Sui Version of MicroStrategy?

Written by: CryptoMiao

“……Based on my understanding of the Sui Foundation, acquiring a listed company and then playing a financing game of stepping on the left foot and the right foot is not the style of the Sui Foundation. The Sui official still prefers a practical approach. It is more likely, as mentioned in section 04 of the article, to facilitate further business cooperation, equity cooperation, and exit channels for investors with other companies.”

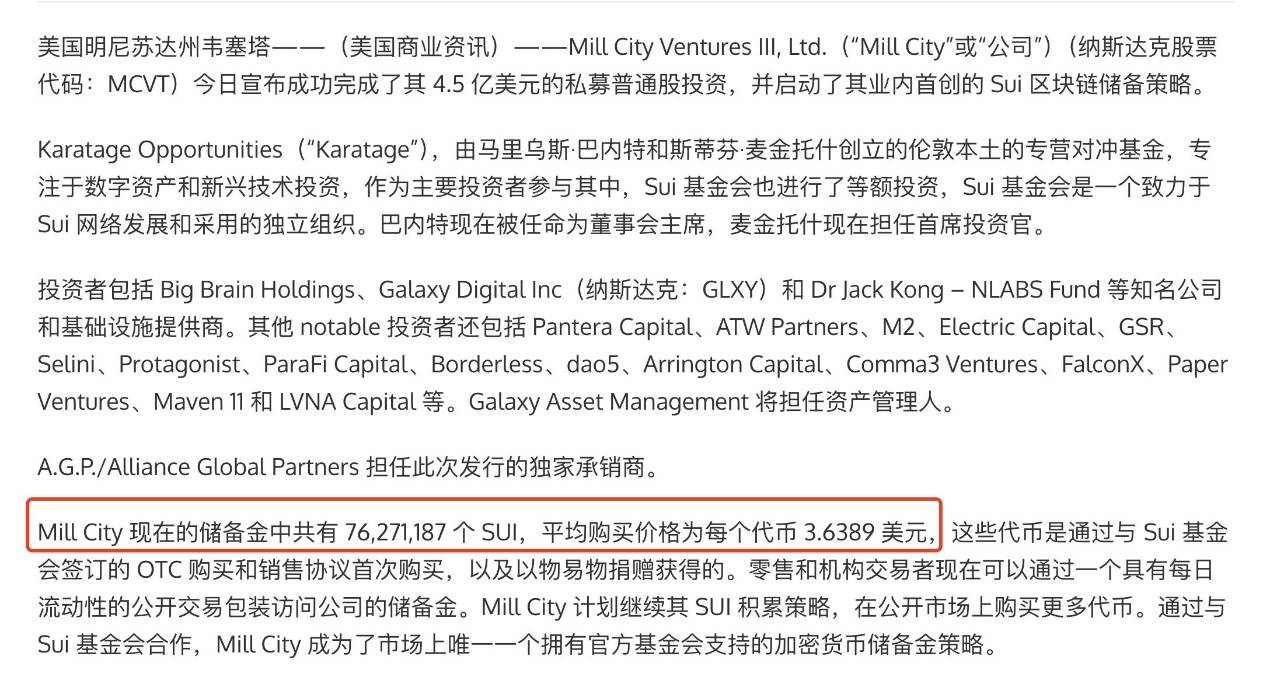

Recently, multiple sources have confirmed that the listed company Mill City Ventures III has raised $450 million in private financing to purchase Sui tokens as asset reserves.

Currently, they have purchased 76.27M SUI tokens from the Sui Foundation at an average price of $3.6389 through over-the-counter (OTC) transactions.

1. Sui Strategy is Not MicroStrategy

Many people say this is the Sui version of MicroStrategy, but that is not the case; they have essential differences.

MicroStrategy mostly issues convertible bonds, raises money, and then buys BTC. If the stock price does not perform well, investors do not convert their shares and must take cash upon maturity. Essentially, it is still a form of debt.

The Sui strategy involves direct equity financing, meaning this money does not need to be repaid; they become shareholders directly, and if it goes to zero, there is no need to repay.

Moreover, through this financing, they have changed the actual controller of the company.

2. Who Invested the $450 Million?

This $450 million private financing was contributed by multiple institutions, with the main lead investor being the London-based digital asset hedge fund Karatage Opportunities, which invested an equal amount as the Sui Foundation. Other notable investors include Pantera Capital, ATW Partners, M2, Electric Capital, GSR, Selini, Protagonist, ParaFi Capital, Borderless, dao5, Galaxy Digital, and Big Brain Holdings.

Karatage Opportunities, the hedge fund, is also an early investor in the Sui Foundation, so they are all part of the same family.

This means that Sui itself provided the $450 million, invested in the listed company, and then bought back its own asset Sui, putting Sui into the listed company and retrieving the money, transferring it from one hand to the other.

3. How to Shell List Mill City?

Before the announcement, Mill City Ventures III (MCVT) had a market capitalization of $11.2 million on July 24, 2025. After the announcement on July 25, it surged over 200%, reaching a market cap of $35.7 million. Currently (as of August 2, 2025), it stands at $29.83 million.

The entry price for the Sui Foundation is $5.42, and based on this price, the original shareholders' equity value is $32.93 million.

The foundation's investment value is $450 million, and the equity change is approximately:

This means that the Sui Foundation (and its allies) has become the absolute controlling shareholder of the listed company by injecting Sui as an asset, holding a 93% controlling stake.

PS: The entry price for the Sui Foundation is $5.42, while the average stock price before the investment was $1.8, providing the original shareholders with a 3x premium to purchase control of the company.

In other words, they spent 11.2M * 2 = 22.4M to buy a listed company.

4. Why Did Sui Shell List?

(1) Pretending to be an Asset, Actually Seeking Listing (Seeking Cooperation)

Firstly, unlike MicroStrategy, this is not about purchasing quality assets like BTC to increase shareholder value.

Instead, they have become shareholders themselves, akin to Satoshi Nakamoto using BTC to buy a controlling stake in a listed company, with the aim of seeking further circulation of Sui in the capital market and further business and equity cooperation with other enterprises.

After all, some companies may want to cooperate with Sui, but directly holding Sui tokens could be problematic.

For example, whether holding tokens violates company bylaws, what to do if they are stolen, how to hold them, whether a new management structure is needed, how to convince the board of directors and shareholders, how to value them on financial statements, how to disclose information, and the varying legal and regulatory requirements across countries.

However, holding company stock is much easier; cooperation can be initiated by signing agreements, following a standard process without technical risks and compliance hurdles.

For instance, if Nintendo were to hold shares in Mill City, it would mean that Pokémon and Sui could genuinely collaborate further. Having Nintendo hold Sui tokens would be complicated, involving a series of procedures, while collaborating through stock ownership would be straightforward.

(2) Seeking an Exit Mechanism for Investors

Many early investors have gradually unlocked a large number of Sui tokens, and if they were to sell directly, it would have a massive impact on the Sui price.

If there is a listed company as a platform, they can seek capital market buyers, reducing the impact on the Sui token price, whether through direct secondary market sales or OTC transactions, as the stock market can absorb much more than the token market.

Moreover, if new investors want to join Sui, they can negotiate to trade early investors' tokens in the form of stocks.

5. Does the Decline in Token Price Affect the Company?

Some say that with Sui's entry price at an average of $3.64, and Sui currently at $3.5, the game of passing the parcel is over.

Is that really the case?

Essentially, the company's purchase of Sui is an action where the Sui official will use their own money to buy their own Sui; whether it rises or falls, it is still theirs, and they do not intend to sell.

The original shareholders have already received a 3x price premium, so their interests will not be harmed.

6. How Should the Company Be Valued?

Previously, the company had been hovering around $10 million, and with the $450 million investment, the Fair Value (FV) is approximately $460 million.

If we simplify the calculation and ignore other company assets, we can just look at the Sui held by the company for FV (similar to how MicroStrategy only looks at BTC value).

7. The Relationship Between Stock Price and Sui Token Price

According to a simple model, if we only look at the Sui held for Fair Value:

If the company’s market cap is $450 million, and the FV of the Sui held is $450 million, it means buying stock is equivalent to buying Sui of equal value.

If the company’s market cap is $562 million > FV of Sui held at $450 million, it means that for every $1 of stock, $0.8 of Sui value is bought, resulting in a 25% stock premium.

Then the foundation can raise funds from the market, and after financing, further buy Sui, increasing the company’s value and subsequently boosting the stock price.

- If the company’s market cap is $360 million and FV of Sui held is $450 million, it means that for every share of stock, $1.25 of Sui value is bought.

In this case, the foundation can sell Sui to repurchase stock; for every $1 of Sui sold, they can repurchase $1.25 worth of Sui holdings, driving up the stock price.

Ultimately, the company’s Market Cap = Fair Value (simple calculation).

Of course, in reality, stocks generally have a premium, so Market Cap = Fair Value * (1 + premium).

8. In Conclusion

The above is merely a judgment based on existing public information and is not investment advice. Based on my understanding of the Sui Foundation, acquiring a listed company and then playing a financing game of stepping on the left foot and the right foot is not the style of the Sui Foundation. The Sui official still prefers a practical approach.

It is more likely, as mentioned in 4. Why Did Sui Shell List?, to facilitate further business cooperation, equity cooperation, and exit channels for investors with other companies.

Therefore, unless other companies also join the game of using Sui as an asset, there may not be significant buying pressure in the short term. In the long run, bridging the gap between traditional capital markets and Web3 is more conducive to long-term development.

Sui Holders, be patient; the project team is working (market making).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。