Image source: "Billion"

Author: Lin Wanwan, Dongcha Beating

In the world of cryptocurrency, the loudest sound is not the clanging of trading bells, but the connections that quietly pocketed $9 billion.

In July 2025, 80,000 dormant Bitcoin addresses that had been inactive for 14 years suddenly moved their assets, marking one of the largest nominal Bitcoin transactions in history. Such a large transfer should have triggered a 30% market drop, but the reality was—there was no significant crash, no panic; this batch of Bitcoin was quietly absorbed by the market.

$9 billion worth of chips was "silently" consumed by the market. The operator was neither an exchange nor a hedge fund, but a somewhat obscure Wall Street player: Galaxy Digital.

During the latest Q2 earnings call on August 5, someone asked the CEO: How did you secure the client for 80,000 BTC? Was there a formal bidding process?

The CEO casually replied, "This deal is more about relationships than quotes."

Who exactly is behind Galaxy Digital? What kind of political and business resources were mobilized to secure this epic transaction? And what new power structure is this network creating for the crypto world?

The "Circle of Friends" at the Top: Political Capital in the Boardroom

The key to this transaction lies not in the quotes on stage, but in the connections behind the scenes—all pointing to an old Wall Street figure.

The 56-year-old founder Mike Novogratz is a standard "Wall Street product."

He worked at Goldman Sachs for 11 years, starting from the Southeast Asia futures desk and eventually becoming a partner in fixed income. At that time, Novogratz was one of the few who could navigate between macro trading, asset allocation, and national policy.

He then joined Fortress Investment Group, leading macro strategy investments and becoming one of the key figures to bet on emerging markets and sovereign debt.

During that period, he frequently interacted with policy institutions, central banks, and market departments in Latin America, Asia, and Eastern Europe, negotiating bond issuances and exchange rate policies with local governments, becoming familiar with the game logic of leverage and sovereignty in the "gray areas."

From 2012 to 2015, he became a member of the New York Federal Reserve's Investment Advisory Committee, directly participating in policy consulting, monetary mechanism research, and financial institution evaluations. This gave him a rare "dual capability"—understanding both derivatives trading and the language and rhythm of regulatory bodies.

He is someone who has been dealing with the intersection of political power, Wall Street capital, and information for over a decade.

He had already heavily invested in Bitcoin and Ethereum with his own funds back in 2013, totaling about $7 million. By 2017, he publicly stated in an interview with CNBC, "In the past two years, I made over $250 million from crypto assets."

However, he is not a "native" of the crypto industry, nor a typical speculator. His real pivot occurred in 2015—when he suffered losses in the Brazilian interest rate market, he exited Fortress and briefly retreated from frontline investment. It was during this "downtime" that he first seriously examined Bitcoin and reestablished his understanding of currency, credit, and financial infrastructure.

But Novogratz did not stop at merely "holding Bitcoin" like many early crypto evangelists. His ambition is to establish a new "financial system design" for the on-chain world. He said, "What I see is a systemic void—liquidity in the crypto world is deepening, but there is no structure."

In his view, the entire chain of asset management, market making, clearing, ETF custody, PIPE financing, audit disclosure, and regulatory lobbying that exists in the traditional financial world has almost no counterpart in the crypto world. This is a "systemic wasteland" that urgently needs reconstruction.

Galaxy Digital was born in this structural gap.

In 2018, Novogratz personally invested $350 million, successfully listing the company through a reverse merger with the Canadian shell company Bradmer Pharmaceuticals, becoming the first crypto financial platform to provide full-stack services to institutions. This was designed to be a "Wall Street version of an on-chain investment bank."

However, the journey from the Canadian exchange to NASDAQ took Galaxy Digital a total of 1,320 days, nearly four years. During this time, the company underwent nine rounds of feedback from the SEC, countless legal reviews, and invested over $25 million to meet compliance requirements. In an entire crypto industry facing collective obstacles and frequent "overseas" regulatory winters, Galaxy persevered.

It is not a trading platform, nor a VC, but a "financial structure service provider" in the crypto field. Galaxy Digital was designed by him to be the "Wall Street version of on-chain Goldman Sachs." Its structural design bears the imprint of his Wall Street background:

· Service offerings benchmarked against Goldman Sachs: covering asset management, market making, OTC trading, proprietary research, risk management, and financial advisory;

· Trading structures benchmarked against Citadel: supporting dark pool matching, low-latency derivatives systems, and ETF liquidity integration;

· Policy pathways benchmarked against Brookings: establishing policy research teams, writing reports, participating in hearings, and entering regulatory sandboxes;

· Compliance pathways benchmarked against Deloitte and EY: creating a "digital asset legal packaging system" that supports financial statement accounting and audit disclosure.

At the core of all this is the "political and business circle" built by Galaxy's board of directors.

Among the board members of Galaxy Digital is Tyler Williams, a former Deputy Assistant Secretary of the U.S. Treasury, who was appointed as a special advisor on digital assets by the current Treasury Secretary in 2025—he can translate crypto language into regulatory language and is an important bridge for Galaxy's communication with the SEC, CFTC, FASB, and other institutions.

There is also board member Doug Deason, one of the most influential real estate and energy lobbyists in Texas. He has participated in promoting several pieces of legislation related to mining, electricity prices, and taxes, and is a key figure behind Galaxy's successful conversion of Bitcoin mining sites into AI computing centers.

This structure, where "policy-capital-technology" converges, gives Galaxy a rare "policy influence capability" among crypto companies.

In the new financial structure he built, Galaxy is not just trading and asset management; it is also a "legitimate electrification" service provider for traditional companies entering the on-chain world.

Compared to CZ's extreme operational capabilities and SBF's aggressive funding strategies, Mike Novogratz represents a different type of founder. He never emphasizes "decentralization," but rather "structural arrangements"; he has never used coin price as the sole metric, but focuses more on whether privacy, regulation, systems, finance, custody, and compliance pathways are genuinely connected.

This also explains why, although Galaxy may not be the strongest in terms of traffic, it became the only player capable of securing large orders, completing settlements, and reassuring counterparties in that silent transaction of 80,000 Bitcoins.

Many people think that Galaxy Digital's moat is its capital, but the real advantage lies in its political and business acumen.

The Bankers Behind the Crypto Treasury

The 80,000 Bitcoins are just one corner of this network, with companies represented by the Chinese billionaire CZ also starting to view Galaxy Digital as a "political passport" to compliance.

In mid-2025, a new mainstream narrative in U.S. stocks quietly emerged: crypto equity. The U.S. stock market is undergoing a capital "shell game": putting BTC and ETH into listed companies, allowing crypto assets to appear on Wall Street under the guise of financial reports.

However, until the end of 2023, this was still seen as a "taboo" in the capital market.

It is actually very difficult for U.S. companies to "legally hold coins," because the financial system cannot accommodate it. According to the FASB accounting standards at the time, Bitcoin and other crypto assets could only be recorded as "intangible assets"—if the coin price fell, it had to be written down, but if it rose, it could not be counted as income, leading to serious distortions in company financial reports and making audits difficult to pass.

For example, if you bought 10,000 ETH, you had to immediately record a loss if it fell, but if it rose, you could pretend it didn't happen and couldn't count it as profit. This made corporate financial reports look terrible and audits a mess.

The FASB's new regulations, which took effect in the 2025 fiscal year, allowed for "fair value" accounting, where price increases could be counted as income, truly opened the door to "compliance for holding coins."

Galaxy was one of the first to enter this space and brought a batch of listed companies to "legally enter" the market.

The earliest to sense the opportunity were a group of ancient ETH whales. They quietly packaged their ETH into U.S. shell companies, using a left-hand-to-right-hand approach to complete disguised cashing out without alarming the market, leveraging U.S. stock liquidity. SharpLink Gaming emerged as a leader in this "cashing out" strategy.

Soon, the Chinese billionaire CZ followed suit—stuffing his company's platform token BNB into a U.S. company, reverse merging, packaging, and listing, turning the platform token into a compliant asset, and then entering the capital valuation system.

Behind this series of operations, Galaxy Digital has quietly emerged—it is the orchestrating consultant of the entire script.

It customizes "crypto treasury" narrative plans for these companies: from OTC building, asset custody, to compliance disclosure and staking returns, every step cannot be separated from the political and business channels it has built, and every step precisely treads the gray area between regulatory blind spots and capital leverage.

Galaxy Digital's core business has three directions: OTC trading + custody + strategic consulting.

It has top-tier crypto OTC trading capabilities across the U.S., able to complete large-scale matching and risk hedging for clients amid volatility; it also provides compliance asset management services such as ETF custody, staking, and tax reporting, managing billions of dollars in digital assets; furthermore, it deeply engages in strategic planning for enterprise-level clients, from PIPE financing to asset classification, financial accounting, disclosure pathways, and even co-investing with its own funds, helping traditional companies transform into "crypto treasuries."

Take SharpLink Gaming, a leading company in the ETH treasury space, as an example. This company purchased ETH through Galaxy's large OTC and signed an asset management agreement with them. A portion of the ETH acquired by the company is custodied at Galaxy, and under Galaxy's guidance, the entire process from financing to disclosure is designed. It provides clients with a complete set of "on-chain financial structures," including PIPE structures, asset classification, and custody proofs, helping enterprises achieve a discreet yet compliant accumulation of assets.

According to SEC disclosures, Galaxy and ParaFi Capital charge an annual tiered management fee of 0.25% to 1.25%, with a minimum of $1.25 million. As SharpLink's holdings expand, Galaxy will secure stable long-term income.

This is no longer a single transaction but a clearly structured, stable-return "on-chain treasury business." In the institutionalization path of crypto finance, Galaxy is becoming an indispensable entry point for companies looking to legally "hold coins on their books."

This template is not a mere copy-paste but a complete pathway:

· First, help you buy coins discreetly yet compliantly: provide OTC channels, combined with PIPE investment structures, directed placements, and warrant plans.

· Second, teach you how to "embed crypto assets into financial reports": how to get auditors to confirm that these coins really exist?

· Third, solve the U.S. political channels for you: the compliance pathways for U.S. stocks, how to disclose, all in one go. In the process of traditional companies transforming into crypto treasuries, Galaxy has been involved in nearly every key action.

CEO Novogratz stated in the Q2 conference call: "Almost all traditional institutions on Wall Street are preparing for a brand new financial architecture—assets moving from accounts to wallets, funds and stocks beginning to be tokenized, and stablecoins becoming mainstream payment vehicles."

What Galaxy is doing is making these institutional changes transition from "concept" to "financial statements."

For many listed companies, choosing Galaxy Digital is not just selecting a crypto service provider; it feels more like choosing a channel with a "politically legitimate identity."

The Reshuffling of Power Dynamics in the Crypto Industry

In 2025, the crypto industry seems to be ushering in a spring of normalization: ETF approvals, stablecoin legislation, corporate coin holdings—all moving closer to traditional finance.

However, in this wave of "compliance," the real winners are not the natives who have been shouting decentralization for a decade, but a small group of political and business intermediaries who are well-versed in institutional language and adept at navigating policy rhythms.

From the crypto circle to Wall Street, from wallets to financial reports, the path of crypto assets appears compliant on the surface, but underneath lies a typical institutional arbitrage—whoever can build a bridge between regulation and capital holds the pricing power.

During the Q2 earnings call in 2025, an analyst asked, "How do you view the development opportunities for stablecoins and asset tokenization?"

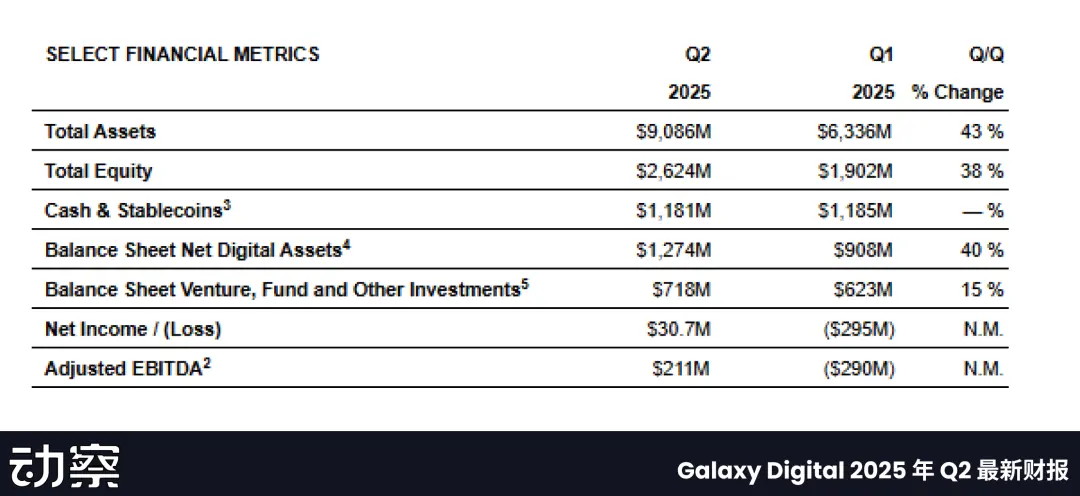

Novogratz's response hardly touched on products but instead offered a seemingly simple yet institutionally significant judgment: "Assets are migrating, accounts are moving to wallets, and compliance pathways will become the core competitive advantage." It was also in this quarter that Galaxy Digital began turning a profit.

Galaxy Digital is a hidden intermediary in this power transfer. It does not issue tokens or tell narratives but excels in structural design, packaging on-chain assets into every link of PIPE financing, ETF custody, and audit disclosure, using a complete set of compliance grammar to legitimize new finance.

What it sells is not services but structures; it does not earn market money but profits from the seams of compliance systems.

This is the true power structure of the crypto industry: while surface market prices, protocols, and narratives fluctuate, the underlying institutional structure has long been firmly controlled by a select few.

An increasing number of crypto projects and traditional companies are completing their "political entry" through it. And the ones truly being fed are not the developers or investors, but those with dual language capabilities who can freely switch between crypto, traditional finance, and power.

As compliance becomes a scarce resource, a new hierarchy is quietly taking shape: the era no longer rewards those who run fast; power is returning to the hands of those who manage the rules.

Click to learn about job openings at ChainCatcher

Recommended reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。