JLP can triple in a year, but it can also drop 30% in three months. How can retail investors hedge risks to ensure it "only goes up and never down"?

Written by: Alex Liu, Foresight News

From JLP to Neutral

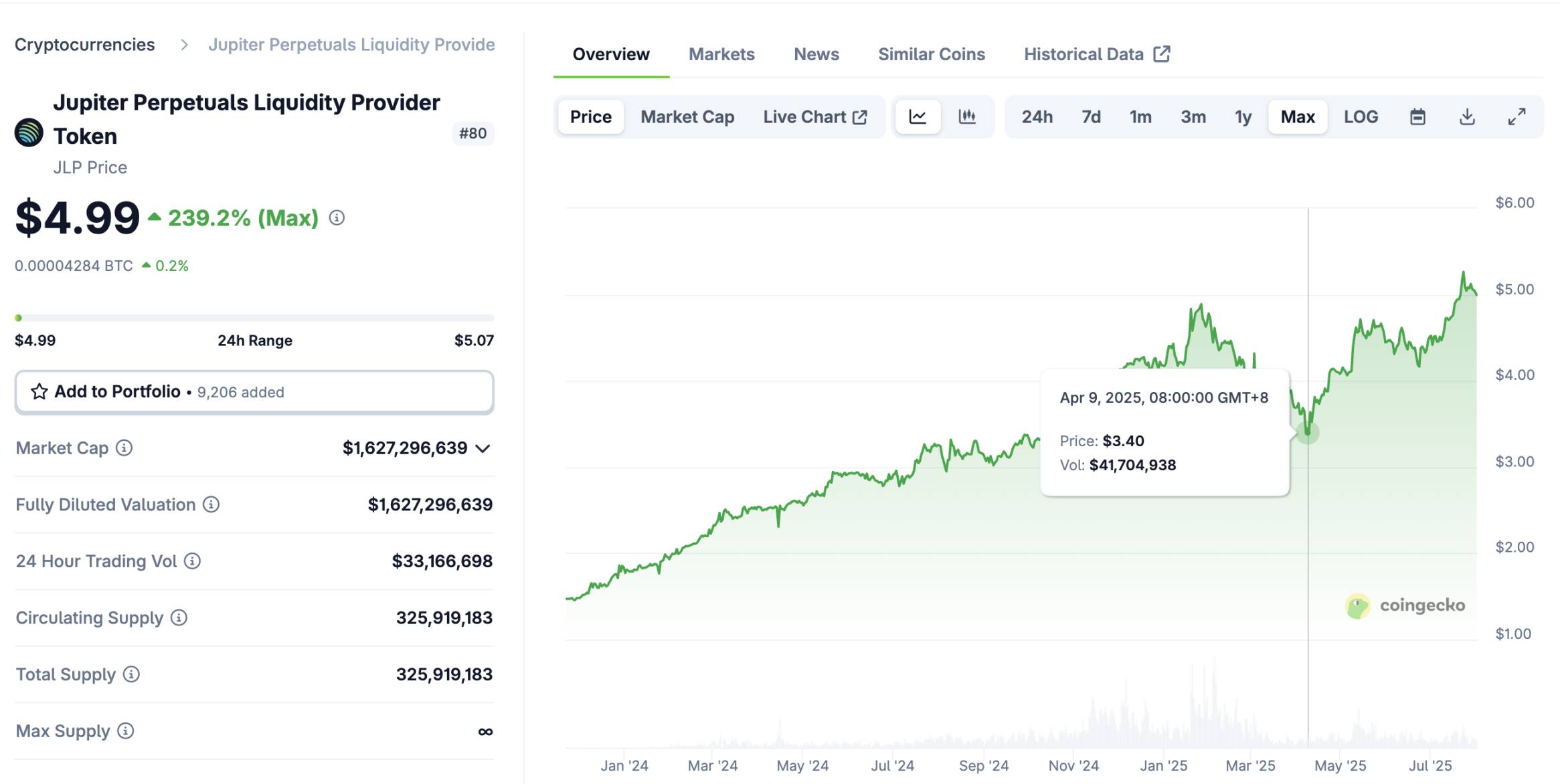

To make money, the first step is often to find quality assets. It is not an exaggeration to say that JLP is one of the top quality assets in the entire crypto world. In its first year, it increased by three times, with a maximum drawdown of a 30% correction in the following three months. While performing excellently, it has a capital volume exceeding $1 billion, making it highly scalable. How did it achieve this?

JLP's price trend, data: coingecko

JLP stands for Jupiter Perpetual Liquidity Provider Token. Holding JLP is equivalent to depositing money into Jupiter to act as a counterparty for contract traders. When contract traders make a profit, JLP incurs a loss, and vice versa. After countless similar products have been repeatedly verified, over a long time scale, contract traders always end up losing, which is the first source of income for JLP.

Additionally, 75% of the trading fees from Jupiter's perpetual contracts will return to JLP, and the substantial fee income keeps JLP's annualized income consistently above 30%, sometimes even exceeding 50%.

JLP itself is composed of 47% SOL, 8% ETH, 13% BTC, and 32% USDC, maintaining exposure to crypto asset risks. Thus, during SOL's strong performance in 2024, combined with the previous two sources of income, JLP increased by over three times. In the three months when SOL dropped from $295 to below $100, due to JLP's limited risk exposure and the buffering from the previous two sources of income, the decline was only 30%. After SOL's price rebounded, JLP set a new high ahead of time.

From this perspective, the scenarios in which JLP incurs losses are when contract traders make short-term profits in extreme market conditions (but statistics indicate they will eventually lose it back…) and when the long-term price of crypto assets weakens. It seems that the long-term risk is only the latter. As long as we can hedge this portion of the risk, we can obtain a high-yield strategy based on quality assets.

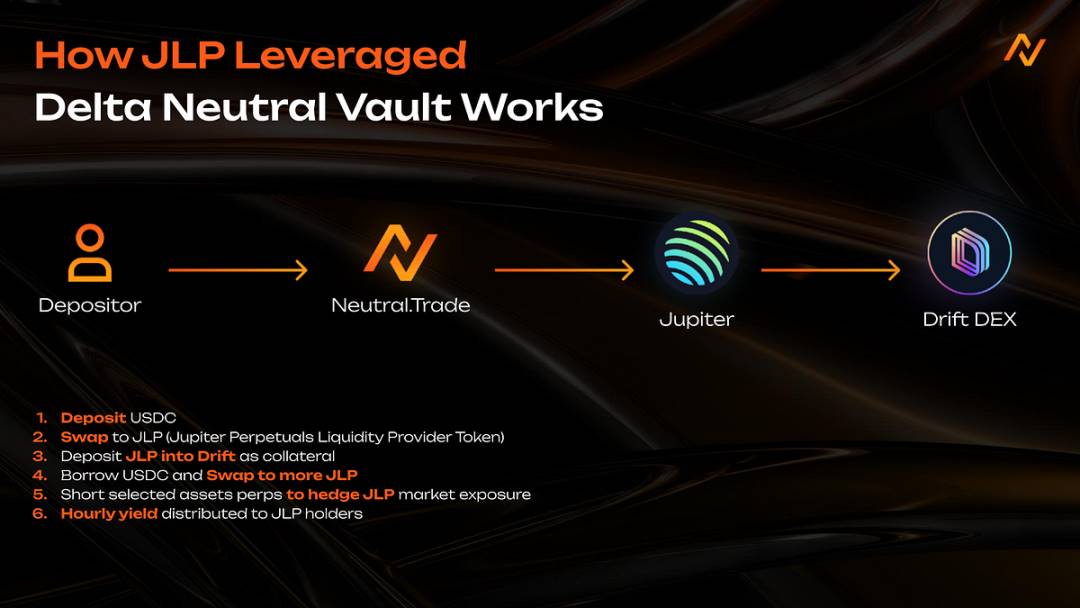

Neutral is an institutional-grade on-chain strategy hedge fund on Solana, providing such a strategic solution:

Users deposit USDC, exchange USDC for JLP. They then collateralize JLP in a lending protocol, borrow USDC, and exchange it back for JLP. (Profit is made when JLP's annualized yield exceeds the borrowing interest.) Finally, they use perpetual contracts (Drift) to short the corresponding crypto asset shares (SOL, ETH, BTC) held in JLP to achieve a market-neutral strategy (theoretically, it will not incur losses due to price fluctuations).

The Neutral treasury currently has a TVL (Total Value Locked) exceeding $12 million, with an annualized yield exceeding 15%, and the maximum drawdown is kept within 2%.

Retail Risks vs. Institutional Advantages

So why should I not execute this strategy myself and instead rely on products like Neutral? If I do it myself, I won't incur any fees (Neutral charges a performance fee of 10% to 25% for various strategies, deducted from the profits).

The reason is simple: retail investors often cannot effectively manage the risks associated with complex strategy yields.

In executing the aforementioned strategy, short hedging carries the risk of liquidation, abnormal funding rates, and the borrowing leverage portion has the risk of losses due to long-term interest rate inversions. Even if one stays awake monitoring the market, there may not be excess funds available to add margin or unwind the borrowing cycle in case of emergencies.

Institutional-grade hedge funds, on the other hand, are monitored by teams 24/7 and have rich experience and contingency plans for various systemic risks, making them significantly stronger than retail investors in risk management. The premise of earning returns is the safety of the principal. Whether to believe in using a Degen model for maximum returns or to sacrifice some returns for more secure risk management needs to be carefully considered based on individual circumstances.

Project Overview

Returning to the Neutral project itself. It is not the only on-chain hedge fund on the market; it is chosen for introduction because it is collaborating with the Solana Chinese community for promotion, which provides relatively reliable backing. Additionally, it has an ongoing points system with expectations for token issuance, allowing users to maximize benefits while earning strategy returns (the points calculation rule is: 1 point is generated for every $1 of assets held for 1 year, equivalent to depositing $365 to earn 1 point daily).

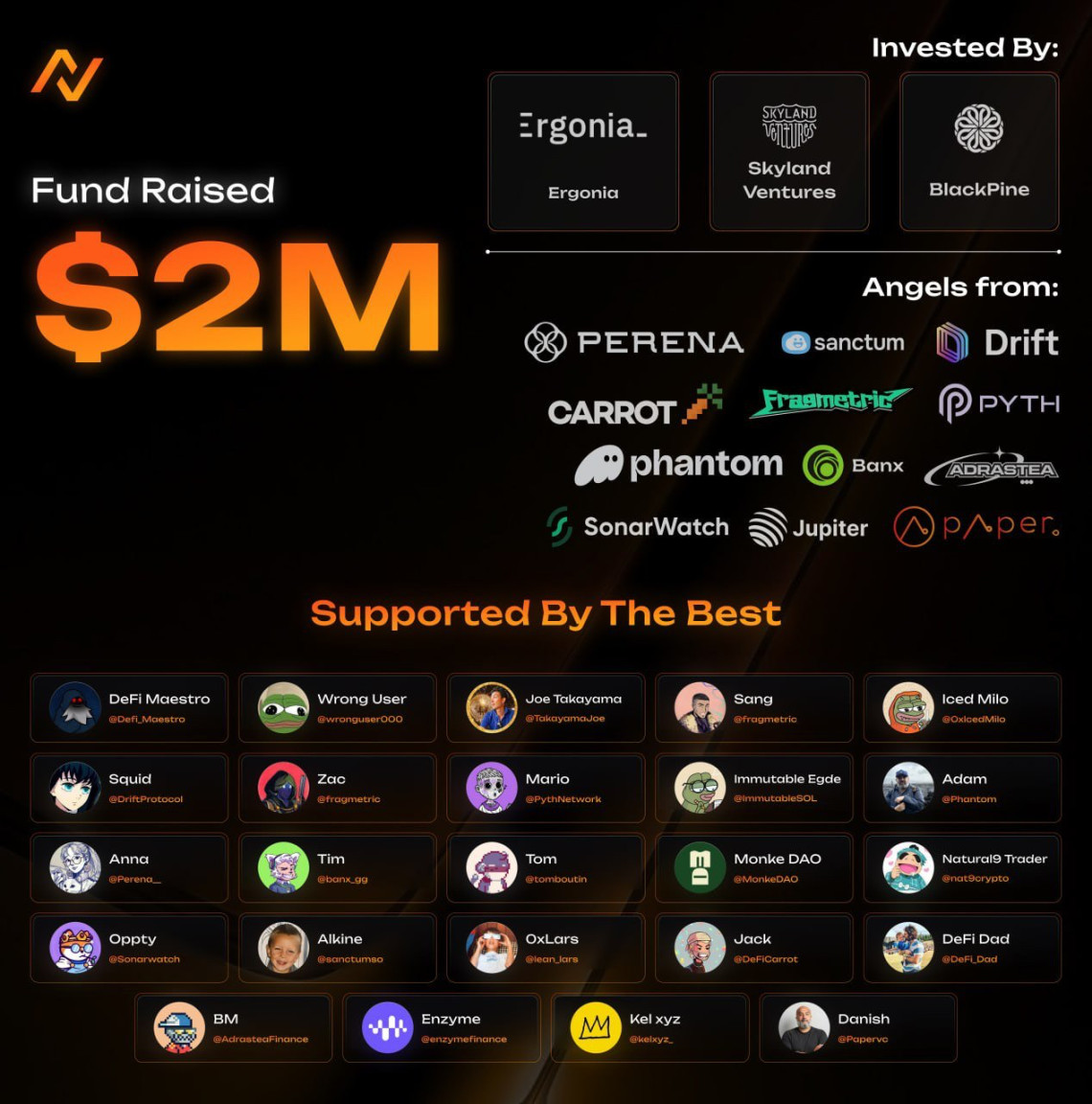

Neutral was originally a winning project at the Solana Radar hackathon and has now grown to a TVL of nearly $36 million, generating nearly $2.5 million in returns for users, establishing itself as an emerging protocol of considerable scale. The founders, Rick and Jared, are experienced quantitative traders from Goldman Sachs and one of the top three hedge funds globally. On June 1, Neutral announced it secured $2 million in funding from Cumberland and several Solana ecosystem projects and participants.

In addition to the main JLP neutral strategy, Neutral also offers multiple yield strategies, including Hyperliquid fee arbitrage. It is important to note that not all strategies are market-neutral; strategies labeled as Directional may experience significant fluctuations with market conditions, and interested readers can research further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。