Written by: Tia

At 1 AM on August 11, 2025, the cross-chain communication protocol LayerZero proposed a significant acquisition: to buy all circulating tokens of the cross-chain bridge Stargate (STG) for $110 million and incorporate Stargate into its ecosystem. Upon the announcement, LayerZero's token ZRO surged over 30% on the same day.

If this transaction is successfully completed, it will become one of the most representative "parent-child mergers" in the cross-chain field. However, behind the surface narrative of synergy, this acquisition has sparked strong backlash within the Stargate community, with some token holders even describing it as "low-priced land grab" and "governance kidnapping."

According to the plan announced by LayerZero:

The acquisition price is $0.1675 per STG, exchanged at a ratio of 1 STG : 0.08634 ZRO (based on the current ZRO price of $1.94);

The Stargate DAO will be dissolved, and all protocol surplus will be used for ZRO buyback and destruction;

Long-term staked veSTG and liquid STG will be exchanged at the same ratio, with no additional premium;

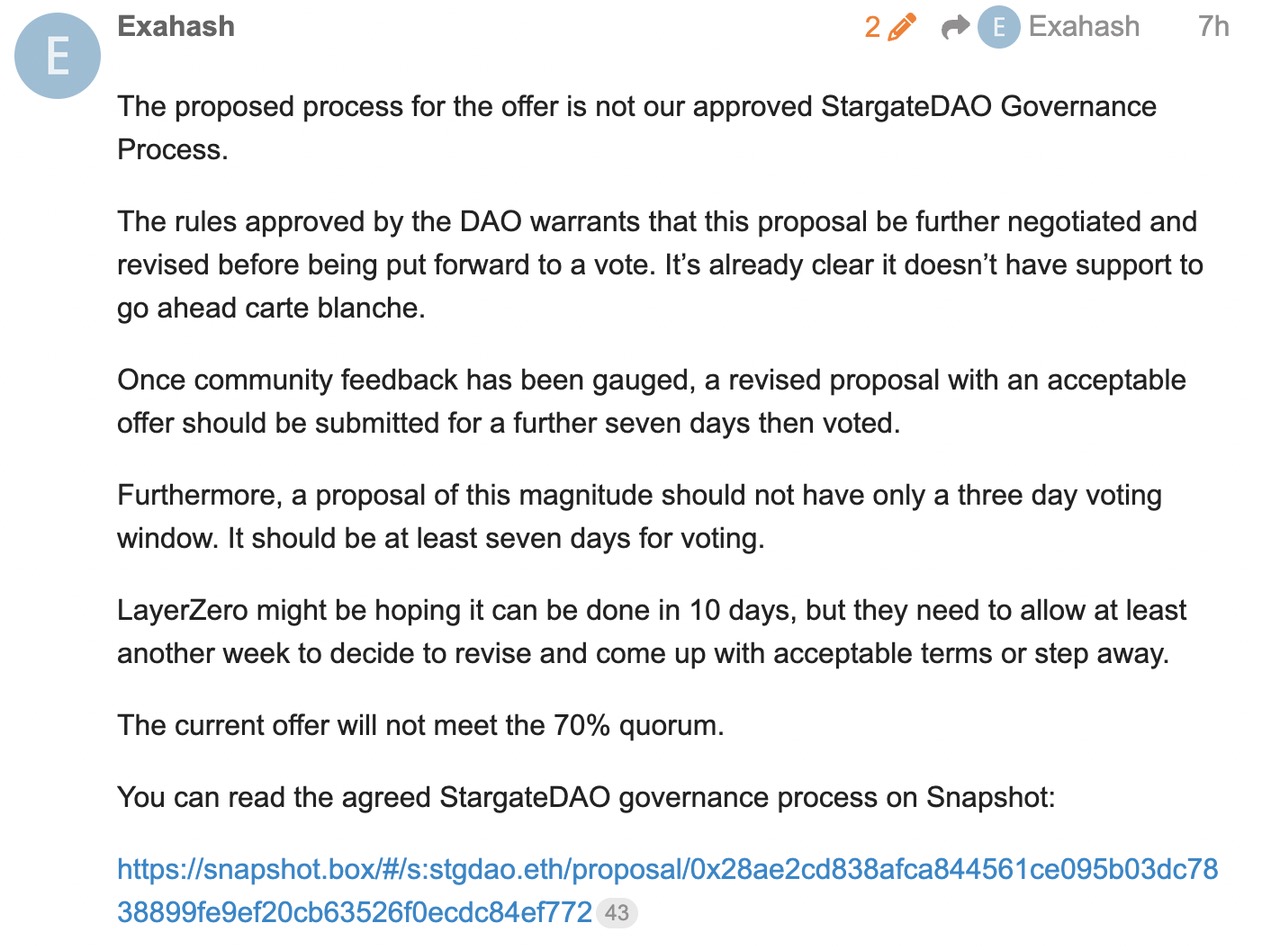

The community discussion period is only 7 days, followed by a 3-day Snapshot vote, requiring a 70% approval rate and 1.2M veSTG participation to pass.

Motivation Behind Capital Integration

From an execution standpoint, this is a "one-time delivery" type of acquisition: LayerZero will exchange a fixed price for all STG, completely taking over the protocol and revenue streams, absorbing Stargate's independent governance, token economic model, and dividend mechanism into the ZRO system.

Stargate is currently the most widely used cross-chain bridge, with a cumulative transaction volume exceeding $70 billion, and it helps new chains quickly introduce liquidity through the Hydra mechanism. After the acquisition, LayerZero will not only bind the underlying communication protocol with cross-chain liquidity entry but also directly reach end users, forming a "bottom-layer communication + application-layer cross-chain" closed loop.

Dismantling STG and injecting Stargate's revenue into ZRO buybacks can strengthen ZRO's value capture logic and reduce market attention dispersion on multi-token systems—this is beneficial for secondary market performance and future financing valuations.

Concerns from the Opposition

However, the opposition points out that the pricing in this proposal severely underestimates Stargate's long-term potential and may even relate to LayerZero's future asset integration for a U.S. IPO.

The total valuation of $110 million is considered a bear market anchor price. A few months ago, the Stargate Foundation provided an STG valuation of $0.60 per token in its internal bull market model, and that was before the passage of the U.S. "GENIUS Act." According to U.S. Treasury Secretary Bessent's predictions, after the implementation of this act, the global stablecoin market will leap from $250 billion to $3.7 trillion, and the velocity of money (the basis for Stargate's fees) will grow even faster.

During this period, Stargate's integration numbers, transaction volumes, and long-term staker yields have all seen significant growth, and the team has proactively waived OFT traffic fees to promote ecosystem expansion. As it is about to enter the Intents market, its profitability will further improve. Meanwhile, market analysts like Tom Lee have raised their potential price expectations for Ethereum to over $10,000, which means the value expectations for the protocol's treasury assets are also increasing.

Based on these prospects, the opposition believes that the acquisition price neither reflects growth potential nor provides a reasonable acquisition premium, especially given the timing before a potential altcoin bull market (ALTSZN).

Moreover, this proposal will erase the rights of long-term stakers. veSTG holders previously enjoyed a 50/50 revenue share, with staking periods of up to 4 years. In this acquisition, they are treated the same as liquid STG, with no premium compensation and losing future dividend rights.

The 7-day discussion period and 3-day voting period have also been criticized as a "blitzkrieg," depriving the community of time to negotiate better terms and not introducing other potential acquirers for competitive bidding. Some have even warned that this is a typical negotiation "anchoring strategy"—first throwing out an extremely low offer, then using a slightly higher price as a "sweetener" to mask the unfairness of the initial proposal.

Strategic Integration or Value Transfer?

From a strategic perspective, the integration of Stargate into LayerZero can indeed bring about a centralization effect on technology, users, and token value. For ZRO holders, this is almost a risk-free benefit: more revenue, a clear buyback logic, and stronger narrative cohesion.

But for STG holders, especially long-term stakers, this feels more like a value transfer: deprivation of revenue rights, lack of acquisition premium, and disappearance of DAO governance rights.

The opposition suggests that the acquisition should not be rushed before the market cycle following the implementation of the GENIUS Act is fully underway. They call for the Stargate DAO to extend the negotiation period, introduce other potential acquirers including Coinbase, Robinhood, Circle, Tether, etc., for competitive bidding, and consider hiring an investment banking team to secure a higher valuation for the DAO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。