Crypto Liquid Staking Debate Grows After SEC’s New Clarification

Amanda Fischer, a former Chief of Staff to SEC Chair Gary Gensler, has raised serious concerns about Crypto Liquid Staking, comparing it to the risky lending and borrowing practices that led to the 2008 Lehman Brothers collapse.

Source: X (Previously Twitter)

Amanda Fischer Raises Alarm on Crypto Liquid Staking

According to her, this Crypto Liquid Staking works today could open the door to a financial disaster in the cryptocurrency world, one that could ripple through markets just like the housing crisis did nearly two decades ago.

-

In her recent social media thread, Fischer warned that ownership allows users to lock their cryptocurrencies and receive synthetic tokens in return.

-

These tokens can be used in other markets while still earning rewards on the original asset.

-

She claims this is similar to what Lehman did borrowing customer assets and using them for leveraged market bets.

-

She also pointed out that this type of rehypothecation using one asset multiple times across trades could become even more dangerous when done without proper oversight.

SEC’s New Guidance Sparks Division

The U.S. Securities and Exchange Commission (SEC) recently issued a staff statement clarifying that staking receipt tokens, which are central to Crypto Liquid Staking are not securities .

What this implies is that they won't be governed by the conventional securities laws such as the Securities Act of 1933 or the Exchange Act of 1934.

As per the SEC's Corporation Finance unit, these tokens are not dependent on other people's efforts to appreciate in value. Rather, they attach themselves directly to the staked cryptocurrency itself.

This move has polarized the agency. Commissioner Caroline Crenshaw was highly critical of the step, claiming that the SEC is understating the risks and giving people a false sense of security.

On the other hand, the proponents of the new approach, such as Commissioner Hester Peirce, claim that it is progress towards treating cryptocurrencies in a similar manner to traditional finance instruments.

Industry Leaders Push Back Against Lehman Comparison

Fischer's analogy to Lehman Brothers has not passed without challenge. Cryptocurrency influencers and attorneys argue she's exaggerating the dangers and misreading the SEC's recent stance.

Solana's Helius Labs and NFT marketplace Magic Eden founders have labeled her thread "fear-based" and "misleading."

They argue that crypto liquid staking today is mostly limited to passive and non-leveraged strategies, unlike the risky bets that brought down Lehman.

Is the Crypto Market in a Bubble?

Adding to the uncertainty, major financial voices like Robert Kiyosaki have also warned in July that a crash may be near .

Source: X (Formerly Twitter)

With global asset prices crypto, gold, silver, and stocks all reaching record highs, many fear a bubble is about to burst.

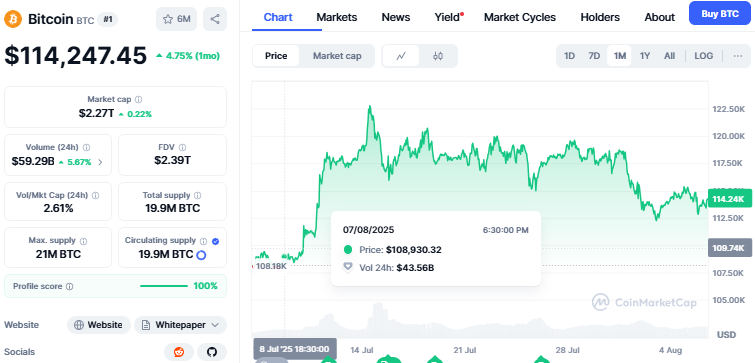

BTC ATH: Bitcoin recently hit an all-time high of $122,000, while the global cryptocurrency market surged past $4 trillion.

Source: CoinMarketCap

It is now trading at $114,247 with an increase of 4.71% in a month.

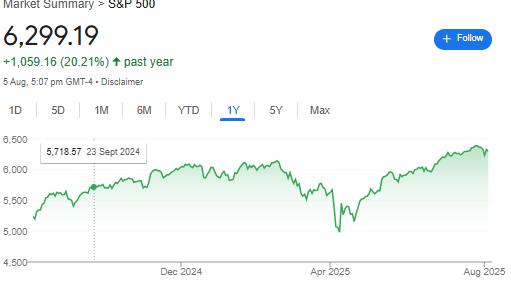

S&P 500: S&P 500 surged by 20% within a year. Currently valued at 6299

Source: Google Finance

Source: Google Finance

If these assets start dropping, liquid staking risks could deepen the losses.

The Bigger Picture: $66 Billion Locked in Staking

Despite the warnings, Crypto Liquid Staking continues to grow. Over $66 billion is currently locked in liquid staking protocols, according to data from DefiLlama.

This shows the rising trust and adoption of owning in the digital ecosystem. However, the debate over how safe and regulated this model should be is far from over.

With questions of how to move on being redefined continuously by the SEC and the competing voices on it internally, the future of the Crypto Liquid Staking remains an open one.

Whilst the accuracy of the warning by Fischer can only be determined by time, what has stood clearly revealed is that digital currency risk management in this changing yet essential space, is under the spotlight.

Also read: Pi Network Domain Auction Extends: PI Binance Listing the Reason?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。