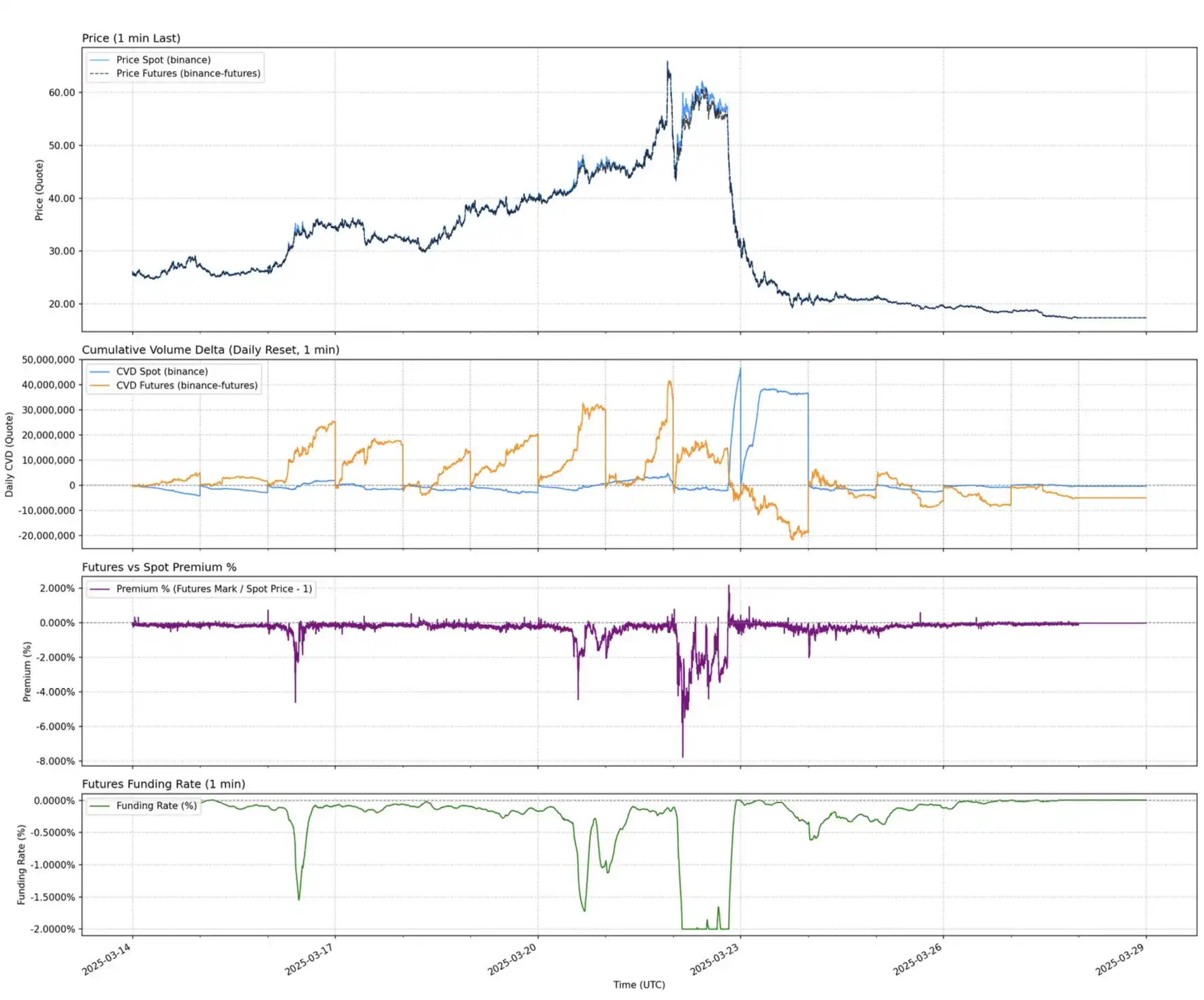

Devens noted, "When bullish sentiment heats up, traders open leveraged long positions, and the perpetual price briefly exceeds the mark price, positive funding rates incentivize market makers to short the perpetual and hedge with spot," while the opposite may lead to negative funding rates, resulting in price inversion. She cited the extreme mismatch of AUCTION-USDT, where spot buying and perpetual selling caused a spot premium, with an 8-hour funding rate reaching -2%, annualized at about 2195%.

II. Pendle PT Rotation Strategy and Its Synergy

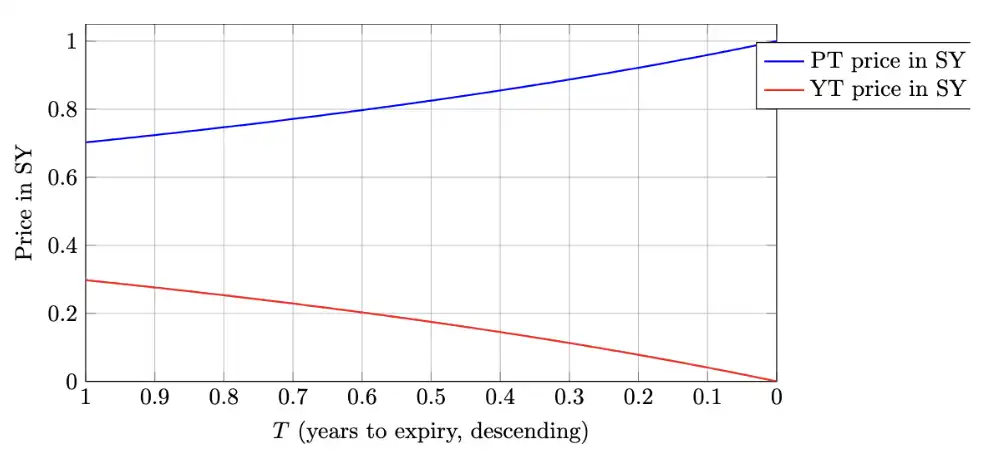

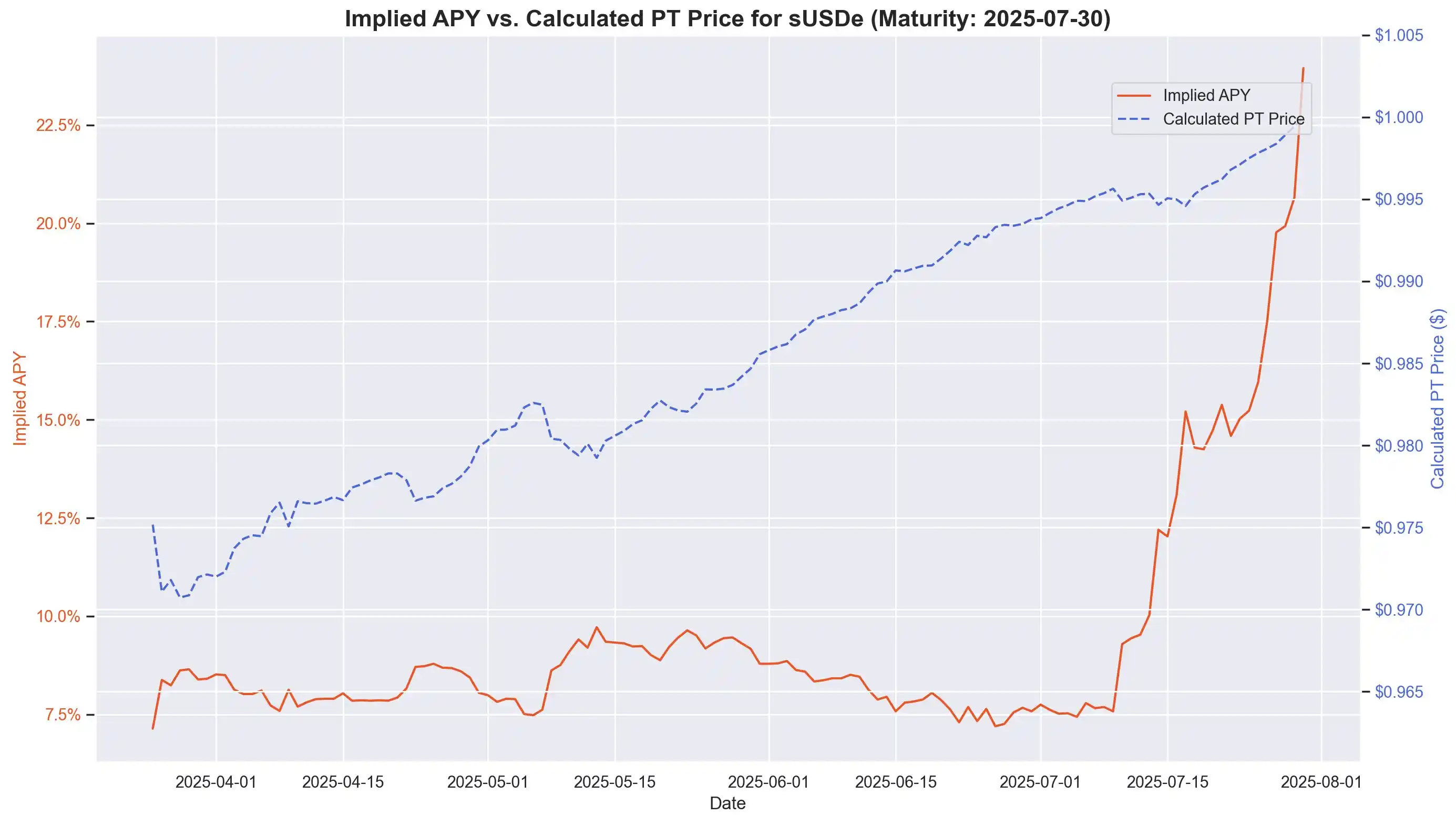

This volatility has created a demand for more predictable yield products: Pendle's PT-loop strategy, which previously introduced a token model that separates principal and yield: Principal Token (PT) and Yield Token (YT). PT can be redeemed for 1 USDe at maturity, and its current price is at a discount to par value, similar to a zero-coupon bond, with the implied annualized yield derived from the discount and remaining term being the annualized yield of YT.

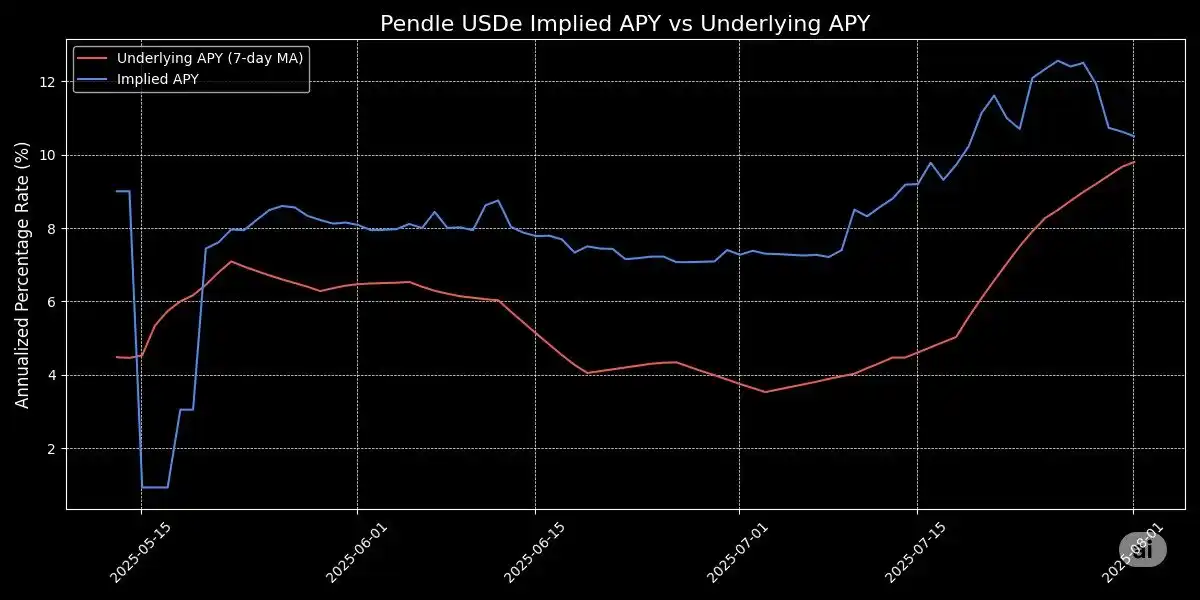

This design provides USDe holders with a tool to lock in fixed income, avoiding risks from funding rate fluctuations. Historically, when funding rates were high, annualized yields exceeded 20%, currently around 10.4%. Additionally, PT token holders enjoy a 25x SAT token reward from Pendle.

Pendle's total locked value (TVL) reached $6.6 billion, with $4.01 billion (about 60%) coming from Ethena's USDe market. The two form a high degree of synergy, with Pendle addressing the yield volatility issue of USDe, but capital efficiency remains limited. YT buyers efficiently gain yield exposure, while PT holders, needing to lock $1 collateral, have yield space limited to the interest spread.

III. Leveraged Rotation Strategy and Risk Control

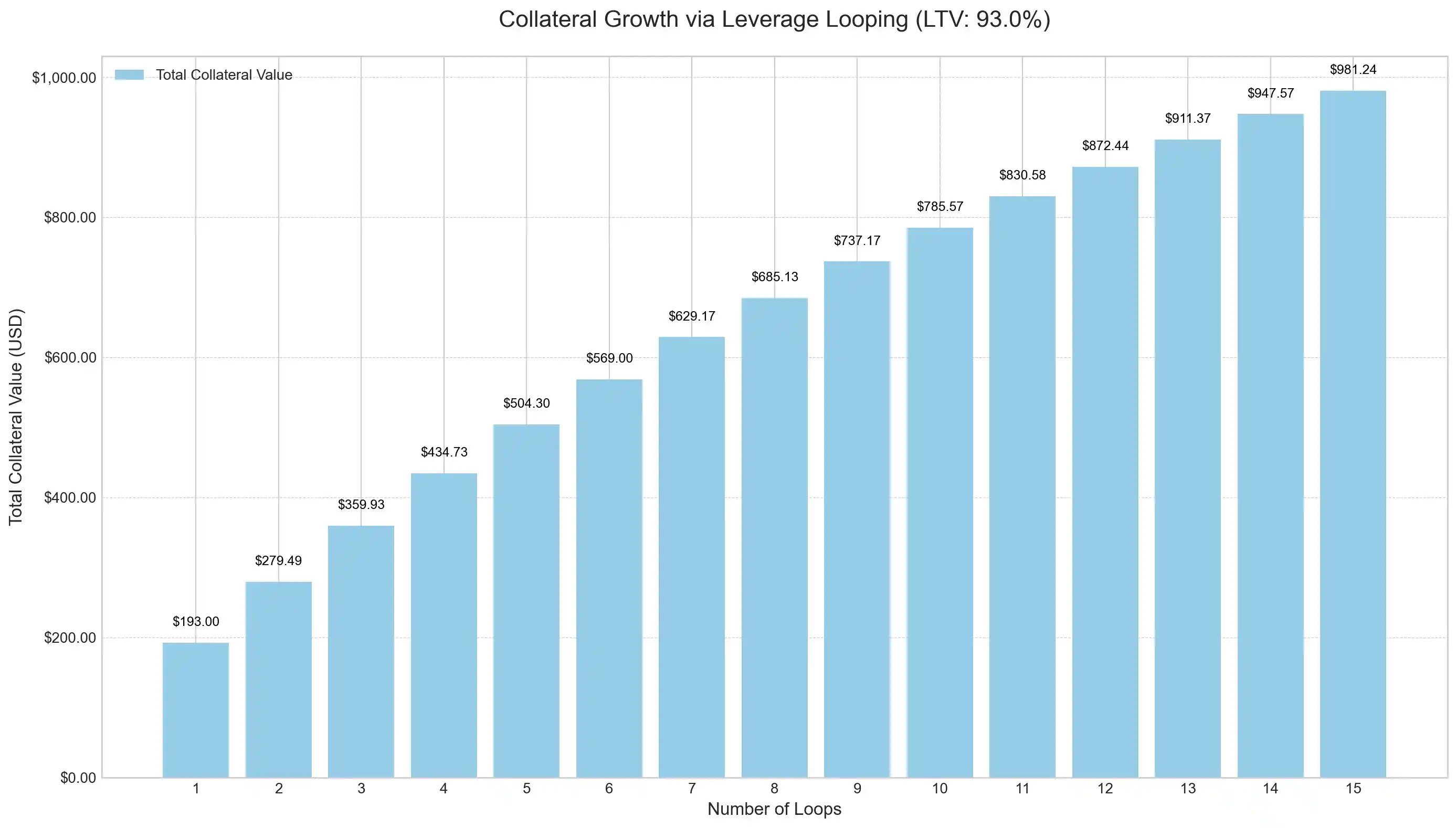

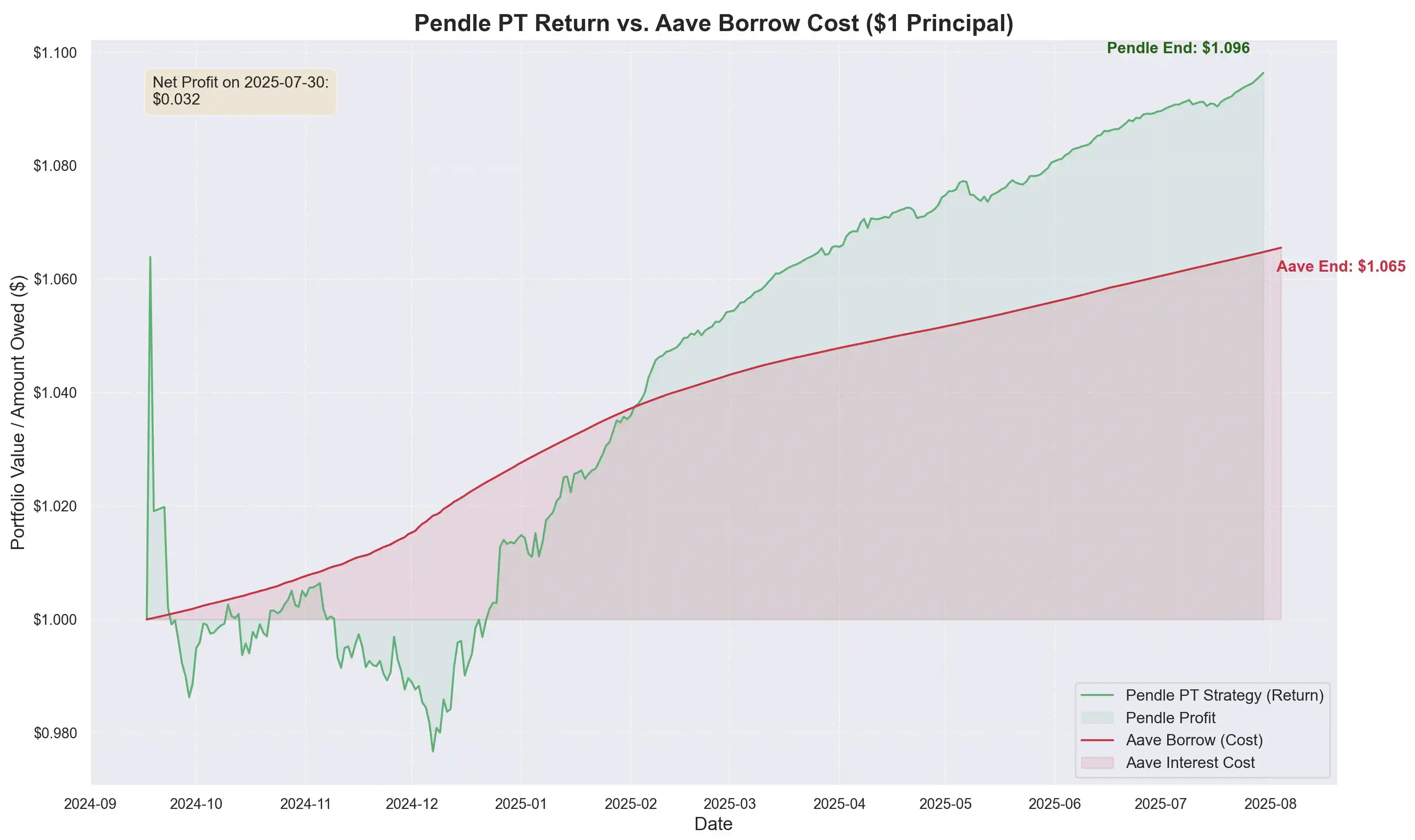

To enhance capital efficiency, users engage in leveraged rotation through the money market, repeatedly borrowing and staking to amplify yields. An example of the strategy operation is: depositing sUSDe, borrowing USDC at a 93% collateralization rate, then converting USDC back to sUSDe, repeating the process to achieve about 10x leverage. As long as the annualized yield of USDe exceeds the borrowing cost of USDC, the strategy continues to profit.

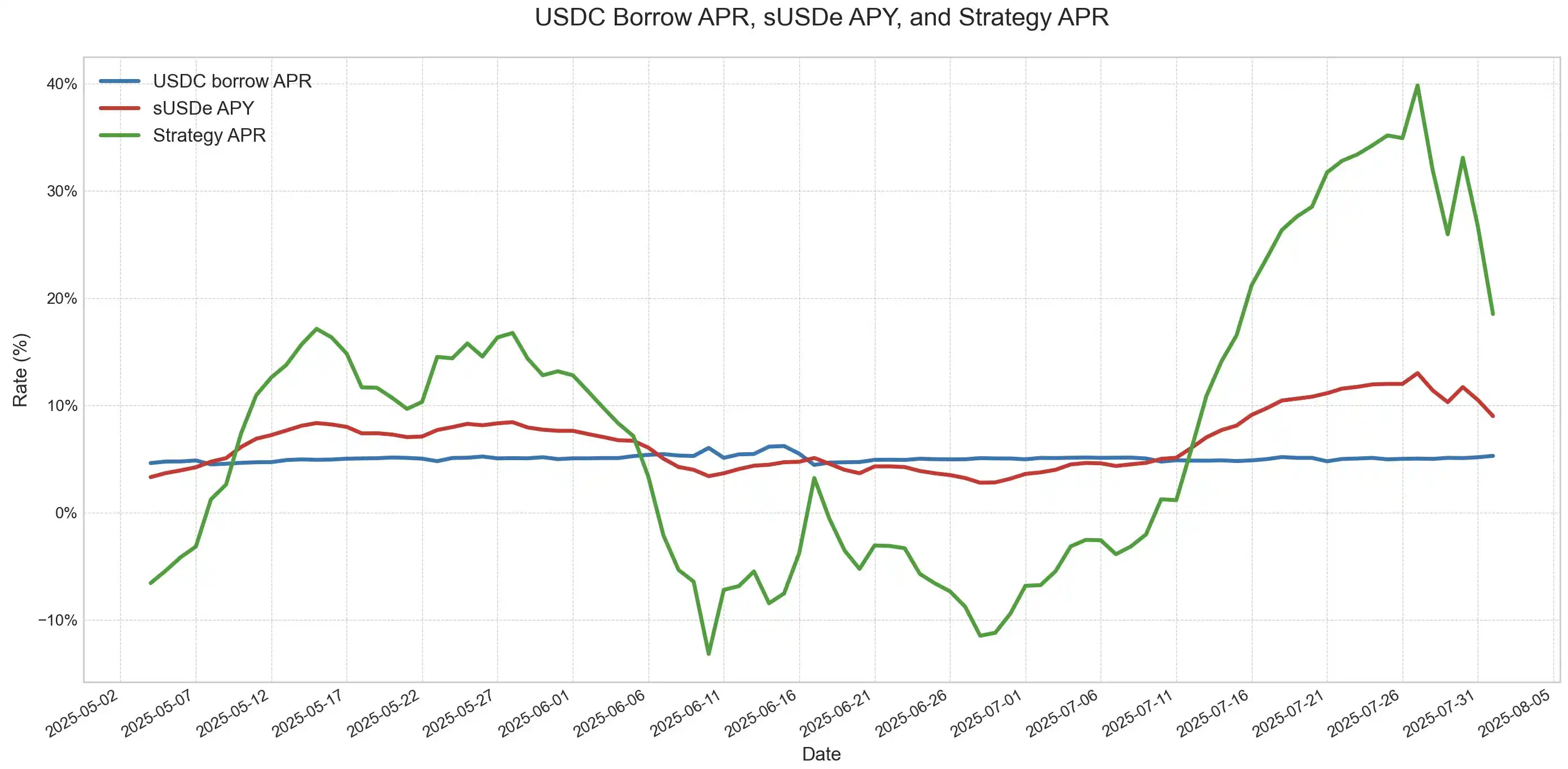

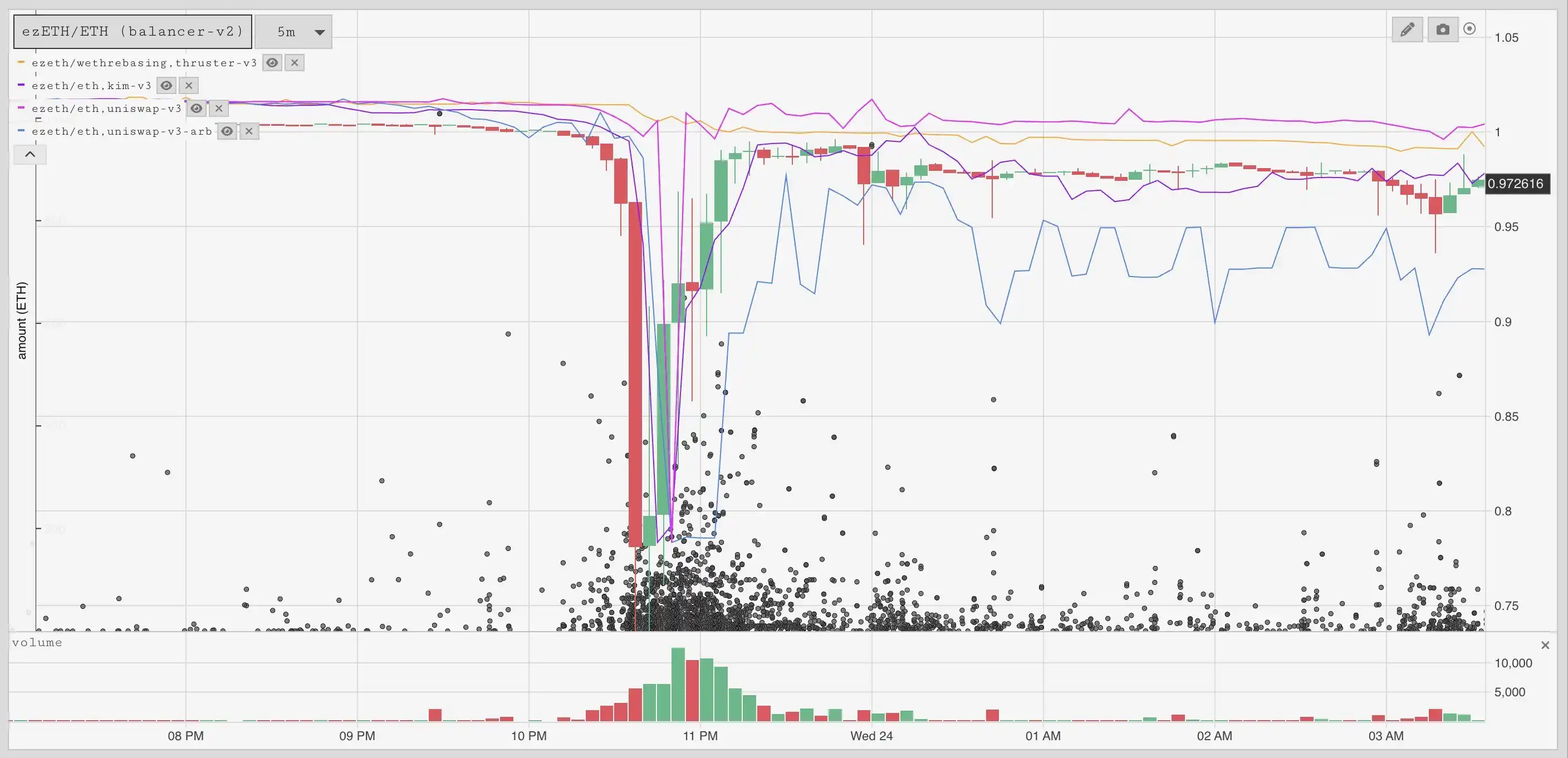

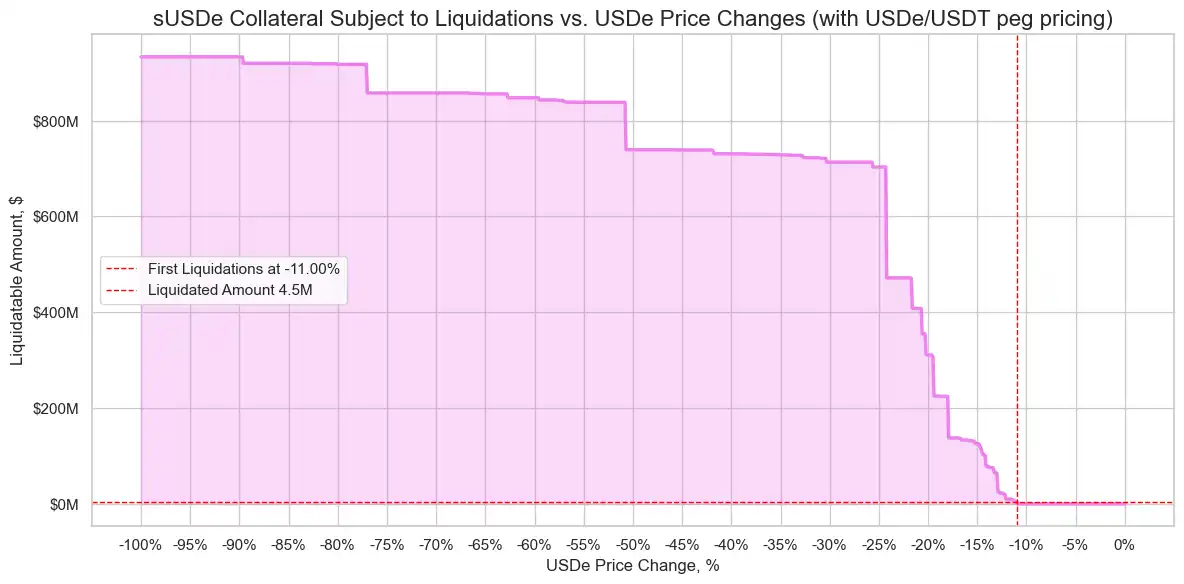

However, if yields suddenly drop or borrowing rates spike, profits will quickly erode. The main risk focuses on the design of price oracles. A large number of positions rely on AMM oracles, which are susceptible to temporary price dislocations, triggering chain liquidations and forcing borrowers to sell collateral assets at steep discounts, even if the assets are sufficient. Devens cited a similar event with ezETH/ETH rotation as a warning.

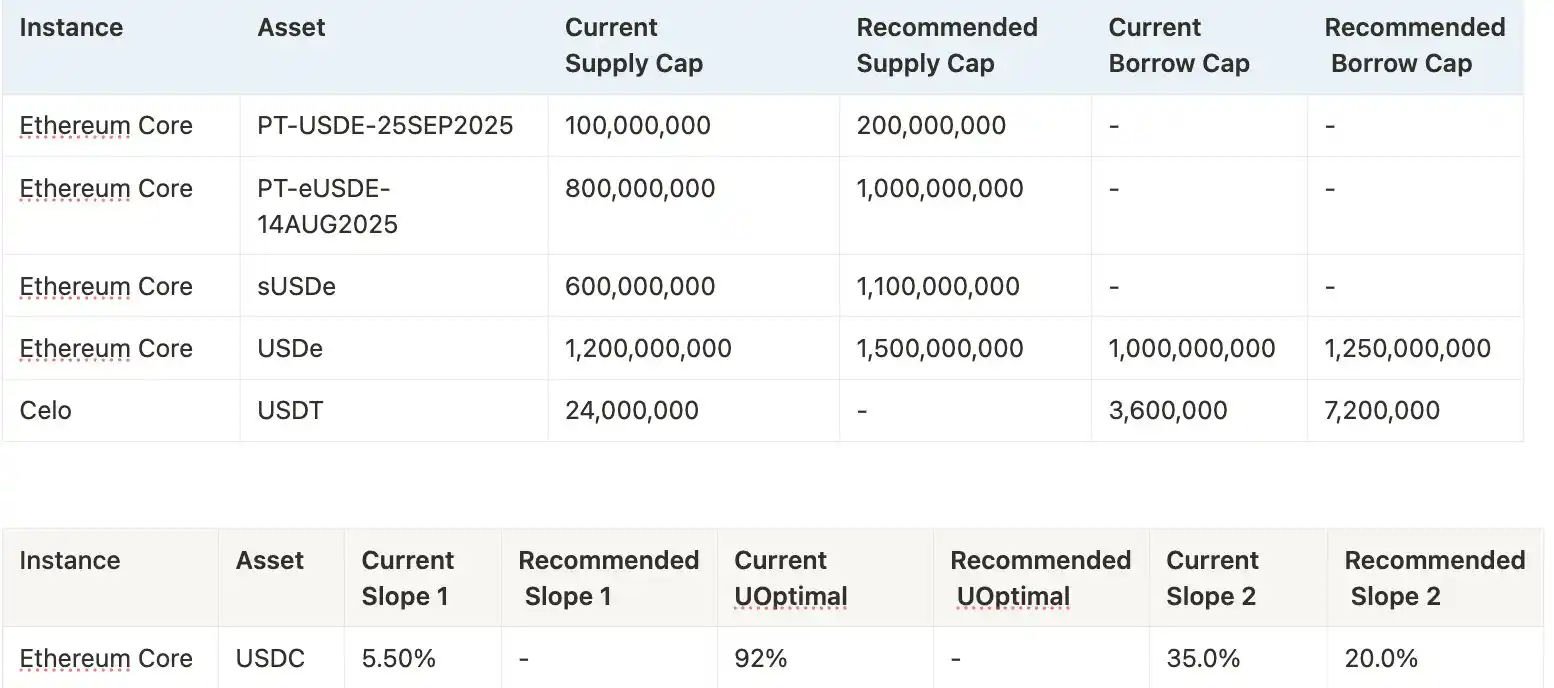

To mitigate risks, Aave made two key architectural adjustments. First, given that the risk team pointed out the potential liquidation risk of borrowing sUSDe, Aave DAO directly pegged the USDe exchange rate to USDT, eliminating the main risk factor, leaving only interest rate risk.

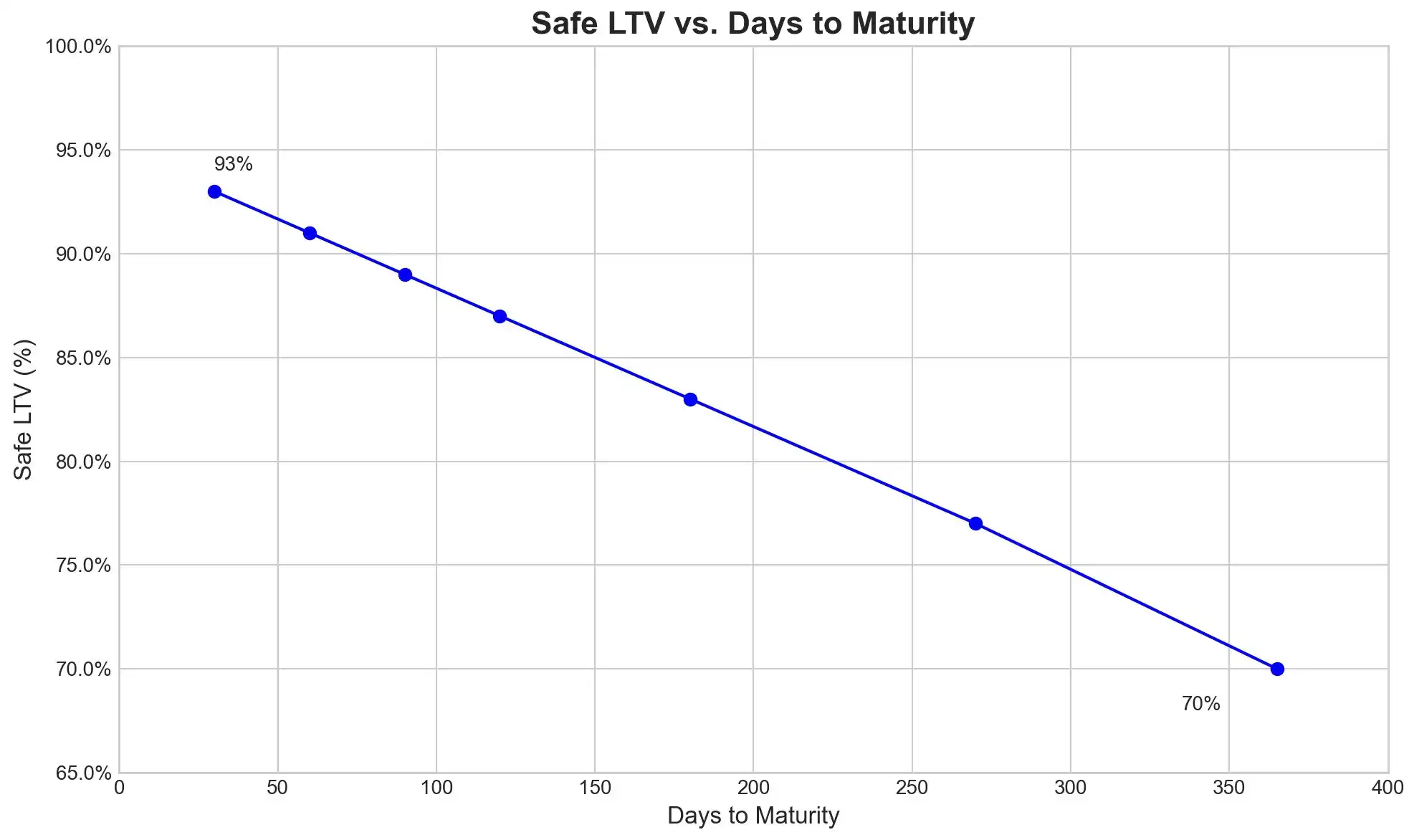

Second, Aave accepts PT-USDe tokens directly as collateral, allowing users to leverage fixed-rate positions, breaking the dual constraints of capital efficiency and yield volatility. Aave employs a linear discounting method for pricing PT collateral, based on the implied annualized yield of PT tokens, anchored to USDT.

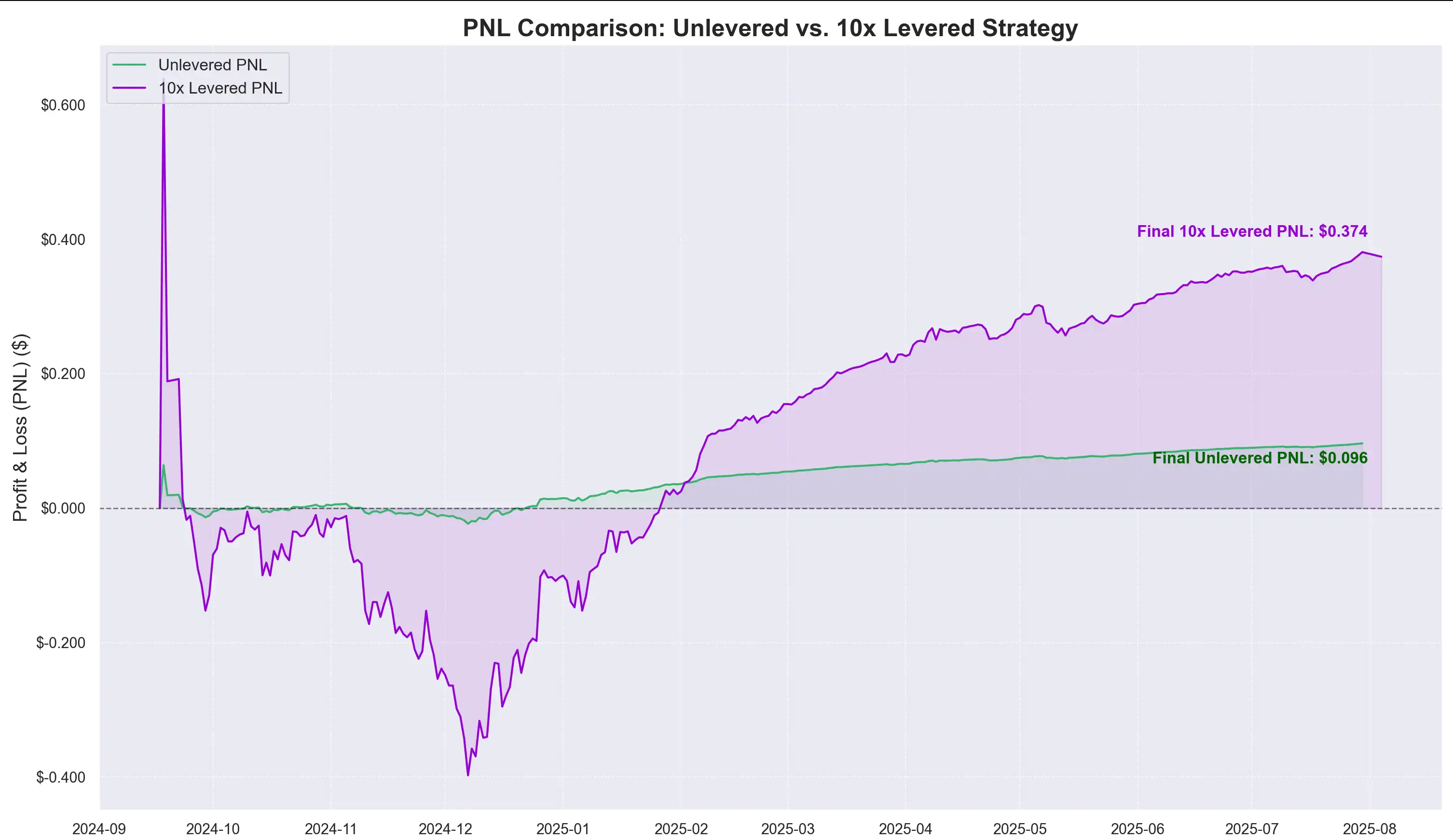

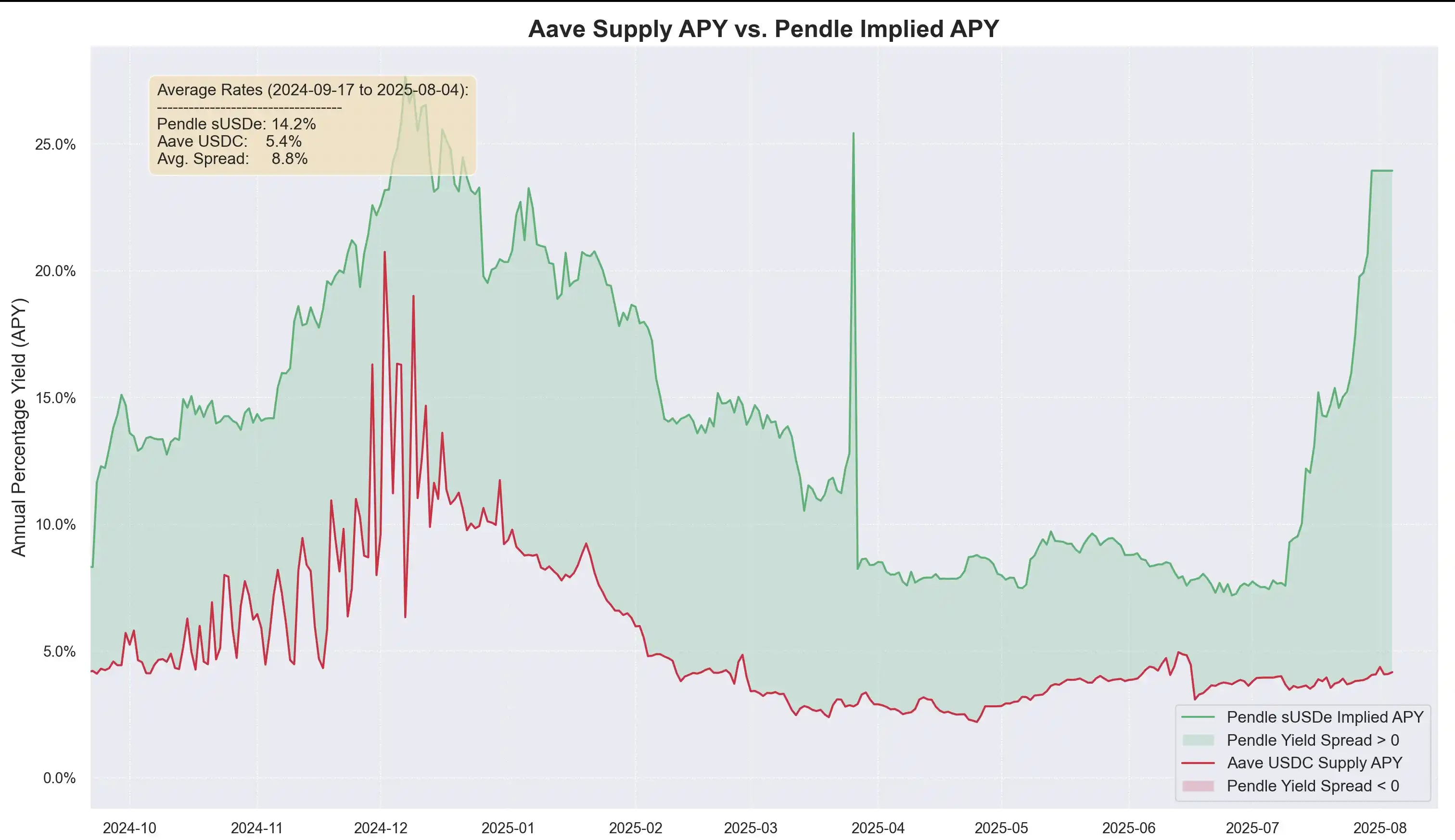

The price of PT, like a zero-coupon bond, gradually returns to par value as it approaches maturity, making yields more predictable. Since last September, the leveraged rotation strategy has achieved an annualized yield of about 40%, equivalent to a return of $0.374 for every $1 invested.

IV. Risk Management and Systemic Protection Mechanisms

Devens pointed out that Pendle's yield has long been above borrowing costs, with an average unleveraged spread of about 8.8%. The PT oracle designed by Aave includes a price floor and an emergency stop mechanism. Once triggered, the loan-to-value (LTV) ratio immediately drops to zero, freezing the market and preventing bad debts from occurring.

Taking the Pendle PT-USDe maturing in September as an example, the risk team set the initial discount rate of the oracle at 7.6% annualized, with a maximum discount rate of 31.1% under extreme market pressure, triggering an emergency stop if exceeded. The design of a safe LTV ensures that when the discount floor is reached, liquidation is nearly impossible, and the value of PT collateral remains above the liquidation threshold.

By insuring USDe and its derivatives to be equivalent to USDT, Aave has facilitated aggressive leveraged rotation. However, Devens emphasizes that both rotators and protocols must bear corresponding risks. Asset supply limits are frequently filled quickly, especially as USDC supply increasingly relies on PT-USDe collateral, with USDC in this structure resembling a senior priority share, where holders enjoy enhanced interest rates due to high utilization, with risks only exposed when bad debts occur.

V. Ecological Impact and Outlook

The scalability of future strategies depends on whether Aave continues to increase collateral limits. The risk team has repeatedly proposed increasing limits, with a recent proposal for $1.1 billion, but policy restrictions state that each increase cannot exceed twice the previous limit and must be spaced three days apart.

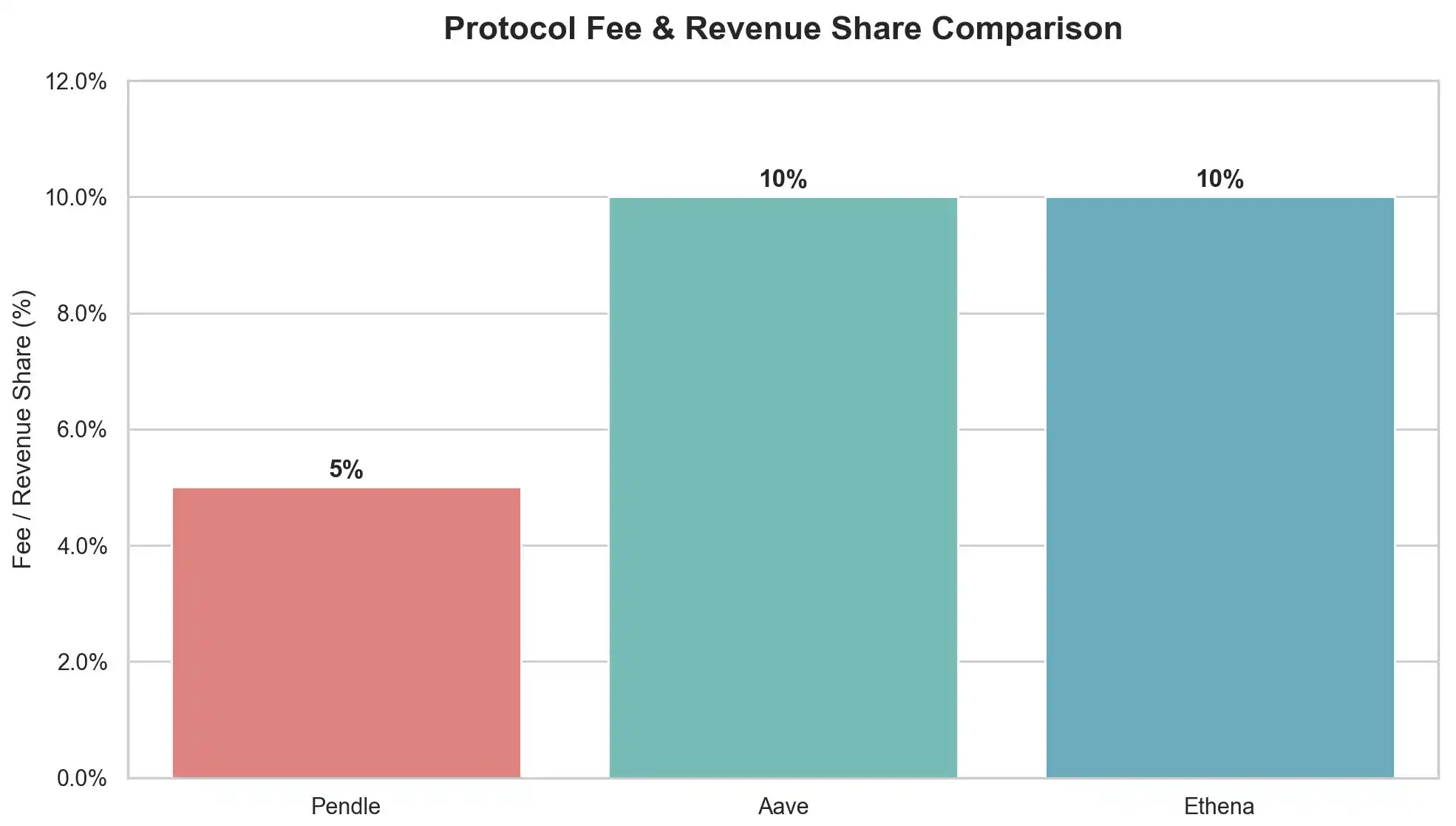

The benefits for all parties in the ecosystem are clear: Pendle charges a 5% fee on YT, Aave receives a 10% reserve from USDC borrowing interest, and Ethena plans to take about a 10% share after enabling a fee switch. Devens concludes that Aave, by pegging to USDT and setting a discount cap, provides high profit potential for Pendle's PT-USDe leveraged rotation strategy, but the increase in leverage also intensifies systemic risks among Aave, Pendle, and Ethena, requiring ongoing attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。