1.市场观察

美国财政部长贝森特正牵头物色将于明年5月任期届满的美联储主席鲍威尔的继任者,候选名单已扩展至约十人,包括前圣路易斯联储主席詹姆斯·布拉德和经济顾问马克·萨默林等。特朗普持续施压要求降息,并已将名单缩减至四人,其倾向于支持降息的候选人。然而,贝森特在阐述下任主席的“招聘要求”时,强调了赢得市场信任、具备前瞻性思维、以及维护货币政策独立性的重要性,他担忧美联储职能的过度扩张已危及这一核心原则。

在贸易政策方面,贝森特将特朗普政府旨在“重新平衡”贸易逆差的对等关税比作“融化的冰块”,暗示若贸易失衡状况改善,关税可能逐步降低甚至取消,并透露与亚洲多国的贸易谈判预计在10月底前基本完成。此外,地缘政治也成为市场焦点,中信证券分析指出,若美俄元首会谈能在俄乌冲突问题上取得实质性突破,可能阶段性回落黄金、原油的地缘风险溢价,并提振股市风险偏好,同时对能源、金属等商品供应格局产生深远影响。

比特币今晨突破12.2万美元,距离历史新高仅差900美元,加密分析师Orbion指出当前资金从比特币轮动至以太坊再到小币种的模式,完美复刻了2017年和2021年崩盘前的景象,并预言比特币可能在9月底见顶, 随后在10月底前回落至5.5万美元的低位。然而,分析师Murphy提供了相对乐观的短期视角,他指出比特币价格已回到12万美元附近,以11.7万美元为支撑的价格区间得到重新确认,当前价格在一个上升通道内运行,短期反弹的首个目标价是通道上轨的12.5万美元,若能突破并站稳,则可能进一步上攻至13.7万美元。

此外,以太坊年初至今的涨幅已追平比特币,分析师Axel Bitblaze表示,随着价格突破4200美元,市场已进入“以太坊季”,尽管全面的“山寨季”尚未来临。 Greeks.Live分析师Adam指出,以太坊各主要期限的隐含波动率高达65%至70%,远超比特币,显示市场对其未来价格波动的强烈预期。对于后市走向,分析师IncomeSharks建议投资者不宜盲目追高,如果错过了之前的低价买入机会,可以等待价格回落至4,000美元附近,这将是一个较好的入场点。如果ETH继续上涨至4,800美元,则需要等到该位置的回调后再考虑买入。Ash Crypto则认为,以太坊已突破4100美元这一关键阻力位,价格将迅速推向4400至4500美元区间。Lord Hawkins基于Wyckoff理论分析,以太坊突破4200美元已进入“强势信号”阶段,若能确认支撑,价格或将加速上涨,目标直指6000美元。而Crypto Rover和Titan of Crypto则从更宏大的图表形态出发,指出以太坊已突破多年形成的对称三角形上轨,参考历史数据,这可能推动价格向8000美元区域迈进。尽管长期预测存在巨大分歧,但短期内市场普遍看涨,分析师Ted Pillows认为,ETH价格成功突破$4,000关口,目前几乎无明显阻力,认为以太坊在比特币不出现大幅回调的前提下,有望在本周创下历史新高。

周末以太坊首次跻身全球资产前25强,市值于8月10日清晨飙升至5200亿美元,HashKey首席分析师Jeffrey Ding指出,这标志着加密资产正向主流金融深度融合。从监管角度看,美国SEC对流动性质押的明确豁免消除了合规不确定性,为ETF产品注入收益机制,有望吸引更多机构资金,推动行业规范化。市场层面,机构级持仓的激增与链上活跃度的提升,反映出资本正从传统资产向加密领域倾斜,以太坊作为高流动性资产,正受益于全球通胀对冲需求,展现出巨大的潜在市值扩张空间。从Web3生态建设的视角来看,此类政策利好将加速DeFi与NFT应用的创新迭代,巩固以太坊作为核心基础设施的地位,并促进跨链互操作与真实世界资产的整合,进而可能重塑全球数字金融的格局。

周末$SOON价格出现剧烈波动,24小时爆仓1090万美元,仅次于比特币和以太坊,并一度登上Upbit交易量榜首后迅速回落。值得注意的是,BitMEX创始人Arthur Hayes在近期出售PEPE、ENA获利之后,于周末斥资793万美元加仓ETH、LDO、ETHF和PENDLE,而Vitalik的链上资产也随着以太坊突破4300美元而突破10亿美元。此外,ZORA在近期回调后又再次创下历史新高,Base生态AERO、VIRTUAL、ZORA等代币也出现了大幅上涨。

2. 关键数据(截至8月11日12:00 HKT)

(数据来源:Coinglass、Upbit、Coingecko、SoSoValue、Tomars、GMGN)

比特币:121,684美元(年初至今+29.97%),日现货交易量442.74亿美元

以太坊:4,334.05美元(年初至今+29.68%),日现货交易量为306.79亿美元

恐贪指数:62(贪婪)

平均GAS:BTC:1 sat/vB、ETH:0.37 Gwei

市场占有率:BTC 59.9%,ETH 12.8%

Upbit 24 小时交易量排行:XRP、ETH、BTC、PROVE、ENA

24小时BTC多空比:49.99%/50.01%

板块涨跌:DeFi板块上涨2.83%;NFT板块上涨2.29%

24小时爆仓数据:全球共112015人被爆仓 ,爆仓总金额为3.67亿美元,其BTC爆仓1.13亿美元、ETH爆仓9816万美元、SOON爆仓1090万美元

BTC中长线趋势通道:通道上沿线(117570.51美元),下沿线(115242.38美元)

ETH中长线趋势通道:通道上沿线(3930.35美元),下沿线(3852.52美元)

*注:当价格高于上沿和下沿时则为中长期看多趋势,反之则为看空趋势,当价格在区间内或短期反复通过成本区间则为筑底或筑顶状态。

3.ETF流向(截至8月8日)

比特币ETF:+4.039亿美元

以太坊ETF:+4.61亿美元

4. 今日前瞻

Superp 基金会将一次性解锁并分配剩余 3% 空投,预计8月12日将上线申领页面

Solayer(LAYER)将于8月11日解锁约2702万枚代币,与现流通量的比例为9.51%,价值约1700万美元

io.net(IO)将于8月11日解锁约1329万枚代币,与现流通量的比例为6.51%,价值约830万美元

BounceBit(BB)将于8月11日解锁约4290万枚代币,与现流通量的比例为6.36%,价值约540万美元

Aptos (APT) 将于8月11日解锁约1160万枚代币,价值约5200万美元

peaq(PEAQ)将于8月12日解锁约8484万枚代币,与现流通量的比例为7.03%,价值约560万美元

美国7月未季调CPI年率:前值2.70%、预期值2.80%(8月12日20:30)

美国7月季调后CPI月率:前值0.3%、预期值0.2%(8月12日20:30)

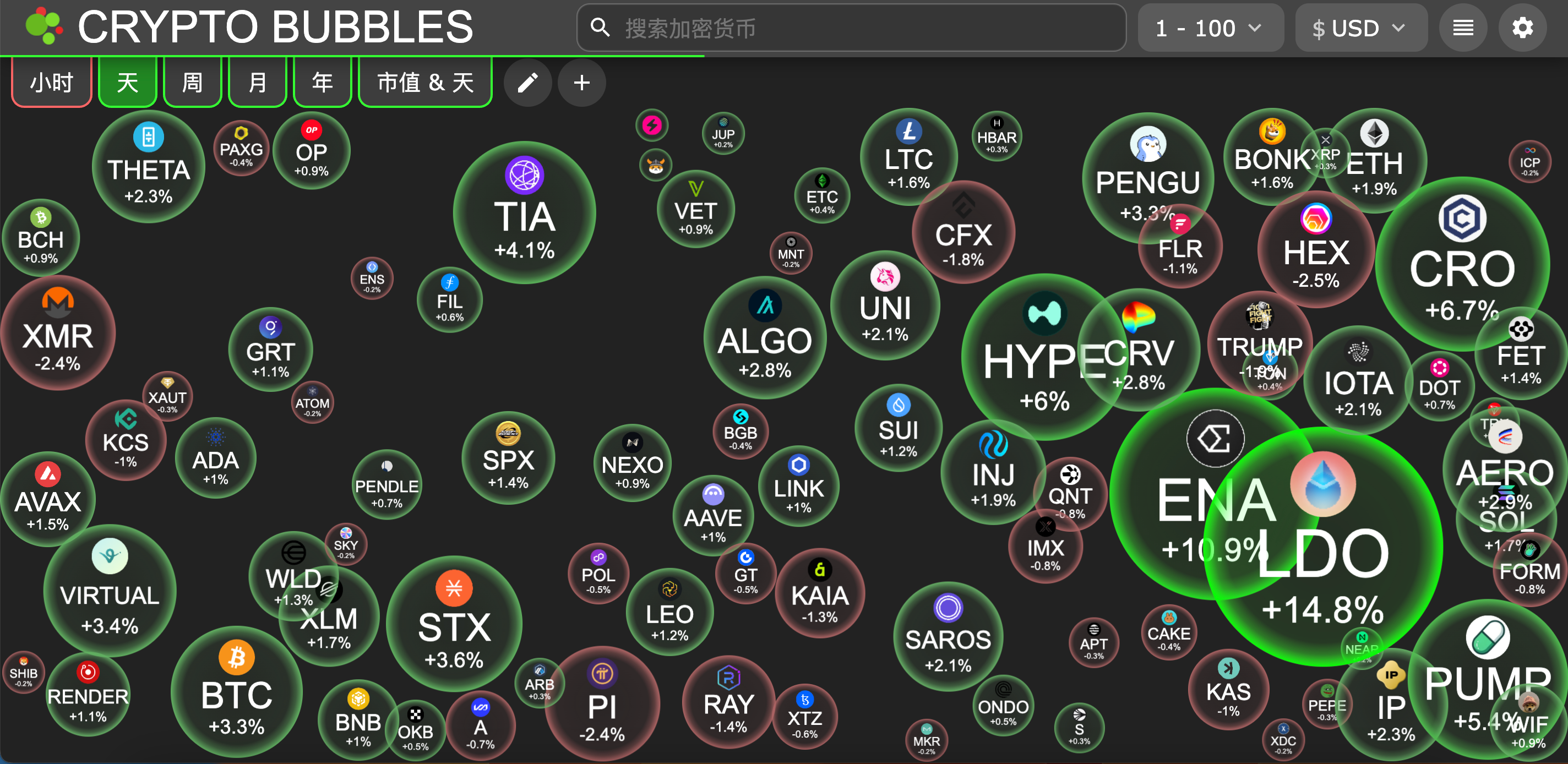

今日市值前100最大涨幅:Lido涨14.8%,Ethena涨10.9%,Cronos涨6.7%,Hyperliquid涨6%,Pump.fun涨5.4%。

5. 热点新闻

本文由HashKey提供支持,HashKey Exchange是香港最大持牌虚拟资产交易所,也是亚洲最值得信赖的加密资产法币门户。致力于在合规、资金安全和平台保障方面为虚拟资产交易所定义新标杆。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。