Author: SoSo Value

On August 7, Trump issued an executive order that expanded the investment menu of the largest retirement fund pool in the U.S.—the 401(k) plan—from a "traditional three dishes and one soup" to an "alternative buffet," with new options including private equity, real estate, and digital assets (such as Bitcoin, Ethereum, etc.). This is a historic first, allowing up to $9 trillion in long-term funds covering 90 million Americans to begin accessing the crypto market. Although it may take six months to two years for this "elephant" to truly step in, once it starts to move, this stable and lasting buying power may be the source of future "slow bull" trends in the crypto spot market.

What is a 401(k) retirement plan: initiated by employers, participated by employees, automatically deducted, long-term savings

A 401(k) is a long-term retirement savings account set up by U.S. employers for employees, enjoying tax benefits. Employees can invest a portion of their salary without paying taxes upfront, directly into this account, and withdraw it for spending upon retirement. Employers prepare an investment list (usually containing 20-30 funds), and employees decide how much of their salary to invest (for example, 6%), then select funds and allocation ratios from the list. Salaries are automatically deducted, and employers typically also "match" contributions—such as contributing half of what the employee invests as a benefit.

Decision-making power in the 401(k) plan: employers have the final say and act as "prudent stewards"

In a 401(k), employers have significant authority, deciding which funds can be included in the list, while employees can only choose from the list and cannot add their own options. When selecting fund companies or custodians, employers must adhere to the "prudent person rule"—meaning they must be as careful as if managing their own family's finances. If a poor choice leads to employee losses, employers may face legal liability.

The scale of the 401(k) plan is enormous: approaching $9 trillion, with over 90 million participants

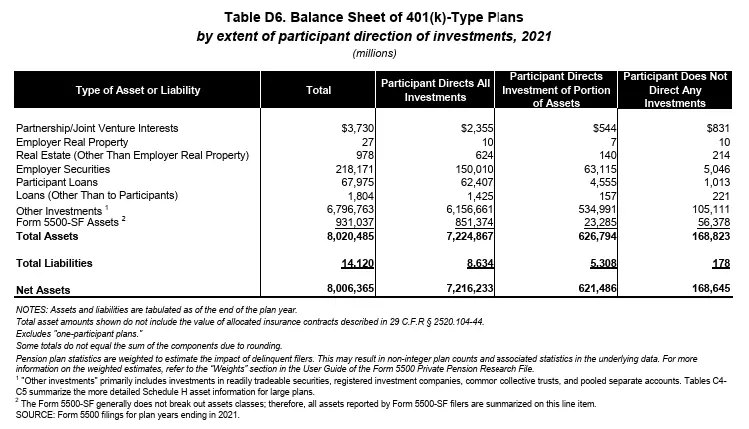

According to the U.S. Department of Labor, the total assets in 401(k) plans were approximately $8 trillion in 2021; the Investment Company Institute estimates that by the first quarter of 2025, this figure will reach $8.7 trillion. The White House has also revealed that over 90 million people across the U.S. are using this plan.

How significant is this change?

- A historic first: Previously, the investment list for 401(k) plans did not include crypto assets; this is the first time policy has opened the door.

- Potential funding pool: Even if only 2% of 401(k) funds flow into crypto, based on $9 trillion, that would mean $170 billion in new buying power—while the total of existing global crypto spot ETFs and listed reserves is only $260 billion.

- Market impact: Once such long-term funds enter the market, they could fundamentally change the structure of the crypto market—from primarily short-term trading to a price discovery process that relies more on long-term funds, forming a steady "slow bull" pattern.

Analyst perspective: Even if 401(k) plans only allocate 2% of their funds, the crypto market could immediately gain $170 billion—almost equivalent to two-thirds of the total existing crypto spot ETFs and listed reserves.

Implementing the funds will require three steps

Don't rush to celebrate; the money won't flood in tomorrow. It is expected to take at least six months to two years for implementation:

- The Department of Labor will first issue detailed rules clarifying how 401(k) plans can invest in alternative assets, including proportion limits and product disclosures.

- Service providers will design fund products that comply with the rules, incorporating crypto assets.

- Employers will decide whether to add these new funds to the investment menu, and employees will then decide whether to allocate to them.

Which types of crypto assets are most likely to be included first?

Crypto spot ETFs are the most likely candidates, as they are regulated by the SEC, have strong compliance, stable custody, and valuation mechanisms, and good liquidity. They may likely be included in target date funds (TDF) or balanced funds, with allocations possibly below 5%, but the impact would still be significant.

Why is this different from 2020?

In 2020, the Department of Labor under Trump also hinted at allowing 401(k) plans to access private assets, but because it was a spontaneous departmental action and private assets have poor liquidity, it ultimately resulted in little change. This time is completely different:

- The president personally signed the executive order, giving it more weight.

- Crypto ETFs have good liquidity and high acceptance among retail investors.

- The policy has been coordinated with the Treasury Department, SEC, and other parties, representing a true top-level design.

The market is already reacting

According to SoSoValue data, the MAG7 index token, which includes the top seven tokens, has risen nearly 5% in the past 24 hours, outperforming Bitcoin by 15.58 percentage points this year—indicating that while funds have not yet arrived, the market's imagination has already taken hold.

Trump's crypto ambitions

The executive order also reiterated his slogan—to make the U.S. the "world's crypto capital" and to embrace digital assets as a necessary path for driving economic growth and technological leadership.

In summary: This is a long race that could last for several years. When the $9 trillion retirement fund elephant even just extends a leg into the crypto market, it will change the foundation of the entire spot ecosystem.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。