The long-dormant sea monster suddenly turns over, causing a stir on Wall Street.

Written by: Yanz, Liam

In July 2025, the crypto market ignited the flames of a bull market once again.

Unlike previous bull markets, crypto assets like Bitcoin have begun to deeply integrate with U.S. stocks in this cycle. While everyone is focusing on the tokenization of U.S. stocks by Robinhood, a long-silent old exchange is quietly opening the doors to the capital market.

This exchange is called Kraken.

Once referred to as the "big brother of the crypto world," it was known for its security and stability but had long remained hidden in the shadows of giants like Coinbase and Binance. In the Chinese community, it has long been labeled as a "safe withdrawal channel," having previously been so low-key that it was almost forgotten.

Now, the situation has changed.

In the second quarter of 2025, Kraken ranked second in the Kaiko global spot exchange composite score with a score of 89, just behind Coinbase; its quarterly revenue grew by 18% year-on-year, with trading volume reaching $186.8 billion; it launched the Layer 2 network Ink, the stock tokenization platform xStocks, and acquired NinjaTrader… the long-dormant sea monster suddenly turns over, causing a stir on Wall Street.

By the end of July, Kraken was preparing for its final round of financing with a valuation of $15 billion, gearing up for an IPO in 2026.

From "the honest person in the geek circle" to "the next crypto unicorn," there was a prolonged internal struggle in between; Kraken's story is a 14-year transformation saga.

From Card Trader to Exchange Founder

In the 1990s, Jesse Powell was just a teenager obsessed with Magic: The Gathering.

Unlike other players who were keen on battles, he was better at finding arbitrage opportunities in the card market—this was when he first realized: "Anything of value can be priced and traded."

After the millennium, Powell worked in technical support for an internet service provider. The online game Ultima Online became popular in the office.

This was the first large-scale online game with real currency trading elements, where a virtual castle could sell for thousands of dollars. Exchanging virtual items for real money made Powell see the embryonic form of "digitalization of real assets."

Soon after, he became fascinated with Diablo II. Initially, he just killed monsters and sold equipment, with ordinary players earning about $25 an hour being considered good. But Powell quickly discovered a more efficient arbitrage method: exchanging $5 worth of in-game gold for rare items and then selling them on eBay for $30, achieving a 6-fold return on each transaction. This side business later expanded to over 20 games, evolving into a small virtual currency trading empire.

Powell later referred to this experience as "the prelude to cryptocurrency."

In 2010, Bitcoin entered his view.

At first, Powell thought it was just another form of "World of Warcraft gold." But he soon realized that Bitcoin solved the core problems in virtual currency trading—refund disputes, delivery difficulties, and high cross-border payment costs… The decentralization and low-cost transactions of Bitcoin made Powell aware: "This could not only change the virtual gaming economy but could even reshape the financial system in reality."

Within a year, he transitioned from a virtual game currency merchant to a Bitcoin enthusiast.

In 2011, a friend he met while playing Magic: The Gathering invited him to visit the then-largest Bitcoin exchange, Mt. Gox. Rather than a visit, it was more of a trip to solve problems.

During that visit, the notorious hack of 880,000 coins broke out. Powell spent about a week and a half helping Mt. Gox resume operations, and it was then that he intuitively saw the enormous risks in the crypto world:

"If cryptocurrency wants to enter the mainstream, it needs a more serious player—a secure, compliant exchange that can earn the trust of regulators and users."

That same year, Jesse Powell and his technical partner Thanh Luu officially founded Kraken in San Francisco.

Unlike other entrepreneurs pursuing speed, Powell spent an entire year building a security team, undergoing third-party audits, and pioneering two-factor authentication (2FA), becoming one of the first crypto exchanges to publicly prove its security capabilities.

In the following decade, Kraken followed a path of slow-paced expansion.

In 2013, it became one of the first overseas exchanges to obtain a license from Japan's Financial Services Agency; in 2014, it assisted in the asset liquidation of Mt. Gox's collapse, further establishing its reputation for compliance and security; by 2020, it had expanded operations to over 200 countries and regions, obtaining licenses in multiple countries including the U.S., Canada, the U.K., Japan, and Australia, becoming one of the most comprehensive compliant exchanges globally.

The groundwork for steady expansion was laid, and Kraken was just waiting for an opportunity to turn around.

The Transformation of an Old Exchange

For a long time, Kraken was labeled as "old, safe, and low-key," but behind this label was the perception of being "stuffy and outdated."

In the Chinese crypto circle, it was long associated with the ability to quickly trade stablecoin USDT for fiat currencies like the U.S. dollar and euro, leading to its label as a "safe withdrawal channel." In the public's eyes, it resembled an old-fashioned bank: stable and reliable, but lacking brand flair and never leading the narrative.

In contrast, Coinbase, also based in the U.S., was like the "Apple" of the crypto world—glamorous, user-friendly, and ubiquitous.

It excelled in marketing, from Coinbase Learn educational content to Super Bowl ads in 2022, NBA partnerships, esports team sponsorships, and celebrity endorsements, gradually becoming synonymous with crypto assets in the minds of Americans.

In comparison, Kraken's first thirteen years felt more like a self-cultivation journey for a tech geek, akin to "Linux"—powerful and professional, but long living in the geek circle.

Social media data might illustrate the issue better: while Coinbase's X followers reached 6.5 million, Kraken was still hovering around 1.6 million.

However, all of this was completely overturned in 2025.

Kraken frequently made headlines, and its honest, invisible image was no more; instead, it transformed into a vibrant, action-oriented crypto powerhouse:

Stock Tokenization (xStocks): Launched tokenized stock and ETF trading on the blockchain in collaboration with Backed Finance, covering over 60 U.S. stock assets including Apple, Tesla, and Nvidia.

Traditional Finance Acquisitions: Acquired retail futures platform NinjaTrader for $1.5 billion, expanding into derivatives and futures trading.

Stablecoin Ecosystem: Made strategic investments in stablecoin issuer StablR, promoting the global application of EURR and USDR.

Layer 2 Ecosystem Ink: Built its own blockchain network, laying out on-chain financial infrastructure.

Institutional Services: Kraken Institutional provides full-stack digital asset services for hedge funds and ETF issuers.

The transformation on the marketing side came a bit earlier. Starting in 2023, Kraken began to address its brand shortcomings.

From 2023 to 2025, Kraken sponsored the Williams Racing F1 team, boosting its brand influence, and subsequently launched the Grid Pass digital collectibles (NFTs), attracting high-net-worth individuals through global live broadcasts of racing events.

In 2024, Kraken reached shirt sponsorship agreements with Premier League's Tottenham Hotspur, La Liga's Atletico Madrid, and Bundesliga's RB Leipzig, allowing the Kraken logo to appear in global sports broadcasts.

The awakening of both the Kraken brand and its business is merely a surface phenomenon; the fundamental change lies in the crisis.

In 2022, Kraken experienced a management crisis.

Then-CEO and co-founder Jesse Powell faced internal dissatisfaction due to strong ideological differences regarding libertarian culture and team values, leading to team turmoil. Former CMO Matt Mason left abruptly after just a year in February 2020, and the position remained vacant for two years; the product head changed three times in four years; since 2021, the Chief Business Officer position was left unfilled, and was later simply eliminated…

With ongoing vacancies in management and team divisions, founder Powell chose to step down as CEO in 2022, taking on the role of chairman of the board.

This change was both a transfer of power and a deep reflection on company culture.

From then on, Kraken embarked on a path of transformation.

That same year, Mayur Gupta joined as CMO, reshaping Kraken's image through global brand marketing for the first time, with sports sponsorships, NFT collections, and content-driven communication allowing this "techie exchange" to engage with Generation Z.

The series of marketing strategies he led later gained market recognition, with Business Insider listing him as one of the "most innovative CMOs of 2024."

More significant business changes occurred at the end of 2024 when Tribe Capital co-founder Arjun Sethi joined Kraken as co-CEO.

Notably, Tribe Capital is Kraken's second-largest institutional investor, and founder Arjun Sethi joined Kraken's board in 2020, which, from an external perspective, was also a form of shareholder self-rescue.

Coming from a Silicon Valley VC background, Sethi believed that Kraken needed to undergo an identity upgrade, with one keyword—"breaking the circle."

Transforming from a single crypto exchange to a global digital finance platform.

Under Sethi's leadership, Kraken launched the stock tokenization trading platform xStocks; acquired NinjaTrader, expanding into derivatives and futures trading…

Sethi stated, "We are open to more acquisitions for the future."

This co-CEO believes that a new area with "huge potential" for digital assets is corporate financial management, "Many public and private companies are exploring holding cryptocurrencies."

Today, Kraken has emerged from the shadows of its past internal conflicts, no longer the silent sea monster. It has a new voice, a new brand, and a new story.

It is no longer satisfied with being a safe haven for crypto; instead, it aims to build a bridge between crypto assets and traditional finance, and even become a core participant in the global asset tokenization wave.

This 14-year-old established exchange is now charging onto the IPO stage with a brand new posture.

Towards IPO

At the end of July 2025, according to The Information, Kraken is raising $500 million at a $15 billion valuation, a 36% increase from its valuation of about $11 billion in 2022.

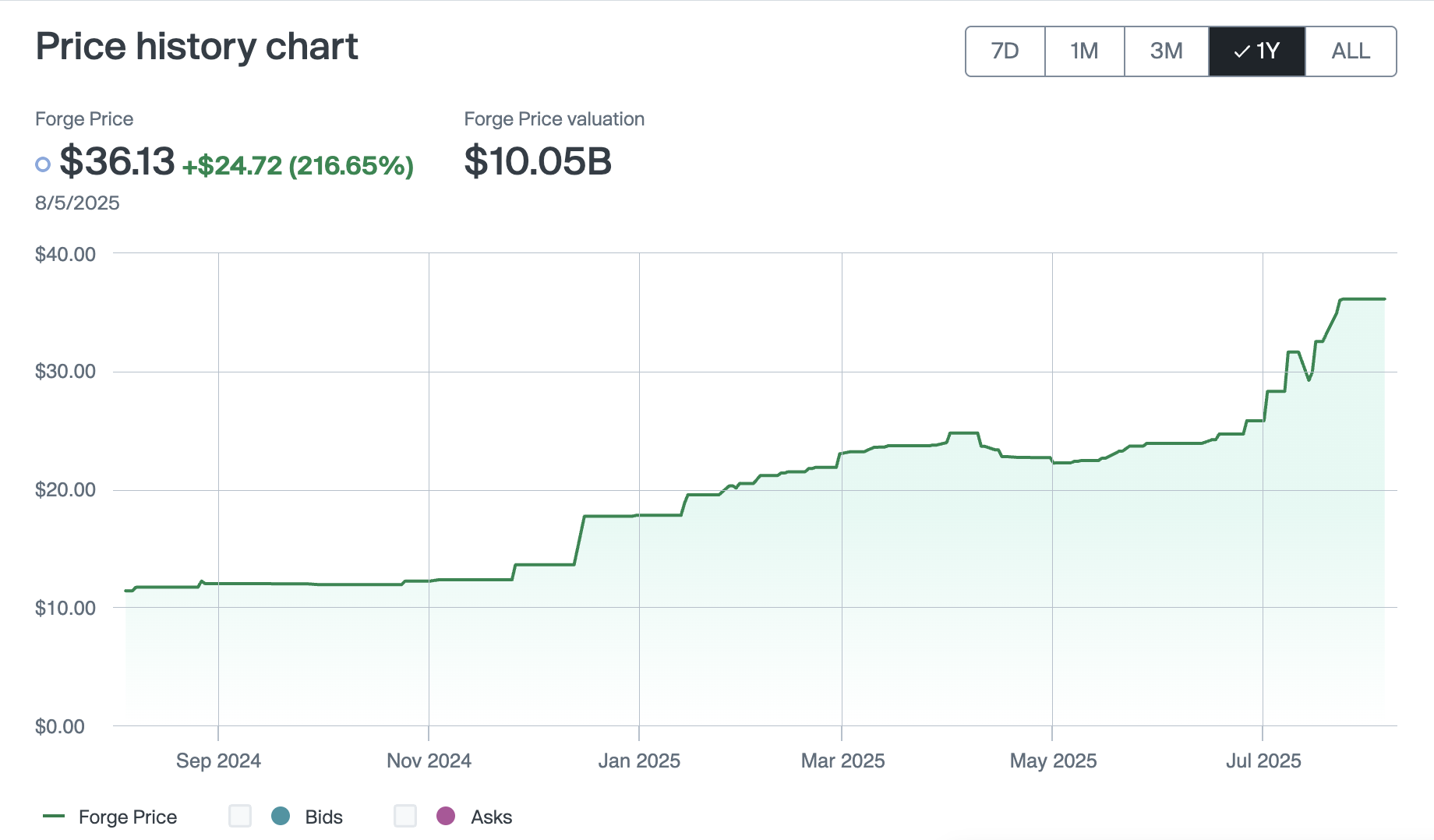

According to data from the over-the-counter equity trading platform Forge, Kraken's stock OTC quotes have more than doubled in the past year, with its current valuation surpassing $10 billion.

This financing is widely seen in the industry as the final sprint before the IPO, with Kraken expected to enter the capital market as early as the first quarter of 2026.

For Kraken, this is an excellent policy window.

In March 2025, the U.S. SEC dropped its lawsuit against Kraken for securities violations; in June of the same year, Kraken obtained a license under the EU's Markets in Crypto-Assets (MiCA) regulation, achieving comprehensive compliance operations in the EU.

All of this is inseparable from Trump's friendly policies towards the crypto industry, as well as from the early bet made by Kraken's founder on Trump.

In June 2024, Kraken co-founder Jesse Powell personally donated $1 million worth of crypto assets, mostly in ETH, to Trump. After Trump launched the meme coin TRUMP, Kraken became the first U.S. cryptocurrency exchange to list the TRUMP token.

In addition to policy support, Kraken has also shown strong momentum in business operations and financial data.

From a business perspective, Kraken's revenue structure is diverse and continues to enrich, primarily including trading fees, staking rewards, leverage and derivatives services, as well as asset custody, OTC matching, and institutional customized tools, with trading fees being the core.

In 2024, Kraken achieved $1.5 billion in revenue, with quarterly revenues of $472 million and $412 million recorded in the first half of 2025, representing year-on-year growth of 19% and 18%, respectively. Adjusted EBITDA reached $187 million and $80 million, respectively.

In the second quarter of 2025, Kraken's total trading volume reached $186.8 billion, a year-on-year increase of 19%; managed platform assets were $43.2 billion, up 47% year-on-year; total customer count exceeded 15 million, supporting over 200 digital assets and six national currencies.

Compared to Coinbase, Kraken's current daily trading volume is about $1.37 billion, roughly half of Coinbase's. However, Kraken is carving out an independent path through differentiated business narratives.

At the forefront is stock tokenization.

Kraken is one of the biggest proponents of stock tokenization. On the xStocks platform launched in collaboration with Backed Finance, over 60 stock tokens, including those of Apple, Tesla, and Nvidia, have gone live, opening a new gateway for non-U.S. investors to purchase stocks of U.S. listed companies, available for trading 24/7. Users can also use xStocks for DeFi collateral, liquidity pools, and smart contract calls, achievements that traditional securities trading cannot reach.

The future Kraken is no longer limited to being an exchange; it is more likely to evolve into a "Kraken Bank."

As early as September 2020, Kraken became the first digital asset company in the U.S. to obtain a special purpose depository institution (SPDI) bank license from the state of Wyoming. This means Kraken can offer digital asset custody, U.S. dollar deposit accounts, and 24/7 settlement services like a traditional bank, but it must adopt a full-reserve system to avoid the risks associated with fractional reserves.

In the future, Kraken officially plans to launch a broader range of financial products, including debit cards for institutions and individuals, mobile banking products integrated with crypto wallets, wealth management, and payment solutions.

In its official announcement, the intention to build a bridge between the future crypto economy and the existing financial system remains steadfast. It echoes Jesse's words from the founding of Kraken: "For cryptocurrency to enter the mainstream market, it needs a truly serious player—one that can operate steadily, collaborate with regulators and law enforcement, and explain cryptocurrency to banks, building a bridge from the traditional system to the crypto world."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。