1. Market Observation

On Thursday local time, U.S. President Trump signed an executive order establishing "reciprocal" tariff rates covering goods from multiple countries, with rates ranging from 10% to 41%. Countries that did not reach an agreement face higher rates, including 25% for India, 39% for Switzerland, and 30% for South Africa. Tariffs on Canadian goods were raised from 25% to 35%, and a 40% transit tax will be imposed on transshipped goods. The White House stated that this move aims to protect U.S. manufacturing and address trade imbalances.

According to the latest data, the core PCE price index rose 2.8% year-on-year in June, exceeding market expectations and reaching a five-month high, indicating persistent inflationary pressures. However, another aspect of the economy shows signs of fatigue, with consumer spending growth slowing and real disposable income remaining flat, which limits consumption willingness and keeps the household savings rate at a relatively cautious 4.5%. Despite the FOMC maintaining interest rates unchanged for the fifth consecutive time this week, two board members have unusually voted in favor of a rate cut, marking the first occurrence in over thirty years. Federal Reserve Chairman Powell clarified after the meeting that the current resilient labor market is the primary determinant of monetary policy, with the unemployment rate becoming a core concern. With only 24 hours left in the "Super 72 Hours," the market is holding its breath for tonight's upcoming non-farm employment data, which could be key in determining the direction of Powell's policy. Currently, the probability of a rate cut in September has dropped to a 50-50 chance.

Against the backdrop of active regulatory developments, Hong Kong's upcoming implementation of the "Stablecoin Regulation" in August is also attracting attention. HashKey's chief analyst Jeffrey Ding pointed out that this initiative marks the formal entry of stablecoin technology into the regulatory framework, with its clear structure and credibility attracting many strong enterprises to apply for licenses. This indicates that related technologies will shift from the concept demonstration phase to large-scale commercial deployment. In response, HashKey is actively positioning itself to enhance its capabilities in trading, custody, clearing, and risk control, aiming to build an infrastructure system that can efficiently handle cross-border capital flows, thereby promoting the deep integration of stablecoins with the real-world economy.

Bitcoin briefly fell below $115,000 this morning but has since rebounded above $115,500. Analyst Altcoin Sherpa noted that if Bitcoin loses the critical support at $114,000, market conditions could worsen. TheBreakoutZone believes that if the current descending channel is breached, the next high-risk reward demand zone to watch is between $111,700 and $113,500. Near the current price, data from Hyblock Capital shows that $115,883 is an important liquidation level, while KillaXBT's analysis of buy and sell orders suggests that if the price can form a higher low at $115,700, it may struggle to reach $113,800 again. Looking at the upside potential, analyst Captain Faibik stated that if bulls can successfully break through the descending wedge resistance at $118,000, it would open the door to challenge historical highs. Swissblock also mentioned that although Bitcoin faced resistance at $118,000, the market is absorbing selling pressure in preparation for the next breakout. KillaXBT further predicts that if a breakout occurs, short strategies may need to wait for the price to reach the $125,000 to $127,000 range before considering action. On the fundamental side, Charles Edwards, founder of Capriole Investments, observed a significant increase in enterprise-level buyers over the past six weeks, with a staggering buy-sell ratio of 100:1, while spot ETFs have resumed net inflows, and news of the White House planning to establish a strategic Bitcoin reserve has greatly boosted market sentiment.

Additionally, Ethereum briefly dipped to around $3,600 this morning. Analyst Big Smokey pointed out that although ETH continues to face selling pressure at the $4,000 mark, its rebound speed has outpaced Bitcoin, mainly due to retail investors actively buying after long liquidation pressure around $3,600, with its cumulative funding rate briefly turning negative, seen as a buy signal. However, cautious sentiment remains in the market. CryptoQuant analyst Axel Adler Jr. mentioned that Ethereum has repeatedly failed to break through the psychological barrier of $4,000 since March this year, coupled with a decline in its ecosystem's TVL and DEX trading volume compared to competitors like Solana and BNB Chain, which has exacerbated investor concerns about weak on-chain activity. Nevertheless, Axel Adler Jr. also proposed a potential bullish scenario: if enterprises continue to increase their Ethereum reserves, its price could aim for $5,000. In terms of trading strategy, analyst 0xSun adopted a hedging strategy, going long on Ethereum while shorting a basket of altcoins, reasoning that institutional funds are more likely to flow into ETH, which serves as the main market driver, while altcoins face greater uncertainty.

Yesterday, the most notable event was undoubtedly the SEC's policy shift, with SEC Chairman Paul Atkins announcing the launch of a full committee-level "Project Crypto," aimed at making the U.S. a global center for crypto assets by amending securities rules. The plan includes establishing clear token classification standards, updating custody rules, simplifying trading licenses, setting up principled regulatory pathways for DeFi and tokenized assets, and introducing an "innovation exemption" mechanism. Significant news also emerged from the traditional finance sector, with Bridgewater founder Ray Dalio officially stepping down from the board, marking the end of his era at the company, while Bridgewater has brought in the Brunei sovereign wealth fund as a new major shareholder. Additionally, design giant Figma successfully went public and was revealed to hold a substantial amount of Bitcoin, surging 250% at the open and rising another 25% after hours, currently priced at $115. It is reported that Figma holds 700,000 BTC and plans to increase its holdings, with on-chain data showing that its founder Dylan Field's address holds 2.3 million AGLD tokens, valued at $1.76 million.

2. Key Data (As of August 1, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $115,619 (Year-to-date +23.51%), Daily Spot Trading Volume $5.2244 billion

Ethereum: $3,682.83 (Year-to-date +11.05%), Daily Spot Trading Volume $3.4676 billion

Fear and Greed Index: 65 (Greed)

Average GAS: BTC: 3 sat/vB, ETH: 0.23 Gwei

Market Share: BTC 61.1%, ETH 11.8%

Upbit 24-hour Trading Volume Ranking: XRP, STRIKE, ETH, BTC, ENA

24-hour BTC Long-Short Ratio: 47.95%/52.05%

Sector Performance: NFT down 8.98%; Meme down 8.73%

24-hour Liquidation Data: A total of 160,329 people were liquidated globally, with a total liquidation amount of $630 million, including $151 million in BTC, $182 million in ETH, and $37.32 million in SOL.

BTC Medium-Long Term Trend Channel: Upper Line ($118,359.86), Lower Line ($116,016.10)

ETH Medium-Long Term Trend Channel: Upper Line ($3,687.83), Lower Line ($3,614.81)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (As of July 31)

Bitcoin ETF: -$115 million, marking the first net outflow after five days of net inflows

Ethereum ETF: +$16.9996 million, continuing 20 days of net inflows

4. Today's Outlook

Trump States Tariff Deadline Will Not Be Extended, Expires August 1

Indonesia to Raise Cryptocurrency Trading Tax Rate on August 1

Binance to Delist XVS/TRY and YGG/TRY Spot Trading Pairs on August 1

Sui (SUI) will unlock approximately 44 million tokens on August 1, accounting for 1.27% of the current circulating supply, valued at approximately $188 million;

GoPlus Security (GPS) will unlock approximately 542 million tokens on August 1, accounting for 20.42% of the current circulating supply, valued at approximately $11.6 million;

ZetaChain (ZETA) will unlock approximately 44.26 million tokens on August 1, accounting for 4.78% of the current circulating supply, valued at approximately $9.9 million.

Ethena (ENA) will unlock approximately 40.63 million tokens at 3 PM on August 2, accounting for 0.64% of the current circulating supply, valued at approximately $25 million;

U.S. July Unemployment Rate: Previous 4.10%, Expected 4.20% (August 1, 20:30)

U.S. July Seasonally Adjusted Non-Farm Employment Change (10,000): Previous 14.7, Expected 11

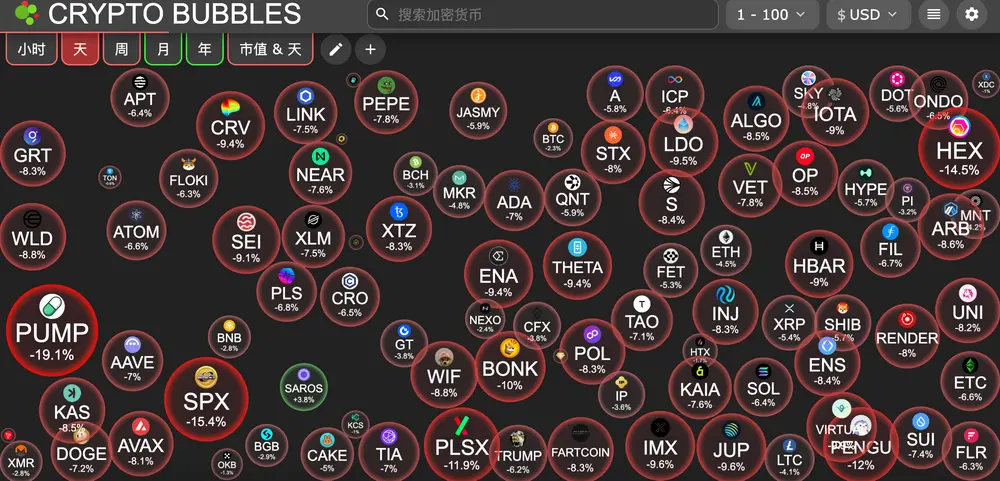

Today's Top 100 Market Cap Largest Declines: Pump.fun down 19.1%, SPX6900 down 15.4%, HEX down 14.5%, Pudgy Penguins down 12%, PulseX down 11.9%.

5. Hot News

Strategy Q2 Achieves Operating Revenue of $14 Billion, Net Profit of $10 Billion

U.S. Stock Market Close: Three Major Indices Decline, New Stock Figma Soars 256%

Coinbase Increases Holdings by 2,509 Bitcoins in Q2, Total Holdings Reach 11,776 Bitcoins

White House: 39% Tariff on Swiss Goods, Canadian Tariff Raised from 25% to 35%

“Ancient Whale Holding 3,963 BTC for 14.5 Years” Sells Another 180 BTC

Galaxy Report: Corporate Cryptocurrency Asset Holdings Exceed $100 Billion

Pudgy Penguins CEO: Team Involved in U.S. Crypto Legislation, PENGU ETF Will Cover Tokens and NFTs

Data: Total Value of ETH Treasury Reserves of 64 Entities Exceeds $10 Billion

Public Company xTAO Holds $16 Million in TAO, Becomes Largest Public Holder of Bittensor

Kaia's Native USDT Launches at Korean Tourist Spots, Tourists Can Exchange Cash at Stablecoin ATMs

DoubleZero Launches $3 Million SOL Staking Pool and Introduces Staking Token dzSOL

This article is supported by HashKey. HashKey Exchange is Hong Kong's largest licensed virtual asset exchange and Asia's most trusted fiat gateway for crypto assets. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform assurance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。