I. Macroeconomic Liquidity

Improvement in monetary liquidity. Federal Reserve officials have expressed new concerns about the latest signs of weakness in the U.S. labor market, enhancing market expectations for a potential interest rate cut as early as September. Although U.S. stocks continued to rise in August, the retail buying power, a key support force within the market, is showing signs of weakening, and risks are quietly gathering for September. The cryptocurrency market is following the decline of U.S. stocks.

II. Overall Market Trends

Top 300 by Market Cap Gainers:

This week, BTC fell, altcoins broadly declined, and speculative stocks surged. The market's main focus revolves around ETH.

Top 5 Gainers

Gains

Top 5 Losers

Losses

MYX

1600%

FRAX

20%

M

60%

PI

20%

REKT

30%

WEMIX

20%

PUMP

20%

SUPER

20%

TOSHI

20%

MOG

20%

- ETH: The ETH/BTC exchange rate strengthened. U.S. stock BMNR holds $3 billion in ETH, becoming the largest treasury.

- PROVE: A cloud computing platform for ZK zero-knowledge proofs, surged significantly in South Korea.

- MYX: An on-chain contract exchange operated by a domestic team, skyrocketing several times due to short squeezes.

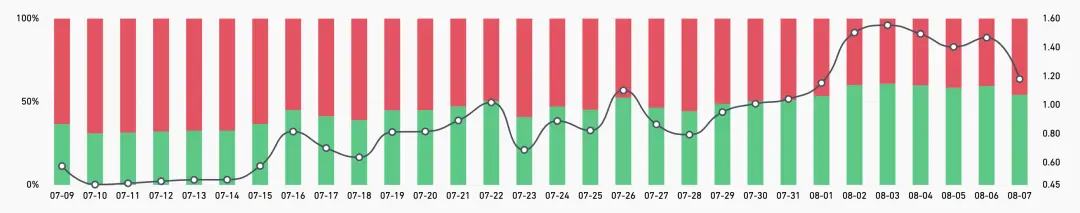

III. On-Chain Data

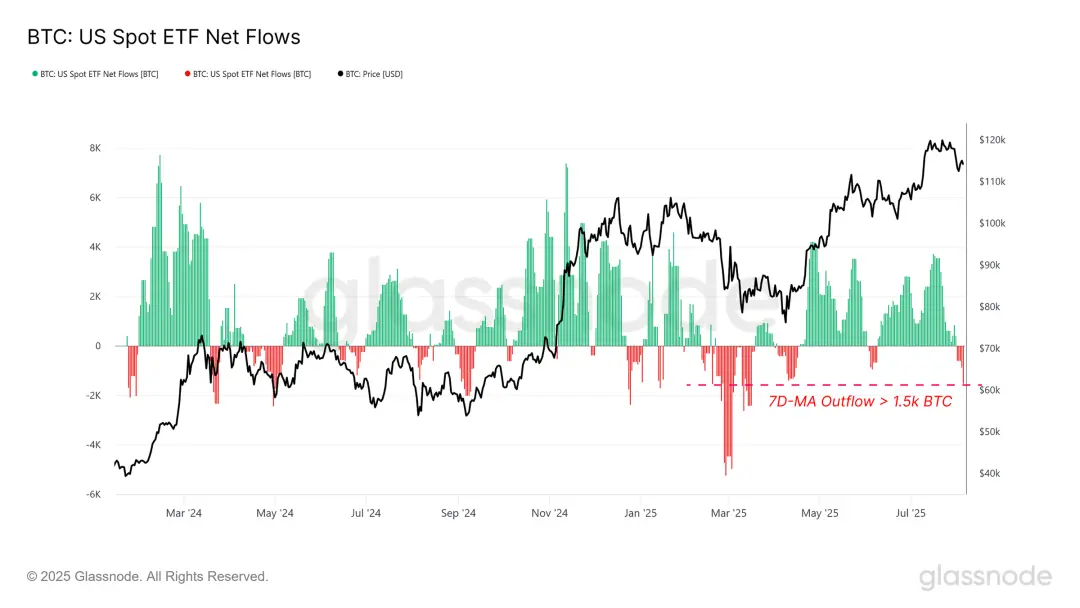

BTC shows indecisiveness after reaching a new price high. The profitability of short-term holders has declined, and ETF fund flows have turned negative, marking the largest outflow since April 25. The market financing rate has retreated, indicating weakened confidence in short-term price increases.

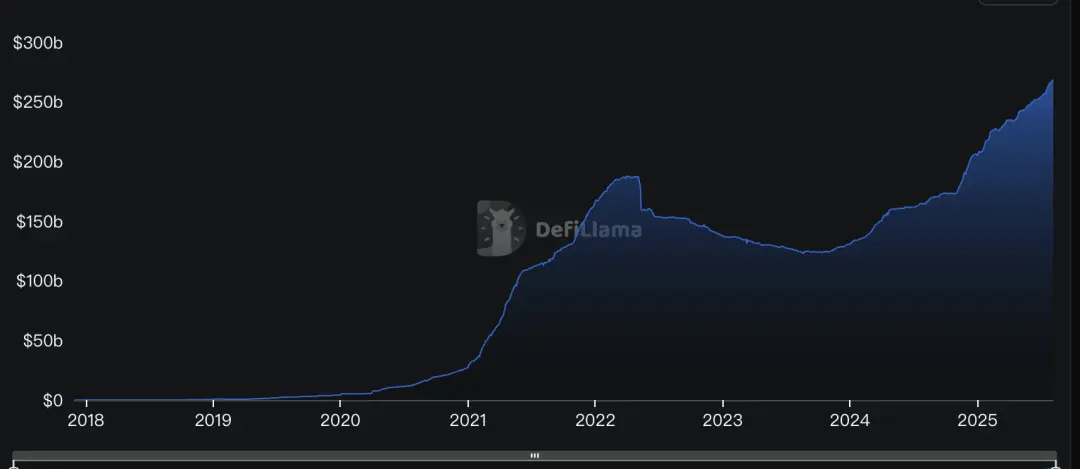

The supply of stablecoins continues to grow by 1%.

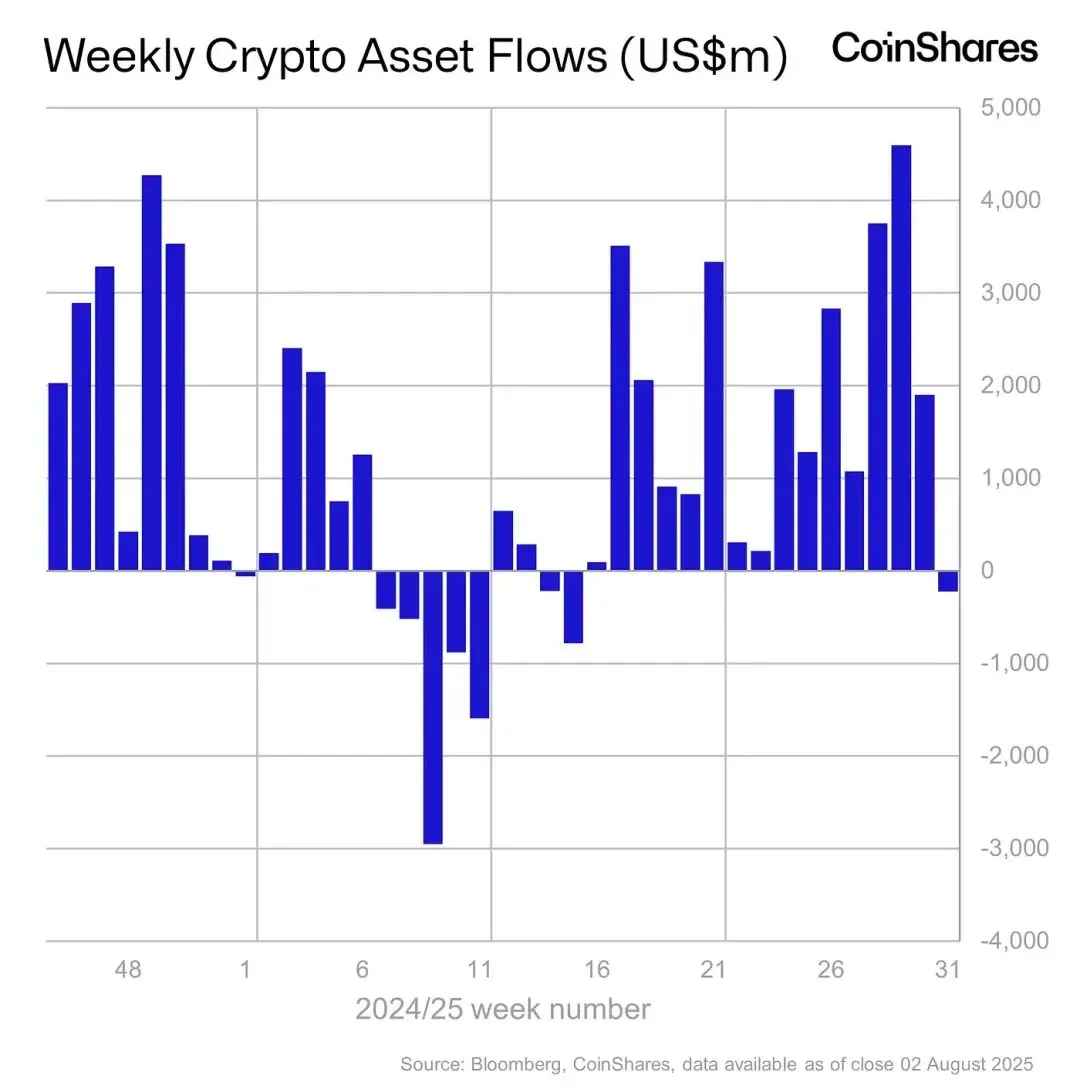

Institutional funds have seen their first net outflow in 15 weeks, while ETH continues to see inflows.

The long-term trend indicator MVRV-ZScore, based on the total market cost, reflects the overall profitability of the market. When the indicator is above 6, it indicates a top range; when below 2, it indicates a bottom range. MVRV has declined.

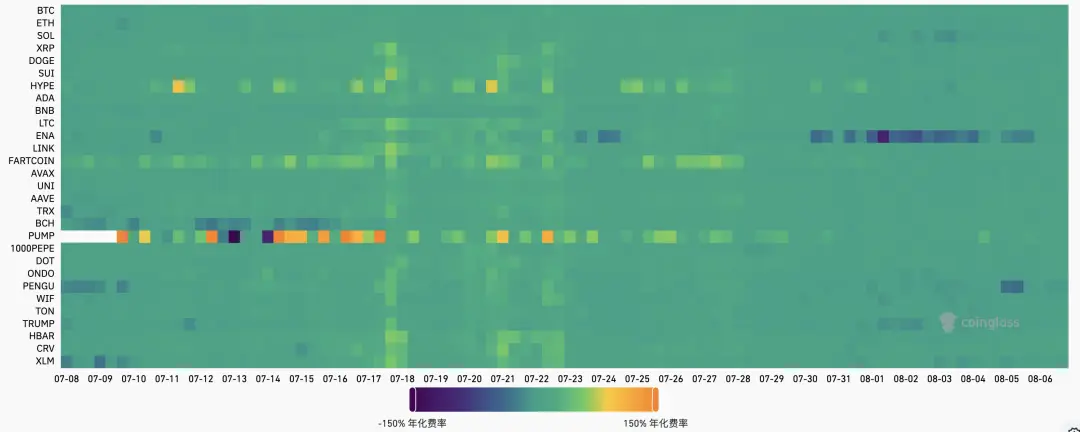

IV. Futures Market

Futures funding rate: This week, the rate is 0.01%, which is normal. A rate of 0.05-0.1% indicates a high level of long leverage, suggesting a short-term market top; a rate of -0.1% to 0% indicates a high level of short leverage, suggesting a short-term market bottom.

Futures open interest: This week, BTC open interest began to decline, indicating a withdrawal of major market funds.

Futures long-short ratio: 1.1, indicating neutral market sentiment. Retail sentiment often serves as a contrarian indicator; below 0.7 indicates fear, while above 2.0 indicates greed. The data for the long-short ratio is highly volatile, reducing its reference significance.

V. Spot Market

BTC experienced weak fluctuations this week, with its dominance rate declining by 5% to 61%. Looking back at July, the overall market capitalization of cryptocurrencies rose by 13%, driven by the continuous growth in institutional fund demand. Altcoins, led by ETH, performed excellently, with ETH spot ETFs recording a record net inflow for 20 consecutive days. The U.S. House of Representatives passed the Genius Act, aimed at regulating stablecoins, which was signed into law by President Trump.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。