This article explores the historical evolution of stable asset trading, the emergence of key new forces in liquidity management, and future development trends.

Written by: tokenbrice

Translated by: LlamaC

Early Stages of Stable Asset Trading (2018-2019)

Once upon a time, over five years ago, the only options available for trading on the mainnet were Uniswap, Bancor, and some cumbersome order book-based decentralized exchanges (DEX) like EtherDelta. As a result, the choices for stable asset trading at that time were extremely limited, and we could only use the USDC/USDT pool on Uniswap V2, which was a crazy move.

Let’s focus on this historical anecdote to understand the extent of the waste that occurred at that time. For liquidity pools, the key parameter is the relative price change of the two assets: if you have participated in any volatile liquidity provision (LP), you are certainly familiar with this. For example, if you provide liquidity for LINK/ETH, the biggest pain point of impermanent loss occurs when ETH skyrockets while LINK plummets: your ETH (price rising) in the LP position decreases, while LINK (price falling) increases.

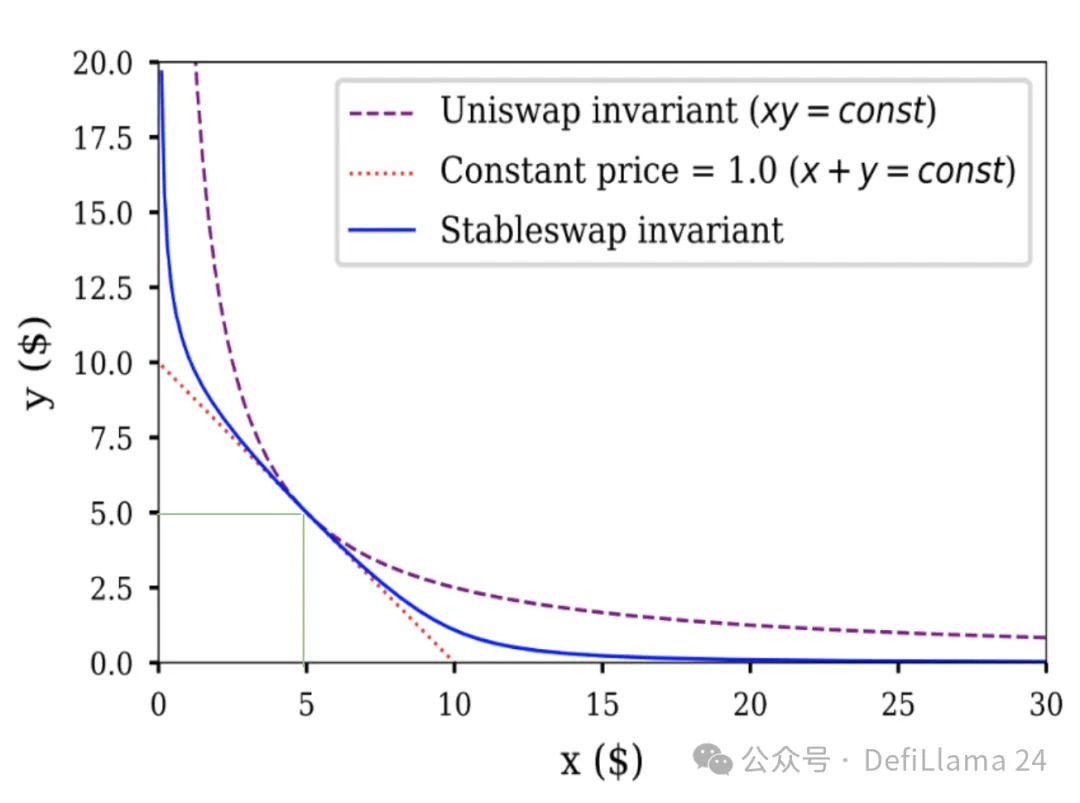

However, USDC/USDT is another matter; these two assets are highly correlated, and during a specific event (USDC SVB depegging), the maximum price difference between them was about 10%; under normal circumstances, the price difference between the two is only in basis points. However, UNIv2 distributes liquidity across the entire price range, meaning it allocates equal amounts of liquidity at any position between 1 USDC = 0.0000000001 USDT and 1 USDC = 10000000000000 USDT. Simply put: 99.9% of the liquidity in UNIv2_USDC/USDT is never utilized. I think it will be clearer on the chart:

◎ x*y=k and StableSwap

The only valuable liquidity (assuming 1 USDC ≃ 1 USDT) is located at the intersection of the two green lines, which accounts for a tiny fraction of the entire liquidity distribution curve.

On the other hand, note the liquidity distribution of stablecoin trading (stableswap) shown in blue in the same chart. For assets with similar prices, the area covered by this curve is much larger than that under Uniswap's invariant.

The StableSwap Revolution in Stable Asset Trading (2020)

Once StableSwap went live, stablecoin liquidity quickly migrated there due to its significantly improved efficiency (we're talking about an efficiency increase of over 100 times compared to UNIv2). It was the first instance of concentrated liquidity on the mainnet, predating UNIv3. The two are difficult to compare directly, as UNIv3 is more flexible while Curve-StableSwap is more focused; however, credit should be given where it is due. In addition to the efficiency improvement, Curve also provided an incentive model—veCRV+CRV incentives, which have been discussed multiple times in this blog.

Incentive mechanisms are crucial for stable asset trading pairs because they have some specific characteristics: compared to volatile trading pairs, they generally have lower overall trading volumes, and the fees that LPs can collect are much lower (until recently, the regular fees for volatile assets were 0.3% to 1% per trade, while stable assets were 0.05%). Their trading volumes exhibit spikes related to events concerning the coin (for example, the USDC depegging was one of the highest trading volume days in USDC's history).

For all these reasons, until recently, I believed that incentive mechanisms were more critical for stable asset trading pairs than for volatile assets. However, with the emergence of Fluid DEX and EulerSwap, I no longer think so. But before delving into them, we must first revisit another important milestone in the history of stable asset liquidity: the launch of Uniswap V3.

The Arrival of Uniswap V3 Concentrated Liquidity (2021)

Uniswap V3 was released and provided customizable concentrated liquidity for almost all asset types, significantly improving the efficiency of all liquidity providers. However, since it is not only applicable to stable assets, this also almost means that LPs for volatile assets would face higher impermanent loss. Given the innovative nature of this liquidity structure and the lack of early infrastructure, the rollout of UNIv3 initially progressed slowly.

However, this customizable concentration brought tangible benefits, especially for what I call the "loosely pegged assets" subcategory of stable assets: for example, the following trading pairs: wstETH/ETH (related, but wstETH is unilaterally rising relative to ETH), LUSD/USDC (related, but LUSD may be slightly above or below the pegged price).

In this case, UNIv3's concentrated liquidity allows LPs to replicate a distribution as efficient as Curve's Stableswap, but adjusted according to the price movements of the tokens, which again brings significant efficiency improvements. However, the ultimate breakthrough (in terms of the current industry state) was not achieved until the emergence of Fluid DEX and EulerSwap a few years later.

Debt as Liquidity (2025)

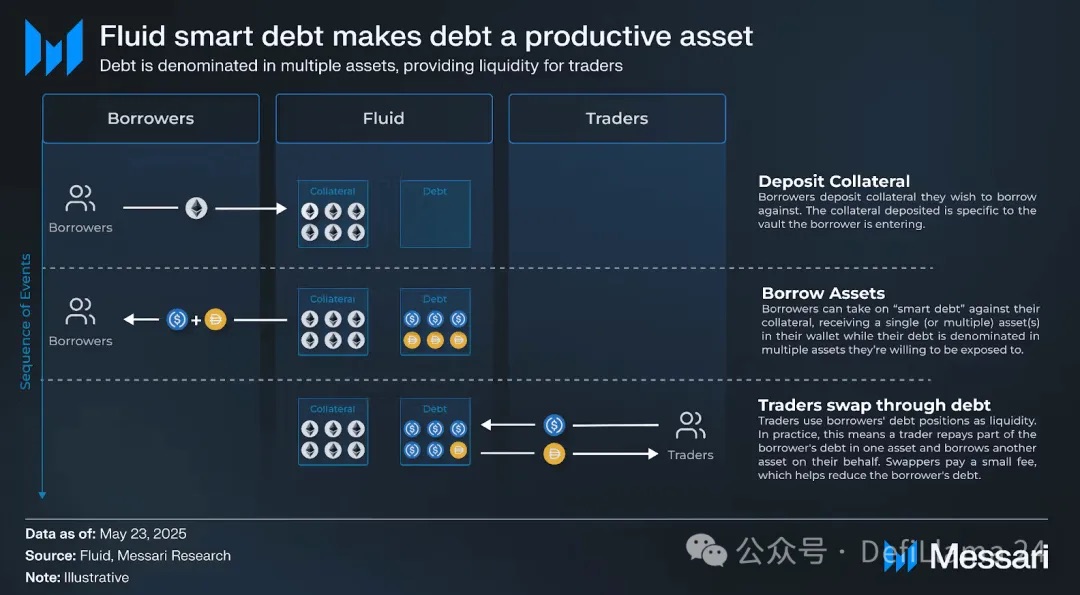

For the sake of brevity, I will not delve into the models of Fluid and EulerSwap in this article, as I prefer to focus on their significance for liquidity building. Simply put, Fluid has found an innovative way to convert debt into liquidity through "smart debt."

Imagine a regular user providing ETH as collateral and borrowing USDC. Does he really want USDC? It’s likely he doesn’t care as long as he borrows a safe and dollar-pegged stablecoin. He would probably also accept USDT.

This is precisely what smart debt achieves. In the smart debt vault, borrowers borrow a combination of USDC and USDT, which constantly changes: their debt now serves as liquidity for the USDC/USDT trading pair. For borrowers, this means lower borrowing costs, as they can now earn trading fees, potentially offsetting borrowing interest.

This is from the borrower's perspective, but now let’s switch to the protocol's mindset. What does this mean for Circle and Tether? Essentially, it means almost zero-cost liquidity, with no need for any incentives. This is not new for Circle, which has been supported by the entire ecosystem for years—but it is significant for other stablecoins like GHO, BOLD, or FRAX.

I mainly focus on Fluid, but the idea is similar for EulerSwap, although the implementation differs. EulerSwap is still in the testing phase, but it has already generated considerable trading volume on the USDC/USDT trading pair.

If you understand this, you can grasp my argument: "I believe that in the DeFi space, stable asset trading will ultimately not be dominated by anything other than projects like Euler/Fluid or similar."

Still not clear? Keep the following points in mind:

Stable asset trading pairs generally have lower trading volumes ⇒ lower fees. Therefore, on traditional decentralized exchanges, they require substantial incentives to maintain liquidity, while Fluid and Euler can maintain this liquidity at almost zero cost.

⇒ If (which has already begun) the fee competition for stable asset trading enters a "price war," then the chances of traditional decentralized exchanges (DEX) winning are zero.

0xOrb, a Potential Challenger (circa 2026)?

Now, to give you a comprehensive understanding of the entire stable asset trading landscape, I must mention another project that has not yet launched but has considerable potential: 0xOrb. Its promise is simple: stablecoin trading, but supporting n assets, with n potentially reaching 1000.

For stablecoins, you can imagine a super liquidity pool with ample supplies of USDC and USDT, then gradually introducing "alternative" stablecoins and providing excellent liquidity for trading between them and mainstream stablecoins. This approach has certain advantages for long-tail pegged assets, but I believe such liquidity pools will not dominate core trading volumes (like USDC>USDT or cbBTC>wBTC).

Moreover, these liquidity pools can also achieve cross-chain functionality, although I think the benefits here are minimal and even harmful (⇒ it increases the risk and complexity of the infrastructure without providing any benefits), as thanks to products like CCTP, USDC and USDT can now achieve increasingly faster 1:1 cross-chain transfers.

What does this mean for existing pure decentralized exchange (DEX) participants?

First and foremost, the most important note: we are discussing the trading of stable assets here. Replicating the same strategy on volatile trading pairs is much more challenging, as evidenced by the losses suffered by Fluid's Smart Debt + Collateral ETH/USDC vault and its liquidity providers.

DEXs like Aerodrome, which generate most of their trading volume and fees through volatile trading pairs, may not be affected by these newcomers. However, the reality is much harsher for DEXs focused on stable assets. At the end of this article, I would like to discuss two of them as examples:

Curve: Game Over Unless Major Changes Occur

Stable asset trading remains crucial for Curve, which is still regarded as the home of stablecoin liquidity. Indeed, it once attempted to capture volatile trading volume through CryptoSwap but ultimately failed.

With the arrival of Fluid and EulerSwap, I believe Curve is the DEX most likely to lose market share, and I do not think it can maintain significant trading volume (in fact, it has long been kicked out of the top ten) unless major changes occur: veCRV restructuring: drawing on the experiences of new models like veAERO to optimize CRV's incentive distribution. Utilizing crvUSD to improve DEX efficiency: for example, by providing crvUSD loans to Curve LPs. New liquidity structures for volatile assets: so that Curve can capture related trading volumes.

Ekubo: The Confident Latecomer Accelerating Towards Extinction

The situation for Ekubo can be said to be even worse, as they are a recent entrant to this field. On the surface, Ekubo appears to be a rapidly growing DEX on Ethereum, with considerable trading volume. Ekubo is essentially an alternative to UNIv4, offering more options for liquidity structure customization, and its DAO has a lower extraction rate than Uniswap (though this is the lowest standard among all projects, it is still the case).

The problem lies in the source of the trading volume: the vast majority (over 95%) is concentrated in the USDC/USDT trading pair, with a fee of only 0.00005% and substantial incentives. Ekubo is essentially engaged in a price war that it is destined to lose, as it cannot maintain such low fees in the long term (liquidity providers need to earn), while Fluid/Euler can do so (if borrowers earn even 0.1% through smart debt, their situation is better than without smart debt, so they will feel satisfied).

◎ Ekubo Statistics, as of July 7, 2025

With a pool of $2.6 million TVL, processing about $130 million in trading volume daily, collecting $662 in fees each day, and incentivizing around 8% through EKUBO, they are rapidly approaching the limits of their capabilities.

The most interesting part is that it was Ekubo itself that initiated this "price war" with the USDC/USDT trading fee rate, only to ultimately face a disastrous defeat under the rules it set. DeFi will never be boring.

As always, I hope this article inspires you and deepens your understanding of the stable asset trading game. I look forward to being "attacked" by the Ekubo community simply for stating fact-based opinions; their reactions only bolster my confidence in my judgments, as I have observed the same responses in the following situations:

I condemned the absurd security measures of MAI, and it was soon hacked and depegged.

I criticized the manipulation and lies of R/David Garai, and within six months, R was hacked and nearly disappeared.

I criticized the actions of the Prisma team, and within 12 months, they were hacked and the protocol was shut down.

The list goes on. Good luck to everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。