以太坊价格崩溃:4.18亿美元鲸鱼抛售打破ETH 4K预测

今天最新的以太坊新闻显示,加密市场出现严重的疲态。就在交易者盯着突破4,000美元的关口时,一场突如其来的以太坊鲸鱼抛售给看涨的希望泼了冷水。

随着鲸鱼抛售近5亿美元的ETH,指标全面转向看跌,市场在问:以太坊价格崩溃才刚刚开始吗?

让我们来分析一下数字、图表,以及内幕人士在幕后真正做了什么。

4.188亿美元ETH抛售警报:鲸鱼们是在为更大的崩溃做准备吗?

根据链上分析师JA_Maartun的说法,以及CryptoQuant的分享,代币的净交易量刚刚达到了惊人的-4.188亿美元。这意味着卖方在一天内超越了买方,差距高达115,400个代币。

当任何加密货币出现如此不平衡时,通常会导致重大价格波动,引发诸如以太坊价格为何崩溃等问题。从历史上看,极端的负交易量暗示交易者在预期价格下跌之前退出头寸。

这是以太坊价格崩溃的第一个重大信号吗?是的,我们可以这么说,但这并不是全部,还有更多原因。

谁在抛售——为什么是现在?内幕ETH鲸鱼抛售

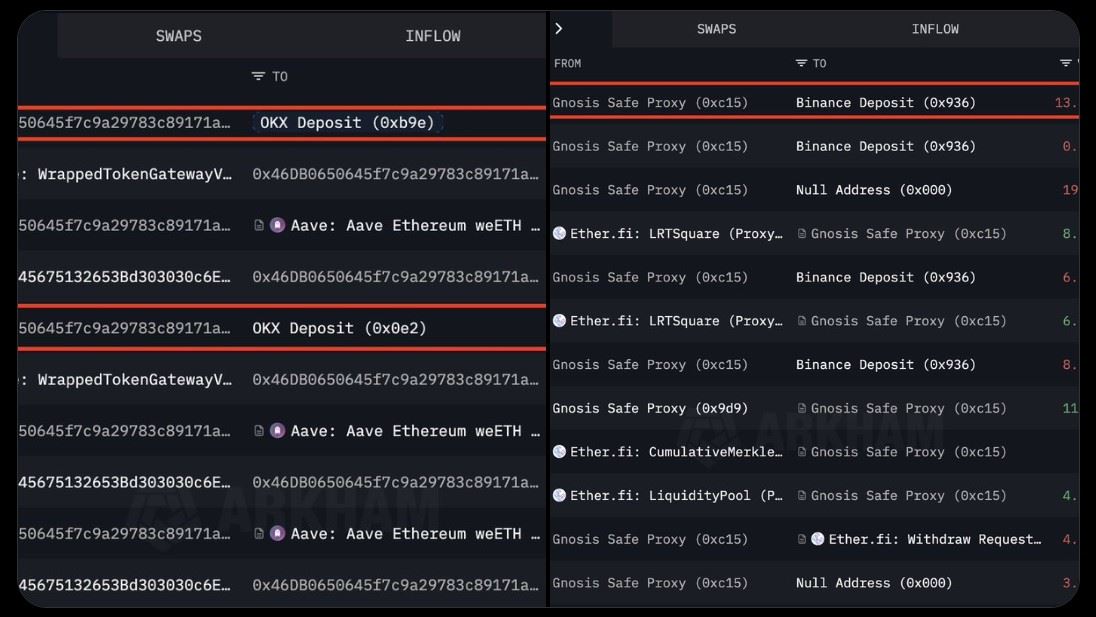

区块链追踪公司Lookonchain已识别出两个进行大规模退出的钱包地址:

0xc156:存入13,459个(约4900万美元)到Binance

0x46DB:转移5,504个(约1980万美元)到OKX

来源:Lookonchain X Post,8月6日

这些行动强烈表明,以太坊的卖压增加,导致今天价格下跌。无论是为了获利了结,还是对流动质押漏洞的恐惧,或是预期美联储降息,或是其他宏观因素,这些都在代币最需要稳定的时候增加了压力。

ETH价格在3,700美元处被拒绝:技术指标闪烁红灯

当前ETH价格在Binance TradingView图表上交易接近3,626美元。尽管7月份出现强劲反弹,但该代币未能维持在3,700美元以上的动能,在该水平上显示出重复的蜡烛拒绝。

关键技术信号:

RSI为57.21,低于超买的67+

MACD交叉确认力量减弱

支撑区:3,450 – 3,600美元

阻力区:3,700 – 3,750美元

自从在3,880美元见顶以来未能形成新高是交易者需要密切关注的红旗。根据我作为加密分析师的观察,市场现在正在测试支撑位——如果支撑位被打破,那么该币将进入深度以太坊价格崩溃情景。

延迟爆发?$ETH 4K预测仍在雷达上

尽管有看跌信号,负面的以太坊最新消息,但并不是每个人都在抛售。知名分析师CryptoGoos在推特上表示:“一旦突破4,000美元,真正的烟花就开始了!”

这是一个大胆的预测。但随着当前卖压增加,牛市需要付出更多努力。

任何希望尽快达到4,000美元的可能性都依赖于捍卫3,600美元,并迅速以成交量重新夺回3,700美元。如果失败,市场可能会忘记烟花,准备迎接抛售。

结论:抛售是真实的——是买入抄底还是退一步?

卖出信号非常明显。鲸鱼在抛售,指标在降温,技术形态在破裂。尽管如此,这个代币并没有死——它只是面临几周以来最大的考验。

投资者需要仔细权衡风险。这只是突破前的健康调整,还是以太坊价格崩溃的早期阶段?

无论如何,接下来的几天至关重要。对某些人来说,这是一个抄底的机会。对其他人来说,这可能是退一步,安全距离观察$ETH意外展开的时刻。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。